This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

This article has been viewed 194,762 times.

Motorcycle riding is enjoyed by many people throughout the world. However, maintaining and owning a motorcycle can be costly. For those who need to get a motorcycle loan with bad credit in order to keep their favorite ride, a few basic steps can have a big impact and help cash-strapped cyclists to find personal finance solutions.

Steps

Increasing Your Chances of Getting the Loan

-

1Talk with your dealer. Not all dealers are as accommodating to low or poor credit scores. You will need to find a dealer that is willing to work with your credit to get you the loan that you want. Some dealers specialize in this and have unique relationships with lenders that are ready to work with you.[1] [2]

- You will need to speak with the dealer's finance team or department directly to learn if they can help you.

- Inform them clearly of your situation. You won't get an accurate picture of how likely you are to be financed if you don't convey your exact credit situation to your dealers finance team.

- You may not need to submit an application for financing to learn if you will get the loan or not. A capable finance manager should be able to tell you how likely you are to receive the loan when you do actually apply.

-

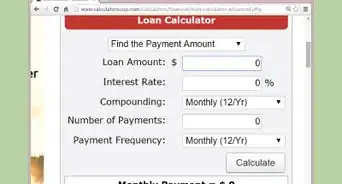

2Find the right lender. It may be tempting to apply wherever you can in an attempt to successfully get your application accepted. However, applying to many lenders at once can actually hurt your credit score further. You should also know that not all lenders are ideal for a motorcycle loan.[3]

- Apply only to lenders that specialize in personal loans[4] or in motorcycle loans.

- Look for key terms such as bad credit, poor credit, no credit, motorcycle financing, or after bankruptcy loans. Remember, though, that bankruptcy will typically not be a factor if it has been discharged for two or more years.

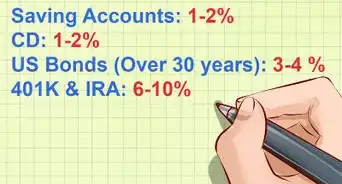

- Loans made to people with bad credit may have higher interest rates. Be fully aware of the conditions of your loan before accepting.[5]

Advertisement -

3Inform your lender if you have a co-signer. A co-signer to a loan is another person that promises to take on payments if you are unable. If your co-signer has a better credit score than you, this can help you to obtain the loan you are seeking.[6] [7]

- Your co-signer should have excellent credit.

- Having a co-signer helps assure your lender that they are more likely to receive their payments.

-

4Demonstrate your payments on a previous motorcycle. If you have made payments on another motorcycle, you can demonstrate your consistency on those payments. Despite your low credit score, by showing your previous motorcycle payments were always met on time, you increase the likelihood that you will receive the loan.[8]

-

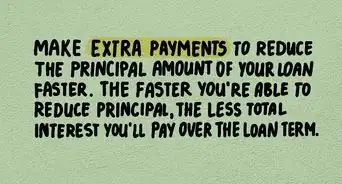

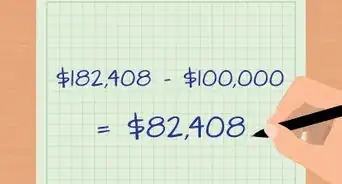

5Make a larger down payment. Try to save up as much money as you can, without a loan, for a down payment. By placing a larger amount of money down on your motorcycle upfront, you show that you are serious about this investment. Lenders will view larger down payments in your favor.[9]

- By paying off a majority of the cost, you will also save money on interest when you do take out a loan.

Working With Your Lender

-

1Meet the basic requirements. Regardless of how good or bad your current credit score is, you will need to meet some basic requirements first. The requirements help the lender to gauge your capability to repay the loan.[10]

- Must have valid forms of identification, such as a driver or motorcycle license, and a social security number.

- Must be at least eighteen years old.

- You should be earning enough discretionary income to pay the payments. Demonstrating you earn enough to cover the monthly payment will increase your chances of getting the loan.

- Have held stable employment for at least six months. Having a stable source of income will show that your payments are more likely to be on time and the proper amount.

- If you are self-employed, you may need to be able to prove that you have worked in your industry for at least two years, and provide a profit and loss statement or a gross earnings statement for the past year.

-

2Communicate with your lender. It may seem like having a bad credit score leaves most of the application process up to luck, but a little communication goes a long way. Discuss some of the following points with your lender:[11]

- If you had a one time reason for your poor credit, such as a medical emergency, explain this and assure your lender that this expense was unavoidable and is in the past.

- Prove your level of income. Showing exactly how much you earn isn't always required, however, doing so will show that you are serious and capable of paying your loan. Bring in the last two years tax returns or your last six pay stubs to share.

- Let them know how stable you are. If you have lived and worked in the same place for a period of a few years, let your lender know this. Stability indicates that you are more likely to fully pay back the loan on time.

- Explain any filing for bankruptcy. If you did file for bankruptcy you should explain why, especially if it was due to a major life event such as a medical bill.

-

3Take actions to protect your lender. Showing that you are willing to work to protect your lender's investment will go a long way in their consideration of your application. Demonstrate that you are willing to work with them by informing them of the following actions you should take:[12]

- Allow them to automatically take payments from your account. This shows that you are confident that the funds will be there as well as assuring them that you will not miss a payment.

- Inform them that you will be purchasing full coverage insurance, extended warranty, and a GAP policy.

- Full coverage insurance and GAP policies will help protect the value of your motorcycle in case of an accident or theft.

- Having an extended warranty will help protect the value of the motorcycle by replacing and repairing parts covered by that warranty, should they fail.

Improving Your Credit

-

1Check for errors. The people that work to calculate your credit score can make mistakes. These mistakes may cause your score to appear much lower than it actually is. Check your credit score and dispute any errors that you may suspect.

- There are a few online services that let you dispute any errors you may have found such as Experian, Trans Union, or Equifax. If you find disputes with one, check all three to make sure they are fully addressed.

- Fixing errors in your credit score will increase the score and give you an accurate picture of where your credit is currently.

-

2Try negotiating. Despite having missed a few payments, or made a few late payments, you may still be able to negotiate with your creditors to have these events changed in order to improve your credit score. Try asking about the following when negotiating your delinquent or late payments:[13] [14]

- Ask your creditors if you can pay off the full amount on a delinquent loan in order to have it labeled “paid as agreed” instead of a missed payment.

- If you have only one or two missed payments on an otherwise great payment schedule, write a letter to your creditor that highlights your overall positive payments. They may remove the late payments affecting your score negatively.

-

3Use your credit cards effectively. Credit card use is a great way to positively increase your credit score, so long as you use them properly. Try taking the following steps to increase your credit score by best managing your credit cards.[15] [16]

- If you do not have a credit card, obtain one and start using it. Sometimes you can get a prepaid credit card if you do not qualify for a regular credit card. These will often charge higher interest rates along with additional fees.

- Keep the amount charged on your credit card low. Having charges that are maxed out, or close to it, will hurt your credit score.

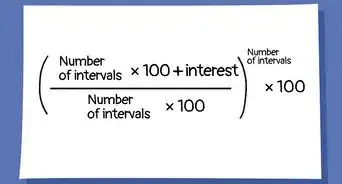

- Don't overuse your credit card. Using 30% of your card's maximum limit a month is acceptable, so take the card limit and divide it by three to get the amount you can spend per month. Try to pay off that balance in full every month. Using your card too much in a month, even if you pay it off, will only give the impression that you are a reckless spender.

- Increase your limit. If you do use your card often, increase the maximum limit. You must be careful to not also increase your spending amount. Strive for ten to thirty percent of your card's limit a month.

- Don't close any cards. Closing a card will look bad to any credit scoring system. Instead, keep your card working for you by using it to pay for a small monthly bill which is easily repaid.

Expert Q&A

-

QuestionWhat rate would I get for a motorcycle loan through a credit union with a FICO of 600?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker There would be several factors involved besides the credit score. They would look at your debt to income ratio, how long you have been employed, reasons for the lower credit score. They will also look at what is outstanding that should be dealt with.

There would be several factors involved besides the credit score. They would look at your debt to income ratio, how long you have been employed, reasons for the lower credit score. They will also look at what is outstanding that should be dealt with.

Warnings

- Avoid payday loan lenders. These are a poor choice for a motorcycle loan and will almost always have extremely high interest rates.⧼thumbs_response⧽

- If you avoid all debts and have a zero credit score, you could be in just as much trouble as someone with bad credit. It can take months to raise a zero credit score, so plan ahead.⧼thumbs_response⧽

References

- ↑ http://www.streetdirectory.com/travel_guide/142169/debts_loans/securing_motorcycle_loans_for_bad_credit_individuals___5_tips.html

- ↑ http://www.motorcycle-financing-guide.com/bad-credit-motorcycle-loans/

- ↑ http://www.motorcycle-financing-guide.com/bad-credit-motorcycle-loans/

- ↑ http://www.streetdirectory.com/travel_guide/142169/debts_loans/securing_motorcycle_loans_for_bad_credit_individuals___5_tips.html

- ↑ http://www.finweb.com/loans/qualifying-for-bad-credit-motorcycle-loans.html#axzz3g4HW3M2Q

- ↑ https://www.debt.org/credit/loans/bad/

- ↑ http://www.motorcycle-financing-guide.com/bad-credit-motorcycle-loans/

- ↑ http://www.motorcycle-financing-guide.com/bad-credit-motorcycle-loans/

- ↑ http://www.finweb.com/loans/qualifying-for-bad-credit-motorcycle-loans.html#axzz3g4HW3M2Q

- ↑ http://www.finweb.com/loans/qualifying-for-bad-credit-motorcycle-loans.html#axzz3g4HW3M2Q

- ↑ http://www.motorcycle-financing-guide.com/bad-credit-motorcycle-loans/

- ↑ http://www.motorcycle-financing-guide.com/bad-credit-motorcycle-loans/

- ↑ http://time.com/money/3093382/everything-you-need-to-know-about-raising-fico-credit-score/

- ↑ http://www.forbes.com/sites/moneybuilder/2014/05/02/11-ways-to-raise-your-credit-score-fast/

- ↑ http://www.forbes.com/sites/moneybuilder/2014/05/02/11-ways-to-raise-your-credit-score-fast/

- ↑ http://time.com/money/3093382/everything-you-need-to-know-about-raising-fico-credit-score/

About This Article

If you have bad credit, you may still be able to get a loan for a motorcycle if you’re upfront with your dealer or lender. Talk to the finance teams of different motorcycle dealers to see if they can offer you a loan with bad credit. They might offer you a loan if you have a co-signer or if you pay a larger down payment. However, be prepared to pay a higher interest rate on your loan to balance the added risk for the lender. If you can’t get a loan from a dealer, try applying to other lenders that specialize in personal loans and motorcycle loans. For more tips from our Financial co-author, including how to improve your credit score, read on!