This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 17 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 962,118 times.

Though they aren’t used as often as they used to be, cheques (or checks) are still issued frequently for a variety of reasons. Whether in the form of a personal cheque written as a gift or a business cheque issued for services rendered, most everyone will find themselves needing to cash one. Knowing how to make sure a cheque is valid and how to cash it will help you get your money as quickly and inexpensively as possible.

Steps

Making Sure a Cheque is Cashable

-

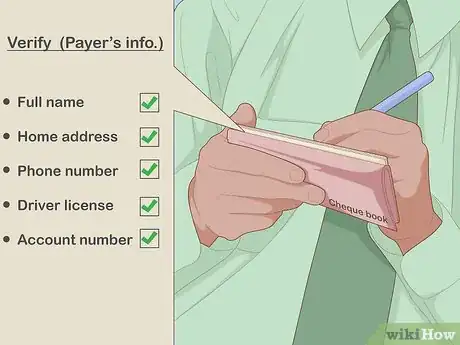

1Verify the trustworthiness of the person writing the cheque. If the person writing you the cheque is a close friend, you probably trust them to write a cheque that you can cash. If you are accepting a cheque as payment from someone you do not know, confirm the following information:[1]

- Full name

- Home address

- Phone number

- Driver's license number

- Check with the bank the cheque will be drawn on to confirm that the person writing the check has an account with funds available to cover the check. Many banks will verify the account the cheque is drawing from if you contact them.[2]

-

2Make sure the check is made out to you. It is very important for your name to be written correctly on the cheque. Banks can deny payment if the name does not match that of the person attempting to cash it.

- If you own a small business, different rules may apply. Many banks will not cash a cheque made out to your small business. They will deposit it to the business’s bank account instead.

- If the check is made out to more than one person, all payees (the person or persons being paid) must sign the cheque.

Advertisement -

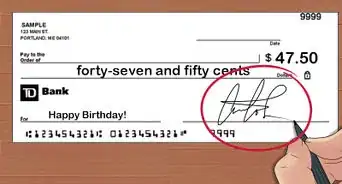

3Check for any endorsement problems. All of the information on the cheque needs to be complete and accurate. This includes the date, amount of payment, and signature. If the information is invalid or missing, your bank will refuse payment on the cheque.

- Check the date. It is important that the date is accurate. The date written on the cheque is the first date at which the funds may be withdrawn. Also, many banking institutions have the right (but not the obligation) to deny payment after a period of six months has passed.[3]

- Check the numerical amount and written amount.The numerical amount box is located below the date. It represents the exact amount to be paid to the payee. You must make certain that this is the correct amount you are owed and that it matches the written dollar amount located to the left of the box. If the written and numerical amounts are different, most banks will honor the written amount.[4]

- Check the signature. For the cheque to be valid, it must contain the signature of the owner of the account from which the funds will be withdrawn. It is imperative that it is signed or the cheque will not be honored.[5]

-

4Endorse the cheque. On the reverse side of the cheque, there will usually be a line for a signature that says something like “Endorse here.” You must sign on this line before you can cash your cheque.[6]

- Remember that if there is more than one payee -- e.g., “Pay to the order of Jackson and Leanna Teller” -- all payees must endorse the cheque.[7]

- A check can be deposited into a joint account with only one of the joint owners signing the check.

- Once the check is endorsed, unless there are written restrictions, the check becomes a "bearer" instrument so that anyone can cash it.

Cashing a Cheque at Your Own Bank

-

1Find your nearest branch location. Many larger banks have multiple locations. You can find these locations by checking your bank’s website, calling them on the phone, or searching online.

-

2Bring a valid photo I.D. When you cash a cheque in person, you will be required to show a valid photo I.D. Driver’s licenses and passports are usually the best choices. In some cases, military or school I.D.s may be accepted.

- You may not be required to show a photo I.D. if you cash the cheque at an ATM or via your smartphone.

-

3Take the cheque to your bank. Any teller can take the cheque and give you cash. Many banks will cash cheques without charging a fee if you are an account holder with them.

- Some banks may require you to deposit the cheque to your account rather than cash it. This is particularly likely if the cheque you are trying to cash is written on an account from another bank.[8]

- If the bank on which the cheque is drawn refuses to pay your bank -- in other words, the cheque “bounces” -- your bank will reimburse itself from your bank account. Banks will also usually charge a fee for the trouble of dealing with a returned cheque.

-

4Cash the cheque with a teller. The traditional way of cashing a cheque is to stand in line and wait for a bank teller to assist you. Make sure you have a valid form of photo identification with you.

- Many banks prefer that you have your bank debit card with you as well. If you do not have your debit card, you may be required to fill in additional forms to cash your cheque.

-

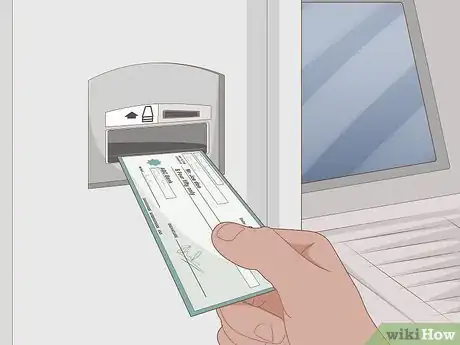

5Cash the cheque at an ATM. At many larger banks, you can cash a cheque at their ATMs (Automatic Teller Machines). The funds are usually available immediately.

- In most cases, you will need your bank debit card to deposit or cash a cheque at an ATM. The debit card identifies your account so that you can deposit or cash your cheque.

- Make sure you endorse the cheque before inserting it into the ATM.

-

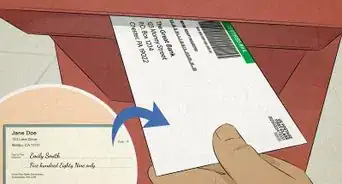

6Deposit the cheque electronically. Many banks now allow you to deposit cheques into your account using a smartphone. The process may vary between banks, but it usually involves downloading the bank’s app and using your smartphone camera to take a photo of your cheque.

- Make sure to follow all the directions in the app.

- Take a clear, well-lighted photograph of the front and back sides of the cheque.

Cashing a Cheque in Other Ways

-

1Visit the bank that issued the cheque. You can find the name of the bank by looking at the front of the cheque. Most banks are required to cash cheques that are drawn on accounts at their bank (if there are sufficient funds in that account).[9] The bank may also charge you a fee if you're not an account holder with them.[10]

- You must cash the cheque in person with a bank teller if you are not an account holder.

- Be aware that if the account the cheque is written on does not have sufficient funds to cover the cheque, the bank is not required to cash it.[11]

- Some states in the U.S. have laws that require banks to cash cheques drawn on their accounts without charging a fee. You can find out online if you live in a state where this applies.[12]

-

2Use a retailer to cash the cheque. Some grocery stores and a number of large retailers will cash certain kinds of cheques that they believe are reliable. For instance, they will cash payroll cheques or government cheques but not personal cheques (cheques written by individuals drawn from their personal accounts). Merchants often charge small fees for cashing a cheque for you.[13]

- For example, many 7-Eleven convenience stores will cash cheques for a small fee (which varies by location).

- As another example, Walmart will cash cheques of up to $5,000USD, for which they will charge a fee of $6. They will only cash payroll, government, and tax cheques.[14]

-

3Use a prepaid card. Many financial institutions now offer prepaid cards to people without bank accounts. If you have a prepaid card, you will usually be able to deposit cheques at select ATMs. You may be charged a fee to deposit and withdraw funds, depending on the card.[15]

- For example, Visa has a reloadable “Payroll Card” that you can get through your employer. You can deposit cheques and withdraw money at any ATM that accepts Visa debit cards.[16]

- Many large banks also offer prepaid debit cards. Chase offers a prepaid card that allows you to deposit a cheque at any Chase ATM. The card has a monthly fee of $4.95.[17]

- Prepaid cards are usually available through large financial institutions such as MasterCard and American Express.

-

4Use a cheque-cashing service. There are many cheque-cashing stores and services that will cash cheques for a percentage of the amount. These should usually be reserved as a last resort, as their fees tend to be quite high.[18]

- The advantage of cheque-cashing services is that they will usually cash personal cheques. Most retailers will not. However, these services may charge a hefty fee to cash your cheque, so it’s best to try your other options first.[19]

- If you do not have a bank account and need cash immediately from a personal cheque, cheque-cashing services may be your only option.

-

5Endorse the cheque to a trusted proxy. If you do not have a bank account and have someone you absolutely trust, you can make over the cheque to them. They can then cash the cheque with their bank and give you the money.

- To endorse the cheque to another person, write “Pay to the order of _______” on the reverse side of the cheque. Sign your name. In some cases, you may also be required to initial near the written and numerical amounts of the cheque.

- Never ask someone you do not know intimately to cash a cheque for you. Never cash a cheque for someone you do not know and trust extremely well.

Expert Q&A

-

QuestionWhat can I do to change my check if it is in dollars and I want it in Rand?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor As the payee, you cannot legally change the currency denoted on a check. You have two choices: (1) Return the check to its original maker and request a new one in Rand, or (2) Cash the check in dollars and convert thee proceeds into Rand.

As the payee, you cannot legally change the currency denoted on a check. You have two choices: (1) Return the check to its original maker and request a new one in Rand, or (2) Cash the check in dollars and convert thee proceeds into Rand. -

QuestionHow do I cash a cheque made out to my company?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor Effectively, an individual cashing a cheque made to a company is a third party cheque (I'm assuming the company has endorsed the cheque to you). Most banks do not accept third party checks for cash since they cannot ensure that the signature of the original maker is valid. However, your bank may allow you to deposit the check and hold the funds until the cheque clears. You might consider returning the cheque to your company for deposit into their account and getting a company check made payable to you.

Effectively, an individual cashing a cheque made to a company is a third party cheque (I'm assuming the company has endorsed the cheque to you). Most banks do not accept third party checks for cash since they cannot ensure that the signature of the original maker is valid. However, your bank may allow you to deposit the check and hold the funds until the cheque clears. You might consider returning the cheque to your company for deposit into their account and getting a company check made payable to you.

Warnings

- Be very careful when accepting ante- or post-dated cheques, since these may be given to you for fraudulent purposes. Also be careful when cashing cashier's cheques or bank cheques (cheques drawn on bank funds rather than that of an account-holder). If the cheque is a fake, you will be responsible for reimbursing your bank.⧼thumbs_response⧽

- Never endorse a cheque until it is about to be cashed. If you lose an endorsed cheque on the way to the bank or wherever you are cashing it, someone who finds the cheque can cash it and keep your money.⧼thumbs_response⧽

References

- ↑ https://www.fdic.gov/consumers/consumer/news/cnwin0607/scams.html

- ↑ http://www.consumerreports.org/cro/money/consumer-protection/counterfeit-currency-and-checks/overview/index.htm

- ↑ http://www.investopedia.com/university/banking/banking3.asp

- ↑ http://www.consumerfinance.gov/askcfpb/945/i-received-check-where-words-and-numbers-amount-are-different-check-valid-and-how-much.html

- ↑ http://www.consumerfinance.gov/askcfpb/943/i-received-check-someone-forgot-sign-can-i-still-cash-it.html

- ↑ http://www.moneyinstructor.com/wsp/endorse.asp

- ↑ http://www.consumerfinance.gov/askcfpb/941/i-received-check-payable-both-my-spouse-and-myself-do-both-us-have-sign-back-check.html

- ↑ http://www.consumerfinance.gov/askcfpb/931/can-i-cash-check-any-bank-or-credit-union.html

- ↑ http://www.consumerfinance.gov/askcfpb/931/can-i-cash-check-any-bank-or-credit-union.html

- ↑ http://money.usnews.com/money/blogs/my-money/2012/09/28/how-to-cash-a-check-without-a-bank-account-

- ↑ http://www.consumerfinance.gov/askcfpb/939/i-received-check-and-tried-cash-it-bankcredit-union-holds-account-which-check-was-written-bankcredit-union-wouldnt-cash-check-because-they-said-account-did-not-have-enough-money-can-bank-or-credit-union-do.html

- ↑ http://www.consumerfinance.gov/askcfpb/937/i-received-check-and-tried-cash-it-bankcredit-union-that-holds-account-which-check-is-written-bankcredit-union-charged-me-fee-cashing-check-can-bankcredit-union-do.html

- ↑ http://money.usnews.com/money/blogs/my-money/2015/02/20/how-to-cash-a-check-without-a-bank-account

- ↑ http://www.walmart.com/cp/Check-Cashing/632047

- ↑ http://www.forbes.com/sites/halahtouryalai/2013/07/23/are-hourly-workers-being-short-changed-the-truth-about-payroll-cards/

- ↑ http://usa.visa.com/personal/personal-cards/prepaid-cards/payroll-card/faq.jsp

- ↑ http://money.usnews.com/money/blogs/my-money/2015/02/20/how-to-cash-a-check-without-a-bank-account

- ↑ http://money.usnews.com/money/blogs/my-money/2015/02/20/how-to-cash-a-check-without-a-bank-account

- ↑ http://www.bankrate.com/financing/banking/check-cashing-still-not-a-good-deal/

- ↑ http://www.lawyerment.com/library/kb/Banking_and_Finance/Banking/Current_Account/1388.htm

- ↑ http://www.lawyerment.com/library/kb/Banking_and_Finance/Banking/Current_Account/1388.htm

About This Article

To cash a cheque, first sign the back of the check on the line that says, “Endorse here.” Then, take the check and a photo I.D. to your bank and ask a teller to cash it. Alternatively, you may be able to cash a cheque at an ATM machine using your debit card. If you don’t need the cash right away, you can also deposit the cheque using your bank’s app on your smartphone. For more ways you can cash a cheque, read on!