wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 159,923 times.

Learn more...

The routing number on a check uniquely identifies the financial institution and the location where the check was printed. Financial institutions use routing numbers to instantaneously process financial transactions. The last, or ninth, digit of the routing number is important because it is used to verify the authenticity of the routing number. If this number becomes damaged or illegible, you can use an algorithm to calculate it.

Steps

Calculating the Check Digit

-

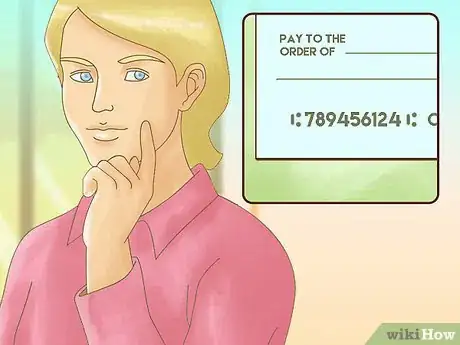

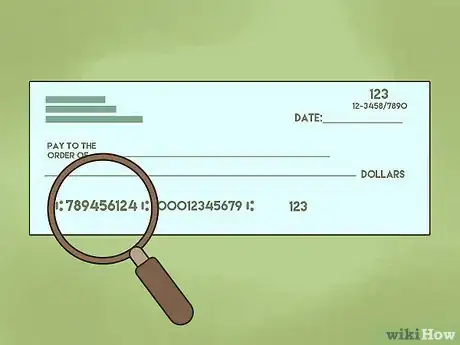

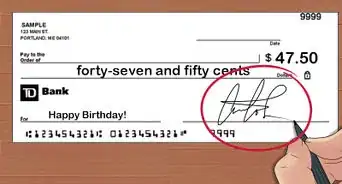

1Understand what a routing number is. The routing number is located in the bottom left hand corner of a check. It is a nine-digit number that uniquely identifies you bank and the location where your check was printed.[1]

- The first four digits are the Federal Reserve routing symbol. This identifies where your check was printed. There are 12 Federal reserve districts and different cities in each district.

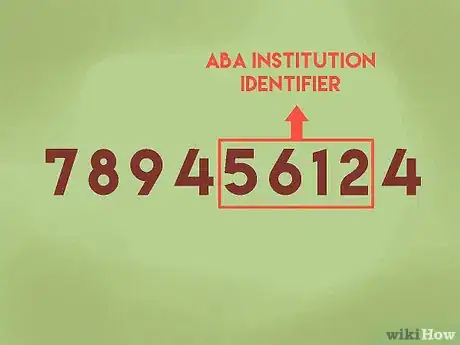

- The next four digits are assigned by the American Bankers Association (ABA). It identifies the financial institution where you opened your account.

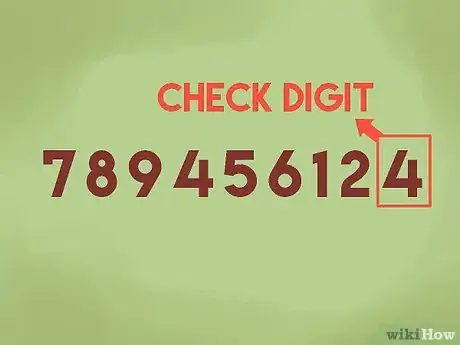

- The ninth digit is the check digit. It is calculated using an algorithm. The check digit is used to validate the 8-digit bank routing number. You can verify the authenticity of a check digit by running the algorithm yourself and comparing the check digit you calculate with the one that is printed on the check.

-

2Understand the Checksum algorithm. This is the algorithm that is used to validate the authenticity of the routing number. It is a series of multiplication and addition operations performed on the digits in the routing number. With a valid routing number, the sum of the algorithm should be evenly divisible by 10.[2] It is also known as the “Modules 10, Straight Summation” method.[3]

- Write down the nine digits of the routing number without any non-numeric characters, such as dashes or spaces.

- Multiply the first digit by 3, the second digit by 7 and the third digit by 1.

- Then, multiply the fourth digit by 3, the fifth digit by 7 and the sixth digit by 1.

- Then, multiply the seventh digit by 3, the eighth digit by 7 and the ninth digit by 1.

- Add up all of the products, and your answer should be evenly divisible by 10 with no remainders.

- For example, using the routing number 789456124, do the following calculation, (7 x 3) + (8 x 7) + (9 x 1) + (4 x 3) + (5 x 7 ) + (6 x 1) + (1 x 3) + (2 x 7) + (4 x 1).

- This equals 21 + 56 + 9 + 12 + 35 + 6 + 3 + 14 + 4 = 160. The answer is evenly divisible by 10, so the routing number is valid.

Advertisement -

3Use the Checksum algorithm to find a missing check digit. If the check digit is missing or illegible, you can use the first eight digits to calculate the ninth digit. Knowing that the final result must be evenly divided by 10 allows you to back track and figure out the missing or illegible digit.[4]

- For example, suppose you only had these first eight digits for the routing number: 02100002. Use the checksum algorithm on the first eight digits, (0 x 3) + (2 x 7) + (1 x 1) + (0 x 3) + (0 x 7 ) + (0 x 1) + (0 x 3) + (2 x 7) = 29.

- Find the next highest number that is divisible by 10. In this case the next highest number divisible by 10 after 29 is 30.

- Subtract 29 from 30 to get the check digit.

- 30 – 29 = 1. The check digit is 1.

- If the you do the algorithm with the first eight digits and you get a number that is already divisible by 10, then you know that the check digit must be 0.

Understanding the Background and Development of the Numbering System

-

1Learn the history of check routing numbers. Prior to 1910, banks had no uniform system for identifying checks written from different banks. In 1911, the American Bankers Association (ABA) published a book listing all of the nation’s financial institutions and assigned identifying numbers to each of them. They established the Routing Number Administration Board govern the use and retirement of routing numbers.[5]

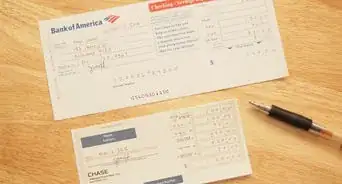

- The two forms of routing numbers still in use today are the fractional form and the magnetic ink character recognition (MICR) form.

- The MICR form is used for automated processing of checks. The numbers and symbols are printed with special shapes that can be read by automated reading equipment. This font is used on all U.S. and Canadian checks, deposit slips and e-commerce drafts.[6]

- The fractional form is outdated and was used when checks were hand-sorted. It still appears on checks along with the MICR form and it can be used if the MICR number is illegible. You can find it in the upper right hand corner of the check.

- The MICR form routing number is printed in the lower left hand corner of the check in a 5/8-inch band.

-

2Understand the Federal Reserve routing symbol. The first four digits identify the location where the check was printed. The first two digits refer to one of the 12 Federal Reserve districts. The third digit identifies a specific office of the Federal Reserve bank within the district. The fourth digit refers to geographic areas within a territory.[7]

-

3Understand the ABA institution identifier. Each financial institution receives a unique four-digit identifying number from the ABA. This makes up the second four digits of the routing number. The ABA institution identifier may be anywhere from one to four digits. Because it must take up four digits in the routing number, a number with less than four digits will have zeroes before it on the check.[8]

-

4Understand the check digit. The check digit verifies the accuracy of the routing number. It helps to maintain the integrity of electronic and telecommunications transactions. It can be calculated with the algorithm, or programmers can use a code to validate the routing number.

-

5Understand the fractional form of the routing number. This appears in the upper right-hand corner of the check. It is a multi-digit fraction that has a hyphenated numerator and a three- or four-digit denominator. It includes the Federal Reserve routing symbol and the ABA institution identifier.[9]

Understanding How Banks Use Routing Numbers

-

1Understand why banks need to read routing numbers on checks. When processing your check, financial institutions need a reliable way of identifying your bank. It is important that they do not confuse it with other banks.[10]

- Sometimes banks have similar names, so relying on the name of a financial institution alone could result in confusion.

- Some banks may have more than one routing number, depending on its location or the type of check being used. But no two banks will ever have identical routing numbers.

-

2Banks use routing numbers to automate several common financial transactions. Routine tasks such as direct deposit and automatic bill transfers rely on accurate routing numbers. The routing number is also used to facilitate money transfers, such as cashing checks or wiring money.[11]

- Since the numbering system and MICR form are consistently used across all financial institutions, these automated tasks can be processed with hardly any delay.

-

3Find your routing number. The routing number is printed on the bottom left-hand corner of your check. Also, some banks may publish their routing numbers online. This is helpful for customers who need the routing numbers for wire transfers or other transactions.[12]

- Having your bank’s routing number so easily available is not a security risk. It only becomes a security risk if someone has your routing number and your account number.

Community Q&A

-

QuestionWhat kind of risk does it pose if someone has obtained my routing number as well as my account number, and why?

Community AnswerMajor security risk. If the person has your routing and account number, they can pull money from your account. If that's happened to you, contact your bank immediately.

Community AnswerMajor security risk. If the person has your routing and account number, they can pull money from your account. If that's happened to you, contact your bank immediately. -

QuestionWhat does it mean if the check number has four digits instead of three?

Community AnswerThere's no real difference. It just denotes that this bank routinely has people who have more than 1000 checks going out over a given period of time.

Community AnswerThere's no real difference. It just denotes that this bank routinely has people who have more than 1000 checks going out over a given period of time. -

QuestionIs there a program that checks the validity of a routing number?

Community AnswerThere are several third-party programs on the internet that can do that. However, you'll have to search for these yourself in your web browser. Just type into a search the phrase, "program that checks the validity of a routing number," to find a good handful of them.

Community AnswerThere are several third-party programs on the internet that can do that. However, you'll have to search for these yourself in your web browser. Just type into a search the phrase, "program that checks the validity of a routing number," to find a good handful of them.

References

- ↑ https://www.usbank.com/checking/aba-routing-number.html

- ↑ http://www.brainjar.com/js/validation/

- ↑ http://www.sxlist.com/techref/ecommerce/bank/routingnumber/index.htm

- ↑ http://www.brainjar.com/js/validation/

- ↑ http://www.sxlist.com/techref/ecommerce/bank/routingnumber/index.htm

- ↑ http://www.sxlist.com/techref/printer/micr.htm

- ↑ http://www.sxlist.com/techref/ecommerce/bank/routingnumber/index.htm

- ↑ http://www.sxlist.com/techref/ecommerce/bank/routingnumber/index.htm

- ↑ http://www.sxlist.com/techref/ecommerce/bank/routingnumber/index.htm

About This Article

To calculate the last digit of a routing number, practice with a complete check and write down the nine-digit routing number in the bottom left hand corner of your check. Next, multiply the first digit by 3, the second digit by 7, and the third digit by 1; repeat this pattern with the remaining six digits. When you add the products, your answer should be divisible by 10 with no remainders. You can use this method to find a missing check digit by backtracking until the final result is divisible by 10. For more advice, like how to find your routing number online for wire transfers, continue reading!