X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 10 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 158,792 times.

Learn more...

Microsoft Excel is a comprehensive spreadsheet and financial analysis tool and can be used in business and in personal finances. Among other budgeting tools, Excel also features functions that can help you calculate payment amounts, mortgage amortization schedules and other helpful figures. Calculate credit card payments in Excel to achieve a much faster pay-off of all balances.

Steps

-

1Launch Excel.

-

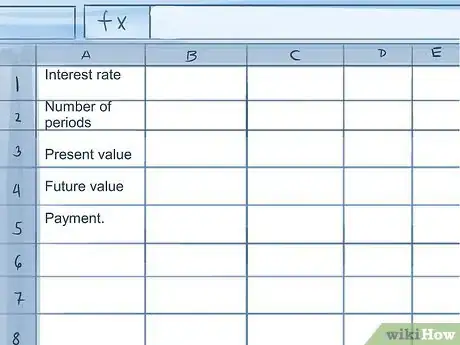

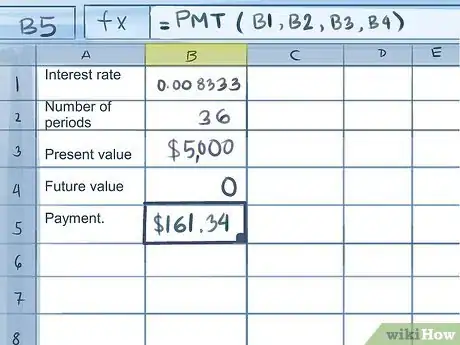

2Label the first 5 cells down column A as follows: Interest rate, Number of periods, Present value, Future value and Payment.[1]Advertisement

-

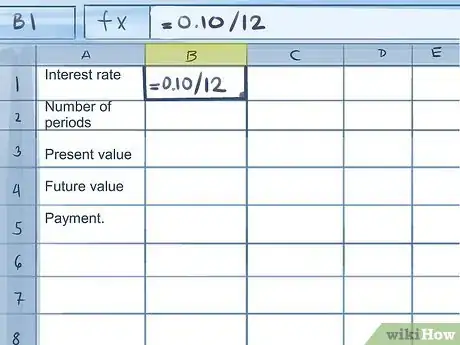

3Enter the interest rate for your credit card balance in column B, next to the "Interest rate" label.

- Because the interest rate listed on your credit card statement is an annual rate, but this calculation requires the monthly interest amount, calculate the interest within the cell by dividing the interest rate by the number of months in a year (12).[2]

- For instance, a 10% rate will require you to type "=.10/12" in the cell and press enter.

-

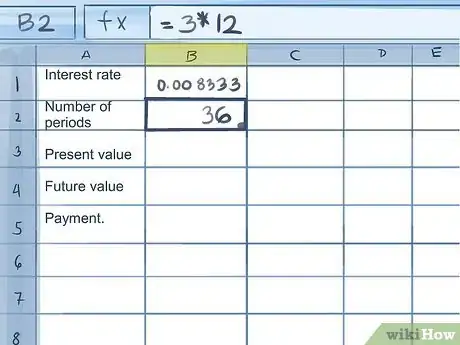

4Determine the time frame in months in which you would like to have your credit card balance paid off.

- Enter this is the cell in column B next to the label, "Number of periods."

- For instance, if you would like to have your balance paid off within 3 years, enter "36" in this cell.

-

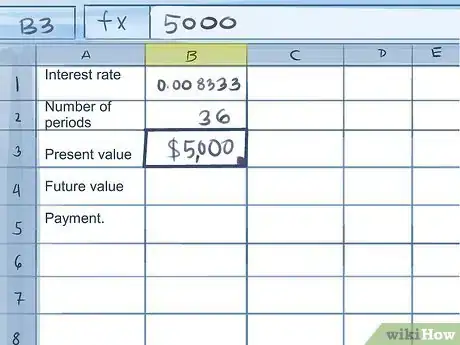

5Input the current credit card balance in the cell in column B next to the label, "Present value."

- For this example we will assume a credit card balance of $5,000.

-

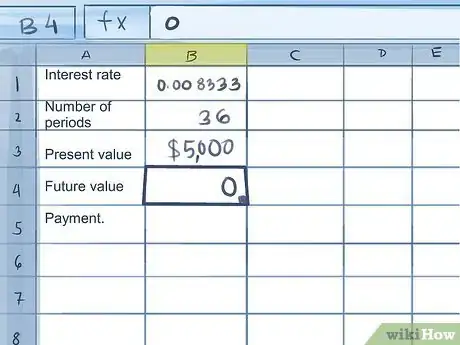

6Type "0" in the cell in column B next to the label "Future value."

-

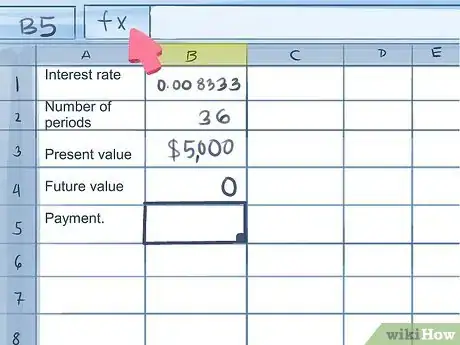

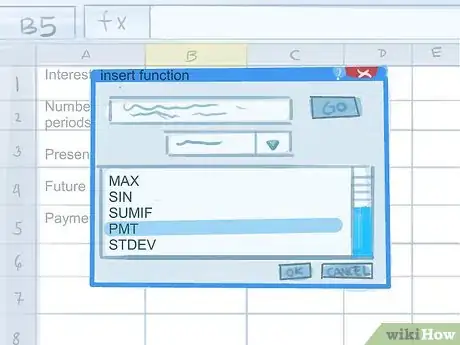

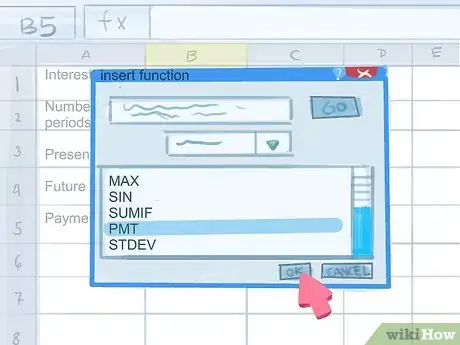

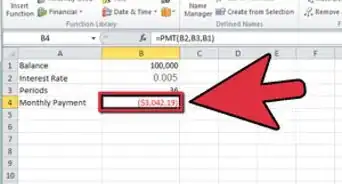

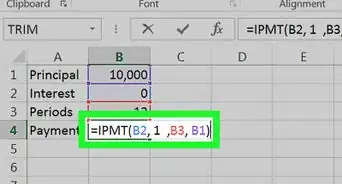

7Click to select the cell in Column B next to the label "Payment," then click the function button (fx) at the left edge of the data entry window to calculate your credit card payment.[3]

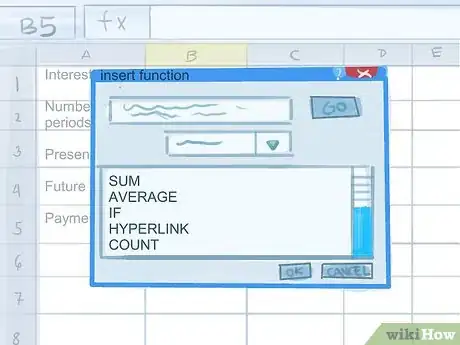

- Excel will pop up a window for you to choose the function you need.

- If "PMT" (payment) is not already in the list of functions, enter it in the search window and click "Go."[4]

- Select the "PMT" function and click "OK."

-

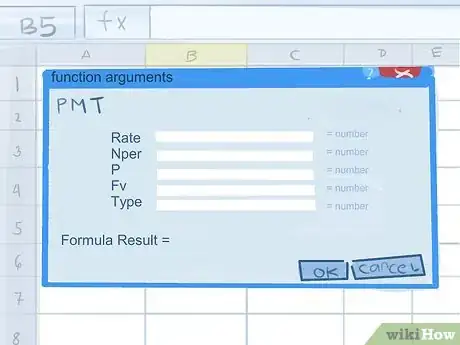

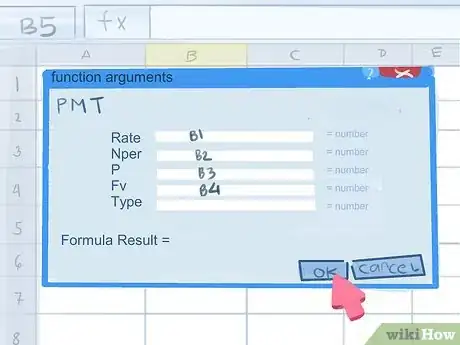

8Enter the data pertaining to your credit card balance, rate and projected payment periods from the fields in column B into the function window.

- You can type the data into each field.

- Alternatively, you can click on the Cell Link icon and then click the cell containing the information. After each entry, click the Cell Link icon again to return to the function window.

-

9Leave the "Type" field in the function argument window blank.

-

10Choose "OK" in the function argument window. You should now see the necessary credit card payment amount required to pay off your balance within the specified period.

Advertisement

Community Q&A

-

QuestionWhy does my answer show up as a negative when none of the input values are negative?

Community AnswerIt is a quirk of Excel. Place a negative symbol next to the PV cell name and the answer will become positive.

Community AnswerIt is a quirk of Excel. Place a negative symbol next to the PV cell name and the answer will become positive.

Advertisement

Warnings

- These calculations only work when no further charges are applied to the credit card in question. If you charge typical monthly expenses to a credit card and pay off the balance at the end of every month, use a different card than the one you are trying to pay off.⧼thumbs_response⧽

Advertisement

References

- ↑ https://exceljet.net/excel-functions/excel-pmt-function

- ↑ https://investinganswers.com/articles/how-calculate-monthly-loan-payment-excel

- ↑ https://kb.wisc.edu/helpdesk/page.php?id=25582

- ↑ https://exceljet.net/formula/calculate-payment-for-a-loan

- ↑ https://support.office.com/en-us/article/nper-function-240535b5-6653-4d2d-bfcf-b6a38151d815

About This Article

Advertisement