This article was co-authored by Ryan Baril. Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

This article has been viewed 53,545 times.

A hardship letter is a key factor in getting approved for a loan modification program. If you can write a polite and accurate hardship letter, you may be able to convince your lender to give you another chance to repay your loan. However, writing such a letter can be intimidating for money borrowers, as they are unsure of what exactly to write and how much of their story to include. Lawyers can usually write one of these letters for you, but at too large a cost for a borrower experiencing financial hardship to afford. Luckily, writing your own hardship letter can be a simple process if you follow the steps below.

Steps

Starting Your Letter

-

1Explore your other options first. Writing a hardship letter may not always be the best solution. Before beginning your hardship letter, consider whether this is the best option for your situation. There may be an alternative that would work better for you.

- For example, you may consider refinancing an underwater mortgage through HARP, consolidating other debts, or selling luxury items to free up some extra money and pay the debt.

-

2Contact your lender. Call your lender's loss mitigation department and speak to a representative. Ask the person for the name and direct phone line of who you need to address your hardship letter to. Be sure to clarify both the spelling of the name and the number so you are sure that you have both right. You should also ask for the address of the lender. Make sure to have a pen and paper ready to write this information down.[1]

- Keep in mind that company you are contacting may not be the same as the original lender. Make sure to contact the company listed on the bill.

Advertisement -

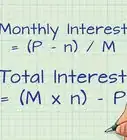

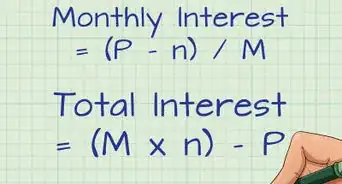

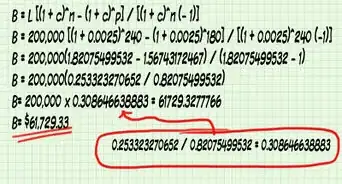

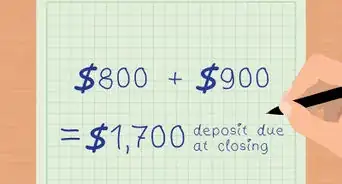

3Calculate your loan modification needs. When you write your letter, you will need to know exactly what to ask for. You know that you can't afford your current mortgage payments, but what exactly do you want the lender to do about it? Do you want them to forgive your missed payments and then restart with your regular payments? Or do you need a lower payment for a period of time? Having a reasonable request of the lender can improve your chances of success.

-

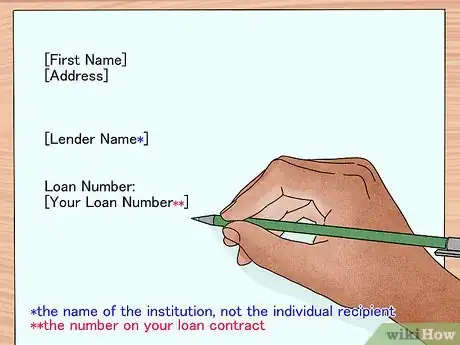

4Put the proper heading on your letter. There is no set format for addressing your letter. However, it is important that your letter gets to the right place in the lender's organization and that they have enough information to access your loan information. To make sure you include all of the required information, consider using the following format:

- On your first line, write your full name. Go down a line and write your address on the next two lines (the second and third lines).

- Write in your lender's name (the name of institution, not the individual recipient).

- Skip another line, then write "Loan number:" and then your loan number. This number can be found on your loan contract.

-

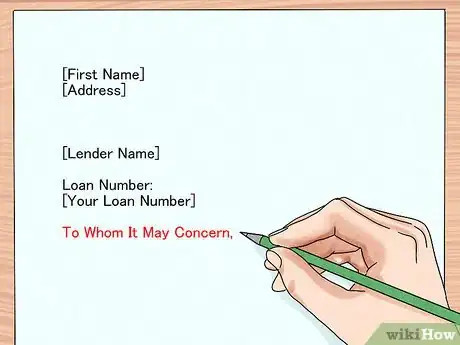

5Open your letter properly. Skip another line after your loan number and write in your greeting. This can be either the generic, "To Whom It May Concern" or a "Dear Mr./Mrs./Ms. ___," depending on how much you know about who are writing the letter to. Then, skip another line before beginning the body of your letter.

Explaining Your Hardship

-

1State your situation. In the next part of your letter, clearly mention which kind of hardship you are suffering from and how you got there. Financial hardship is defined for the purpose of loan modification as a decrease in income or increase in expenses that was completely beyond your control or unexpected. State your hardship and then briefly explain how the situation arose. If you have more than one hardship currently affecting you, be sure to include all of them.

- Different lenders have different standards for what exactly qualifies as financial hardship. In general, valid hardships include the following:

- Loss of income/job.

- Sudden illness/medical expenses.

- Death of immediate family/other borrower on the loan.

- Divorce/separation.

- Military service.

- Legal expenses.

- Changes in loan payments (ARM adjustment).

- An example of an invalid hardship is that you were misled in the loan agreement or were unaware of the terms of the loan.[2]

- Different lenders have different standards for what exactly qualifies as financial hardship. In general, valid hardships include the following:

-

2Explain your plans for the house. It's best when the lender knows exactly what your goals are in obtaining loan modification. Do you want to keep the house or sell it as soon as possible? If you plan to keep the house, state that doing so is "a priority." Otherwise, make sure to note whether you are willing to do a "short sale" to get out of the house quickly. This means selling the house at below market value so that it will sell more quickly.

-

3Make a specific loan modification request. You'll need to offer potential solutions to the lender so that you can work together with them to modify your loan. Think about your loan needs and suggest a loan modification that you think would be fair to your lender and allow you to get out of current financial hardship. For example, consider the following modifications:

- If your interest rate has increased to an unmanageable level, consider asking for a reduction in that interest rate.

- If you are behind on your payments, ask for your lender to grant you a temporary reduction in payments and a plan to repay the back payments over time after your situation improves. When you do this, make sure that the amount you offer is something you can actually afford right now.

- If your home is less valuable than the balance of your loan (due to falling home prices), you may be able to get your lender to decrease the balance of your loan.[3]

- Make sure to state your request in clear terms. For example, don't say, "I want lower payments." Instead, try saying, "I would be able to afford payments of $500 per month for the next three months, at which point I could resume paying my current payments."

-

4Talk about what you have done to ease your hardship. Write down what measures you have taken to overcome this hardship. Talk about your attempt to refinance the mortgage if you have applied for a refinance and failed to qualify. Describe your efforts to cut household expenses or sell other items to cover your mortgage. If you've lost a job, make it clear to the lender that you are actively seeking a new one. Here is where you can make your case that this loan modification is your last resort.[4]

-

5Make a promise to avoid further modification. Mention that you are a good and responsible citizen and, if you get a chance to modify your mortgage loan, you will never default in your mortgage payments and prove yourself a genuine borrower. If your financial situation has improved since you experienced the hardship, say so. Anything that will convince your lender of your ability to pay modified payments can only help your case.[5]

-

6End your letter by summarizing it. Briefly restate your hardship, specific loan modification request, and your promise to make future payments. Make this section only one or two sentences long.[6]

-

7Supply contact information. Start a new paragraph and provide the lender with an phone number and email at which you can be reached. Offer to submit any documentation or proof of your financial situation or hardship at their request. Finish by writing "Sincerely," and then signing your name beneath. Under your signature, type or print your full name again.[7]

Perfecting the Letter

-

1Keep it short and sweet. Check the length of your letter. Your goal should be to shoot for about a page in total. If it is any longer, the lender may not bother to read all of your letter. If your letter is too long, go back and eliminate any unnecessary or irrelevant sentences or details. Try to eliminate personal information that you may have included to make your case. These facts may be important to you but not as much for the lender.[10]

- For example, don't mention if your financial hardship is partially due to a drinking or drug problem.

- Make sure to avoid complaining in the letter because these types of letters are often ignored.

-

2Attach relevant documents. It is likely that your lender will request documentation of your financial situation or hardship. Anticipate this need by attaching information like pay stubs and bank statements from the relevant time period to your letter. Be ready to supply other documents if the lender asks you to.[11]

-

3Don't lie or stretch the truth. Your lender will have access to your financial documentation and likely will request other records of your employment or other documents as necessary. Because of this, it is likely that they will know if you are lying in your hardship letter. Doing so will result in the immediate denial of your loan modification request. This may even be considered fraud, which could give the lender reason to request that you pay the entire loan balance immediately.

-

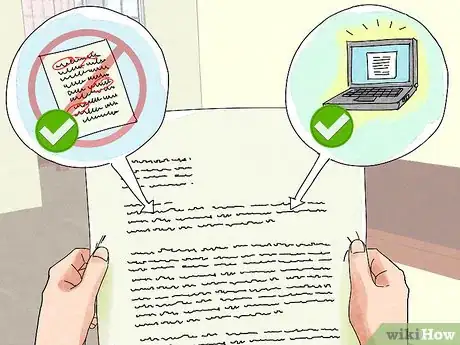

4Edit your letter carefully. When you've edited your letter down to size, go back through and try to identify any errors in your spelling, grammar, and punctuation. Presenting yourself well in your letter depends on your ability to craft a well-written and error-free letter. If necessary, have a friend or relative read over your letter for you to spot any errors or inconsistencies.

- It may be helpful to type your letter, rather than write it by hand, because of the spellchecker included in word processors. Doing so will also make revisions much simpler.

References

- ↑ http://www.bankrate.com/finance/mortgages/writing-a-hardship-letter-for-a-loan-mod.aspx

- ↑ http://library.hsh.com/articles/loan-modifications-help/how-not-to-write-a-loan-modification-hardship-letter/

- ↑ http://www.bankrate.com/finance/mortgages/writing-a-hardship-letter-for-a-loan-mod.aspx

- ↑ http://www.bankrate.com/finance/mortgages/writing-a-hardship-letter-for-a-loan-mod.aspx

- ↑ http://www.nytimes.com/2013/01/06/realestate/mortgages-writing-the-hardship-letter.html?_r=0

- ↑ https://mortgagereliefproject.org/resources/writing-effective-hardship-letter/

- ↑ http://library.hsh.com/articles/loan-modifications-help/how-not-to-write-a-loan-modification-hardship-letter/

- ↑ https://mortgagereliefproject.org/resources/writing-effective-hardship-letter/

- ↑ http://www.bankrate.com/finance/mortgages/writing-a-hardship-letter-for-a-loan-mod.aspx

-Step-18.webp)