This article was co-authored by Alex Kwan and by wikiHow staff writer, Jennifer Mueller, JD. Alex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

This article has been viewed 1,248,871 times.

When you borrow money, you pay interest to the lender. Interest may be computed as simple interest, which is calculated by multiplying the amount of money borrowed by the interest rate and the length of the loan. The mathematical equation for calculating simple interest is However, banks typically charge compound interest on loans. To compound interest, you add the interest to the principal each year of the loan. The following year, interest is paid on the total amount of principal and interest. It's most common to see interest that is compounded each year, but interest may also be compounded monthly, or even weekly or daily. You can also earn interest (either simple or compound) on investments you make.[1]

Steps

Using the Simple Interest Formula

-

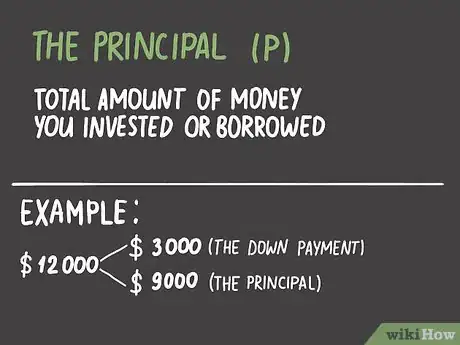

1Determine the total amount borrowed. Interest is paid on the total amount of money borrowed, also known as the principal. In the case of an investment, your principal is the total amount of money you invested. This amount is represented in the simple interest formula by a "P."[2]

- For example, suppose you bought a car for $12,000. You paid a $3,000 down payment and financed the rest. The principal on your car loan would be $9,000.

-

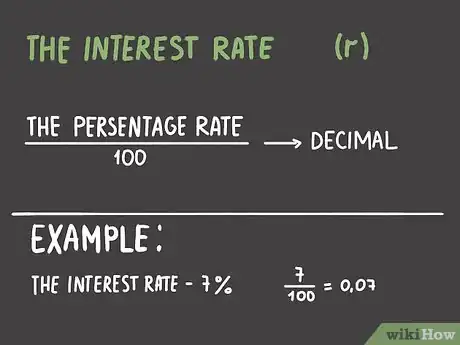

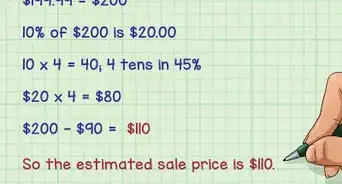

2Convert the interest rate to a decimal value. Interest rates are typically expressed as a percentage. Divide the percentage rate by 100 to turn it into a decimal. Use that decimal in the formula.[3]

- For example, if your car loan had an annual interest rate of 7%, you would express this in the simple interest formula as 0.07.

Tip: Some calculators will automatically convert a percentage to a decimal value. Just make sure you hit the percentage key after the number.

Advertisement -

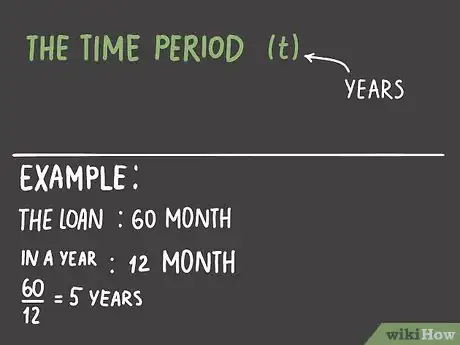

3Use the correct time period for the length of the loan. Loans are usually made for a certain number of years, represented by "t" in the simple interest equation. However, for some loans, such as car loans, the length of the time period is expressed as a number of months. For this simple interest formula, you would need to turn months into years.[4]

- For example, if you took out a 60-month car loan, you would divide 60 by 12 (the number of months in a year) to determine that the loan is 5 years.

- The formula can also be used if you have a loan term expressed in months or weeks. This formula is a little different in that "i" represents the interest rate during each period and "n" refers to the number of periods. You would divide the annual interest rate by the number of periods in a year to get the right value for "i," then use the total number of months for "n." Whether you adjust the time period or the interest rate, you should get the same result.

-

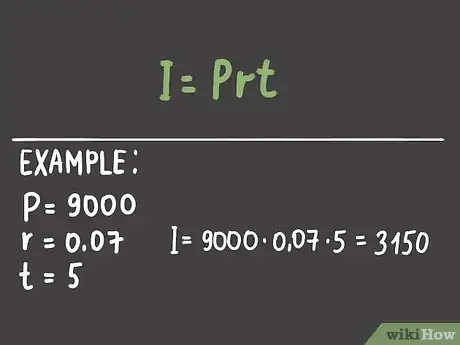

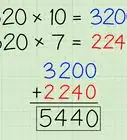

4Find the total interest owed using the formula . Once you have numerical values for the pieces of the formula, multiply them together to determine the amount of interest owed over the life of the loan or investment. Continuing the example, you financed a car with a $9,000 loan at 7% interest for 5 years:[5]

- The interest owed is $3,150. .

-

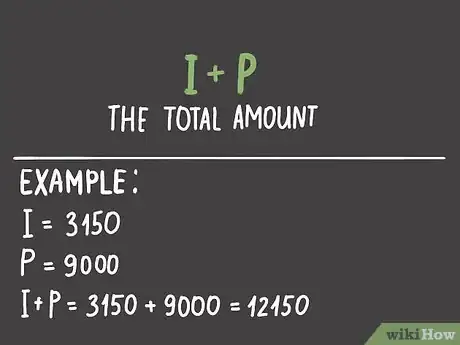

5Calculate the total amount owed over the life of the loan. When you pay back a loan with simple interest, you pay the principal amount that you originally borrowed plus the total interest on that amount. To find the total amount, add the interest back into the principal using the formula .

- Continuing with the previous example, the total amount owed would be $12,150. .

- You can combine both equations together if you're looking for the total amount of money that will be accumulated over the life of the loan or investment by using the formula .

Compounding Interest

-

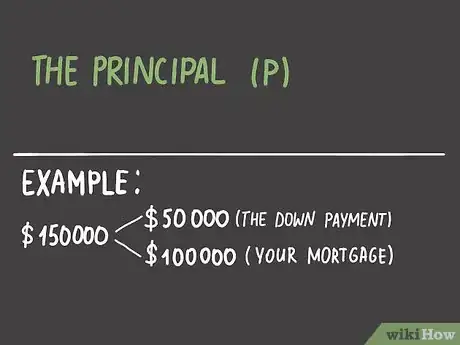

1Start with the initial amount borrowed or invested. Like simple interest, compound interest is charged on the principal. But unlike simple interest, compound interest is added to the principal. In the compound interest formula, the principal is symbolized by a "P," just as in the simple interest formula.[6]

- For example, suppose you bought a house for $150,000. You made a $50,000 down payment and took out a mortgage on the rest. The principal of your mortgage would be $100,000.

-

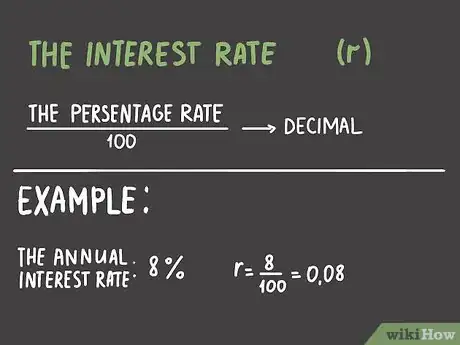

2Express the annual interest rate as a decimal. In the compound interest formula, just as in the simple interest formula, the interest rate is symbolized by the letter "r." Divide the percentage by 100 to get the decimal value.[7]

- For example, if the annual interest rate on your mortgage is 8%, you would use 0.08 in the compound interest formula.

-

3Determine the term of the loan or investment in years. In the compound interest formula, the letter "t" is used to symbolize the number of years the loan or investment will be in effect. As with the simple interest formula, the value for "t" must be years, so if the term is expressed in months or weeks, you would need to convert them to years.[8]

- For example, if you have a 10-year mortgage on the house you bought, you would use 10 in the compound interest formula.

-

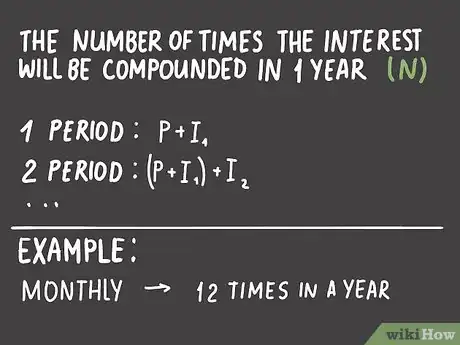

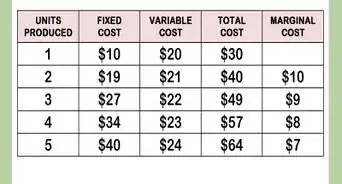

4Find the number of times the interest will be compounded in 1 year. When interest is compounded, it is added to the principal at the end of each compounding period. In the next period, interest is figured on the total amount of principal and interest from the first period. This cycle continues for the entire term of the loan, or until the loan is paid off.[9]

- For example, if your mortgage compounds interest monthly, it would be compounded 12 times in a year. In your compound interest formula, this value is represented by an "n."[10]

- In the case of an investment, interest would be compounded until the end of the deposit term, or until you withdrew your investment.

-

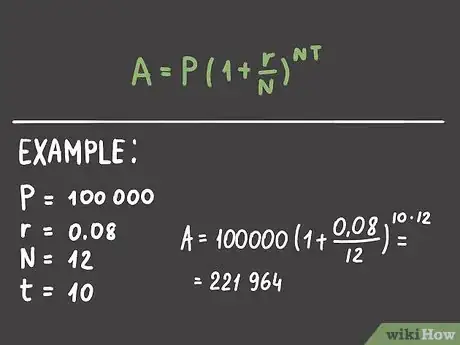

5Calculate the total amount accumulated using the compound interest formula. Once you have numbers for all the values, you can determine the total amount of money that will be accumulated over the life of the loan or investment, including interest. This amount is symbolized by the letter "A" in your formula. Use the formula A = P (1 + r/n)nt.[11]

- The total amount paid over the life of the mortgage would be $221,964. 221,964 = 100,000 (1 + 0.08/12)12(10). The total interest paid would be $121,964.0.

- Compound interest can be significantly greater than simple interest, particularly over the long term. If the same mortgage had simple interest, you would only pay $80,000 in interest over the life of the loan.

Tip: To find the total amount of interest paid, simply subtract the principal amount from the total amount of money accumulated. The result is the total interest paid over the life of the loan or investment.

Expert Q&A

-

QuestionHow do you know how much you have to pay back on an 8% loan?

Alex KwanAlex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

Alex KwanAlex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

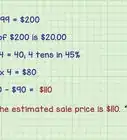

Certified Public Accountant Multiply the principal by the interest. For instance, if you borrowed $100 at 8%, you'd multiply the $100 by 1.08. The 1 is the principal amount and then .08 is the 8% interest, so you'd get $108.

Multiply the principal by the interest. For instance, if you borrowed $100 at 8%, you'd multiply the $100 by 1.08. The 1 is the principal amount and then .08 is the 8% interest, so you'd get $108. -

QuestionHow do I calculate simple interest monthly?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerCalculate the simple interest, then divide the result by the number of months covered by the period of the loan. For instance, if it’s a 1-year loan, divide the interest by 12. For a 2-year loan, divide it by 24, and so on.

wikiHow Staff EditorStaff AnswerCalculate the simple interest, then divide the result by the number of months covered by the period of the loan. For instance, if it’s a 1-year loan, divide the interest by 12. For a 2-year loan, divide it by 24, and so on. -

QuestionHow do you calculate simple interest with a calculator?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerUse the simple interest formula. Enter the amount of the principal (P), then multiply it by the interest rate (r) in decimal form. Multiply the result by the time period of the loan (t) to calculate the interest.

wikiHow Staff EditorStaff AnswerUse the simple interest formula. Enter the amount of the principal (P), then multiply it by the interest rate (r) in decimal form. Multiply the result by the time period of the loan (t) to calculate the interest.

References

- ↑ https://www.investopedia.com/terms/i/interest.asp

- ↑ https://www.mathsisfun.com/money/interest.html

- ↑ https://www.mathsisfun.com/money/interest.html

- ↑ https://www.investopedia.com/terms/s/simple_interest.asp

- ↑ https://www.mathsisfun.com/money/interest.html

- ↑ https://www.cuemath.com/commercial-math/compound-interest/

- ↑ http://qrc.depaul.edu/studyguide2009/Notes/Savings%20Accounts/Compound%20Interest.htm

- ↑ http://qrc.depaul.edu/studyguide2009/Notes/Savings%20Accounts/Compound%20Interest.htm

- ↑ https://www.mathsisfun.com/money/interest.html

About This Article

To calculate simple interest, start by multiplying the principal, which is the initial sum borrowed, by the loan’s interest rate written as a decimal. Then, multiply that number by the total number of time periods since the loan began to find the simple interest. For example, if the principal is $55,000, the interest rate is 0.03 percent, and the number of time periods since the loan began is 10 years, first you’d multiply 55,000 by 0.03 to get 1,650. Then, you’d multiply 1,650 by 10 to get 16,500. Therefore, the simple interest would be $16,500. For more information about each aspect of the equation, keep reading.