This article was co-authored by Marcus Raiyat. Marcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 83,379 times.

Whether you are an Indian resident or live halfway around the world, India’s stocks are one of the hottest global investments at the moment. If you want to invest directly on Indian stock exchanges, start by monitoring the movements of the Sensex and Nifty stocks. As an American or other foreigner looking to invest, it’s important to contact a broker for guidance early in the process. No matter your status, you’ll likely need to open unique trading and banking accounts to buy Indian stocks directly.

Steps

Investing Directly on Indian Stock Exchanges

-

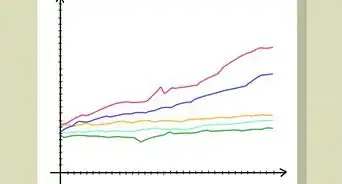

1Track the movements of Sensex and Nifty stocks. The movement of the Bombay Stock Exchange is indexed by the changes occurring to 30 Sensex stocks. The NSE’s movement is tracked by 50 stocks that comprise the Nifty. These stocks represent large, generally stable companies and are a good investment option for beginners to the market.[1]

- For example, Coal India, Ltd., and the State Bank of India are both listed on the NSE.

-

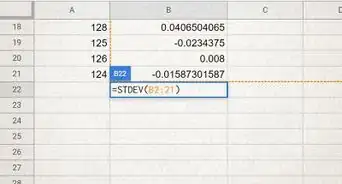

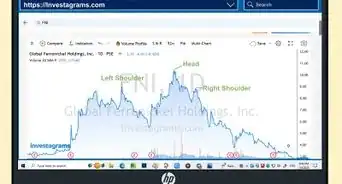

2Research possible stocks. Go online and read financial reports or stock analyses created by financial advisors. Look for news that specifically involves Indian stocks. Search google for “Indian stock news” and read the latest accounts. If you have a broker, compare what you’ve learned with what they know about the market.[2]

- If you can find a company’s annual or quarterly reports online, they will often contain important information regarding revenue and net income.

- Finding out what you can about a company’s management team may also help you to decide whether or not to invest. For example, if they are led by Chief Financial Officer known for success, then the odds of the stock rising is more likely.

Advertisement -

3Work with an Indian broker. When you are ready to start buying and trading, reach out to a brokerage company based in India. They will be able to guide you in preparing any necessary taxation documentation. They can also help you to open any additional savings or banking accounts that will be necessary for trading.

- If you think that you’ll need advice for trading, it’s best to choose a full service broker. A discount broker will only provide minimal trade assistance.

-

4Register for a PAN (Permanent Account Number) card. Go to the PAN Services Unit Website and download the necessary forms. Fill out the forms and include proof of identity, address, and date of birth, along with 2 passport-sized photographs. Mail these documents to the PAN Income Tax Department address on the form.[3]

- If you are going to buy Indian stocks, you must have a 10-digit PAN number. This allows tax authorities to track your investments and tax burden.

-

5Open a savings or banking account. If you don’t have one in place already, you’ll need a banking account in order to transfer funds to your broker or brokerage site for stock purchases. Your profits can also be deposited in your banking account, if you’d like. Many people prefer to create a separate savings account specifically for stock trading.[4]

-

6Establish a Demat account. This is the account where your stocks will virtually reside after your purchases or trades. To open a Demat account you must fill out paperwork with a Depository Agency. They will then issue you an account number that you can use for trading purposes.[5]

- You will also receive statements showing your account status and balance, just like you would with a standard bank account.

- The Depository Agency that houses your Demat account will likely charge you both maintenance and transfer fees. Make sure that you are clear about any fees or charges before creating your account.

-

7Tell your broker which stocks to buy at which price point. The price of stocks continually fluctuates. So, you’ll want to determine at what point you’d like your broker or online brokerage account to make a purchase for you. Then, they will activate a buy order when the stocks reach that level. The same process goes for a sell order.[6]

- For example, your broker can buy 10 shares of Sears Industries out of India at a particular price for you, as long as your account funds will support it.

-

8Be aware of taxation rules in India. Your dividends earned from shares will generally be tax free up to a certain limit. You are also able to avoid a capital gains tax if you hold on to your shares for a profit after 1 year. If you make a profit from selling prior to 1 year, then you will owe a capital gains tax.[7]

- Knowing the timetable for taxation may help you to plan when to buy and sell certain stocks.

Buying Indian Stocks from the U.S.

-

1Work with an in-person broker. Your financial advisor or bank can suggest a broker knowledgeable in Indian stocks who will be able to guide your investments. You can specifically request that your broker buy particular stocks, or you can let them follow an investment strategy based on your overall needs.[8]

- A broker will usually charge a fee or hourly rate in return for their advice and services.

-

2Use an online investment company instead. There are also a number of companies online that will guide you through the process of Indian investing for a fee. These companies are particularly useful if you have some experience with the market and would like more independence when trading.[9]

- For example, Kotak Securities and IndiaBulls are 2 sites that allow for Indian stock trading.

-

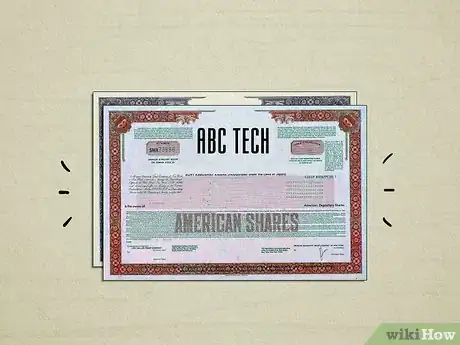

3Purchase American Depository Receipts (ADR). This is a fairly straightforward, low risk way to invest in foreign companies. An ADR becomes available when a U.S. company buys shares of a foreign company and then offers these shares up on the U.S. stock exchanges. You can then buy these shares in U.S. dollars, while still investing in foreign businesses.[10]

- One advantage of working with ADRs is that they are priced in dollars and the dividends are delivered in dollars as well.

- ADRs are also available for trading during standard U.S. market hours.

-

4Make arrangements with an Indian brokerage firm. If your U.S. broker is unable or unwilling to buy Indian stocks, then you can ask them to reach out to an affiliate firm in India for you. This firm will then set up an account for you and will brief you on their particular trading guidelines. Once you are familiar with their policies, you’ll need to discuss if they can access the shares that you are interested in.[11]

-

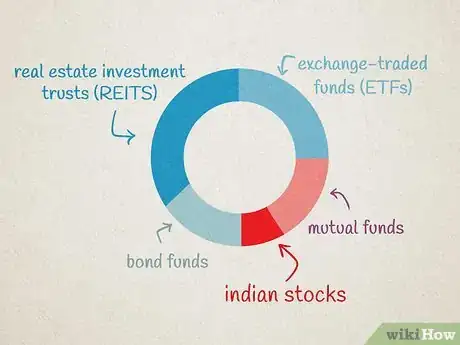

5Set aside a portion of your portfolio for Indian stocks. Investing in foreign markets, such as India, can seem a bit risky. To counter this risk, many people prefer to divide their portfolios between domestic and foreign stocks. Allocating 20% of your investments to Indian stocks allows you to reap profits while minimizing risk.[12]

- Another strategy is to look for an underperforming Indian stock and to invest in it hoping to make a large profit if the company recovers.

-

6Consider any investment limitations in foreign stock purchases. Indian stocks can be a great investment, but they do also come with a certain amount of limited control. It will be more difficult for you to potentially track the status of your invested companies with accurate or timely information. Your stocks may also come under Indian regulations that you may be previously unaware of.[13]

- Keep in mind that you may end up paying more in transaction or brokerage fees when investing in foreign stocks.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhat do I need to know about buying foreign stocks?

Marcus RaiyatMarcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

Marcus RaiyatMarcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

Foreign Exchange Trader

-

QuestionCan foreigners buy Indian stocks?

Drew Hawkins1Community AnswerYes, foreigners can absolutely buy Indian stocks. You don't have to be an Indian resident either. The only requirement is that you open an account as a Foreign Portfolio Investor, or a FPI. You'll also need to register for a Permanent Account Number, or PAN card, which will allow tax authorities to track your investments and tax burden and is a requirement if you want to trade on the stock market. If you're just getting started, work with an Indian broker, who can guide you in preparing the necessary documents and help you open additional savings or bank accounts that you'll need in order to trade on the Indian stock market.

Drew Hawkins1Community AnswerYes, foreigners can absolutely buy Indian stocks. You don't have to be an Indian resident either. The only requirement is that you open an account as a Foreign Portfolio Investor, or a FPI. You'll also need to register for a Permanent Account Number, or PAN card, which will allow tax authorities to track your investments and tax burden and is a requirement if you want to trade on the stock market. If you're just getting started, work with an Indian broker, who can guide you in preparing the necessary documents and help you open additional savings or bank accounts that you'll need in order to trade on the Indian stock market. -

QuestionIs it a good time to invest in Indian stock market?

Drew Hawkins1Community AnswerBecause India's economy is growing, it is a good time to invest in their stock market. Capital goods stocks and automobile stocks have been consistently on the rise and Indian stocks, in general, are one of the hottest global investments. If you're a foreign investor considering buying Indian stocks, get in touch with a local broker who can guide you through the process and help you file all of the necessary paperwork you'll need to legally trade on the market.

Drew Hawkins1Community AnswerBecause India's economy is growing, it is a good time to invest in their stock market. Capital goods stocks and automobile stocks have been consistently on the rise and Indian stocks, in general, are one of the hottest global investments. If you're a foreign investor considering buying Indian stocks, get in touch with a local broker who can guide you through the process and help you file all of the necessary paperwork you'll need to legally trade on the market.

Warnings

- Make sure to not overextend your budget when buying Indian stocks. Before you start trading, determine how much you can spend and stick to it.⧼thumbs_response⧽

References

- ↑ https://www.goodreturns.in/personal-finance/investment/2017/04/a-beginners-guide-on-how-invest-indian-equity-shares-stocks/articlecontent-pf7833-559356.html

- ↑ https://www.nerdwallet.com/blog/investing/how-to-research-stocks/

- ↑ https://gadgets.ndtv.com/internet/features/how-to-submit-pan-card-application-online-623006

- ↑ https://www.blazedream.com/blog/how-to-start-investing-in-indian-stock-market/

- ↑ http://stepupmoney.com/how-to-invest-in-shares-in-india-beginners-guide-to-stock-market-investment-in-india/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

- ↑ https://www.goodreturns.in/personal-finance/investment/2017/04/a-beginners-guide-on-how-invest-indian-equity-shares-stocks/articlecontent-pf7833-559356.html

- ↑ http://stepupmoney.com/how-to-invest-in-shares-in-india-beginners-guide-to-stock-market-investment-in-india/

- ↑ http://stepupmoney.com/how-to-invest-in-shares-in-india-beginners-guide-to-stock-market-investment-in-india/

- ↑ https://www.investopedia.com/articles/investing/120914/top-indian-stocks-traded-us.asp#ixzz57W6fJoUk

- ↑ https://www.investopedia.com/ask/answers/05/foreignstocks.asp#ixzz57W1dpChc

- ↑ https://www.investopedia.com/articles/investing/120914/top-indian-stocks-traded-us.asp#ixzz57W6fJoUk

- ↑ https://www.investopedia.com/ask/answers/05/foreignstocks.asp#ixzz56reZawFP

- ↑ https://www.blazedream.com/blog/how-to-start-investing-in-indian-stock-market/

About This Article

If you live in the United States and want to buy Indian stocks, find a broker who can guide your investments. There are also a number of online companies, like Kotak Securities and IndiaBulls, that can help you through the process of Indian investing for a fee. Since investing in foreign stocks can be risky, set aside a small percentage of your portfolio specifically for these deals. For example, put 20 percent of your investments in Indian stocks to minimize the risk. To learn how to research possible Indian stocks, keep reading!

-Step-3.webp)