X

This article was co-authored by Christopher Batchelor, a trusted member of wikiHow's volunteer community. Christopher Batchelor is a wikiHow community member and technology enthusiast. He has experience using a range of different platforms and software, and likes to keep up with updates and new features.

This article has been viewed 151,186 times.

Learn more...

The Bank of America iPhone app has a feature that allows you to deposit your checks right from your phone. Use this article to find out how to deposit a check from your phone, and you won't have to travel to the bank ever again.

Steps

-

1Download, install and open the Bank of America app from the Apple AppStore (or update the app to the update past August 7, 2012).If running this app on Android smartphone, update your app there too to the updated version taking place on August 16, 2012).

-

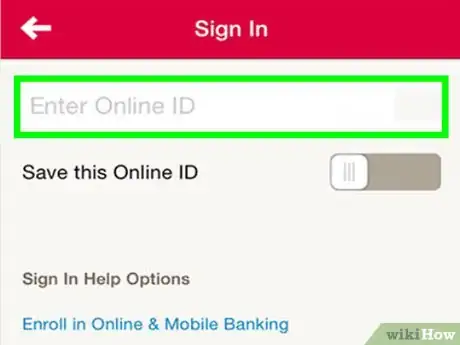

2Login to your Bank of America account, using your online account credentials.Advertisement

-

3Tap the Deposit button in the top right corner of the screen. If this is the first time, you'll need to tell them (via the verification button) that you acknowledge that you would like to use this service.

-

4Tap the "Front of Check" button.

-

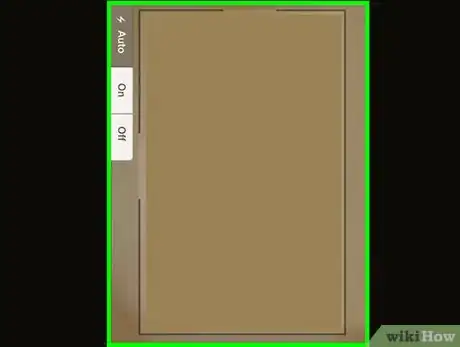

5Hold the iPhone directly over top of the check so that the entire check fits into the display, and so that it is completely still.

-

6Scan the front of the check, using the phone's camera. Make sure to provide plenty light. A blurry picture at this point will require you to rescan the check.

- If the users iPhone has a flash on the front built into the device, give it some light and the device will build in more light via the flash if needed.

-

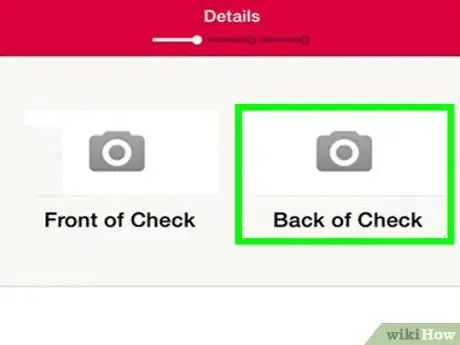

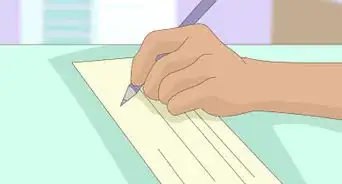

7Endorse the check's back with "For Deposit" or "For Deposit Only" (both will work, though the app says that For Deposit Only is the one it wants to see).

-

8Tap the "Back of Check" button.

-

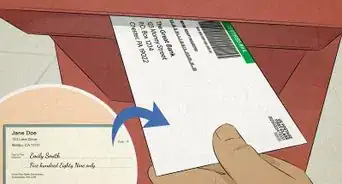

9Flip this document 180 degrees upwards and rescan this side of the check, so the portion you signed with "For Deposit Only" appears on the left side of the image and the "Original Document" watermark appears upside-down in the image.Use the example image to ensure your image scan will be accepted. Hold your iPhone camera over top of this side of the check

-

10Tap the "Deposit To" box.

- Select the account you'd like to deposit the check to.

-

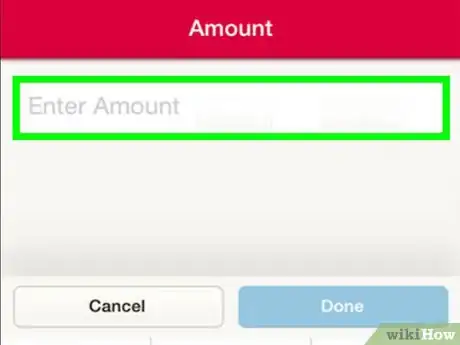

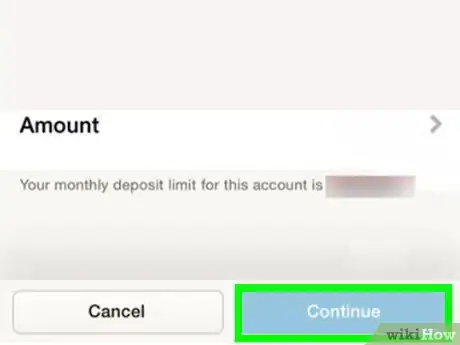

11Tap the "Amount" box. This is a verification box, as the phone isn't able to discern the ICR (Intelligent Character Recognition) image from the check just yet.

-

12Type the amount from the box into the box starting with the dollar amount. Make sure to end the amount with your cents portion (even if the check is for an even-dollar amount), you'll need to enter 00 for this portion.

-

13Tap the "Done" button.

-

14Verify the deposited amount and accounts to ensure correctness.

- Tap the "Continue" button when you are finished.

-

15Tap the "Make Deposit" button from the top-right corner.

-

16Write down your confirmation number from your screen (optional). Tap the Done button, once you have written down your Confirmation number.

Advertisement

Community Q&A

-

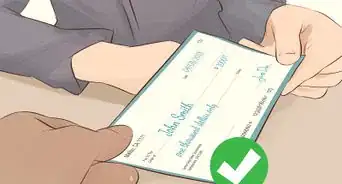

QuestionIf someone endorsed a check over to me, can I deposit it in my account?

Community AnswerYes.

Community AnswerYes. -

QuestionWill the money be on my account right away?

DonaganTop AnswererIt usually takes two or three business days for a deposited check to be credited to an account, sometimes longer depending on where the check originated. Check with your bank.

DonaganTop AnswererIt usually takes two or three business days for a deposited check to be credited to an account, sometimes longer depending on where the check originated. Check with your bank. -

QuestionHow do I know if I already mobile deposited a check?

ChristopherTop AnswererYou'll get a push notification on your phone, saying it's in the process of depositing. Check it the next day via the app.

ChristopherTop AnswererYou'll get a push notification on your phone, saying it's in the process of depositing. Check it the next day via the app.

Advertisement

Warnings

- At this time(09/2013), you can't make a deposit to an IRA account as an account contribution, no matter how hard you try. There is no option in the list for you to do as such. (This is because contributions can only be made in cash amounts and not via check!)⧼thumbs_response⧽

Advertisement

Things You'll Need

- iOS device

- Bank of America app

- Check to deposit (any check will do)

- Pen (to write "For Deposit")

- Bank of America account (checking or savings account)

About This Article

Advertisement