This article was co-authored by Marcus Raiyat. Marcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 451,620 times.

With analysts on a never-ending quest to outperform the market, we have seen the creation of dozens of ways in which to value companies, with new methods surfacing all of the time. This often leads people to forget about some traditional measures that can provide critical details regarding the strength of a company. "Market share" is one such tool, and understanding how to calculate it can help you determine the strength of a firm. When applied appropriately, it can shed valuable light on the future prospects of a company.

Steps

-

1Determine the period you want to examine for each company you are investigating. In order to make sure you are making an apples-to-apples comparison, you must examine sales in a specific time period. You can examine the sales over the length of a quarter, a year, or over several years.

-

2Calculate the company's total revenue (also called total sales). All publicly-traded companies must release quarterly or annual financial statements. These statements will include a record of all of the firm's sales, and may also include an itemized explanation of sales of specific product or service types within the footnotes of the financial statements..[1]

- If the company you are examining sells a wide variety of products and services, it may not be useful to simply examine all of the revenue streams of the firm together. Look for information regarding its sales of a particular type of product or services.

Advertisement -

3Find the total market sales. This is the total amount of sales (or revenue) the entire market is acquiring. For instance, if you look at the clothing market, it's all the clothing sales that are made during the period you're measuring.[2]

- The total market sales amount may be found through industry trade associations or publicly-available research reports. For a fee, companies such as NPD Group provide specific information about sales in a variety of national and international market sectors.

- Alternatively, you can add up the sales of the largest companies in a given product or service market. If a handful of firms dominate the industry with smaller firms making insignificant sales--such as major home appliances or automobiles--total the sales for all of the companies in the industry to calculate total industry sales.[3]

-

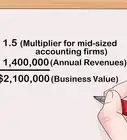

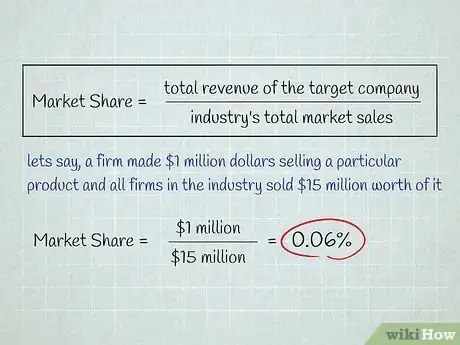

4Divide the target company's total revenue by the entire industry's total market sales. The result of this division equals your company's specific market share. So, if a firm made $1 million dollars selling a particular product and all firms in the industry sold $15 million worth of it, you would divide $1 million by $15 million ($1,000,000 / $15,000,000) to determine the market share of the firm.[4]

- Some prefer market share to be represented by a percentage, while others do not even simplify it into the smallest possible fraction (leaving it as $40 million/$115 million, for example). The form you prefer is irrelevant, as long as you understand what figure represents.[5]

-

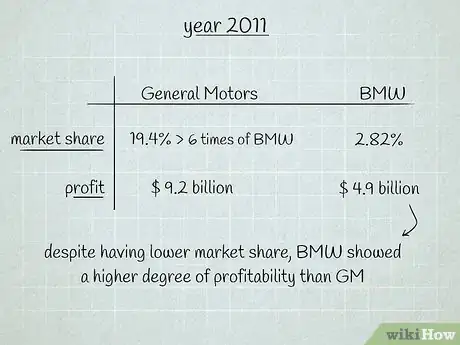

1Understand a company's market strategy. All companies make their products and services unique and offer them at different price levels. Their aim is to capture the specific customers that will enable the company to maximize profit. Large market share, whether measured in units sold or total revenues, does not always correlate with high profitability. For example, the market share of General Motors in 2011 was 19.4%, more than 6 times the share of BMW at 2.82%. GM reported profits of $9.2 billion while BMW reported profits of about $4.9 billion Euros ($5.3 billion U.S.) during the same period. Whether measured by per unit sales or total revenue, BMW showed a higher degree of profitability than GM. Profit per unit, not just market share, is the goal of most companies.[6] [7]

-

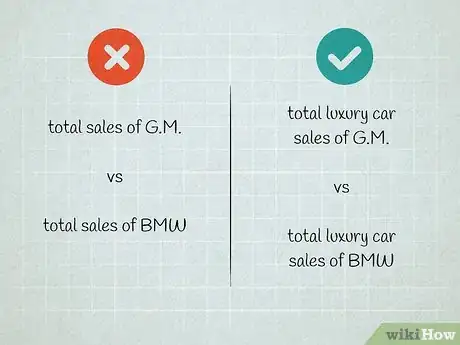

2Define the market parameters. Companies seek to capture as much market share as might be available consistent with their strategy. To again use the automotive example, BMW knows that not every car purchaser is one of its potential customers. It is a luxury car manufacturer, and less than ten percent of car buyers are in the luxury car market. Luxury car sales make up a tiny fraction of the total 12.7 million cars purchased annually in the US. BMW sold 247,907 cars in 2011, more than any other luxury car maker including GM's Cadillac and Buick lines.

- Clearly identify the specific market segment you intend to research. It can be general, focusing on total sales, or restricted to specific products and services. You must define the market on like terms as you examine the sales of each company. Otherwise, you are comparing apples to oranges.

-

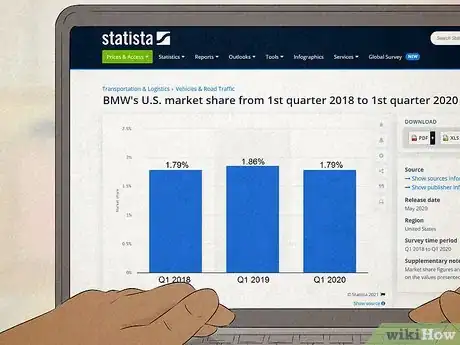

3Identify changes in market share year to year. You can compare a single company's year-to-year performance. Alternatively, you can compare all the companies within a competitive space. Changes in market share might mean the company's strategy is effective (if market share is rising), faulty (if market share falls), or was not implemented effectively. For example, BMW's number of autos sold and their market share increased from 2010. This indicates that their marketing and pricing strategies were more effective than competitors like Lexus, Mercedes, and Acura.[8]

-

1Understand what market share can demonstrate about a business. Market share is not an end-all tool that tells you everything you must know; quite the opposite, it is more of a tool of initial inquiry. You must understand both the strengths and limitations of it as an indicator of value.[9]

- Market share is a good tool to use to compare two or more similar companies that compete against each other in a market. Though not exactly a popularity contest, it does demonstrate the extent to which one firm's product out-competes (or fails to compete against) the rest of the field.

- Consequently, market share can indicate likelihood of a firm's growth. If a firm has claimed increasing market share for several consecutive quarters, they have clearly figured out how to manufacture or market an especially desirable product. Companies that are losing market share may be suffering from just the opposite.[10]

-

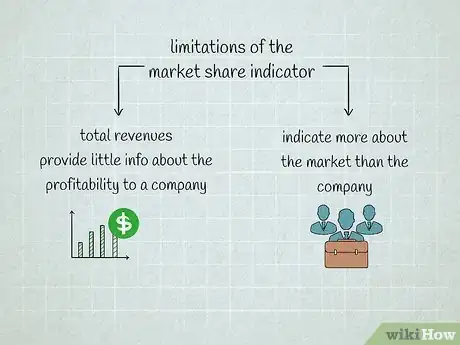

2Comprehend the limitations of the market share indicator. As noted above, market share is a limited tool that can help you develop an initial perception of a firm. Taken by itself, it means little.

- Total revenues--the sole factor used to determine market share--provide little information about the profitability to a company. If one company holds a larger portion of the market but makes substantially smaller profit (revenue minus expenses) than another, market share becomes a substantially less significant indicator of current or future success.

- The market share may indicate more about the market than the company you are evaluating. Some markets have been consistently dominated by a single or small group of companies, and little perceivable change has taken place over the course of many years. The power of an entrenched monopoly can be almost impossible for other companies to break, and so an examination of market share will only demonstrate that fact. However, small firms may still successfully carve out a niche for themselves, and profitability is still possible.[11]

-

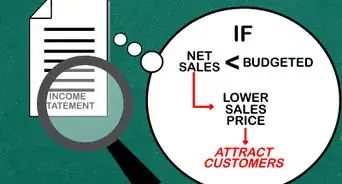

3Think about how market share should shape your investment strategy. The extent to which a company is leading or struggling in its market should impact how you perceive it.

- Companies that have not shown a growth in market share in years may not be worth investing in.

- Firms with a growing market share are worth keeping an eye on. Unless they are poorly managed and unprofitable (which you can also determine by examining all of the publicly released financial documents of a traded company), the value of the company is likely to the rise.

- Firms with declining market share may be struggling. It is not the only factor that must be examined to determine this, but the company should be avoided if they also have declining profits or no new product or service offerings forthcoming.

Expert Q&A

-

QuestionIf total sales of $500 in year two was a 10.5% increase of year one, what were total sales in year one?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor To calculate the previous year's sales, divide the current year's sales ($500) by the rate of increase plus 1 (1.105). Last year's sales were $458.49

To calculate the previous year's sales, divide the current year's sales ($500) by the rate of increase plus 1 (1.105). Last year's sales were $458.49 -

QuestionHow can I calculate market share for a guest house?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor Most partners would consider the cash put into the venture initially plus the amount of liability assumed by each to determine market share. For example, if there were 5 equal partners and each invested the same amount and assumed the same liability, each would own 20%. If there is a difference between cash invested and liability assumed, the partners should determine before the purchase whether a dollar invested in cash is the same as a dollar assumed in liability. If they are dissimilar, total the cash invested and the relative value of the debt assumed, then divide each partners' share based upon his cash investment and adjusted liability.

Most partners would consider the cash put into the venture initially plus the amount of liability assumed by each to determine market share. For example, if there were 5 equal partners and each invested the same amount and assumed the same liability, each would own 20%. If there is a difference between cash invested and liability assumed, the partners should determine before the purchase whether a dollar invested in cash is the same as a dollar assumed in liability. If they are dissimilar, total the cash invested and the relative value of the debt assumed, then divide each partners' share based upon his cash investment and adjusted liability. -

QuestionWhat is an example of market share?

Marcus RaiyatMarcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

Marcus RaiyatMarcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

Foreign Exchange Trader Think of a specific industry as the market for a particular business. Take clothing, for instance. Look at how many people on average buy clothing in a set time period. Then, look at a company like Nike or Adidas—how many customers do they have? Their share of that whole pool of customers is their market share.

Think of a specific industry as the market for a particular business. Take clothing, for instance. Look at how many people on average buy clothing in a set time period. Then, look at a company like Nike or Adidas—how many customers do they have? Their share of that whole pool of customers is their market share.

References

- ↑ http://www.sec.gov/investor/pubs/begfinstmtguide.htm

- ↑ Marcus Raiyat. Foreign Exchange Trader. Expert Interview. 4 March 2021.

- ↑ http://library.mcmaster.ca/sites/default/files/market_share_CBD.pdf

- ↑ Marcus Raiyat. Foreign Exchange Trader. Expert Interview. 4 March 2021.

- ↑ http://www.investinganswers.com/financial-dictionary/businesses-corporations/market-share-778

- ↑ http://www.autonews.com/article/20141110/OEM08/311109994/mazda-chief:-profit-trumps-volume-market-share

- ↑ http://news.pickuptrucks.com/2014/09/gm-losing-market-share-and-gaining-profits.html

- ↑ http://www.investinganswers.com/financial-dictionary/businesses-corporations/market-share-778

- ↑ http://www.investopedia.com/terms/m/marketshare.asp

About This Article

To calculate market share, determine the period you want to examine for the company you're investigating. Calculate the company's total revenue first, then look up the total market sales, which is the total amount of sales (or revenue) the entire market is acquiring. Divide the company's total revenue by the entire industry's total market sales. The result of this division equals your company's specific market share! To learn more about the role, strengths, and limitations of market share, read on!

-Step-04.webp)