This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 17 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 67,490 times.

Getting a loan by using the title to your vehicle as collateral is sometimes a viable way to get cash quickly and easily. Once your immediate financial need is resolved, there is still the task of paying off the loan and regaining control of your vehicle's title. In most cases, this process is a very simple one that requires making payments on time and making sure that, once the debt is settled, the title loan company properly reports the activity and removes the lien on your vehicle's title.

Steps

Reclaiming Your Car Title

-

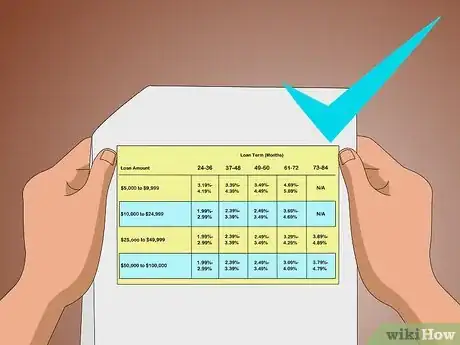

1Review the terms of the loan. When you finally pay off the balance of your title loan, the loan company will remove the lien it placed on your vehicle, which represents the loan company's legal right to take possession of your vehicle until you have paid back your debt. It will then return the title to you. This process should be spelled out in your loan agreement. Look over this document to understand exactly what you need to do in order to restore full title to your vehicle.

- Lenders typically charge a monthly fee that can be quite high, which you will have to pay in addition to the original amount borrowed.[1]

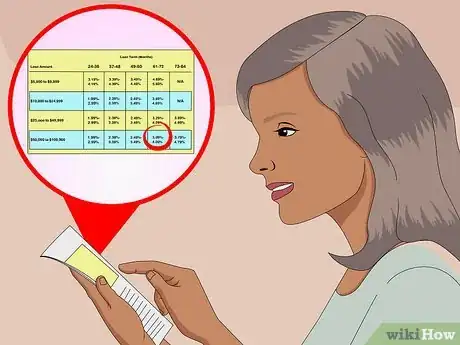

- There will also be an associated APR with the loan, which represents the amount of interest you would have to pay over the course of a year. The lender must present you with the terms of the loan in writing before you sign it.[2]

- When you are applying for a car title loan, federal law requires the lender to tell you both the APR (not just the monthly rate) and the total cost of the loan in dollars.[3] [4]

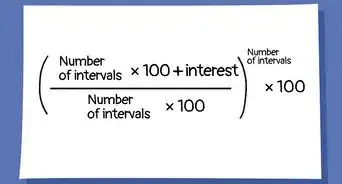

- Your APR will be based on the amount borrowed, the monthly interest rate, the fees you must pay, and the duration of the loan.[5]

-

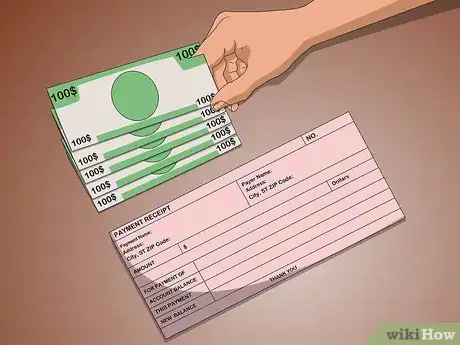

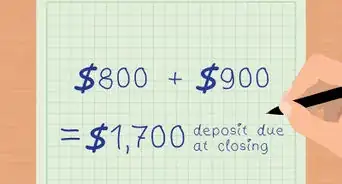

2Pay off your car title loan as soon as possible. When you sign a loan agreement with a title loan company, you are basically saying that the loan company can take your car if you do not pay back the amount borrowed under the terms of the agreement.[6] Therefore, before you can regain the vehicle title you surrendered when you received the loan, you must pay off the loan in full, including the original loan amount, monthly interest, and any additional fees.

- Try to pay off this amount as soon as possible to avoid further fees or charges.

- If you are having trouble coming up with the money, and you really need your vehicle, try borrowing from a source that charges less interest/fees than what the title loan company is charging you.

Advertisement -

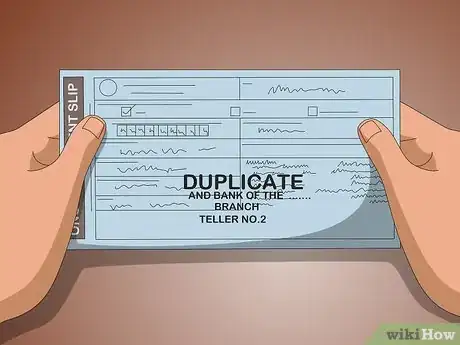

3Obtain proof that the loan is settled. Most title loan companies will supply documentation that confirms the loan is settled in full, complete with details regarding the payoff date, history of payments remitted, and other relevant data. Keep this document in a safe place in case there are any problems with restoring your vehicle's title.

-

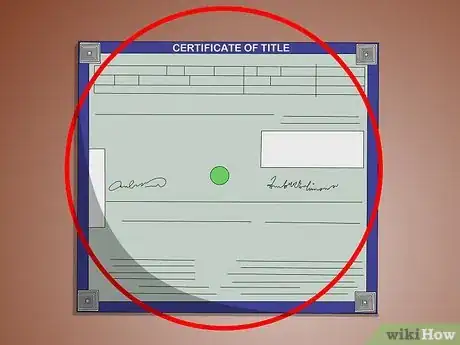

4Receive your vehicle's title. After you have paid off the loan in full, the loan company will sign your vehicle's title to signify the release of its lien on the vehicle and mail you the vehicle title you surrendered at the time you executed the loan. Depending on your jurisdiction, the loan company may have to return this title in a specified amount of time.

- For example, in Texas, a title loan company must return the title to you and clear its lien on your vehicle's title within 10 business days of receiving payment in full.[7]

-

5Submit your vehicle's title to the appropriate government agency to clear the lien. Generally, you will be working with your state's Department of Motor Vehicles ("DMV") to clear the lien on your vehicle's title. While the process varies by state, generally you will have to complete a form to restore title and mail that form, along with your vehicle's title, to the DMV along with a processing fee. The DMV will then remove the lien from the title and issue you a new title, restored fully in your name.

- For example, in California, you must submit your title within 30 days of receiving it from the title loan company, pay a transfer fee of $15, and then the DMV will issue you a new title identifying you as the sole owner of the vehicle.[8] [9]

- In Texas, you must visit your local county's tax office, pay a title fee of between $28–$33, and then submit your vehicle's title, proof of release of lien, and a completed title application to restore your vehicle's title.[10]

-

6Monitor the progress of your title. Many agencies will provide verification that the paperwork from the title loan company has been received and is in process, and can give you an estimated amount of time for processing. This will help you get some idea of when to expect your restored title.

- You can use this chart to find the contact information for the DMV for your state.[11]

-

7Review your restored title. Once you receive your restored title, go over it to make sure the information is accurate and complete. If there are any errors or omissions, contact the issuing agency immediately and arrange to have the information updated. This will help prevent any possible difficulties with the title in the future, such as when securing tags, paying taxes on the vehicle, or selling the automobile to a new owner.

Finding Alternatives to Car Title Loans

-

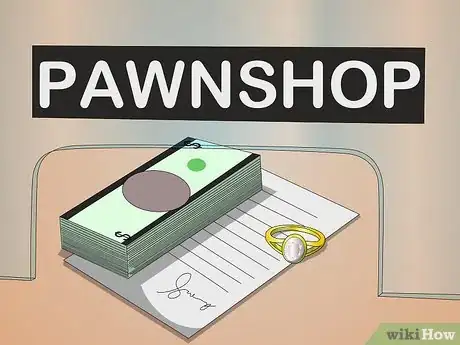

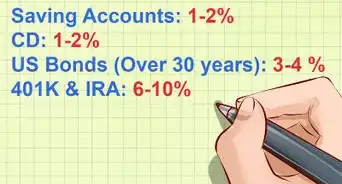

1Consider other forms of borrowing money. Car title loans can be problematic for the borrower for a variety of reasons, most notably the high interest rates and fees associated with this type of loan which could lead to an inability to pay while interest continues to compound on the original amount you borrowed. Ultimately, this can lead to you losing your vehicle, which can impair your ability to carry out daily tasks or attend work. Before you consider obtaining a car title loan, consider other methods of borrowing money:[12] [13] [14] [15]

- Getting a loan from a bank or credit union.

- Getting a paycheck cash advance from your employer.

- Borrowing money from family, friends, or your church.

- Getting a cash advance on your credit card.

- If your need for money arises from obligations to other creditors, try contacting them and discussing repayment plans or other ways to satisfy or reduce your debt.

-

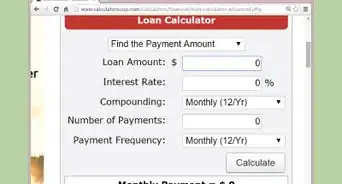

2Compare the costs of these alternative methods. If you are able to identify other methods of borrowing the money you need, it is best to compare them before selecting one. Take note of the following information and use it to decide which terms are most favorable to you:[16]

- The APR.

- Any additional fees involved.

- The time by which you must repay the amount borrowed.

- The consequences involved if you are unable to repay the loan.

-

3Choose an alternative form of borrowing. After you have considered your options, choose the one that makes the most financial sense. Your option should have comparatively low interest rates, a reasonable repayment window, and should provide you with sensible options should you encounter difficulties with repayment. Above all else, you should remember to only borrow what you believe you can pay back in the time provided.

- The last thing you want is to enter a vicious cycle of borrowing money, incurring high fees, and then having to borrow more money to pay off the initial loan.

Understanding How Car Title Loans Work

-

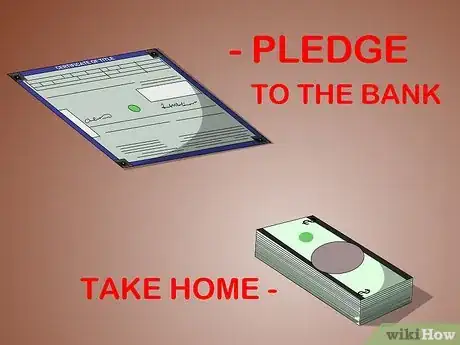

1Consider what a car title loan is. The basic idea of this type of loan is that you—in return for an agreed-upon amount of money, usually a relatively small amount—give a lender the title to your vehicle.[17] You must generally own the vehicle outright.[18] You also are generally required to pay a borrowing fee in addition to repaying the loan itself. This amount is usually due within a short time, usually around 30 days from the date you take the loan.[19]

- In the case that you are unable to pay off the loan in the designated timeframe, the lender will take possession of your vehicle using the title you surrendered at the time of the loan.

- A 2013 study found that the average consumer takes out a car loan for about $950, renews the loan eight times, and ends up paying about $2,100 in interest alone at a 300% annual percentage rate ("APR").[20]

-

2Check to see if the lender is properly licensed/registered. Before you obtain a car title loan from a particular company, it is best to check if that company is properly registered with the state. While not all states require such registration and state law differs with regards to the regulation of title-loan companies, you should at least check to see if the loan company has complied with any required official process before you take out a loan.

- For example, in California, all title-loan companies must be registered with the California Department of Business Oversight.[21] You can search online to see if the company is registered using the database provided.[22]

- While this is not a guarantee that the loan company is reputable, it is far better than obtaining a loan from an unregistered company.

-

3Present the lender with necessary information. The first step in obtaining a car title loan is to go to a lender that deals in this type of loan transaction and present the lender with the information the lender will use to process your loan. This information includes:[23] [24]

- A completed loan application.

- Your car itself.

- Your car's title.

- A form of photo identification.

- Proof of insurance.

- Some lenders also ask for an extra set of car keys (used to take your vehicle if you default on the loan) or require you to enroll in some type of roadside-assistance plan.

-

4Review the terms of your loan agreement. The second step in obtaining a car loan is to review the terms of the loan itself. Read through the entire document, paying special attention to any monthly fees, the APR, the total amount of the loan, and the date by which you must repay the loan.

-

5Surrender your car title to receive cash. After a borrower has reviewed and agreed to the terms of a car title loan, the lender provides the borrower with a cash advance and the borrower gives the lender the certificate of title for his or her vehicle. The lender will then place a lien on your car's title.[25]

- Generally, you will still be able to use your car during the duration of the loan.[26] You will not have full legal title to it, however, because you have surrendered the title to the loan company as a form of collateral.

-

6Understand what happens if you can't pay back the loan. If you can't pay back the original amount borrowed plus any applicable fees by the date these amounts are due (again, usually within 30 days), there are several things that can happen:[27]

- The lender might allow you to "roll over" your loan, giving you an extension of time in which to pay off your outstanding balance. You will, however, likely be charged an additional monthly fee for doing so that can be quite high.

- If you roll over your loan repayment multiple times, you may end up paying more in fees than the amount you originally borrowed.[28]

- If you cannot pay off the balance despite one or more roll overs or extensions, the lender will eventually stop offering these extensions, declare your loan to be in default, and then take your car using the title you provided at the time you signed the loan agreement.[29] You will lose possession of your vehicle.

- Some states require title loan companies that repossess and sell your car to pay you the difference between the sale price and the amount of your loan.[30] Some states do not.

Warnings

- Before you get a car title loan, ask yourself if you will be able to repay the loan by the time it is due. Think about exactly how you will pay off the loan (i.e., what money will you use). If you doubt your ability to do so, it is probably best to avoid this type of loan as interest and fees can accrue quickly.⧼thumbs_response⧽

References

- ↑ https://www.consumer.gov/articles/1013-car-title-loans#!what-to-know

- ↑ http://www.consumer.ftc.gov/articles/0514-car-title-loans

- ↑ https://www.consumer.gov/articles/1013-car-title-loans#!what-to-know

- ↑ http://www.cnn.com/2008/LIVING/wayoflife/10/08/aa.car.title.loans/index.html?iref=24hours

- ↑ https://www.consumer.gov/articles/1013-car-title-loans#!what-to-know

- ↑ http://www.idfpr.com/finlit101/faq/titleloans.asp

- ↑ http://www.txdmv.gov/motorists/buying-or-selling-a-vehicle/add-remove-lien

- ↑ https://dmv.ca.gov/portal/dmv/?1dmy&urile=wcm:path:/dmv_content_en/dmv/vr/vr_info

- ↑ https://dmv.ca.gov/portal/dmv/?1dmy&urile=wcm:path:/dmv_content_en/dmv/pubs/brochures/fast_facts/ffvr34

- ↑ http://www.txdmv.gov/motorists/buying-or-selling-a-vehicle/add-remove-lien

- ↑ http://www.dmv.org/dmv-office-finder.php

- ↑ https://www.consumer.gov/articles/1013-car-title-loans#!what-to-do

- ↑ http://www.cnn.com/2008/LIVING/wayoflife/10/08/aa.car.title.loans/index.html?iref=24hours

- ↑ http://www.aarp.org/money/credit-loans-debt/info-01-2014/how-car-title-loans-may-wreck-your-finances.html

- ↑ http://www.consumer.ftc.gov/articles/0514-car-title-loans

- ↑ https://www.consumer.gov/articles/1013-car-title-loans#!what-to-do

- ↑ https://www.consumer.gov/articles/1013-car-title-loans#!what-it-is

- ↑ http://www.illinoislegalaid.org/index.cfm?fuseaction=home.dsp_content&contentID=1975

- ↑ https://www.consumer.gov/articles/1013-car-title-loans#!what-it-is

- ↑ http://www.aarp.org/money/credit-loans-debt/info-01-2014/how-car-title-loans-may-wreck-your-finances.html

- ↑ http://dcba.lacounty.gov/wps/portal/dca/main/home/yourmoney/owningacar?1dmy&page=dept.dca.yourmoney.detail.hidden&pswid=Z7_F000GOBS2O6440A0P50QJC2Q45&urile=wcm%3Apath%3A/dca+content/dca+site/home/your+money/owning+a+car/tipsheet+car+title+loans

- ↑ http://dbo.ca.gov/FSD/Licensees/

- ↑ https://www.consumer.gov/articles/1013-car-title-loans#!what-to-know

- ↑ http://www.consumer.ftc.gov/articles/0514-car-title-loans

- ↑ http://www.consumeraffairs.com/finance/payday.html

- ↑ http://dcba.lacounty.gov/wps/portal/dca/main/home/yourmoney/owningacar?1dmy&page=dept.dca.yourmoney.detail.hidden&pswid=Z7_F000GOBS2O6440A0P50QJC2Q45&urile=wcm%3Apath%3A/dca+content/dca+site/home/your+money/owning+a+car/tipsheet+car+title+loans

- ↑ https://www.consumer.gov/articles/1013-car-title-loans#!what-to-know

- ↑ http://www.consumer.ftc.gov/articles/0514-car-title-loans

- ↑ http://news.vanderbilt.edu/2013/04/car-title-loans-people/

- ↑ http://www.consumer.ftc.gov/articles/0514-car-title-loans

- ↑ http://www.consumerfed.org/pdfs/Resources.CTL.StateLawTermChart12.2.12.pdf