This article was co-authored by Jack Herrick. Jack Herrick is an American entrepreneur and wiki enthusiast. His entrepreneurial projects include wikiHow, eHow, Luminescent Technologies, and BigTray. In January 2005, Herrick started wikiHow with the goal of creating "the how-to guide for everything." He has a Master of Business Administration (MBA) from Dartmouth College.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 101,127 times.

Measuring company growth is necessary if you want to determine the success of any company, including your own. There are a number of ways in which you can measure the growth of a company, and no "best way" to do so. In order to get accurate results, you must implement consistent methods that evaluate all areas of the company, from internal factors to external. Consider the following steps if you want to measure company growth

Steps

Setting Growth Goals

-

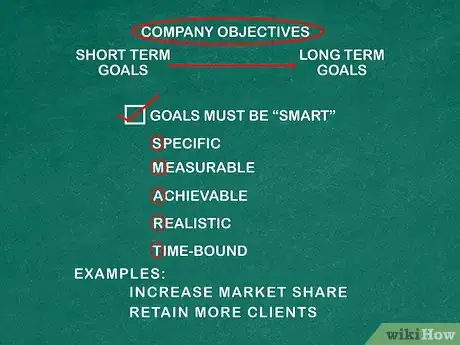

1Lay out company objectives so that you can determine progress. If you have goals to meet, not only do you have something to strive for, but you have something to measure against. When setting your objectives for your company, don't set yourself up to fail. Be realistic about what you can achieve so that you can be successful at achieving it. In the same way, don't lower your expectations so that you can easily accomplish your objectives. Set objectives that are both realistic and challenging.

- Goals may include objectives like increasing market share or retaining more clients.[1]

- Consider splitting your goals into short term and long term goals, which refer to goals achievable in under a year and those achievable in over one year, respectively.

- A good way to check your goals is to make them conform to the acronym SMART (Specific, Measurable, Achievable, Realistic, Time-Bound).

EXPERT TIPJack Herrick is an American entrepreneur and wiki enthusiast. His entrepreneurial projects include wikiHow, eHow, Luminescent Technologies, and BigTray. In January 2005, Herrick started wikiHow with the goal of creating "the how-to guide for everything." He has a Master of Business Administration (MBA) from Dartmouth College.Founder of wikiHow

Jack Herrick

Jack Herrick

Founder of wikiHowJack Herrick, founder of wikiHow, adds: “The most important thing when you’re measuring growth metrics is to measure them consistently and accurately, and to not be persuaded that the numbers you’re seeing aren’t real.”

-

2Put together a business plan so that you stay on track. Your business plan should reflect the objectives that you have for your company, as well as the methods you plan to apply in trying to achieve them. When measuring company growth, you will consult your business plan to not only see if you have managed to achieve objectives, but also confirm that you have successfully followed the plan that you set out for your business.

- If necessary, put together additional methods to measure the growth variables that you have selected. These so-called key performance indicators (KPIs) can be measurements taken from financial statements, sales figures, or other sources that you think are necessary to assess the company's growth.[2]

Advertisement -

3Hire an outside source to assist you in measuring company growth. This external service will come in and evaluate your current business. Having an outside consultant look at your organization can provide you with a fresh perspective that can identify problems you might have missed. Consultants are particularly useful for using accounting or statistical analysis to measure growth of specific business metrics.[3]

- Be aware that even the best statistical analysis sometimes overlooks basic managerial problems that can only be solved by the company's leadership.

-

4Benchmark your company against competitors. Growth is important within your company, but measuring growth in comparison to competing businesses determines your success in the industry. If you improve your reputation in the marketplace, you will ultimately attract more clients and increase growth within the company.

- If your competitors are publicly-traded companies, you will be able to find the figures you need in their annual reports, which by law must be posted on their websites.

- You may be able to find what you need in press reports, trade publications, or media coverage regarding your competitors.[4]

- When calculating performance ratios, be sure to compare them to industry averages, provided you are able to find them. Try searching online for research in your industry.[5]

Measuring Operational Growth

-

1Assess your customer base and determine whether that has increased. Not only are you looking for more customers, but you should be seeing better quality customers. Your customer base should be bringing in more profit. This means you are seeking to gain repeat customers and build customer loyalty.

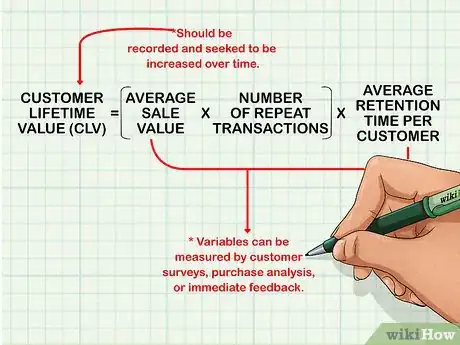

- Customer value is often measured as customer lifetime value (CLV). This figure is calculated by multiplying the average sale value by the number of repeat transactions and then multiplying that total by the average retention time of each customer.[6]

- The result of the CLV calculation should be regularly recorded and businesses should seek to increase it often time.

- This can be measured by customer surveys, purchase analysis, or by immediate feedback ("is this your first time shopping with us?"). Systems need to be implemented to measure these variables.[7]

-

2Compute revenue growth. Revenue growth is one of the simplest ways to measure company growth over a period of time. Typically, growth is measured using the compounded annual growth rate (CAGR). This calculation is particularly useful for summarizing growth over longer time frames, like 5, 10, or 20 years.[8]

- The CAGR equation is as follows: CAGR = final value divided by starting value times 1 over number of periods less 1 or (FV/SV)1/n-1.

- The beginning value here would be revenue in the first year in the range being calculated and ending value would be revenue in the last.

- For a longer explanation of how to calculate CAGR, see how to calculate compounded annual growth rate.

-

3Calculate workforce growth. Keep track of new hires for the year and compare them to previous years. A growing company should continue to hire new employees as it expands. You can also express this figure as a percentage by dividing the number of new hires in a year by the total number of employees at the beginning of that year.

-

4Find your market share growth. Market share is a company's portion of the total value of their given industry. It is calculated by dividing the company’s total revenues by the total revenues in an industry over a period of time by the company's revenue over the same period. This period can be a quarter, a year, or several years.

- Growth can be determined by calculating the company's market share in several different periods and looking for growth or shrinkage in that company's share of the market.[9]

- For example, if you are researching a company in a $1 billion market and that company had revenues of $150 million in 2014 (15 percent of the market) and $170 million in 2015 (17 percent of the market), their market share has increased 2 percent in the past year.

Calculating Value Growth

-

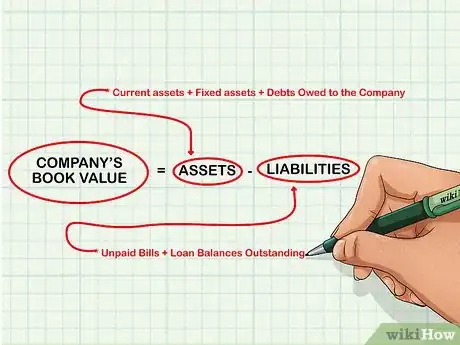

1Calculate the company's book value. The company's book value represents the difference between the company's assets and liabilities. In simpler terms, it represents the net value of all of the company's property, or what the company would be able to sell itself for if it were forced to liquidate quickly.

- To calculate book value: add up the company's assets, including current assets, fixed assets, and debts owed to the company, and then subtract liabilities, like unpaid bills and loan balances outstanding.

-

2Measure market capitalization. For publicly traded companies (companies who sell stock to the public), market capitalization (market cap) is a measurement of the total value of the company's outstanding stock. It is calculated by multiplying the current stock price by the total number of outstanding shares. Market cap is often used to measure a company's growth over time and is the most common indicator of a company's size used by financial professionals.[10]

- The information needed to calculate market cap can be found in the company's annual report and on any stock-trading or stock market news website.

- For more on market cap, see calculate the market value of a company.

-

3Find cash flow growth. Cash flows show how much actual money a company is earning. They are often used by financial professionals to determine the value of a company. This is done through the process of discounted cash flow analysis, in which future cash flows are extrapolated to determine a value for the company. Measure current cash flows against past cash flows to determine whether or not the business remains solvent.

- Discounted cash flow analysis involves projecting future free cash flows for an investment or company. These cash flows are then "discounted" back to the present at a set discount rate. This discount rate reflects the time value of money (reflects the idea that an amount of money today is worth more than that same amount of money in the future).

- The discounted cash flows are then compared to the present cost of the investment to determine whether or not that investment is a good one.[11]

-

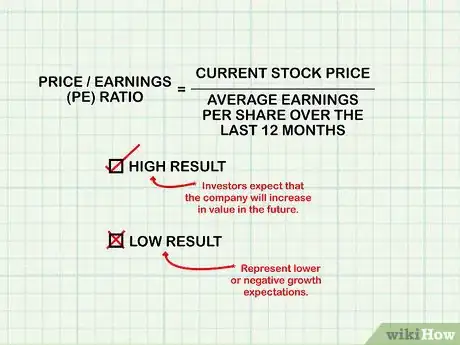

4Calculate the price/earnings (PE) ratio. For a publicly-traded company, the PE ratio represents the premium paid for the company's stock. That is, it is the current stock price divided by the average earnings per share over the last twelve months. A high result from this calculation means that investors expect that the company will increase in value in the future. Conversely, a low value may represent lower or negative growth expectations.[12]

- For more on calculating the PE ratio, see how to calculate the PE ratio.

Measuring Efficiency Improvements

-

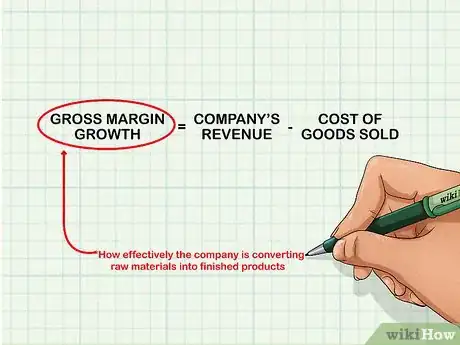

1Calculate gross margin growth. The gross margin is simply the difference between the company's revenue and its cost of goods sold (or cost of services provided). This represents how effectively the company is converting raw materials into finished products.[13]

- Look for this metric to improve over time as the company streamlines its production process.

-

2Find profit growth. Net profit, also called net income or simply profit, is the "bottom line" of the company. It measures the company's earnings after all expenses and taxes have been subtracted from revenue. Profits are then used to either pay dividends or are reinvested in the company. Profits, like revenues, are often measured using the compounded annual growth rate (CAGR). This allows companies to show their averaged profit growth over time, rather than focusing on individual years.[14]

- To calculate CAGR for profits, see calculate CAGR.

-

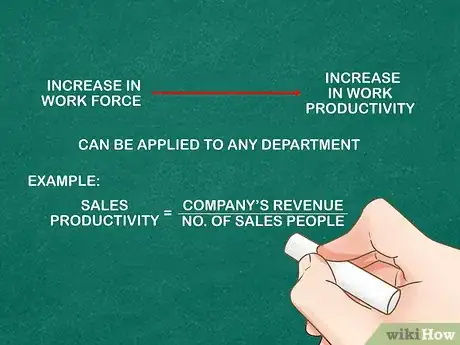

3Evaluate your staff and consider their level of business growth. Compare staff levels, turnover and performance, and determine whether those areas have shown improvement. Assess whether or not increases in workforce have led to equivalent increases in productivity. This can be applied to any department.[15]

- For examples, sales productivity is calculated as the company's revenue divided by the number of salespeople.

-

4Analyze changes in your customer acquisition cost. The customer acquisition cost measures how much you have to spend on marketing and sales to earn the business of a new customer. This is found by dividing these costs (sales and marketing) by the number of new customers over a set period of time.

- A reduction in this cost is evidence that you are building a recognized brand. It also can show you if you are overspending on sales and marketing (if additional spending in these areas fails to bring a similar increase in new customers).[16]

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionCan I use the employment level of a given firm as a growth measure?

Chris McTigrit, MBAChris McTigrit is an Accounting Professional. Chris has over 20 years of accounting experience including working for the Arkansas Department of Finance and Administration. He received his MBA from the University of Arkansas at Little Rock in 2007.

Chris McTigrit, MBAChris McTigrit is an Accounting Professional. Chris has over 20 years of accounting experience including working for the Arkansas Department of Finance and Administration. He received his MBA from the University of Arkansas at Little Rock in 2007.

Master of Business Administration, University of Arkansas at Little Rock Master of Business Administration, University of Arkansas at Little RockExpert Answer

Master of Business Administration, University of Arkansas at Little RockExpert Answer -

QuestionHow do you determine a small enterprises' growth that doesn't keep formal records of its operation?

Chris McTigrit, MBAChris McTigrit is an Accounting Professional. Chris has over 20 years of accounting experience including working for the Arkansas Department of Finance and Administration. He received his MBA from the University of Arkansas at Little Rock in 2007.

Chris McTigrit, MBAChris McTigrit is an Accounting Professional. Chris has over 20 years of accounting experience including working for the Arkansas Department of Finance and Administration. He received his MBA from the University of Arkansas at Little Rock in 2007.

Master of Business Administration, University of Arkansas at Little Rock Master of Business Administration, University of Arkansas at Little RockExpert AnswerThe enterprise must keep records in order to track performance and growth. The records need not be something formal like a corporate annual report, but must be systematic, consistent, and accurate. For a small business, you could keep track of your sales in a handwritten notebook and use that to determine growth.

Master of Business Administration, University of Arkansas at Little RockExpert AnswerThe enterprise must keep records in order to track performance and growth. The records need not be something formal like a corporate annual report, but must be systematic, consistent, and accurate. For a small business, you could keep track of your sales in a handwritten notebook and use that to determine growth.

References

- ↑ http://quickbooks.intuit.com/r/financial-management/how-to-measure-your-small-businesss-performance/

- ↑ http://quickbooks.intuit.com/r/financial-management/how-to-measure-your-small-businesss-performance/

- ↑ https://hbr.org/1988/01/no-nonsense-guide-to-measuring-productivity

- ↑ http://quickbooks.intuit.com/r/financial-management/how-to-measure-your-small-businesss-performance/

- ↑ http://www.forbes.com/sites/martinzwilling/2011/09/28/10-metrics-every-growing-business-must-keep-an-eye-on/#1eca7e4c7f04

- ↑ https://www.entrepreneur.com/article/224153

- ↑ http://www.forbes.com/sites/martinzwilling/2011/09/28/10-metrics-every-growing-business-must-keep-an-eye-on/#1eca7e4c7f04

- ↑ https://www.business-case-analysis.com/growth-metrics.html

- ↑ http://www.investopedia.com/ask/answers/033015/how-do-i-determine-particular-companys-market-share.asp

- ↑ http://www.investopedia.com/terms/m/marketcapitalization.asp

- ↑ http://www.investopedia.com/terms/d/dcf.asp

- ↑ https://money-zine.com/investing/understanding-financial-ratios/

- ↑ https://money-zine.com/investing/understanding-financial-ratios/

- ↑ https://www.business-case-analysis.com/growth-metrics.html

- ↑ http://www.forbes.com/sites/martinzwilling/2011/09/28/10-metrics-every-growing-business-must-keep-an-eye-on/#1eca7e4c7f04

- ↑ http://www.forbes.com/sites/martinzwilling/2011/09/28/10-metrics-every-growing-business-must-keep-an-eye-on/#1eca7e4c7f04

About This Article

One way to measure your company's growth is to calculate its book value, or what the company could sell for right now, which you can find by subtracting your liabilities from your assets. However, if you're trying to summarize growth over a long time frame, like 5, 10, or 20 years, opt to determine your company's revenue growth, instead. To do this, you'll need to calculate your company's compounded annual growth rate, which is based on your revenue in both the first and the last years of the range you're measuring. For more advice from our founder, like how to measure your company's efficiency, keep reading.