This article was co-authored by Priya Malani. Priya Malani is a Financial Advisor and the Founding Partner of Stash Wealth, a financial planning and investment management firm for HENRYs™ (High Earners, Not Rich Yet). She has over 15 years of wealth management and financial advising experience. Priya's work with Stash Wealth has been featured in Fortune, Wall Street Journal, and CNBC as well as entertainment and lifestyle brands such as the NYPost, Bustle, SiriusXM, and Refinery29. She earned a BA in Economics from Agnes Scott College in 2004.

This article has been viewed 268,968 times.

If you’re starting to use a new credit card, you will need to sign the back of your card before using it. Sign the card after you have activated it online or over the phone. Use a felt-tipped pen, and sign your name as you’d sign on any other document. Do not leave the back of your card blank, and do not write “see ID” instead of signing your name.

Things You Should Know

- Write your signature on the signature bar of the card using a felt-tipped pen.

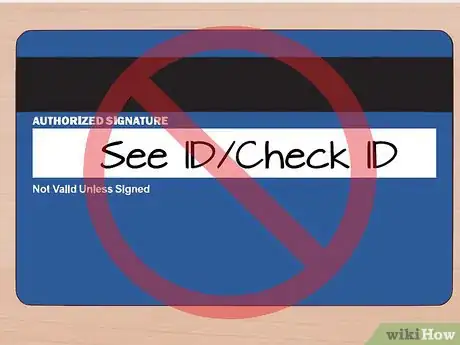

- Sign your full name instead of writing "See ID" or "Check ID."

- Fill in the signature bar before using your credit card at the store.

Steps

Signing the Card Clearly

-

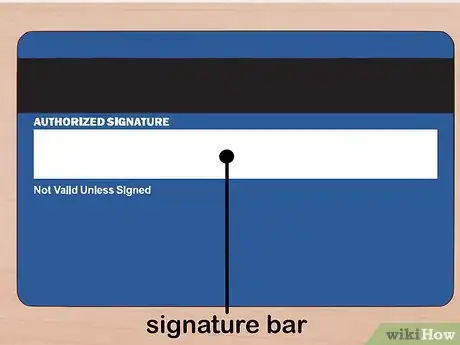

1Find the signature bar. This will be located on the back of the card. Flip the credit card over so you’re looking at the reverse side, and look for the light gray or white bar.[1]

- Some cards may have an adhesive sticker over the signature bar. If yours does, remove the sticker before signing.

-

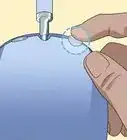

2Sign using a felt-tipped pen. Since the back of the credit card is made of plastic, it won’t absorb ink as easily as a piece of paper would. A felt-tipped pen or a fine-tip Sharpie will leave a permanent signature, and you won’t risk smearing ink across the back of your card.[2]

- Do not use an uncommon color of ink, such as red or green.

- Also do not sign using a ballpoint pen. Ballpoint pens may scratch up your card or leave only a faint signature on the plastic.

Advertisement -

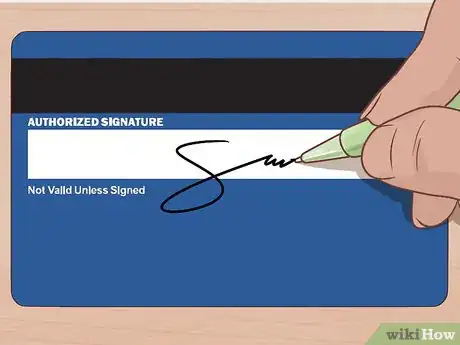

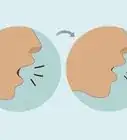

3Sign your name as you normally do. Consistency and clarity are key when signing the back of your credit card. Your signature here should look like your signature on any other document.[3]

- It’s fine if your signature is sloppy or hard to read, as long as it looks like that whenever you sign your name.

- If a store clerk suspects credit card fraud, their first step will be to compare the signature on the back of your card with your signature on the receipt.[4]

-

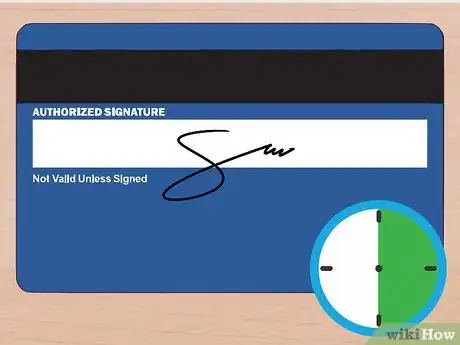

4Let the ink dry. Don’t put the credit card away immediately after you sign the back. If you put the card away too soon, the ink may smear and your signature will become unintelligible.[5]

- Depending on the ink you use, the signature may take up to 30 minutes to dry.

Avoiding Common Mistakes

-

1Do not write “See ID.” You may have been told that you can protect yourself against credit card fraud by writing “See ID” or “Check ID” rather than signing your name. The idea behind this is that, should someone steal your credit card, they’ll be unable to use it without also having your ID. However, most merchants are prohibited from accepting cards that don’t have the user’s signature.[6]

- Look at the fine print on the back of your card. It probably contains a statement similar to: “Invalid without an authorized signature.”

- Also, most store clerks will swipe your credit card without even glancing at the back of it to confirm your signature.

-

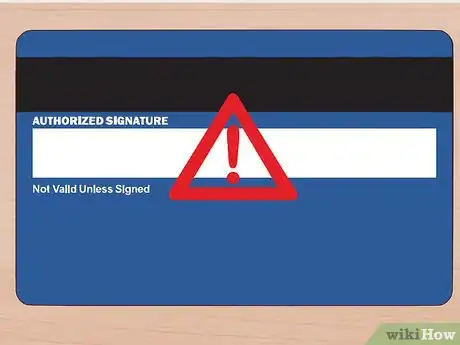

2Do not leave the signature line blank. Technically, you’re legally required to sign your credit card before use in order to validate the card. Some store clerks may refuse to swipe your card if they see that you haven’t signed the back.[7]

- With the increasingly prevalence of chip readers and self-service card readers (e.g., at gas pumps), many store clerks don’t have the opportunity to ask to see your card.[8]

- Leaving the back of your card blank in no way increases the security of your credit card. A thief could feasibly use the card with or without your signature.

-

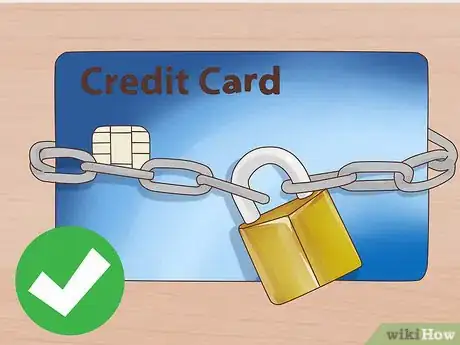

3Confirm that your card has fraud protection. If you’re concerned about a potential thief using your signed credit card to make purchases, the best way to protect yourself is to make sure your credit card has fraud protection. Contact your credit card company’s Customer Service department and ask if your account has fraud coverage.[9]

- If you do have fraud protection, U.S. laws limit the cardholder’s liability to $50.

- According to U.S. federal laws, all major credit card companies must provide fraud protection. To find out what your liability is in the case of a stolen credit card, call your credit card company and ask what their policies are.[10]

Our Most Loved Articles & Quizzes

References

- ↑ https://pocketsense.com/credit-card-signature-tips-7529635.html

- ↑ https://pocketsense.com/credit-card-signature-tips-7529635.html

- ↑ https://pocketsense.com/credit-card-signature-tips-7529635.html

- ↑ https://www.discover.com/credit-cards/resources/should-i-sign-my-credit-card

- ↑ https://pocketsense.com/credit-card-signature-tips-7529635.html

- ↑ https://credit.org/2017/05/05/should-i-sign-the-back-of-my-credit-card/

- ↑ https://credit.org/2017/05/05/should-i-sign-the-back-of-my-credit-card/

- ↑ https://www.nerdwallet.com/blog/credit-cards/unsafe-sign-credit-card/

- ↑ https://lifehacker.com/should-you-sign-the-back-of-your-credit-card-1558289863

- ↑ Priya Malani. Financial Advisor & Founding Partner, Stash Wealth. Expert Interview. 23 March 2020.

About This Article

To sign your credit card correctly, flip the credit card over so you can see the light gray or white signature bar. Since the back of the credit card is made of plastic, normal ink won’t absorb easily, so use a felt-tipped pen or Sharpie marker to leave a signature that won’t smear. Once you have the correct kind of pen, sign the bar as you normally would. Make sure it looks like your signature on any other document since a store clerk will compare the signature on your card to the signature on the receipt if they suspect fraud. Finally, give your signature 30 minutes to dry, or you might smear it by sliding the card back into your wallet. For more tips, like how to avoid common mistakes when signing your credit card, read on!