This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 18,595 times.

With the ease of online investing, buying shares of a company has become a relatively simple way to build a nest egg or start a retirement fund. Investing in a company in your own country is typically fairly straightforward — you may even be able to buy your shares directly from the company and save yourself some money on broker fees and commissions. If you want to invest in foreign businesses, however, you'll likely have a few extra hurdles. With a tender offer, you might even be able to get shares of a company before it goes public. While this is a relatively risky investment, the potential returns can be significant.[1]

Steps

-

1Choose the companies you want to invest in. Look in a business sector you're familiar with, especially if you're new to investing. Choose stocks in companies that perform well financially and seem poised for growth. Look at the company's financial reports, typically available on the company's website, as well as news reports about the company and information about the executives running the company.

- Simply investing in a company that you happen to like is also a perfectly reasonable strategy, provided you're only making a small, token investment. For example, if you love to drink Coke, you might want to buy a few shares in the Coca-Cola company.

- Read financial news stories about the stock to determine if experts consider the stock to be undervalued. This can indicate that the stock is a good investment if it outperforms other stocks that are similarly priced.

-

2Look for a direct investment option. Many companies have direct stock plans (DSPs) that allow you to buy stock directly from the company rather than using a broker. This can save you money over time in broker commissions and brokerage fees, although you may have to pay a fee to use the plan.[2]

- The company will typically have information about its DSP on its corporate website. It will outline the information you need to sign up for the plan, as well as minimum investments.

- Some companies allow you to invest a specific amount and purchase only fractions of shares.

- Keep in mind that when you buy through a DSP, you may not be able to sell your shares any time you want. There may also be other restrictions.

Advertisement -

3Open a brokerage account if you don't want to invest directly. If you prefer to use a broker, or if the company you want to buy shares of doesn't offer a DSP, choose a brokerage firm to manage your investments for you. Many online brokers cater to beginners and have valuable resources that can teach you about investing.[3]

- If you're new to investing, you might want to consider a full-service broker. Although the fees are typically higher than discount brokers, a full-service broker will provide expert personal guidance and services you won't find at most discount brokers.

- Online discount brokers are typically easier to use and have lower fees than full-service brokers. Many offer commission-free trades, which can save you a lot of money.

Tip: While fees and commissions should be your primary consideration when choosing a broker, don't let them be the sole reason you choose one broker over another. Factor in the resources the broker has available, the ease of use of the trading platform, and the broker's reputation.

-

4Place an order for the stock you want to buy. Buying stock is a little different from buying something in a store where the price is clearly marked and you know what you're going to pay. Because stock prices fluctuate continuously, you have a choice to buy the stock at whatever the going rate happens to be at the time your broker executes the order or set the maximum price you're willing to pay.[4]

- A market order tells your broker that you want to buy the stock at whatever the going rate is when the broker places your order. You can order either a specific number of shares or however many shares you can get for a specific amount of money.

- A limit order tells your broker that you will only pay a specific maximum amount per share. While this gives you a little more control over the transaction, these orders may take longer to place.

-

5Track the performance of your investments. Once you've purchased your shares, keep tabs on how they're doing so you know what your investment is worth. While you shouldn't get panicky about daily fluctuations, you may want to consider selling your stock if it has a consistent downturn. Ways to track your investment's performance include:[5]

- Reviewing your account statements from your broker

- Checking stock tables online

- Comparing your stock's performance to a sector index

- Following general economic, stock market, and financial news, as well as specific stories about the company you've invested in

Investing in Foreign Companies

-

1Use mutual funds or exchange-traded funds (ETFs) to avoid risk. The idea of investing in emerging markets, such as India or China, can be tantalizing. However, foreign investment can be risky and expensive. Fortunately, mutual funds in your own country may offer a fund that holds a basket of shares from the market that's sparked your interest.[6]

- ETFs are easiest for beginning investors because shares in these funds are traded just like stock and there's typically no minimum investment required.

- Because funds are automatically diversified, they take the hassle out of trying to choose individual stocks.

Tip: If you already own shares of domestic companies, limit your purchase of shares in foreign companies to no more than 20-25% of your portfolio.

-

2Identify companies you want to invest in. If you decide mutual funds or ETFs aren't for you, you'll have to research companies in the country you're interested in to find ones that are worthy of investment. Use the same criteria you would use to evaluate companies in your home country, focusing on an industry or market sector that you're familiar with.[7]

- When you look for foreign companies to invest in, you also want to pay particular attention to the situation in the country where the company is headquartered. Politics, natural disasters, and other crises can turn even the most solid foreign company into a bad investment.

- Study the country's regulatory framework for investments. Some countries don't require companies to provide detailed financial reports or offer much protection for investors against fraud.

-

3Check the guidelines for foreign investment. Some countries have guidelines that limit foreign investment by individuals or require that you maintain ties with the country. You may have to open a bank account with a bank in the country or select someone in the country who has power of attorney over your assets (typically your broker).[8]

- For example, if you want to purchase shares of a company in India, you must first open an account with an Indian bank. While you can fund that bank account with foreign currency, you must exchange that currency for rupees before you can execute a trade.

Warning: Foreign investment may have tax consequences in your own country as well as in the foreign country. Talk to an investment advisor who has experience with international investments.

-

4Hire a broker who trades on the foreign stock market. Identify the stock markets in the country where you want to invest. Start with brokers in your own country. Many large brokerage firms have international offices and trade on multiple foreign markets.[9]

- For example, if you want to invest in Chinese companies, you need a broker who trades on the Shanghai, Shenzhen, or Hong Kong exchange. This may require you to open an account with a Chinese brokerage firm, although some larger brokers trade on the Hong Kong exchange.

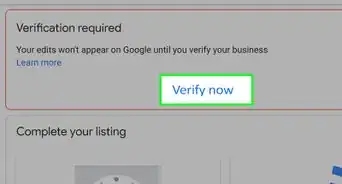

- If you do need to hire a foreign broker, you can typically do this online. However, you may have to go through additional steps to verify your identity.

-

5Exchange your currency if necessary. Typically, if you want to buy shares of a foreign company, you have to make your purchase in that company's local currency. Most brokers offer currency exchange, but you may get better rates if you go through a different service.[10]

- Because the value of currency fluctuates, you want to make sure you get the best possible exchange rate. This will ensure that you're able to get as many shares as possible for your money.

-

6Place an order to purchase shares in a company or fund. Stock markets all over the world operate in pretty much the same way. You place an order for stock with your broker and your broker purchases those shares for you on the exchange. Be mindful of time zones when you place your order.[11]

- If you place a market order, your broker will purchase the shares at whatever the going rate happens to be when they execute the order. With a limit order, on the other hand, you can set the maximum price per share that you're willing to pay for the stock.

- Keep exchange rates in mind when you're purchasing shares of a foreign company. You may want to monitor exchange rate trends to capitalize on the best possible rate.

-

7Monitor the political and financial situation in the country. Once you hold shares in a foreign company you have a stake in that country's political and financial future. Check international news to stay on top of political changes that might affect the value of your shares.[12]

- For example, if there's an election coming up in the country, the results of that election could significantly affect the value of your shares.

- If you can read the local language, looking for local news online gives you a more direct sense of what's going on in the country. Many browsers can also translate languages for you, but this may not always be the most reliable.

-

1Verify that you qualify as an accredited investor if necessary. In some countries, such as the US, only accredited investors are allowed to buy private company shares. Accredited investors have enough income to absorb a loss and are financially sophisticated enough to understand the risks. Generally, to qualify as an accredited investor as an individual, you must have: [13]

- Earned income of more than $200,000 a year (or $300,000 combined with your spouse)

- A net worth of more than $1 million, excluding the value of your primary residence

Tip: To calculate your net worth, add up the value of all of your assets, then subtract your debts. The resulting figure is your net worth.

-

2Check online platforms to identify stock options on the secondary market. Online platforms, such as SecondMarket and SharesPost, list company information and stock options available for sale on the open market. Typically, these platforms merely connect buyers and sellers but do not provide trading advice or verify company information.[14]

- If you're not looking to invest a large amount of money in stock options, these marketplaces may be your best bet. Essentially, they operate somewhat like auction platforms, such as eBay, that connect buyers and sellers.

- Because companies tend to stay private for longer than they did during the "secondary boom" from 2006-2013, stock options are more restricted. Although these online platforms aren't as populated as they once were, it's still possible for you to find something that interests you.

-

3Search financial news reports for direct tender offers. Many companies launch their own tender offers to raise additional capital before they go public. Because regulations require these tender offers to be publicized, you can find information about them on financial news websites or in the business and finance sections of general media outlets.[15]

- The public disclosure includes information about the options available and the starting price they'll go for. It will also let you know how long the tender offer will be open. Typically, tender offers are open for at least 20 days.

-

4Secure funds to purchase the stock options. You'll need to make the money available for the purchase of the stock options before the tender offer closes. Typically, companies work with a broker to deposit funds in an escrow account until the tender offer closes.[16]

- Any portion of your funds that are unused will be returned to you once the stock options are distributed.

- Keep in mind that high demand may drive up the price, so you may not end up getting as many stock options as you originally thought you would.

-

5Wait for the company to exercise its right of first refusal if necessary. If you're buying stock options directly from an individual, the company may have placed conditions on the sale. The most common condition is a right of first refusal, which gives the company the right to purchase its own shares before the individual who holds them sells them to someone else.[17]

- A right of first refusal gives the company a period of time to act, typically anywhere from a couple of weeks to a month. After that time elapses, if the company hasn't purchased its own shares, the individual who holds them is free to sell them to you.

- An individual holding shares subject to this condition is typically required to notify the company of their intent to sell their shares. If you see this condition on the shares (or options), ask the seller for proof that the company has been notified.

-

6Complete your purchase. The process of actually purchasing private company shares is similar to buying any kind of stock. If you buy them directly from an individual, you'll typically pay the price they ask. If you're buying the shares through a tender offer, the price may fluctuate depending on demand.[18]

- Generally, you can specify the number of shares you want to buy or the amount of money you want to spend. If you specify a monetary amount, you'll simply get as many shares as you possibly can for that amount.

- If you're buying the shares directly from an individual, these details may be dictated by the seller. For example, they may only want to sell 20% of their shares. In that case, that would be the maximum amount you could buy, even if you had more money and wanted more.

Warnings

- If you're new to investing, seek guidance from a qualified broker before purchasing company shares. Many online trading platforms offer tutorials and other learning resources to get you started.⧼thumbs_response⧽

References

- ↑ https://www.fenwick.com/FenwickDocuments/Pre-IPO-Liquidity-for-Late-Stage-Start-Up.pdf

- ↑ https://www.sec.gov/fast-answers/answersdriphtm.html

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

- ↑ https://www.getsmarteraboutmoney.ca/invest/investment-products/stocks/how-to-monitor-stock-performance/

- ↑ https://www.nerdwallet.com/blog/investing/investing-in-international-stocks-everything-you-need-to-know/

- ↑ https://www.nerdwallet.com/blog/investing/investing-in-international-stocks-everything-you-need-to-know/

- ↑ https://www.businesstoday.in/moneytoday/investment/tips-for-nris-to-invest-in-indian-mutual-funds-stock-market/story/18846.html

- ↑ https://www.fool.com/investing/how-to-invest-in-china-stocks.aspx

- ↑ https://www.nerdwallet.com/blog/investing/investing-in-international-stocks-everything-you-need-to-know/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

- ↑ https://www.nerdwallet.com/blog/investing/investing-in-international-stocks-everything-you-need-to-know/

- ↑ https://www.investor.gov/additional-resources/news-alerts/alerts-bulletins/updated-investor-bulletin-accredited-investors

- ↑ https://www.fenwick.com/FenwickDocuments/Pre-IPO-Liquidity-for-Late-Stage-Start-Up.pdf

- ↑ https://media2.mofo.com/documents/090701tenderoffers.pdf

- ↑ https://kbfinancialadvisors.com/what-are-tender-offers-how-to-prepare/

- ↑ https://www.fenwick.com/FenwickDocuments/Pre-IPO-Liquidity-for-Late-Stage-Start-Up.pdf

- ↑ https://www.fenwick.com/FenwickDocuments/Pre-IPO-Liquidity-for-Late-Stage-Start-Up.pdf