This article was co-authored by Andrew Lokenauth and by wikiHow staff writer, Jennifer Mueller, JD. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 50,157 times.

To be listed on a major stock exchange, such as NASDAQ or the New York Stock Exchange, a company must meet certain requirements, such as trading at a minimum share price and making financial disclosures promptly. Failure to meet these requirements results in the shares being delisted. If you own delisted shares, you can still sell them on the Over-the-Counter Bulletin Board (OTCBB) or on the Pink Sheets, which have more relaxed regulations and few listing requirements. OTC trading is volatile, and this level of risk is typically not suitable for beginning investors. If you do have a loss, you can write it off on your taxes to decrease your tax liability.[1]

Steps

-

1Research the company and its performance. You can reduce some of the inherent risks in Over-the-Counter (OTC) trading if you know as much as possible about the company and its history. Go to the company's corporate website and read company news and press releases.[2]

- Review annual reports going back several years to get a sense of the company's financial well-being. If the company has its quarterly conference calls archived on its website, listen to the two most recent calls to get a sense of what's going on in the company and how its executives are handling the situation.

- In addition to information provided by the company itself, look beyond the company to get a sense of its reputation and what other investors as well as experts in the industry are saying about the company and its future.

- Don't let yourself be led by only other investors, since you don't really know their expertise. The best person that can help you with such a research is a certified financial advisor.

-

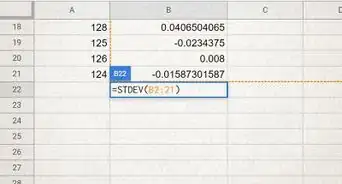

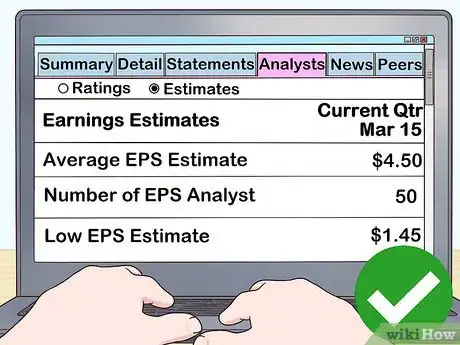

2Read reports and estimates from stock analysts. Recent reports from analysts can help you more accurately predict what might happen with your delisted shares. Estimates from analysts can also help you determine how to time the sell of your shares.

- When a company is delisted, institutional investors may be required to sell their shares under the terms of their investment mandates.[3] If significant numbers of shares are held by institutional investors, this could flood the OTC market with shares, resulting in substantially lower prices.

Advertisement -

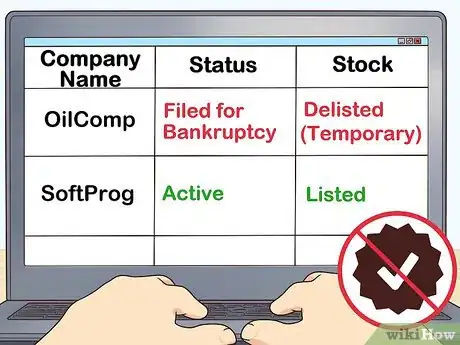

3Find out why the company was delisted. A company may be involuntarily delisted because it failed to meet the minimum standards, or because it didn't pay the annual listing fees. Companies also may voluntarily choose to delist from an exchange.[4]

- For example, a company that has filed for bankruptcy and is reorganizing may choose to temporarily delist its stock. If your other research indicates the company is likely to come out of bankruptcy on relatively healthy footing, your shares may be worth more than they would if the company was involuntarily delisted for failing to meet the minimum listing standards.

- Be extra cautious if the company has filed for bankruptcy. Although companies can emerge from bankruptcy as viable businesses, trading stock in a bankrupt company is typically a losing proposition.[5]

-

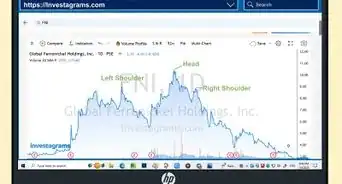

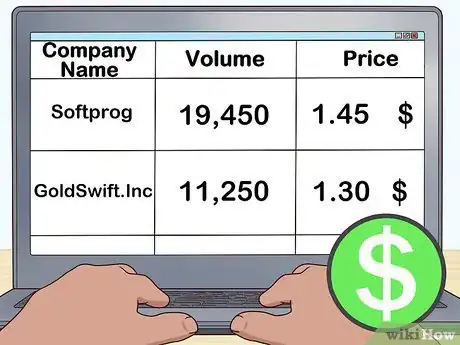

4Watch what other investors are doing. In the immediate aftermath of a company being delisted, prices of shares may fluctuate wildly as investors react. Track the price to figure out if other investors are still buying the stock.[6]

- OTC markets are heavily vulnerable to manipulation, so be wary of big moves, especially a significant increase in the price of the stock.

-

5Decide what you want to get out of the stock. Based on your overall investment and the length of time you've had the stock, you may have a minimum price that you'd like to get from the stock. Even if that price still represents a loss, this is the amount at which you're comfortable selling the stock.[7]

- If you're risk-averse and aren't interested in trading on the OTC market, you may just want to get rid of the stock as soon as possible. However, with a little bit of patience, you may be able to get a better deal.

- OTC markets have low-price stocks that typically attract smaller investors interested in "playing" the markets for out-sized payoffs. If you're willing to wait out some of the volatility, you have the potential for a larger return.

Trading Over-the-Counter

-

1Choose a broker. Before you start trading OTC shares, open an account with a Financial Industry Regulatory Authority (FINRA)-registered broker-dealer. While you make your own investment decisions, your broker-dealer handles the trading and reporting process.[8]

- If you don't already have a broker, look for one online with an intuitive platform that you can easily navigate. The best brokerage firms for OTC trading typically charge flat commissions.[9]

- Pay attention to the account minimums as well. Some brokers require no minimum account balance, while others may require you to have several thousand dollars. Those with higher account minimums may charge lower commissions and fees.

-

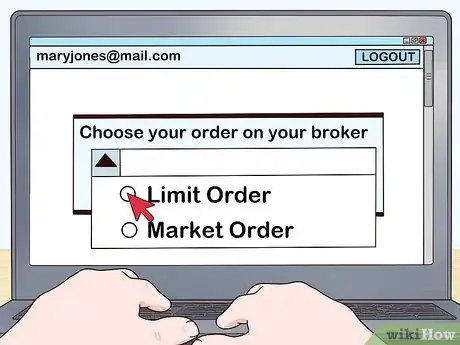

2Define your order for your broker-dealer. Based on your research, place either a limit order or a market order with your broker-dealer. With a limit order, you specify the exact price you're willing to accept in exchange for your shares. Choose a market order if you simply want the shares sold as quickly as possible and are willing to take whatever is the best offer.[10]

- For example, if your research indicates the company has filed for bankruptcy and is moving into liquidation, you would probably want a market order.

- As another example, suppose the company had a good reputation and seemed to be going through a rough patch. However, an investor recently came through with the funds the company needed to make it through, and it is widely predicted to rebound. In that case, you would probably want a limit order.

-

3Confirm the trade. Tell your broker-dealer the type of order you want. They then work to execute the trade. Your broker-dealer may complete the trade internally, or search for another broker-dealer with a matching investor.[11]

- Your broker-dealer may have to adjust the price you set in your order, depending on market fluctuations. For example, if the price you specified in a limit order is much higher than the price at which the stock is currently trading, the order is no longer marketable and your broker-dealer would have to lower the price.

- Before your broker-dealer completes the trade, they will seek confirmation from you that you are willing and able to complete the trade at the terms offered.

- If your broker-dealer completes the trade internally, FINRA regulations require them to give you at least the best-available quoted price.[12]

-

4Settle the trade. The trade is not complete until the buyer delivers funds to you and you deliver your shares to them. Your broker-dealer is responsible for ensuring the proper settlement of the trade.[13]

- Your broker-dealer is also responsible for reporting the trade to FINRA.

Writing Off a Loss

-

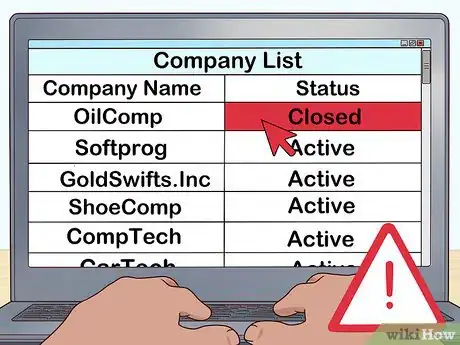

1Find out the company's status. If the delisted shares are for a company that has gone out of business, or is in liquidation status, you may be able to write off the shares as a loss on your taxes without selling them first.[14]

- In most cases, you have to sell your stock before you can write it off as a loss on your taxes. However, if the shares are literally worthless or the company no longer exists, it would be impossible to sell your shares.

- Talk to a tax professional about how to write off your shares as a loss on your taxes. You may not be able to claim the full dollar amount that you paid for them.

-

2Talk to your broker. Many brokers will buy worthless (or nearly worthless) stock from customers. That way you can easily get rid of the stock and get a trade confirmation for your tax records.[15]

- While each broker-dealer has its own rules regarding how it handles worthless stock, regulations require all registered broker-dealers to give investors at least the best available quoted price.[16]

- If you just want to get rid of the stock and aren't interested in OTC trading at all, this might be the best option for you to quickly sell your delisted shares.

-

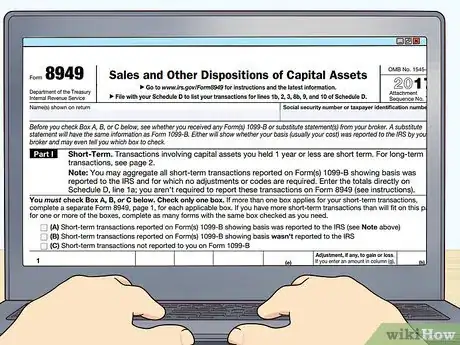

3Report the sale on Form 8949. When you file your taxes for the year you sold your delisted shares, use Form 8949 to provide information about the sale to the IRS. If you're using an online tax preparation service, you'll be prompted to enter this information.[17]

- Your loss is the difference between the adjusted basis of the stock and the amount for which you sold it. Generally, your adjusted basis for stock will be the amount you initially paid for your shares, plus the cost of the purchase, such as fees and commissions.[18]

- Download the paper form at https://www.irs.gov/pub/irs-pdf/f8949.pdf.

-

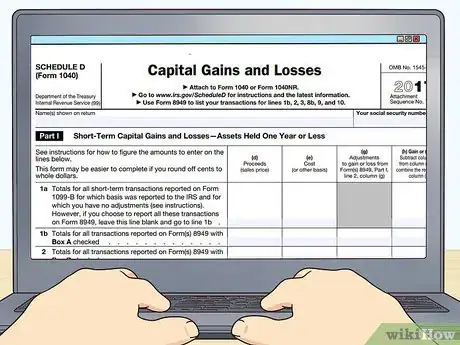

4Use Schedule D to summarize your capital gains and losses. Investments in the stock market are capital investments. Other capital assets include real estate, equipment, and furniture. Losses from personal-use property, such as your home or your car, can't be deducted – but investments in stocks always can.[19]

- Download the paper form at https://www.irs.gov/pub/irs-pdf/f1040sd.pdf.

- Sales of stock will represent either a capital gain or capital loss to you, which you must report on your tax return for that year. Capital losses are tied to capital gains. You calculate them separately than your other income, such as wages or income from a business.

-

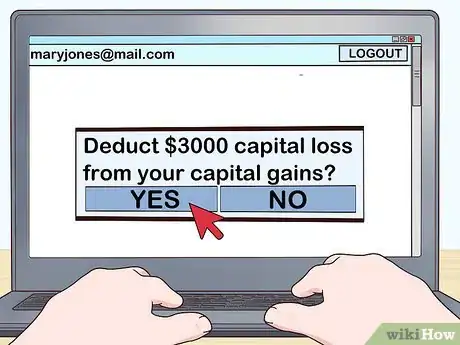

5Claim a deduction for your loss on your taxes. The sale of delisted shares was likely a loss for you. Deduct any capital losses to the extent of your capital gains. If your capital losses exceed your capital gains, you can still deduct up to $3,000.[20]

- The rest of your loss, if any, can potentially be carried over to the next year.

Warnings

- Over-the-counter trading is inherently volatile and risky. Unless you are an experienced investor, you may be better off simply selling your delisted shares to your broker and writing off the loss.⧼thumbs_response⧽

References

- ↑ https://www.investopedia.com/investing/the-dirt-on-delisted-stocks/

- ↑ https://www.otcmarkets.com/learn/market-101/trading

- ↑ https://www.investopedia.com/investing/the-dirt-on-delisted-stocks/

- ↑ https://www.investopedia.com/investing/the-dirt-on-delisted-stocks/

- ↑ https://www.sec.gov/reportspubs/investor-publications/investorpubsbankrupthtm.html

- ↑ https://www.sec.gov/files/White_OutcomesOTCinvesting.pdf

- ↑ https://www.sec.gov/files/White_OutcomesOTCinvesting.pdf

- ↑ https://www.otcmarkets.com/learn/market-101/trading

- ↑ https://www.nerdwallet.com/blog/investing/the-best-online-brokers-for-penny-stock-trading/

- ↑ https://www.otcmarkets.com/learn/market-101/trading

- ↑ https://www.otcmarkets.com/learn/market-101/trading

- ↑ http://finra.complinet.com/en/display/display.html?rbid=2403&element_id=10455

- ↑ https://www.otcmarkets.com/learn/market-101/trading

- ↑ https://www.kiplinger.com/article/investing/T052-C001-S001-how-to-sell-worthless-stock.html

- ↑ https://www.kiplinger.com/article/investing/T052-C001-S001-how-to-sell-worthless-stock.html

- ↑ https://www.otcmarkets.com/learn/market-101/trading

- ↑ https://www.irs.gov/taxtopics/tc409

- ↑ https://www.irs.gov/publications/p551#en_US_201612_publink1000256905

- ↑ https://www.irs.gov/taxtopics/tc409

- ↑ https://www.irs.gov/taxtopics/tc409

-Step-3.webp)