This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 11 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 88% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 146,905 times.

Learn more...

Corporate bonds are a financial tool that a corporation uses to raise funding. They are an alternative to acquiring loans from a bank or issuing shares of stock. Corporations use the money from bond sales to finance a variety of improvements, like business growth, new factories, or new equipment. When an investor buys a corporate bond, he is essentially buying an IOU from the corporation that is to be paid back after a pre-determined time (the maturity date). The bond will also typically pay coupon payments, which are interest-based payments made to the bondholder at regular intervals (usually semi-annually).[1] Corporations usually enlist the help of investment banks, which function as underwriters, to organize the creation, marketing, and sale of the bonds.

Steps

Deciding to Issue Corporate Bonds

-

1Consider internal financing first. Internal financing is generally cheaper than seeking outside funding for a project. Conduct a review of your company's financials to uncover areas where you can save money or redirect funds. Some areas to check include within subsidiaries, executive perks, capital expenditure, and recruitment expenses, among others.[2]

-

2Look into alternative external fundraising options. If you determine that outside funding is necessary, consider selling stock or acquiring a loan. A loan can reliably provide capital to the company, however it can also restrict their activities and may charge a higher interest rate than a bond issuance would. With stock issuances, companies can get even cheaper capital, however now they have sold even more of their equity to investors and may be held responsible for fulfilling investor requests.

- Bonds should not be issued by companies who already carry large amounts of debt, as a bond issuance simply increases debt and makes an already unstable company more so.[3]

Advertisement -

3Consider private placement. Private placement involves the selling of unregistered (not registered with the SEC, that is) stocks or bonds to institutional investors. This type of bond may be advantageous to a company as the costs of the issuance are cheaper due to smaller regulatory and marketing costs. However, this type of issuance still requires the assistance of an investment bank, both to file the proper letter of intent and private placement memorandum and to connect the issuing company with institutional investors (large, non-bank funds).[4]

- Private placements are advantageous for smaller companies. The process of issuing them is simpler and minimum size requirements are lower. In general, a regular corporate issue will require a minimums in the tens or hundreds of millions of dollars. However, private placements can be issued with much lower total values.

-

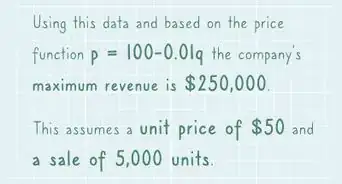

4Calculate the cost of issuing bonds. In order to issue corporate bonds, the company will have to be sure that it is able to make payments on the bonds. That is, future cash flows will have to be substantial enough to cover both the coupon payments every six months or every year and the par value of the bonds when they reach maturity. This will require both a schedule of potential bond payments and the future expenses and earnings of the company.

- The company will also have to factor in transaction costs associated with the issuance of the bonds, which will be charged by the investment bank.

- For these reasons, bond issuances are usually not a good idea for startups, because their revenues may be low or negative for the first couple years of operation, leaving them unable to service their debt obligation.[5]

-

5Decide on bond terms. Bonds are issued with specific durations and the duration and payment frequency of your bonds will depend on your capital needs. In addition, your bond will be rated for risk based on your company's risk profile. The combination of these factors will determine the interest rate on the bond. In addition, market analysis will determine the price on the bond. These are the basic terms of the bond, however there may be others, including:

- Whether or not the bond is secured by the company's assets. These "collateralized" bonds allow investors to claim the company's assets in the event the bond payments go unpaid. Collateralized debt may carry less interest expense for the issuer, as it is considered less risky.

- Callable bonds. These bonds are able to be "called," or paid off, before the maturity date.

- Convertible bonds. These are bonds that can be converted into a set number of the company's shares of stock. Ideally, these allows for the investor to benefit from rising stock prices and the company can then be off the hook for repaying the bonds.[6]

Registering Your Bond Issue

-

1Write a publicly distributed prospectus. The initial prospectus for a corporate bond issuance must be a publicly distributed prospectus. That is, it must be available to the public and meet certain criteria. This prospectus must specify the following information:

- The nature of the issuer's business.

- A management profile of the issuer.

- A list of principal investors.

- The conditions or features of the bonds being issued.

- Financial risks inherent to the company or the bonds.[7]

-

2Gather required supplemental information. Additional supplemental information may be required to be submitted to the SEC when registering your bond issue. The SEC will specify the nature of this information. However, in all cases the SEC will require financial records and statements from the company for the present year and in some cases for a number of prior years. These documents must comply with US generally accepted accounting procedures (GAAP) and must be prepared by a certified public accountant (CPA).[8]

-

3Compile the information and submit the registration statement to the SEC. If the issuer is already working with an underwriter or underwriting syndicate, all of the participants in the deal, including the issuer and members of the underwriting syndicate, work collectively on the language and format of the registration statement.[9] Otherwise, the issuer will be responsible for this filing.

-

4Wait for approval before moving forward. Corporate bonds cannot be offered for sale to the public without the approval of the SEC. If there are issues with your registration, you will be forced to correct them before you can move forward.[10]

Creating an Offering Proposal

-

1Solicit proposals from underwriters. The underwriter is an investment bank acts as a middleman between the bond issuer and the investors. Contact several investment banks and ask if they are interested in underwriting your bond issuance. Those that are will submit initial prospectuses, sometimes called red herrings because of their color, that will describe their strategy for the sale of the bonds, including pricing, marketing strategies, and syndication plans.

- The issuer may have to meet with several banks several different times to clarify proposal strategies and negotiate terms.[11]

-

2Select an underwriter. The underwriting firm works with your company (the issuer) to begin the process of issuing corporate bonds by determining the specifics of the bond, including when the bonds will mature, the interest rate offered, and the price of the bonds. Both the issuer and the underwriting firm will be represented by legal counsel.

- Investment banks function as underwriters because they have a better understanding of bond market and regulations than the issuer.[12]

-

3Invite additional underwriters to be involved in the deal. The primary underwriter will invite other investment firms to join the deal. Those who accept the invitation create what is called an underwriting syndicate. Your project is deemed officially "launched" once the syndicate has been formed.

- Forming a syndicate allows the underwriters to reduce individual risk and reach a larger group of potential investors.[13]

-

4Price the bonds. Set the final price of the issue after you've sent the registration letter and taken preliminary orders for the bonds. Submit the final pricing to the Trade Reporting and Compliance Engine (TRACE) which is a part of the National Association of Securities Dealers.

- The underwriter should price the bond in accordance with their understanding of the bond market. This includes gauging demand for this type of bond, for bonds within the industry, and interest/trust in the issuer.

- That is, the issuer using has no involvement in the determination of the price of the bonds beyond choosing an underwriter to help them do that pricing.[14]

- In many cases, the investment bank will include a provision in the offering proposal to buy a certain number or all of the bonds being created. In this case, the bank will then seek to sell the bonds to the public at a higher price than they paid. The difference is referred to as the underwriting spread.[15]

-

5Compile the offering proposal. A completed offering proposal will include four distinct parts that describe the issuer and the bond being issued:

- The executive summary, which summarizes the issuer's nature, key financials, goals in issuing the bonds, and any associated risks.

- Investment considerations, which lists the terms of the bond, including pricing, collateral, conditions, and other terms.

- An industry overview comparing the position of the issuer relative to others in the industry and an overall analysis of the industry.

- A financial model that specifies preliminary coupon rates and projected company financials. This information is estimated and is not meant to be binding or perfectly correct.[16]

Finalizing the Bond Issue

-

1Negotiate a bought deal. A bought deal is one where the underwriter purchases a number of shares from the bond issuance in order to resell them itself. The issuer agrees on a maturity and yield for these bonds that is then locked in by the underwriter. The underwriter can then turn around and resell these bonds to syndicate members, institutional investors, and the public for a profit (the underwriting spread).[17]

-

2Locate the right market for the bonds. The remainder of the bonds not sold to institutional investors or syndicate members will be sold to the public. Publicly-issued bonds can be issued in capital markets or banking markets, or both. Work with the underwriter or underwriting syndicate to determine the best market for your bonds based on the nature of your issuance.[18]

-

3Finalize bond terms. The maturity (or maturities), interest rates, and price of the bond will be officially set before the bond are sold. These prices only refer to the sale in the primary market, which is the first time that the bonds are sold. Afterwards, bonds traded from the original originals will be traded in the secondary market and may change prices. However, the issuer will only receive proceeds from the sale of the bonds in the primary market.[19]

-

4Market the bonds. The Lead Manager will complete a questionnaire from the Depository Trust and Clearing Corporation (DTC) which will allow you to be eligible for the bonds services that DTC provides, such as distribution and depository. Once your issue has been approved, you can commence marketing and taking orders for your bonds.[20]

- Bonds may be marketed to investors through the underwriters' personal connections or through financial publications like the Wall Street Journal or Barron's.[21]

-

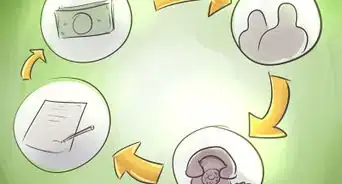

5Allocate bonds to purchasers. After you have received payment for the bonds, created your corporate bonds, and deposited them with DTC, the lead underwriter handles the distribution of the bonds to the underwriting syndicates who in turn issue the bonds to investors. This allocation is sometimes referred to as syndication.[22]

-

6Distribute funds. After the bonds have sold, the lead underwriter is responsible for distributing the funds to the issuer. The issuer can then use these funds to begin or continue whatever project or capital purchases the bonds were originally intended to finance.[23]

Selling Private Placement Bonds

-

1Choose private placement over a public issuance. Companies may choose to issue bonds in the private market for a number of reasons. Some do it for the fact that private placements can typically be issued at a lower cost to the issuer, because underwriter fees may be smaller or nonexistent. Others enter the market to keep their finances private or to diversify their creditors. In addition, some small companies are not able to issue bonds publicly because the total value of the bond issue does not meet underwriter thresholds.

- Private placement can theoretically be any size, from a very small offering under $1 million to very large ones in the billions of dollars.[24]

-

2Decide on bond terms. Private placement bonds can carry the same terms as public bonds. That is, you can set the price, interest rate, and maturity of the bonds, along with other conditions, like making them convertible or callable bonds. Note when pricing these bonds that private placement bonds typically pay higher interest rates than publicly issued bonds.

- An investment bank, though not required for a private placement issue, can help an issuer set up their bond terms to appeal to certain institutional investors.

- Bonds can also be issued in tranches, which are simply separate groups of bonds differentiated by different interest rates or maturities.[25]

-

3Identify qualified institutional investors. The SEC requires that the purchasers of any private placement bonds be "qualified institutional investors." This is a term meaning that the investor is one who can understand the risks of trading securities and can bear those risks. These investors are typically institutions, like pension funds, who have over $100 million under management. The issuer can work with an underwriter to locate these investors or work to locate their own.[26] [27]

-

4Have investors complete letters of intent. The letter of intent, or investment letter, is a letter signed by the institutional investors that promises that the private placement bonds are for investment and not for resale to the public. This is because private placement securities cannot be resold for 2 years. When they are sold, they must be registered with the SEC.[28]

-

5Draft and send out a private placement memorandum. The private placement memorandum, also called an offering memorandum, is the private placement equivalent of a prospectus. It describes the issuer, its management, and business plans, and contains financial statements and information. It also describes every detail of the offering, including risks, terms, interest rates, conditions, and other relevant information.[29]

Community Q&A

-

QuestionAre high yield corporate bonds insured?

Community AnswerHigh yield corporate bonds, also called junk bonds, are issued by companies with a high risk of defaulting on their bond payments. This type of bond is also more susceptible to economic fluctuations than higher-rated bonds. If the company defaults, bondholders may not receive their promised payments from the bonds. However, in the event that the issuing company itself is liquidated, unsecured bondholders have a prioritized claim on the assets of the company. So, high yield corporate bonds are not "insured," and you may end up losing money. However, you may have a way to get your money back if the company defaults.

Community AnswerHigh yield corporate bonds, also called junk bonds, are issued by companies with a high risk of defaulting on their bond payments. This type of bond is also more susceptible to economic fluctuations than higher-rated bonds. If the company defaults, bondholders may not receive their promised payments from the bonds. However, in the event that the issuing company itself is liquidated, unsecured bondholders have a prioritized claim on the assets of the company. So, high yield corporate bonds are not "insured," and you may end up losing money. However, you may have a way to get your money back if the company defaults. -

QuestionAre all of the above steps really necessary if the corporation issuing the bonds is just a small S-corp that wants to raise, say, $100,000?

Community AnswerNot necessarily -- it largely depends on what state you live in. I reside in Texas, for example, and a private placement memorandum (PPM) is heavily regulated by the state. For small(er) placements under 1 million $, there is almost no regulation, but above 1 million, you have to register your PPM with the state of Texas, and have a named registered agent for the state contact, along with audited financials. And that would just be to send a PPM out to prospects, not even a promise you'll get any money out of an investor.

Community AnswerNot necessarily -- it largely depends on what state you live in. I reside in Texas, for example, and a private placement memorandum (PPM) is heavily regulated by the state. For small(er) placements under 1 million $, there is almost no regulation, but above 1 million, you have to register your PPM with the state of Texas, and have a named registered agent for the state contact, along with audited financials. And that would just be to send a PPM out to prospects, not even a promise you'll get any money out of an investor.

References

- ↑ https://www.sec.gov/answers/bondcrp.htm

- ↑ http://www.investopedia.com/articles/bonds/09/corporate-bonds.asp

- ↑ http://www.investopedia.com/articles/investing/062813/why-companies-issue-bonds.asp

- ↑ http://thismatter.com/money/bonds/primary-bond-market.htm

- ↑ http://www.investopedia.com/articles/bonds/09/corporate-bonds.asp

- ↑ http://www.investopedia.com/articles/investing/062813/why-companies-issue-bonds.asp

- ↑ http://www.investopedia.com/articles/investing/103015/issuance-procedure-corporate-highyield-bonds.asp

- ↑ http://www.investopedia.com/articles/investing/103015/issuance-procedure-corporate-highyield-bonds.asp

- ↑ http://thismatter.com/money/bonds/primary-bond-market.htm

- ↑ http://www.investopedia.com/articles/investing/103015/issuance-procedure-corporate-highyield-bonds.asp

- ↑ http://www.investopedia.com/articles/investing/103015/issuance-procedure-corporate-highyield-bonds.asp

- ↑ https://news.morningstar.com/classroom2/course.asp?docId=5458&page=2&CN=COM

- ↑ https://news.morningstar.com/classroom2/course.asp?docId=5458&page=3&CN=COM

- ↑ https://news.morningstar.com/classroom2/course.asp?docId=5458&page=2&CN=COM

- ↑ http://thismatter.com/money/bonds/primary-bond-market.htm

- ↑ http://www.investopedia.com/articles/investing/103015/issuance-procedure-corporate-highyield-bonds.asp

- ↑ http://thismatter.com/money/bonds/primary-bond-market.htm

- ↑ http://www.investopedia.com/articles/bonds/09/corporate-bonds.asp

- ↑ http://www.investopedia.com/articles/investing/103015/issuance-procedure-corporate-highyield-bonds.asp

- ↑ http://www.investopedia.com/terms/d/dtc.asp

- ↑ https://news.morningstar.com/classroom2/course.asp?docId=5458&page=4&CN=COM

- ↑ http://www.investopedia.com/articles/investing/103015/issuance-procedure-corporate-highyield-bonds.asp

- ↑ http://thismatter.com/money/bonds/primary-bond-market.htm

- ↑ http://thismatter.com/money/bonds/primary-bond-market.htm

- ↑ http://thismatter.com/money/bonds/primary-bond-market.htm

- ↑ http://thismatter.com/money/bonds/primary-bond-market.htm

- ↑ http://financial-dictionary.thefreedictionary.com/qualified+institutional+investor

- ↑ http://thismatter.com/money/bonds/primary-bond-market.htm

- ↑ http://www.investopedia.com/terms/o/offeringmemorandum.asp

-Step-04.webp)