This article was co-authored by Brian Stormont, CFP®. Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

There are 19 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 1,001,419 times.

It may seem easier to just ignore it, but your unmanaged credit card debt will haunt every step you take. It may sound like a daunting task, but you can pay off your debt with order and dignity! To attack your debt effectively, use the following strategies.

Steps

Tackling Your Debt Wisely

-

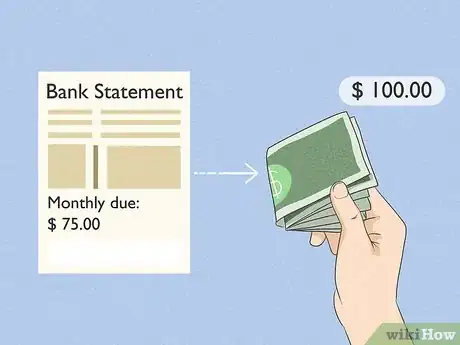

1Make more than the minimum payment. Credit card companies love it when you pay just enough to get by every month. At that rate, you’re mostly paying off interest and barely scratching the surface of your actual debt. Look at your most recent credit card statements to get a ballpark figure on what your monthly interest is, then budget as much of a payment as you can over that amount to actually see a difference in your statement.[1] [2] [3]

- If you want to know how much above the minimum you should pay, remember what interest is. Interest is the price you pay for money, and creditors always want you to pay interest before anything else. So making the minimum payment is usually only enough to keep your interest from compounding your debt into the stratosphere—to keep it where it is, in other words. You want to try to pay enough each month to get beyond the interest and into the principal.

-

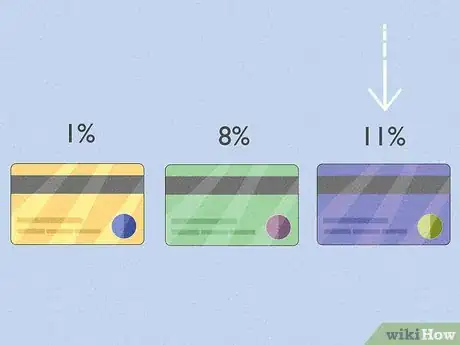

2Pay off debt with the highest interest rate first.[4] It goes almost without saying, but it's something that a lot of people forget. If one credit line is charging you 11% Annual Percentage Rate, or APR (interest over the course of a year) while another credit line is charging you 9% APR, focus all your attention on the debt that falls under 11% interest rate. Pay it off before even touching the other debt. Sure, the other one will accumulate interest in the meantime, but since you’re paying interest either way, you might as well do it at the lower percentage.[5]

- If this process seems too hard, try snowballing your debt. If your interest rates are all roughly the same or you’re simply overwhelmed by the sheer number of payments you have to make each month, make the minimum payments on all but the lowest balance––which you should attack aggressively so that it disappears quickly. Once it’s gone, add the payments you would have paid on the lowest debt to the minimum payment on your next-lowest debt until it, too, disappears. Repeat until all debts are cleared. The sense of satisfaction you will feel in making fewer and fewer payments each month will make the process more bearable and help you achieve your goal.[6] [7]

Advertisement -

3Talk to your credit card companies. Explain your financial situation and ask if there is anything they can do to help. Many will lower your interest rate for a period of time and/or waive current late fee balances to give you an opportunity to catch up.

- If you've been a customer of theirs for a long time, mention that. While some credit card companies don't care about customer loyalty, more than a few do. Those that do sometimes go to great lengths to keep their customer base happy and loyal, whatever the circumstances.

- If at first you don't succeed, ask someone more important. If you can't make any headway with the first persons you speak with, ask to speak to a supervisor. If that doesn't work, ask to speak to the retention department. If that doesn't work, call back in a week or two.

- Come prepared. Be sure to compile a list of other offers you receive. Know your interest rate terms. Check out the rates that competitors are offering.

-

4Never close cards with existing balances. It might seem like an easy way to get a handle on your debt, but it'll do horrors to your credit score, and you'll still be on the hook for the debt.[8] All this will do is send your credit utilization (your available limit v. your current debt) down, further driving down your credit score. Learn more here on how to increase your credit score.

-

5Move your debts around. Let's be clear, transferring money from a credit card with 12% interest to a card with 0% interest may damage your short-term credit. However, barely chipping away at your debt because your interest is too high will damage your finances in the long-term. Shop around for long-term, low- or no-percent interest rate transfer opportunities, or look into transferring some of your debt onto a low-interest card that you already have.[11] Keep the following in mind:[12]

- How long the low interest rate will last. Depending on your total debt and how quickly you think you can pay it off, 0% interest for six months may not be as good a deal as 2% for 18 months.

- The amount of the transfer fee. When transferring, you usually have to pay a certain percentage of your debt up-front. Make sure that a) you can afford this transfer fee and b) the fee is less than you would have paid in interest during the introductory period. Usually, transferring to a low-interest card will involve less fees than transferring to a no-interest card. Weigh how much time you expect it will take to make a dent in your debt when choosing to transfer.[13]

- What the interest rate will be after the introductory period ends. Will it jump up to 18% after 12 months? If it does, will you have paid off enough debt by that time to make that jump worth your while?

- How long you will be required to keep your balance with the company. Since credit-card hopping has become a popular way to avoid paying interest, some companies have begun stipulating that if you transfer your debt to another card before a certain amount of time has passed, the normal interest rate will be applied to all your previous balances retroactively, leaving you with a huge new debt.[14]

- Make sure to read all the fine print! Credit card companies are nothing if not resourceful in finding ways to take your money. Look for all the catches above and more, such as transfer fees and ballooning interest rates, before making any decisions.[15]

-

6See what you can liquidate to lower your debt. No one likes doing it, but sometimes it needs to be done. If you just bought a car, a memory foam mattress, or a new jacuzzi, think seriously about whether you really need these items, especially if you're paying for them on installment. Liquidating your big-ticket items now will mean less financial hardship for you later on.

- Always try to find the sales venue that will get you the highest resale value. Think eBay and jewelers, not pawn shops.

- Get creative and do the math. For example, if you have a car payment, if you can sell your car (even for less than the note is worth) for enough to pay off a card balance or three with higher interest rates and perhaps pay off the interest on the car note, then it makes financial sense to do that.

Budgeting Your Money Like a Pro

-

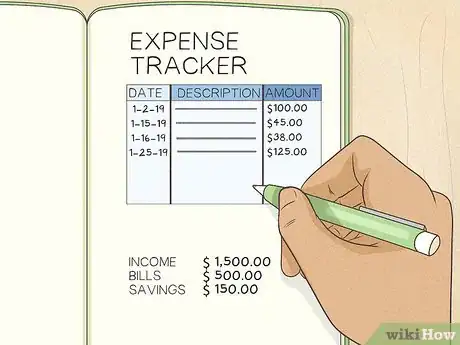

1Track your spending.[16] It’s one thing to make mental notes of things you’ve bought over the month, but it’s another thing altogether to see them add up on paper. This is especially true if you use a credit or debit card (people tend to spend more freely if they pay with plastic) or pay for things using multiple accounts (and therefore never really see the net total). Manually tracking your expenses will not only help you make better decisions, but also identify areas in which you don’t even realize you’re overspending.[17] [18]

-

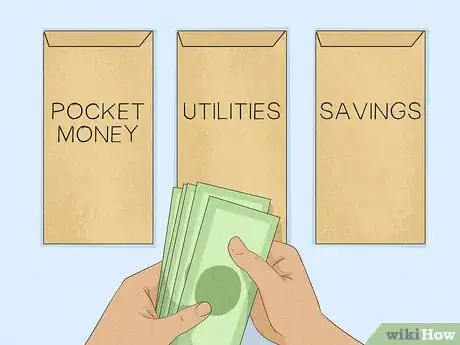

2Develop a budget for yourself. It isn’t enough to just throw a random payment at your credit card(s) every month. Instead, create a strategy, put it in writing, and budget your other expenses around your credit card payments.[19] Here are some popular ways to save money and reduce your debts:

- Think seriously about starting to save pocket money. It sounds childish, but the savings are anything but.

- See if you qualify for food assistance. It's not glamorous, but neither is being broke.[20]

- Reduce your expenses by cutting costs in different areas of your life, such as spending less on entertainment or making sure your car is running efficiently so you spend less on gas.[21]

-

3Spend your tax refund wisely. For a lot of people, a tax refund is a windfall at the beginning of the year. If you anticipate getting a tax refund this year, resolve to set a sizable chunk of it aside in order to pay off some of your debt.

-

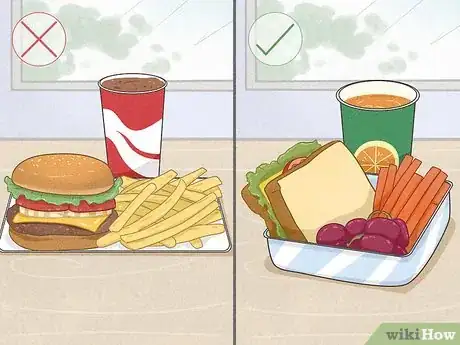

4Sacrifice a small luxury (or three). For example, don’t buy that coffee on the way to work every day; make one at home for a fraction of the cost. Don't buy your books, DVDs, or CDs; just borrow them from your local library. Don't buy lunches for work; just make them at your home. (Pressed for time? Even something as simple as a sandwich or a salad with a hard-boiled egg makes a great lunch. Prep it the night before if necessary.)

- When you’re stressed, treating yourself to the little things can feel like a necessity, and to a certain extent, it is. However, there are much cheaper ways of going about this. Instead of waiting in line for an overpriced mocha, bring a thermos of tea to the park and watch the autumn leaves fall. Instead of going out to dinner with your friends next Friday night, invite them to a potluck at your place. There are plenty of creative ways to cut back without feeling like a Spartan.

-

5Build an emergency cash fund.[22] Credit cards are often our go-to resource for unplanned expenses (the alternator dies, you get sick and miss work, etc.), but this can undo months of payments and completely demoralize you. A better idea is to tuck some money aside strictly for emergencies.[23]

- This doesn’t have to be a drain on your income. Remember those expenses you are cutting back on? Instead of simply not spending, try actually setting aside the money you would have paid on one or two of those expenses (for example, bar money every Friday night, manicure money every-other Sunday, etc.). Create a (free) savings account, put it in a CD, or even hide it in a cookie jar.

- Remember that this fund is for emergencies only. Break your leg? Go ahead and dip in. Want to upgrade your phone? Find the money somewhere else.

- Try to keep about 3-6 months worth of living expenses in your emergency fund.[24]

-

6Don’t relax your spending habits because you've successfully paid off some debt. Once you start to see that credit card balance go down, you may be tempted to treat yourself to a series of restaurant outings or a shiny new smartphone. Don’t do it; a few casual purchases can put you right back where you started, especially if something unexpected happens. Keep the end goal at the forefront of your mind––rewards that cost little or nothing are much better, like seeing a movie at a friend's house or making your favorite rich chocolate dessert and eating it all!

-

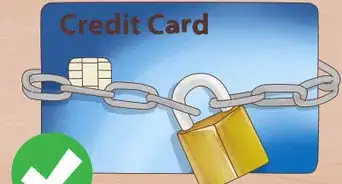

7Keep the goal in mind. Remember what you're trying to do—get out of credit card debt. Just like smokers almost never quit by cutting back, you probably won't get out of debt if you keep adding to it by using your cards all the time. You want to try to minimize your use of cards or stop using your cards altogether.

- Freeze them in a block of ice if you need to. Freezing a sealed bag of water with the cards inside is a fun and mess-free way of doing this. That way, your card will be there if you need it, but you'll have to wait for the ice to thaw, giving you hours to decide whether you really need it.

- Get a lock box. Put your cards in a lock box and put the lock box somewhere out of the way. Either give the key to someone else or put the key at another location, like your desk drawer at work, so that when you need to use the credit card, you will have to think long and hard about doing it.

- As a last resort, take your cards and cut them in to pieces with scissors to make sure you won't use them again.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhat is the smartest way to pay off credit card debt?

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Financial Advisor If you can lower the interest rate on your credit card by even a single percentage point, it will have a big impact. Consider your refinancing options on your credit card so that you can lower the interest rate you are being charged. Taking small steps to cut your spending can also have a big impact. That could look like continuing to eat out, but skipping the glass of wine or appetizer.

If you can lower the interest rate on your credit card by even a single percentage point, it will have a big impact. Consider your refinancing options on your credit card so that you can lower the interest rate you are being charged. Taking small steps to cut your spending can also have a big impact. That could look like continuing to eat out, but skipping the glass of wine or appetizer.

Warnings

- Beware of debt consolidation companies and credit counseling companies who do not provide any service other than debt consolidation. If you are considering entering into a debt consolidation plan, you may want to see a bankruptcy attorney first. He or she can analyze your debt and determine if debt consolidation is a good choice for you. An attorney can also review the debt consolidation contract and make sure that it is a legitimate company.⧼thumbs_response⧽

- Credit is not the tool you think it is. Remember that credit card companies are in the business of making money. Adopting a "Cash is king" policy will go a long way in stopping your dependency on credit.⧼thumbs_response⧽

References

- ↑ https://www.bankofamerica.com/credit-cards/education/how-to-pay-off-credit-card-debt-fast.go

- ↑ https://www.bankofamerica.com/credit-cards/education/paying-more-than-minimum-on-credit-cards.go

- ↑ http://www.bbt.com/bbtdotcom/financial-education/credit/pay-more-than-credit-card-minimum.page

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ http://www.clarkhoward.com/paying-off-credit-card-debt

- ↑ http://www.daveramsey.com/blog/how-the-debt-snowball-method-works

- ↑ http://thebillfold.com/2012/04/paying-off-your-debt-the-snowball-plan-vs-the-avalanche-method/

- ↑ http://www.quickanddirtytips.com/money-finance/credit/how-pay-credit-card-debt?page=all

- ↑ http://www.nolo.com/legal-encyclopedia/how-close-credit-card-account.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-credit-card-accounts-manage-debt.html

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ http://abcnews.go.com/Business/transfer-credit-card-balance/story?id=19581478

- ↑ http://www.bankrate.com/finance/credit-cards/credit-card-balance-transfer-1.aspx

- ↑ http://www.bankrate.com/finance/credit-cards/credit-card-balance-transfer-1.aspx

- ↑ http://www.bankrate.com/finance/credit-cards/credit-card-balance-transfer-1.aspx

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ http://www.saveandinvest.org/military-everyday-finances/track-your-spending

- ↑ https://www.wellsfargo.com/financial-education/basic-finances/manage-money/cashflow-savings/track-spending/

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ http://www.fns.usda.gov/snap/eligibility

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- http://www.ftc.gov/bcp/edu/pubs/consumer/credit/cre26.shtm

- http://www.goodhousekeeping.com/family/budget/stick-to-a-budget

- http://www.bankrate.com/finance/credit-cards/what-debt-to-pay-off-first.aspx

About This Article

To pay off credit card debt, make sure you're paying more than the minimum payment so you are actually paying down the principle, and not just the interest. Then, talk to your credit card company to see if they can help you pay off your card. They may be able to give you a lower interest rate or waive current late fees if you are in financial hardship or have used their cards for a long time. If that still isn’t enough, you may have to sell a car or other luxury item. Read more for advice from our Financial reviewer on budgeting your money to stay motivated and pay off debt faster.