This article was co-authored by Trent Larsen, CFP®. Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 230,453 times.

Most people are aware of the concept of interest, but not everyone knows how to calculate it. Interest is the value that we add to a loan or a deposit to pay for the benefit of using someone else’s money over time. Interest can be calculated in three basic ways. Simple interest is the easiest calculation, generally for short term loans. Compound interest is a bit more complicated and a bit more valuable. Finally, continuously compounding interest grows at the fastest rate and is the formula that most banks use for mortgage loans. The information you need for any of these calculations is generally the same, but the math is a bit different for each.

Steps

Calculating Simple Interest

-

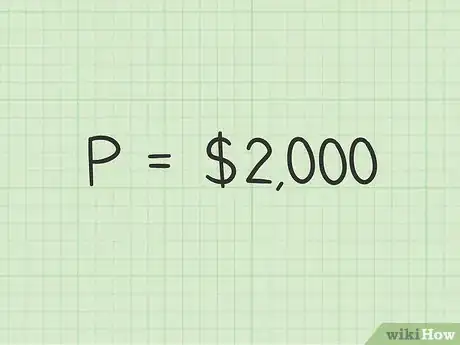

1Determine the principal. The principal is the amount of money that you will use to calculate the interest. This could be an amount of money that you deposit into a savings account or bond of some kind. In that case, you will be earning the interest that you calculate. Alternatively, if you borrow money, such as a home mortgage, the principal is the amount that you borrow, and you will calculate interest that you owe.[1]

- In either case, whether you will be collecting the interest or paying the interest, the amount of the principal is generally symbolized by the variable P.[2]

- For example, if you have made a loan to a friend of $2,000, the principal loaned would be $2,000.

-

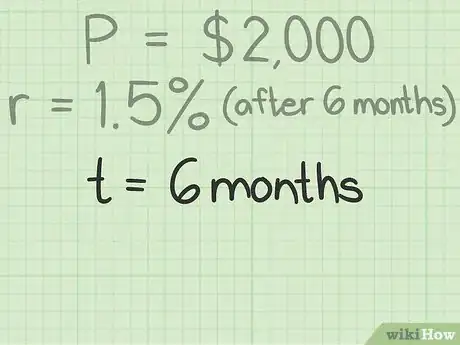

2Determine the interest rate. Before you can calculate how much your principal will appreciate, you need to know by what rate your principal will grow. This is your interest rate. The interest rate is generally advertised or agreed upon between the parties before the loan is made.[3]

- For example, suppose you loaned money to a friend under the understanding that at the end of 6 months your friend would pay you back the $2,000 plus 1.5%. The one-time interest rate is 1.5%. But before you can use the rate of 1.5% you must convert it to a decimal. To change percent to a decimal, divide by 100:

- 1.5% ÷ 100 = 0.015.

Advertisement - For example, suppose you loaned money to a friend under the understanding that at the end of 6 months your friend would pay you back the $2,000 plus 1.5%. The one-time interest rate is 1.5%. But before you can use the rate of 1.5% you must convert it to a decimal. To change percent to a decimal, divide by 100:

-

3Measure the term of the loan. The term is another name for the length of the loan. In some cases, you will agree to the length of the loan when you borrow it. For example, most mortgages have a defined term. For many private loans, the borrower and lender may agree to any term they wish.[4]

- It is important that the length of the term match the interest rate, or at least be measured in the same units. For example, if your interest rate is for a year, then your term should be measured in years as well. If the rate is advertised as 3% per year, but the loan is only six months, then you would calculate a 3% annual interest rate for a term of 0.5 years.

- As another example, if the rate is agreed to be 1% per month, and you borrow the money for six months, then the term for calculation would be 6.

-

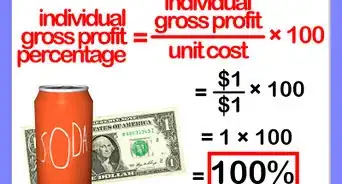

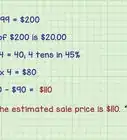

4Calculate the interest. To calculate interest, multiply the principal by the interest rate and the term of the loan. This formula can be expressed algebraically as:[5]

- Using the above example of the loan to a friend, the principal () is $2,000, and the rate () is 0.015 for six months. Because the agreement in this example was for a single term of six months, the variable in this case is 1. Then calculate the interest as follows:

- . Thus, the interest due is $30.

- If you want to calculate the amount of the full payment due (A), with the interest and the return of the principal, then use the formula . This calculation would look like:

-

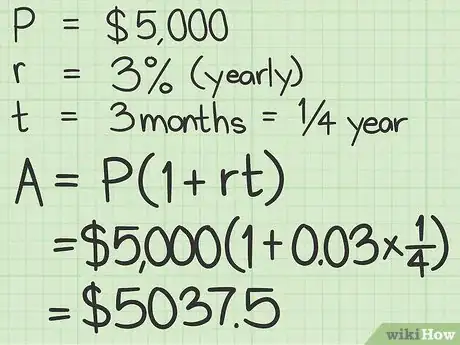

5Try another example. Just for more practice, suppose you deposit $5,000 in a savings account with a 3% annual interest rate. After only three months, you withdraw the money and any interest due at that time.

- In three months, you would earn $37.50 interest.

- Note that t=0.25 here, because three months is one-fourth (0.25) of the original one year term.

Calculating Compound Interest

-

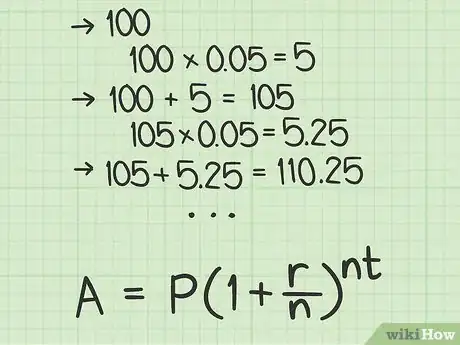

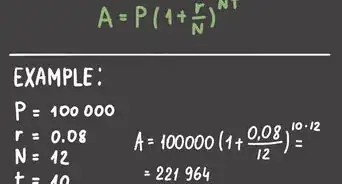

1Understand the meaning of compound interest. Compound interest means that as your interest is earned, the interest goes back into the account, and you begin earning (or paying) interest on top of interest. As a simple example, if you deposit $100 at 5% interest per year, then at the end of one year you will earn $5 interest. If you return that to the account, then at the end of the second year, you will earn 5% of $105, not just the original $100. Over time, this can increase quite substantially.[6]

- The formula for calculating the value (A) of compounding interest is:

- The formula for calculating the value (A) of compounding interest is:

-

2Know the principal amount. As with simple interest, the calculation begins with the amount of the principal. The calculation is the same, whether you are calculating interest on money borrowed or money loaned. The principal amount is generally denoted with the variable .[7]

-

3Measure the rate. The interest rate must be agreed upon at the outset and should be presented in a decimal number for calculation. Recall that the percent number can be converted to a decimal by dividing by 100 (or, as a shortcut, moving the decimal point two places to the left). Make sure that you know the length of time that the interest rate applies to. The rate is noted algebraically as .[8]

- For example, a credit card may advertise interest of 15% per year. However, interest is generally applied each month, so you may want to know the monthly interest rate. In that case, divide by 12, to find the monthly interest rate of 1.25% per month. These two rates, 15% per year or 1.25% per month, are equivalent to each other.

-

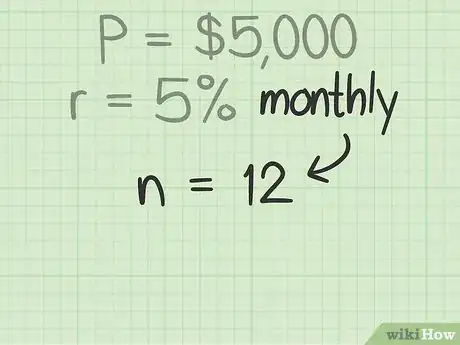

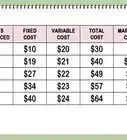

4Know when the interest will compound. Compounding interest means that the interest will be calculated periodically and added back to the principal amount. For some loans, this may happen once a year. For some, it may happen each month or each quarter. You need to know how many times a year the interest will be compounded.[9]

- If interest is compounded annually, then n=1.

- If interest is compounded quarterly, for example, then n=4.

-

5Know the term of the loan. The term is the length of time for which the interest will be calculated. The term is generally measured in years. If you need to calculate interest for some other length of time, you will need to convert into years.[10]

- For example, for a loan of one year, then . But, for a term of 18 months, then .

-

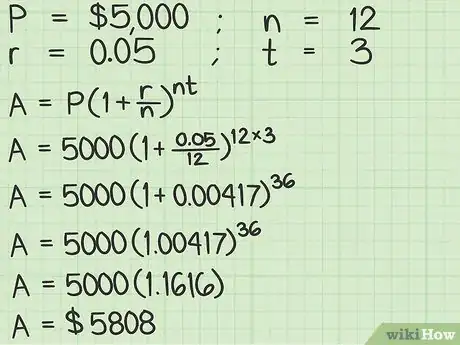

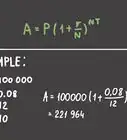

6Identify the variables from the situation. Suppose, for this example, you deposit $5,000 into a savings account that pays 5%, compounded monthly. What will be the value of this account after three years?[11]

- First, identify the variables that you need to solve the problem. In this case:

- First, identify the variables that you need to solve the problem. In this case:

-

7Apply the formula and calculate the compounded interest. Once you have understood the situation and identified the variables, enter them into the formula to find the amount of the interest.[12]

- For the problem started above, this would look as follows:

- Thus, after three years, compound interest will have amounted to $808, in addition to the original $5,000 deposit.

- For the problem started above, this would look as follows:

Calculating Continuously Compounding Interest

-

1Understand continuously compounding interest. As you saw in the previous example, compound interest grows faster than simple interest by adding the interest back to the principal at certain times. Compounding quarterly is more valuable than compounding annually. Compounding monthly is even more valuable than compounding quarterly. The most valuable situation would have the interest compounding continuously - that is, every instant. As quickly as interest can be calculated, it is returned to the account and adds to the principal. This is obviously only theoretical.[13]

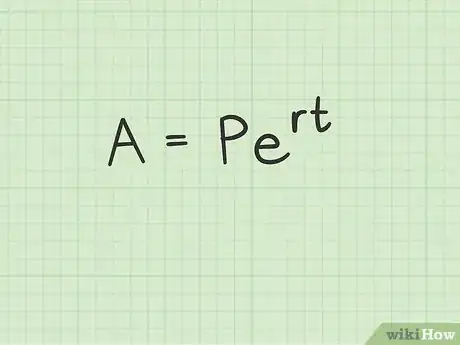

- Using some calculus, mathematicians have developed a formula that simulates interest that is compounded and added back to the account in a continuous stream. This formula, which is used to calculate continuously compounding interest, is:

- Using some calculus, mathematicians have developed a formula that simulates interest that is compounded and added back to the account in a continuous stream. This formula, which is used to calculate continuously compounding interest, is:

-

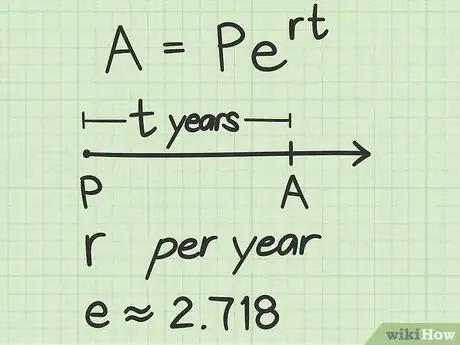

2Know the variables for calculating the interest. The formula for the continuously compounding interest looks similar to the early situations, with some slight differences. The variables for the formula are:[14]

- is the future value (or Amount) of money that the loan will be worth after compounding the interest.

- is the principal.

-

. Although this looks like a variable, it is actually a constant number. The letter is a special number called “Euler’s constant,” named for the mathematician Leonard Euler who discovered its properties.

- Most advanced graphing calculators have a button for . If you press this button, with the number 1, to represent , you will learn that the value of is approximately 2.718.

- is the interest rate per year.

- is the term of the loan, measured in years.

-

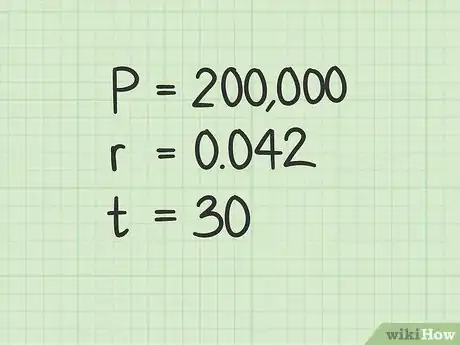

3Know the details of your loan. Banks typically use continuously compounding interest on home mortgage loans. Suppose you want to borrow $200,000 at a rate of 4.2% for a 30 year mortgage. The variables that you will use for the calculation are, therefore:[15]

- , again, is not a variable but is the constant 2.718.

-

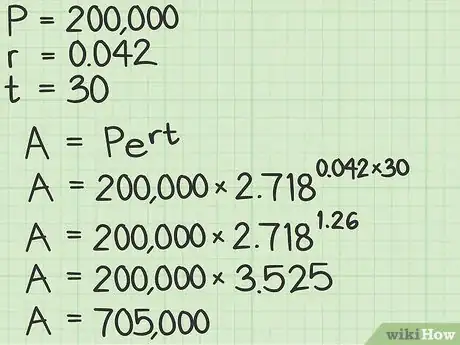

4Use the formula to calculate the interest. Apply the values to the formula to calculate the amount of interest that you will owe on the 30 year loan.[16]

- Notice the enormous value of compounding interest continuously.

Calculating Interest Glossary, Calculator, Practice Problems, and Answers

Community Q&A

-

QuestionHow can I determine what the interest rate is based on the interest payment?

Ed RozmiarekCommunity AnswerUse the formula, Interest = Principal x Rate x Time, and rearrange it algebraically to solve for the rate. Rate = Interest / (Principal x Time). Then, fill in what you know to find the rate.

Ed RozmiarekCommunity AnswerUse the formula, Interest = Principal x Rate x Time, and rearrange it algebraically to solve for the rate. Rate = Interest / (Principal x Time). Then, fill in what you know to find the rate. -

QuestionIf a friend loaned me $42,000.00 nine years ago, how much interest would it have earned?

Community AnswerIt depends on the interest rate he gave you. If you had, for example, five percent interest every year, it would be (1,05^9)*42,000USD, which would be approximately 65,156 USD.

Community AnswerIt depends on the interest rate he gave you. If you had, for example, five percent interest every year, it would be (1,05^9)*42,000USD, which would be approximately 65,156 USD. -

QuestionHow can I calculate the interest earned on $400.00 in a regular savings account?

Ed RozmiarekCommunity AnswerYou need to know the interest rate of the account. You also need to know if the interest compounds continuously, quarterly, or annually. Savings accounts generally do not pay much. Let's assume a low rate of 1% to see the calculation and further assume that it compounds annually. Your actual amount may be different depending on these assumptions. The formula is given in the article above, Value = P(1+r/n)^(nt). P is the principal of $400. R is the rate, which we assume to be 0.01, and n is the number of times per year that it compounds, so n=1, and t=32, then number of years. Put these together : Value = 400*(1.01)^32 = 400*1.375 = $550.

Ed RozmiarekCommunity AnswerYou need to know the interest rate of the account. You also need to know if the interest compounds continuously, quarterly, or annually. Savings accounts generally do not pay much. Let's assume a low rate of 1% to see the calculation and further assume that it compounds annually. Your actual amount may be different depending on these assumptions. The formula is given in the article above, Value = P(1+r/n)^(nt). P is the principal of $400. R is the rate, which we assume to be 0.01, and n is the number of times per year that it compounds, so n=1, and t=32, then number of years. Put these together : Value = 400*(1.01)^32 = 400*1.375 = $550.

References

- ↑ https://www.omnicalculator.com/finance/simple-interest

- ↑ http://www.calculatorsoup.com/calculators/financial/simple-interest-plus-principal-calculator.php

- ↑ http://www.calculatorsoup.com/calculators/financial/simple-interest-plus-principal-calculator.php

- ↑ https://www.cuemath.com/commercial-math/simple-interest/

- ↑ https://www.calculatorsoup.com/calculators/financial/simple-interest-plus-principal-calculator.php

- ↑ http://www.thecalculatorsite.com/articles/finance/compound-interest-formula.php

- ↑ http://www.thecalculatorsite.com/articles/finance/compound-interest-formula.php

- ↑ http://www.thecalculatorsite.com/articles/finance/compound-interest-formula.php

- ↑ https://www.calculatorsoup.com/calculators/financial/compound-interest-calculator.php

- ↑ https://www.calculatorsoup.com/calculators/financial/compound-interest-calculator.php

- ↑ https://www.calculatorsoup.com/calculators/financial/compound-interest-calculator.php

- ↑ https://www.calculatorsoup.com/calculators/financial/compound-interest-calculator.php

- ↑ https://www.cuemath.com/continuous-compounding-formula/

- ↑ https://www.cuemath.com/continuous-compounding-formula/

- ↑ https://www.cuemath.com/continuous-compounding-formula/

- ↑ https://www.cuemath.com/continuous-compounding-formula/

About This Article

To calculate interest, start by determining the principal, which is the amount of money you'll be calculating interest on. Next, determine the interest rate, which was agreed upon at the outset and should be presented in a decimal number for calculation. Then, determine the length of time, or term, the interest will be accruing, which is measured in years. To calculate the interest, multiply the principal by the interest rate and the term of the loan. Keep reading the article if you want to learn more about the differences between calculating simple and compound interest!