This article was co-authored by Erin A. Hadley, CFP®. Erin A. Hadley is the Managing Partner at Occidental Asset Management, LLC in California. Erin is a Certified Financial Planner with over 10 years of experience in investment management and financial planning. She has a Certificate in Personal Financial Planning from the University of California, Berkeley and is a member of The National Association of Personal Finance Advisors (NAPFA).

There are 20 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 90% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 359,393 times.

Government entities and corporations raise money by issuing bonds. The issuer of a bond is a borrower who makes interest payments each year. Investors purchase bonds as an investment. The investor earns interest each year and is repaid their original investment on a specific maturity date. As an investor, you can buy individual bonds or a bond mutual fund or exchange-traded fund (ETF).

Steps

Understanding the Basics of Bonds

-

1Learn how a bond works. A bond is a debt instrument issued by a government entity or a corporation to raise capital. The purchaser of a bond is a creditor and the bond issuer is the debtor.[1]

- When a bond is issued, it is sold to investors for the first time. The investor pays the issuer (government or corporation) for the bond.

- Say, for example, that General Electric (GE) wants to raise money to build a new plant. They issue a $100,000,000 15-year, 8% corporate bond. Assume that 2,000 people buy a portion of the $100,000,000 bond issue. The bond buyers are paid 8% interest on their investment each year.

- At the end of 15 years, the bond matures. GE repays the entire $100,000,000 to the bondholders. All of the bondholders are repaid their portion of bond issue.

- A bond is issued to the public for the first time in the primary market. The GE bond example is a primary market transaction. GE (the issuer) gets the sale proceeds from the investors. They use the proceeds to build the new plant.[2]

-

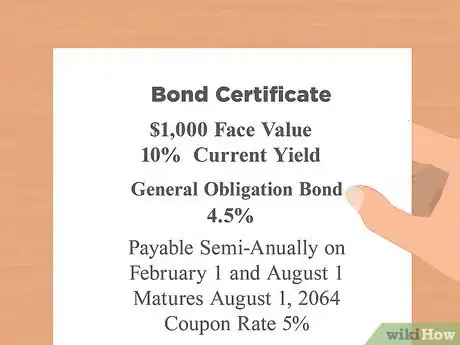

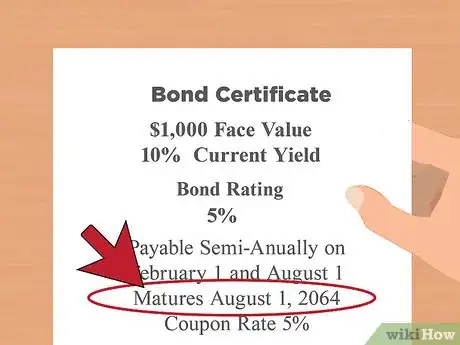

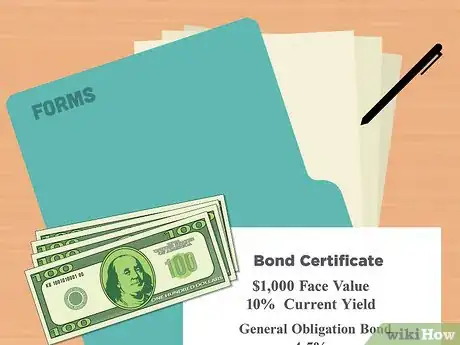

2Understand how bonds are issued. Bonds are issued with a certificate in electronic form. The par value is the dollar amount stated on the face of the bond certificate. The annual interest rate paid to the investor is also included on the bond certificate, along with the maturity date.[3]

- Once the bond is sold to the initial investor in the primary market, the bond can be traded between an unlimited number of investors. Bonds are bought and sold between investors in the secondary market.

- Assume that Bob owns an IBM corporate bond. Bob sells the bond to Sue. The sale between these two investors is a secondary market transaction.

- Bonds trade based on a market price in the secondary market. The price is driven by demand, the interest rate on the bond and the credit quality. If a bond is trading at a discount, the market price is less than $1,000 per bond. Premium bonds are bonds that are priced above $1,000 per bond. An investor who sells a bond may incur a gain or a loss.[4]

Advertisement -

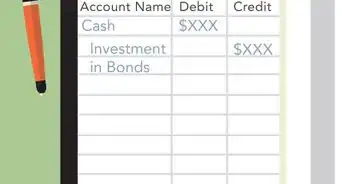

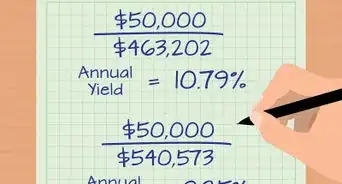

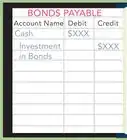

3Analyze a bond purchase and a bond maturity. Par value is $1,000. An investor can buy bonds in any multiple of $1,000 ($5,000, $100,000, etc.). The issuer receives the sales proceeds from the investor, and the investor earns interest each year. On the maturity date, the original investment is returned to the investor.[5]

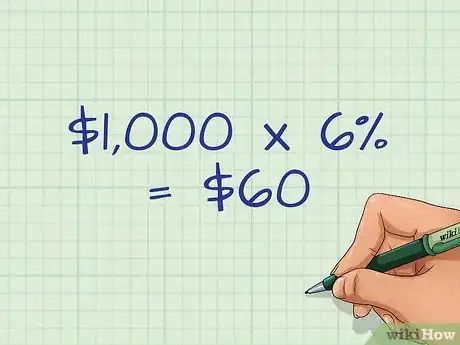

- Assume that Acme Corporation issues a $1,000 6% bond with a maturity date of 5 years.

- The investor earns $60 in interest each year ($1,000 multiplied by 6% = $60). After 5 years, the issuer repays the investor $1,000.

- The last $60 interest payment is also paid on the maturity date. The investor receives a total of $1,060 at maturity.

-

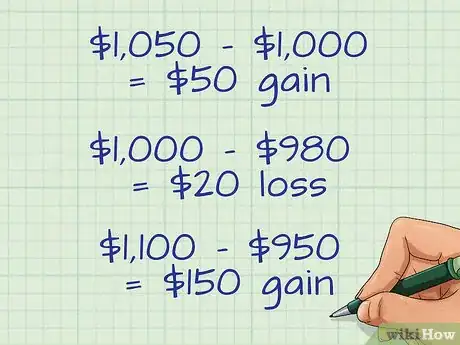

4Consider a gain or loss on a bond sale. If an investor sells a bond before the maturity date, they are selling the security at the current market price. The market price may be higher or lower than the par value (issue price).

- Selling at a premium: Assume that an investor purchases the newly issued bond at $1,000. He or she decides to sell the bond after 3 years, which is before the 5-year maturity date. Assume that the market price is $1,050. The gain is ($1,050 sales price - $1,000 issue price = $50 gain).

- Selling at a discount: Assume that an investor purchases the newly issued bond at $1,000. The investor decides to sell the bond after 3 years, which is before the 5-year maturity date. This time, assume that the market price is $980. The loss is ($1,000 issue price - $980 sale price = $20 loss).

- Remember that bonds can trade between investors. Assume that an investor buys a $1,000 par value bond from an investor at $950. The investor sells the bond to another investor 2 years later at $1,100. Your gain is ($1,100 sales price less $950 = $150 gain). Note that your gain is based on your cost of $950- not the $1,000 issue price.

Investing in Bonds

-

1Set up a brokerage account. Investors can purchase bonds through a brokerage firm which is in communication with governments and companies that want to issue debt. They also have access to the markets where bonds trade in the secondary market.[6] Consider how much advice you need to set up an account.

- If you plan to direct your own investments, you can set up an account online by going to the website of a brokerage firm such as Charles Schwab, Fidelity or TD Ameritrade.

- If you wish to work with an advisor, you can locate an independent professional in your area through one of the following sites: www.letsmakeaplan.org, www.napfa.org, www.garrettplanningnetwork.com.

- You can also go to your local bank or full service firm; just make sure you shop around, as fees and services can vary a great deal.

- When an investor opens an account, the individual will be asked to complete a customer new account form. They will answer questions about investment experience and risk tolerance. When the account is approved, the investor can transfer funds into the account to purchase bonds.

-

2Purchase individual bonds for your portfolio. One investment objective is your timeframe for investing. If an investor has a specific time period for investing, they can select bonds that mature near that future date.[7]

- Bonds have maturity dates from just a few years to 30 years.

- Investors should consider the maturity date of the bond, and when they need access to their invested funds.

- Say, for example, that an investor plans on retiring in 15 years. They can buy bonds with maturity date of 15 years. The bond issuers will return the invested funds on that date. The longer until maturity, the higher the interest rate offered on the bond.

-

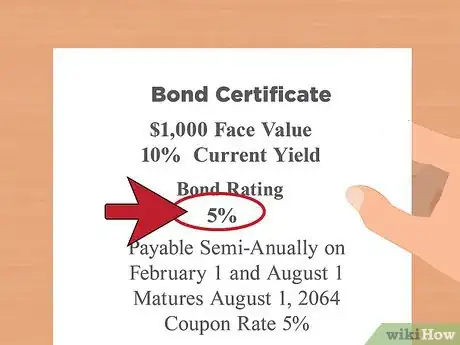

3Check the bond’s rating. An investor must consider the credit rating on the bond. Credit rating refers to the ability of the bond issuer to make all required interest payments and to repay the principal balance on time.[8]

- Bonds are rated, based on their ability to pay interest and repay principal on schedule. Standard and Poor's and Moody’s are the two largest ratings firms. The higher a bond’s rating, the more expensive that bond may be.[9]

- Highly rated bonds can also offer a lower interest rate. If a bond has a poor rating, it will have to offer a higher interest rate to attract investors. Consider a corporate bond due in five years. The highly rated five-year bond might be sold with an interest rate of 5%. The five-year bond with the lower bond rating may have to offer a rate of 7%.

- The higher interest rate compensates bond buyers for taking more risk. The bond with the lower bond rating is judged to have a higher risk of not paying interest and principal payments.

-

4Place an order. Once an investor decides on a bond, a brokerage firm can place the order for him or her. If new offerings are available, investors can buy a bond when it is issued. Most bond purchases, however, are placed in the secondary market. In that instance, the investor is buying the bond from another investor.

- An investor will receive a confirmation from the brokerage firm. The confirmation details the purchase. Trade confirmations should be kept on file.

- Most investors typically hold their securities at the brokerage firm. That allows people to easily access and sell the bonds, or turn them in at maturity. Investors also receive a statement from the firm. The brokerage statement will detail all of the securities holdings at the firm.

- If an investor decides to sell the bond before maturity, the brokerage firm will quote a sale price. That price is based on demand in the secondary market.

- When an investor places a sell order, the brokerage firm will deliver securities to the buyer. The investor also receives a trade confirmation for a bond sale.

Evaluating Bonds

-

1Evaluate the issuer of the bond. The most important characteristic of any bond is its issuer. This is because, as an investor, you are counting on the issuer to return your money as promised. Issuers, which may be corporations or governments, vary in reliability. The primary categories of bond issuers are as follows:

- The United States Treasury. These are considered to the golden standard for reliability (credit-risk free). This means that they will likely have low yields, but will also reliably return your money, even in economic downturns. Interest earned on these bonds is also exempt from state income tax.[10]

- Other United States Government Agencies. These bonds are issued by other government agencies such as Fannie Mae and Ginnie Mae. Yields on these bonds will be higher than Treasury bonds due to slight risk, but the risk here is considered minimal.[11]

- Several of these agencies also offer what are known as mortgage-backed bonds. These are generally more expensive and somewhat riskier than other types of government-issued bonds.[12]

- Municipal governments. These bonds are offered by municipal governments and offer a variety of tax advantages, depending on your location and tax bracket. Their risk is slightly higher than that of a federal government bond.

- Foreign Governments. Foreign government bonds can carry either minimal or very high risk (and thus low or high yields), depending on the nation offering them. Their performance is also susceptible to currency exchange rate fluctuations.[13]

- Corporations. Like foreign governments, the yields and risks associated with corporate bonds can vary widely between issuers. The company's ability to repay the bond will depend on the company's ability to properly convert the investors' money into additional revenue.[14]

-

2Determine a bond's quality. Bonds are given a rating or grade that indicates their credit quality. This measures a bond issuer's ability to repay the invested capital and interest on time. The agencies that rate bonds are private, independent companies such as Standard & Poor's, Moody's, and Fitch. Ratings may be found by searching for the bond online.[15]

- Bonds are generally rated from "AAA" to "C", with a rating closer to AAA indicating higher reliability. Though different rating agencies use different combinations of uppercase and lowercase letters to represent these ratings, they use the same combinations of letters (for example, "AAA" is the same as "aaa").

- As a general guide, anything over "BBB" is considered to be investment grade. That is, the ratings agencies consider it to be safe enough to invest in.

- An additional rating, "D", is sometimes used for bonds in default.[16]

-

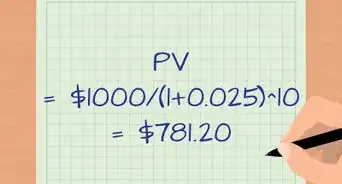

3Determine a bond's interest-rate sensitivity. The value of a bond is susceptible to change due to fluctuations in the market interest rate (usually a government interest rate). Put simply, fluctuations in the interest rate change the value of a bond by making it more or less attractive to investors against other investment options.[17] To measure this susceptibility, bonds and bond funds have a stated value known as duration, which is stated in years. A higher duration represents a greater susceptibility to interest rate fluctuations.[18]

- Specifically, duration represents a period that indicates how long it will take an investor to regain the true value of a bond, considering the present value of its future principal repayment and interest payments.[19]

- In general, if interest rates rise, the value of a bond or bond fund will decrease.[20]

-

4Evaluate bonds as diversification opportunities. By investing in different types of bonds, you can lower your overall investment risk. Diversification may include investing in bonds from different issuers, bonds with different maturity dates, and bonds from different geographical areas. Technically, this style of investing eliminates what is known as non-systemic risk, or risk due to fluctuations in markets and industries.[21] Try the following techniques to diversify your bonds.

- Invest in bonds of varying quality. By balancing risky investments in lower-rated bonds with investments in higher-rated bonds, you mitigate some of the risk associated with lower-rated bonds. Additionally, the large spread in lower-rated bonds may help buffer some of the effects of interest rates on the value of your bond portfolio.

- Buy bonds with different maturity dates to get the best of short-term and long-term returns. Short-term bonds may be performing better than long-term bonds at any given time, or vice versa. By holding money in both types, you are able to more frequently benefit from price fluctuations.[22]

- Invest in geographically diverse bonds. Whether this is within your own country, maybe diversifying between regions or states, or between nations, you can limit a large amount of risk by purchasing bonds from different areas. For example, by purchasing foreign bonds, an American investor might be temporarily insulated from the price effects of a United States interest rate hike.

Buying a Bond Fund or an Exchange-Traded Fund

-

1Consider using a mutual fund or an exchange-traded fund (ETF). Mutual funds and ETF's are pools of funds gathered from many investors. The funds can be invested in many types of securities, including bonds. Mutual funds and ETF's are considered investment securities.[23]

- If an investor wants a portfolio that guarantees a specific dollar amount that will mature on a specific day, he or she should buy individual bonds. Bond funds are a blended portfolio of bonds. There are dozens of bond maturity dates in the portfolio.

- Get some advice. When an investor sets up a brokerage account, he or she should ask his or her advisor for some bond mutual fund recommendations.

- If the investor is not working with an advisor, then he or she must do his or her own research to determine the appropriate bond fund(s) to use.

-

2Match the fund’s investment objective with the investor’s objective. Funds are sold by prospectus. The prospectus is a document that discloses everything an investor should know about the fund. All fund investors must receive a copy of the prospectus.[24]

- The security of a bond fund corresponds with the credit rating of the bonds in the fund's portfolio. If an investor buys a mutual fund with highly rated bonds, the fund’s investments are expected to have a lower risk of default than a portfolio with lower rated bonds.

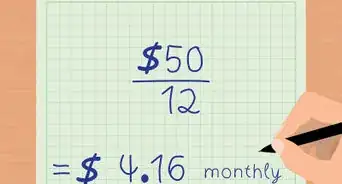

- Review the fund’s investment objective. If, for example, the fund charged ½ of 1% as an annual expense ratio, an investor would pay 50 cents on every $100 invested.[25]

- Take a look at the maturity dates on the bonds in the portfolio. If an investor is investing for 20 years, for example, the investor may want to buy a bond fund with 20-year maturities. That will allow them to earn a higher interest rate than a five- or ten-year maturity bond portfolio.

- Analyze the credit ratings on the bonds. If safety is an important goal for the investor, her or she might buy a highly rated bond fund and accept a lower interest rate. If he or she is willing to take some risk, an investor can earn more interest on a portfolio with a lower credit rating.

- Review the cost of the fund. Funds sold by full-service brokerage firms will have a sales charge. The sales charge compensates the investment advisor.[26]

- There are "load" mutual funds and "no-load" mutual funds: load funds have a sales commission charged in addition to other costs, and can range from 4% to 8% of the value of the investment, whereas no-load funds do not have this additional cost. These are typically sold by full-service brokerage firms.

- Funds also have an annual expense ratio. The expense ratio is charged to cover the costs of operating the fund each year. The charge is based on a percentage of assets.

- Determine if the fund’s objectives are consistent with the investor’s goals. Investors can ask a financial professional for help on this issue.

-

3Place an order for the fund. Once an investor sets up a brokerage account and transfer funds, placing a mutual fund or EFT order is very similar to buying individual bonds. Bond mutual funds are priced each day, based on the current value of the fund, whereas an ETF's price varies throughout the market day.[27]

- When investors buy a fund, they purchase mutual fund shares. These fund shares are similar to buying shares of common stock. When an investor buys a mutual fund, he or she pays the ask price on the business day that they place your order. Nearly all investors hold their mutual fund shares at the brokerage company or mutual fund company.

- Investors can sell mutual fund or EFT shares on any business day. A brokerage firm or your mutual fund can directly place a sell order. The investor will receive the bid price for each share that he or she sells.

- Just as with individual bonds, the investor receives a trade confirmation for all fund buy and sell orders.

References

- ↑ http://www.investinginbonds.com/learnmore.asp?catid=46&id=2

- ↑ http://thismatter.com/money/bonds/primary-bond-market.htm

- ↑ http://www.investopedia.com/ask/answers/09/bond-over-the-counter.asp

- ↑ http://www.investopedia.com/ask/answers/186.asp

- ↑ http://www.businessdictionary.com/definition/par-value.html

- ↑ http://money.cnn.com/pf/money-essentials-buy-bonds/

- ↑ http://www.investopedia.com/terms/m/maturitydate.asp

- ↑ http://www.kiplinger.com/article/investing/T052-C000-S001-what-bond-ratings-mean.html

- ↑ http://www.dummies.com/how-to/content/why-a-companys-bond-rating-is-important.html

- ↑ http://www.thestreet.com/story/229831/1/the-different-kinds-of-bonds.html

- ↑ http://www.thestreet.com/story/229831/1/the-different-kinds-of-bonds.html

- ↑ http://www.thestreet.com/story/229831/1/the-different-kinds-of-bonds.html

- ↑ http://www.thestreet.com/story/229831/1/the-different-kinds-of-bonds.html

- ↑ http://www.thestreet.com/story/229831/1/the-different-kinds-of-bonds.html

- ↑ http://www.investopedia.com/terms/b/bondrating.asp

- ↑ http://www.investopedia.com/terms/b/bondrating.asp

- ↑ https://www.wellsfargoadvantagefunds.com/wfweb/wf/education/choosing/bonds/rates.jsp

- ↑ https://www.finra.org/investors/alerts/duration-what-interest-rate-hike-could-do-your-bond-portfolio

- ↑ https://investor.vanguard.com/insights/bond-fund-basics-duration

- ↑ https://www.finra.org/investors/alerts/duration-what-interest-rate-hike-could-do-your-bond-portfolio

- ↑ http://www.finra.org/investors/diversifying-your-portfolio

- ↑ http://www.finra.org/investors/diversifying-your-portfolio

- ↑ http://www.investopedia.com/terms/m/mutualfund.asp

- ↑ http://www.investinganswers.com/financial-dictionary/mutual-fundsetfs/prospectus-929

- ↑ http://www.morningstar.com/invglossary/expense_ratio.aspx

- ↑ http://www.investopedia.com/articles/mutualfund/05/062805.asp

- ↑ https://www.finra.org/investors/learn-to-invest/types-investments/bonds/bond-funds

About This Article

If you want to invest in bonds, set up a brokerage account through an established brokerage firm. If you have a specific time-frame for investing, select bonds that mature near that future date. You should also check the credit rating on the bond, which is based on the company’s ability to pay interest and repay the principal on schedule. Your investment advisor can give you this information or you can check with a credit rating firm like Standard and Poor’s or Moody’s. Read on for tips from our financial reviewer on why you might choose a mutual fund or exchange-traded fund rather than an individual bond, read on!