This article was co-authored by Chad Seegers, CRPC® and by wikiHow staff writer, Jennifer Mueller, JD. Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

There are 10 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article has 51 testimonials from our readers, earning it our reader-approved status.

This article has been viewed 938,298 times.

If you want to save for retirement or a major purchase, such as a house, investing in the stock market is a way to put your money to work. While there's always some risk involved in any investment, with careful choices and wise planning you can earn more from your money than you would if you simply deposited it into a savings account. A diversified portfolio with a broad mix of assets can keep you on top, even during volatile periods, such as the coronavirus market.[1]

Steps

Determining Your Investment Strategy

-

1List your reasons for investing. Most people invest to build money for their retirement. However, there are other reasons for investing that are equally valid. If you know your reasons for investing, you can develop your investment strategy based on those reasons.[2]

- For example, if you're one of the many people who want to invest for retirement, you need to figure out when you plan to retire and how much money you want to have available to you by that point.

- If your reason for investing is that you want to buy a house (which is itself an investment), decide what kind of house you want to buy an how big of a down payment you want. Keep in mind that the real estate market can change rapidly.

- Your only reason for investing may be that you want to own a piece of your favorite company. If that's you, simply buy some stock in that company and don't worry about anything else.

-

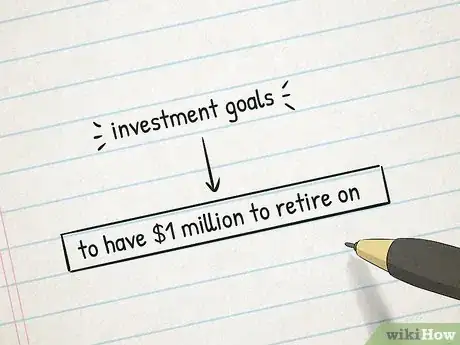

2Identify your investment goals. To some extent, your goals are separate from your reasons. Your goal is the specific amount of money you want to raise through your investment activities.[3]

- For example, you might want to have $1 million to retire on. You'd choose all of your investments with an eye toward meeting that goal.

- Use investments for large goals. If you have a smaller goal, it's better to simply put money in a savings account. For example, if you want to raise $10,000 so you can buy a new car in 2 years, a savings account is a better option than the stock market.

- Research the evidence-based strategies that work in order to decide what strategy you want to use. Once you understand what makes the most sense for you as an investor, you can choose the investment advisor or technology platform that you want to use.[4]

Advertisement -

3Calculate how long you plan to invest. Typically, your investment goals have a time limit, also known as your "time horizon." Look at your reasons for investment and figure out how long you have to save for those goals. Some of these might be self-imposed deadlines, while others will have a specific time limit that you have no control over.[5]

- For example, if you're investing to pay for your child's college education, and your child is currently 4 years old, you have 14 years to reach your goal (assuming your child starts college when they're 18). This is a relatively short time horizon, so you'd want to choose lower-risk investments to increase the chances that you'd reach your goal in that time.

- If you're a 25-year-old who's investing for retirement at the age of 65, on the other hand, you have 40 years. This gives you a little more leeway to play around with riskier investments because you'd be able to recoup any loss.

- If you need money for a short-term goal of 5 years or less, the stock market isn't the best option. You're unlikely to raise the money you need from stock market investments in this time.[6]

- No investment comes with any guaranteed returns. However, if you look at average returns, you can figure out how long it will take you to reach the goals you've set.

-

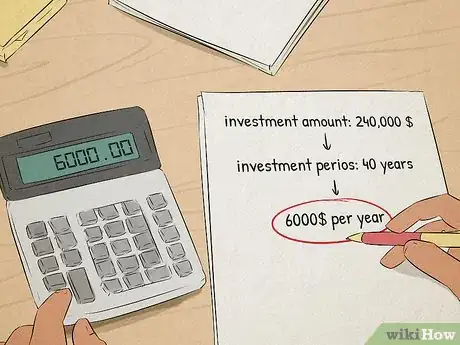

4Set an investment budget. Before you start investing, take a moment to understand your own financial situation. If you don't already have one, create a household budget so you understand exactly how much income you're bringing in and where your money is going each month. Then, figure out how much of your income you can put towards savings and investments.[7]

- Your investment budget helps you determine what rate of return you need to realize if you want to reach your goal by the deadline you've set. For example, suppose you want to retire in 40 years. You have an investment budget of $500 a month, or $6,000 a year. This means that, in those 40 years, you'll have invested $240,000. You'd need a rate of return of at least 6% to meet your goal, assuming your contributions never increase.[8]

-

5Create a practice portfolio to learn how the market works. If you've never invested before, using a stock market simulator allows you to hone your strategy before getting actual money involved. Many online brokers have simulators that allow you to "invest" with fake money so you can get an idea of how to use their platform as well as practice trading.[9]

- If there's already an online broker you're interested in, see if they have a simulator. That way, you can learn about the market while also getting a feel for navigating their site.

Building Your Portfolio

-

1Open an investment account with a brokerage firm. Generally, you'll need a broker to buy stocks and other investment products. The easiest way to get started investing is to open an account online. Compare different brokers to find the one that best suits your needs and your budget.[10]

- Look at trading fees for transactions and any other fees associated with an account. Make sure you understand when you'll be charged and what you'll have to pay. There may be different fees for different types of transactions.

-

2Start investing with companies you're already familiar with. If you're already familiar with a company, you don't have to do as much research to know if you're making a wise investment choice. Buying stock in a few companies you're interested in also keeps you interested in how your portfolio is doing.[11]

- For example, suppose you're an Apple fan. All of your computers and electronic devices have always been Apple products, you watch all the keynote speeches, and you're always first in line to buy the latest device upgrade. Investing in Apple stock would be a good way for you to get started in the market.

-

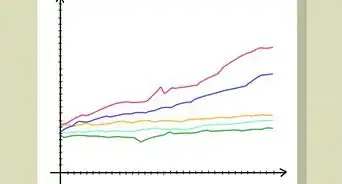

3Buy shares in mutual funds for conservative, long-term growth. Index funds, which hold pieces of all the stock included in a particular index, have strong, regular rates of return. Other exchange-traded funds invest in baskets of other assets, such as real estate or commodities.[12]

- While mutual funds aren't as sexy as buying individual stocks and following the ups and downs of the market, they offer a sound investment strategy for long-term goals.

-

4Grow your portfolio over several years. The best way to take advantage of the market is to time your investments when they have the best value, rather than buying everything you want all at once. Start small and gradually increase your investments in a manageable way.[13]

- If you buy everything you want at once, you might miss out on some of the better prices when the market takes a dip. Generally, you'll earn a better return on your investment by contributing a little each year as opposed to investing all your money at once.

-

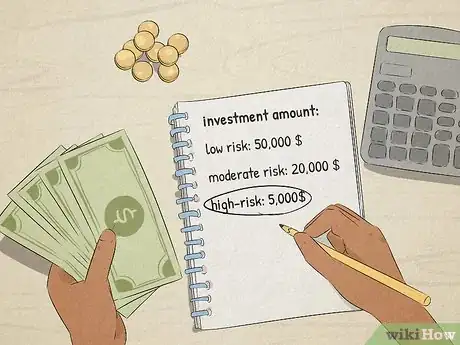

5Leave a small amount for high-risk investments. High-risk investments present an opportunity for a large return on your investment. At the same time, there's a significant probability that you'll lose everything you put in. If you want any high-risk investments at all in your portfolio, keep the proportion relatively small compared to other investments.[14]

- If you're a younger investor who's building your portfolio to fund for retirement, you can tolerate a little more risk than a middle-aged investor. However, you still need to be careful to keep a balanced portfolio and not take on too much risk.

- High-risk investments require more effort because you have to watch their performance more frequently and be prepared to sell if your loss becomes too great.

Maintaining Your Portfolio

-

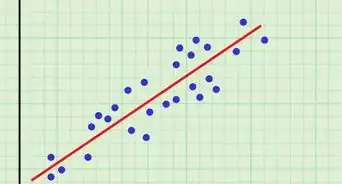

1Choose a mix of assets that will meet your goals with minimal risk. You're likely familiar with the saying that you shouldn't put all your eggs in one basket. This applies to investment as well. Even though you may want to primarily invest in the stock market, it's smart to include other assets, such as bonds and commodities, in your portfolio. These help protect against the inherent riskiness of the stock market.[15]

- If you're just investing in stocks for fun, or if you're only interested in owning a piece of a particular company, you may not necessarily need a mix of assets in your portfolio. However, if you're saving for a specific goal, such as retirement or college, a mix of assets helps ensure you meet your goal.

-

2Diversify your investments within each asset category. A balanced and diverse portfolio doesn't just mean having a mix of assets. Invest in different industries or sectors to balance each of the assets in your portfolio.[16]

- For example, you might hold stocks in tech, manufacturing, and agriculture companies.

- Index funds are naturally diversified because they include all the stocks in that particular index. However, you can still diversify by investing in several different index funds. Watch the market and see how the different indexes behave compared to one another. For example, you might note that one index tends to rise while another falls. Investing in both would counter risk.

-

3Rebalance your portfolio at least once a year. Look at the performance reports your broker generates and identify stocks and other assets that aren't performing as well as they should. Shift your investments so that you retain the balance you want to achieve your goals.[17]

- Rebalancing is also necessary when you have one stock or asset that's out-performing the others, since this also shifts the balance. Sell portions of stocks or other assets that are out-performing and invest that money elsewhere.

- When you get closer to your time horizon, you might want to start rebalancing more often. For example, if you're planning to retire in 2 years, you might want to rebalance once a quarter.

- Remember, you're buying a present value of future cash flows in a business. The market price fluctuates, so don't pay much attention to the day-to-day movement.[18]

-

4Adjust your asset allocation as you get closer to your time horizon. The balance you started with won't work for the entire time you invest. If you start with a long-term goal, when you approach your time horizon, you're now a short-term investor. Eliminate high-risk investments and switch to more assets that pay dividends, interest, or other passive income.[19]

- For example, if you're investing to retire in 40 years, you might start with a few high-risk investments. However, after you've been investing for 35 years, it's time to sell those high-risk stocks rather than risk losing what you've gained.

What Are Common Mistakes When Starting To Invest?

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhere should I start investing in the stock market?

Chad Seegers, CRPC®Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

Chad Seegers, CRPC®Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

Certified Retirement Planning Counselor

-

QuestionHow do I start investing in the stock market?

Chad Seegers, CRPC®Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

Chad Seegers, CRPC®Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

Certified Retirement Planning Counselor Start by studying the various investment platforms. If you're young, it's a good idea to invest in low-cost ETFs, or Exchange Traded Funds, which will give you broad diversified exposure. Those tend to do well over an extended period of time, so just keep buying the shares through good times and bad.

Start by studying the various investment platforms. If you're young, it's a good idea to invest in low-cost ETFs, or Exchange Traded Funds, which will give you broad diversified exposure. Those tend to do well over an extended period of time, so just keep buying the shares through good times and bad.

Warnings

- This article discusses how to invest in the stock market in the US. If you live in another country, the process may be different. Talk to a local stockbroker or investment advisor.⧼thumbs_response⧽

- Never invest more than you can afford to lose.⧼thumbs_response⧽

- Don't rely solely on a broker's recommendation. Do your own homework and decide whether you think an investment is right for you. Ask for a second opinion from an independent financial advisor if you're not sure.[22]⧼thumbs_response⧽

References

- ↑ https://www.investor.gov/additional-resources/general-resources/publications-research/info-sheets/beginners-guide-asset

- ↑ https://www.sec.gov/investor/pubs/roadmap/pick.htm

- ↑ https://www.sec.gov/investor/pubs/roadmap/goals.htm

- ↑ Chad Seegers, CRPC®. Certified Retirement Planning Counselor. Expert Interview. 16 July 2020.

- ↑ https://www.investor.gov/additional-resources/general-resources/publications-research/info-sheets/beginners-guide-asset

- ↑ https://www.nerdwallet.com/article/investing/how-to-invest-in-stocks

- ↑ https://www.sec.gov/investor/pubs/roadmap/habit.htm

- ↑ https://www.calculator.net/investment-calculator.html

- ↑ https://www.nerdwallet.com/article/investing/virtual-trading-stock-market-simulators

- ↑ https://www.sec.gov/investor/pubs/roadmap/pick.htm

- ↑ https://www.nerdwallet.com/article/investing/how-to-invest-in-stocks

- ↑ https://www.nerdwallet.com/article/investing/how-to-invest-in-stocks

- ↑ https://www.sec.gov/investor/pubs/roadmap/risk.htm

- ↑ https://www.sec.gov/investor/pubs/roadmap/risk.htm

- ↑ https://www.investor.gov/additional-resources/general-resources/publications-research/info-sheets/beginners-guide-asset

- ↑ https://www.investor.gov/additional-resources/general-resources/publications-research/info-sheets/beginners-guide-asset

- ↑ https://www.investor.gov/additional-resources/general-resources/publications-research/info-sheets/beginners-guide-asset

- ↑ Chad Seegers, CRPC®. Certified Retirement Planning Counselor. Expert Interview. 16 July 2020.

- ↑ https://www.investor.gov/additional-resources/general-resources/publications-research/info-sheets/beginners-guide-asset

- ↑ https://www.sec.gov/reportspubs/investor-publications/investorpubstakingstockhtm.html

- ↑ https://www.nerdwallet.com/article/investing/how-to-invest-in-stocks

- ↑ https://www.sec.gov/reportspubs/investor-publications/investorpubstakingstockhtm.html

About This Article

To invest in the stock market, consider the overall value of the stock that you’re interested in by analyzing the strength of their cash flow, revenue, and future performance. When you’re building a portfolio, invest in a variety of different companies across many economic sectors to lessen the risk of a sudden loss in the case of a downturn or disaster. Once you’ve decided on the companies you want to invest in, contact a licensed broker to begin buying and trading. For information on picking the right broker and the process of buying and selling, scroll down!

-Step-3.webp)