This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

This article has been viewed 1,242,423 times.

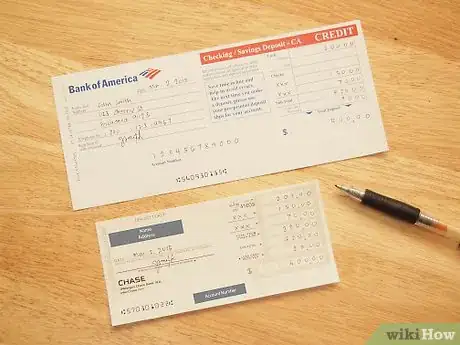

A checking deposit slip is a small written form that is used to place funds into your account. It indicates the deposit date, name and account number of the depositor, and the monetary amount to be deposited in the form of checks, and cash. It's filled out much like a regular check, but it includes various deposit kinds. Read on to find out how to properly fill out a checking deposit slip.

Steps

Gathering Basic Information

-

1Gather your checkbook. Then, look to the very back of your checkbook, behind all of your checks. That's where you'll find your slips. The deposit slip pages are usually of a different color than your checks, and have Deposit Ticket/Slip written above your name and address.

- If for some reason you can't locate your deposit slips, or you simply don't have any, go to your bank and ask a teller for more slips.

-

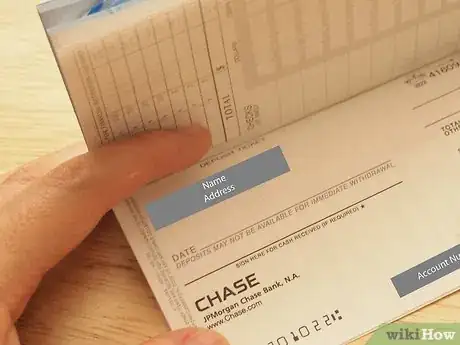

2Ensure that your name and address are printed on the slips. Your checks have your name, address, and sometimes phone number written on them. The same information should be present on your deposit slips. Look to the upper left side corner of your slips to make sure your information is displayed correctly[1] .Advertisement

-

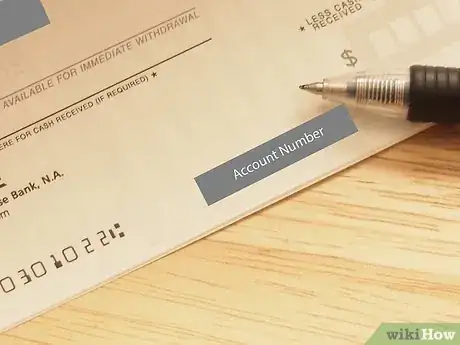

3Locate your account number. Much like your name, address, and sometimes phone number, your deposit slips should have your account number printed on them. Look to the bottom of the slip, and locate two separate strings of numbers. The first set of numbers is your routing number, and the second set is your account number[2] .

- If your information isn't already displayed on your deposit slip, you need to fill it in. Follow the next step.

-

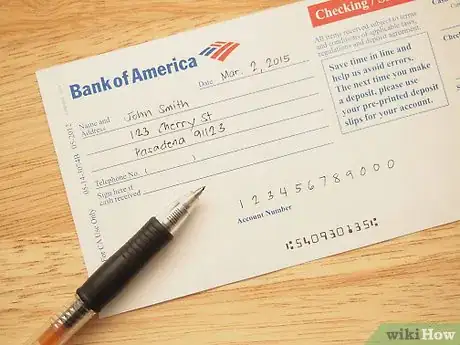

4Write your name, account number and date. It's unlikely that your slip won't already contain this information. But if it doesn't, or you got a blank slip from your bank, make sure to fill in this information. You'll see a few blank lines on the upper left side corner. Fill in your name, the date, and your account number[3] .

- If you're unsure about your account number, you might be able to look it up online through your bank's site. You can also go to your bank, and ask a teller to provide that information.

- Use black or blue ink, rather than a pencil or colored ink.

Filling Out Your Deposit

-

1Fill in the date. If you've already taken care of writing the date on the slip, you can skip this step. If your deposit slip already contained your personal information, look to the left side of the slip. Write the date of when you wish to use the slip in the space provided, next to Date.

-

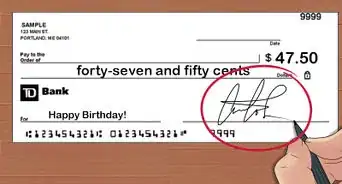

2Sign the slip. Sign your name in the space provided right below the date.

- The space for your signature will say: Sign here if cash received from deposit.

- If you don't wish to receive cash back from this transaction, you can leave this space blank.

-

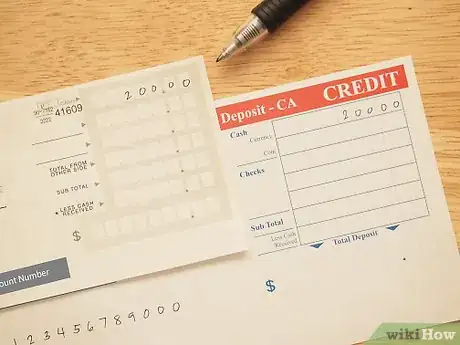

3Enter the amount of cash you're depositing. Look to the right side of your deposit slip. You'll note various columns composed of rows of blanks alongside your slip. The very first line will say Cash next to it. If you're depositing cash, write down the full amount in the box lines next to Cash.

-

4Write down the amount for the check(s) you'd like to deposit. Right below the Cash line, you'll see two lines of boxes provided for check deposits. These lines might be labeled as Checks with blank lines in front of the box lines, or not at all. In any case, the lines following the Cash space are reserved for deposits made in the form of a check.

- Write the check number(s) in the blank lines, and the amount in the box lines.

- It can help to list your checks in ascending or descending order.

-

5Note the first line below Checks. Following the check deposits, you'll see a line labeled as Checks or Total From Other Side. This simply means that if you have more than two checks, you can enter them on the back of the deposit slip. Then, write the combined check total on the front side where it's indicated.

-

6Fill in the subtotal. Below the line reserved for the total amount in checks, it'll say Subtotal. This is where you write down your cash deposit amount plus your combined check deposit amount. Add the sums up, then write it down next to Subtotal.[4]

- Double-check your math to make sure that your balance equals the balance on the deposit slip. The bank teller isn't going to do the math again for you—the back end of the bank is going to make the adjustment, which makes things complicated.

-

7Write down how much cash you'd like to get back. The line below Subtotal will be labeled as Less Cash. This is where you indicate how much cash you'd like to receive from this deposit slip. If you don't want any cash, enter 0 in this line.

- If you entered cash to receive from the deposit, subtract that amount from the Subtotal. Then, write down the amount on the very last line labeled as Net Deposit.

-

8Visit your bank. Take your deposit slip, checks and cash, and visit your banking institution. Proceed to the teller, and hand her or him your deposit slip and funds.

Community Q&A

-

QuestionWhy would I ever need to use the back of the deposit slip?

Community AnswerIf you have multiple checks that you'd like to deposit at once with a teller.

Community AnswerIf you have multiple checks that you'd like to deposit at once with a teller. -

QuestionI was taught to write the bank clearing number, for example: 68-54, and now they use the check number. When did that change?

DonaganTop AnswererIt didn't. You can still use the bank "fractional" number.

DonaganTop AnswererIt didn't. You can still use the bank "fractional" number. -

QuestionWhat do I enter in the check listing spaces when filling out a bank deposit slip?

DonaganTop AnswererEnter the "fraction" number of the bank branch where the check originated and the amount of the check. The fraction (typically involving a hyphen and a slash mark) is printed on the check just below the check number.

DonaganTop AnswererEnter the "fraction" number of the bank branch where the check originated and the amount of the check. The fraction (typically involving a hyphen and a slash mark) is printed on the check just below the check number.

Expert Interview

Thanks for reading our article! If you'd like to learn more about checks, check out our in-depth interview with Gina D'Amore.

References

- ↑ http://www.handsonbanking.org/financial-education/young_adults/how-to-fill-in-a-deposit-slip/

- ↑ http://www.handsonbanking.org/financial-education/young_adults/how-to-fill-in-a-deposit-slip/

- ↑ http://www.handsonbanking.org/financial-education/young_adults/how-to-fill-in-a-deposit-slip/

- ↑ http://www.handsonbanking.org/financial-education/young_adults/how-to-fill-in-a-deposit-slip/

About This Article

To fill out a checking deposit slip, make sure the slip has your name, address, date, and account number, and fill in any information that is missing. Then, sign the slip, and write how much cash you’re depositing on the right side of the slip. If you’re depositing checks, write the check numbers on the blank lines below “Cash” and put the check amounts in their respective boxes. Finally, put the total amount of your deposit on the bottom line and give the slip to your teller. Keep reading to learn how to get cash back from this transaction!