This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 80% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 167,644 times.

If you have a credit card, you're likely familiar with the term Annual Percentage Rate, or APR.[1] This is the yearly interest rate on your credit card's balance. The term can be a bit misleading, though, since credit card balances don’t get charged interest on an annual basis. Keep in mind, too, that delayed/introductory rates (0 percent APR for six months!) will expire after a set amount of time, so keep track of when your rate might change.[2] To keep your finances in check, you need to know how to calculate the actual interest you pay on your credit card's balance on a monthly basis.

Steps

Calculating Interest For Fixed and Variable Rates

-

1Understand how these rates are similar to and different from each other. Both rates are types of "purchase" APRs, meaning that they apply to normal purchases made on a credit card. You need to know your Daily Periodic Rate (DPR) to calculate how much interest you pay on your balance for the month. This is explained in the next step. The important thing to note is that if you pay off the balance before the end of your billing cycle, you do not pay interest on your purchases for either of these "purchase" APRs. Interest is applied only to the outstanding balance at the end of each billing cycle.

- A fixed APR won't change unless you continually fail to pay on time. At that point, the credit card company will send you a letter setting your new default/penalty rate.

- A variable rate can change depending on national rates or other economic factors. For example, it might change based on fluctuation in the federal prime rate published by the Wall Street Journal.[3]

- Look at your contract or credit card statement to figure out what your fixed or variable APR is.

-

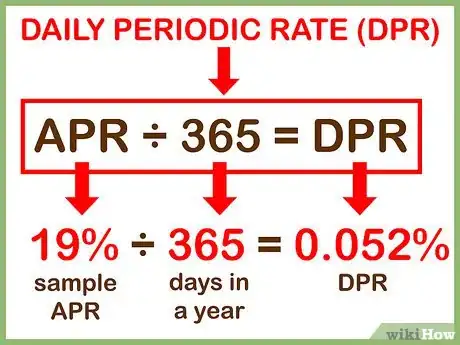

2Calculate Daily Periodic Rates (DPR). Credit card companies usually calculate interest charges on a monthly basis. Because months vary in length — e.g., January is 31 days and February is 28 days — most companies use DPRs to calculate interest. To calculate your DPR, divide your annual APR by 365 (the number of days in one year).

- Take, as an example, a fixed or variable APR of 19 percent: 19 ÷ 365 = 0.052. This is your DPR.

Advertisement -

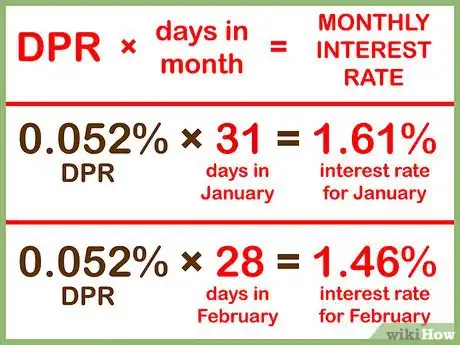

3Multiply that number by the number of days in the current month. In January, you would multiply your DPR by 31: 0.052 x 31 = 1.61. Your monthly interest for January would be 1.61 percent. In February, you would multiply your DPR by 28: 0.052 x 28 = 1.46. Your monthly interest for February would be 1.46 percent

-

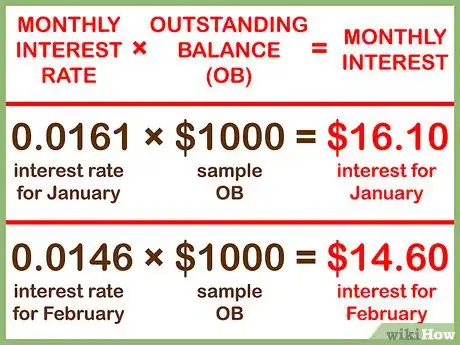

4Multiply your interest rate by your outstanding balance. Remember that if you pay off your entire balance by your billing date, you don’t pay any interest at all. But, if you make the minimum payment or anything less than the entire balance, you pay interest on the outstanding balance. Convert your interest rate to a decimal by moving the decimal point two positions to the left. So, a rate of 1.61 percent in January would be 0.0161, and a rate of 1.46 percent in February would be 0.0146.

- If your outstanding balance on the card at the end of January’s billing cycle is $1,000, you would pay $1,000 x 0.0161, or $16.10.

- If your outstanding balance at the end of February’s billing cycle is $1,000, you would pay $1,000 x 0.0146, or $14.60.

Calculating Interest for Default/Penalty APR

-

1Know what a default/penalty APR is. A default/penalty rate is higher than the rate you got when you signed up for your card. It's triggered when you violate the penalty terms in your contract. Examples of violations might include exceeding your balance limit or consistently making late payments.

-

2Figure out what your default/penalty APR is. You may be able to find a standard default/penalty APR somewhere in your statement or contract. It's more likely, though, that the bank will send you a letter telling you that it's changing your rate. The Credit Card Accountability Responsibility and Disclosure Act of 2009, or CARD Act, requires banks to give 45 days' notice before adjusting your interest rate. Your bank will explain your new rate in the letter.

- For example, you may have had an original APR of 20 percent. However, you missed two straight payments — 60 days. You received a letter saying the credit card company was raising your rate to a default/penalty rate of 35 percent.

-

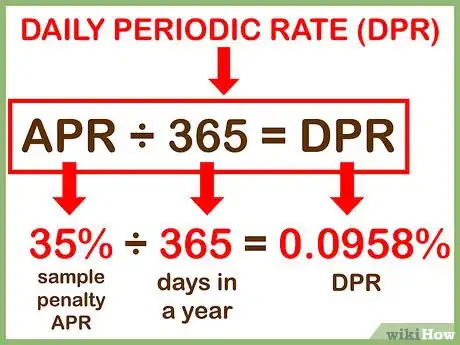

3Calculate the DPR on your new rate. Divide your new rate by the number of days in the year, 365. In our example, you would complete the following equation: 35 ÷ 365 = 0.0958. This is the interest you’re paying on a daily basis.

-

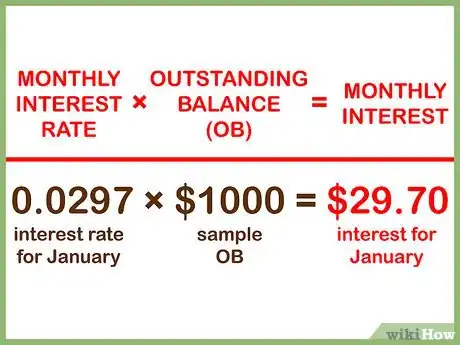

4Figure out your interest rate for a given month. Because the number of days in a month can vary, make sure you’re using the right number for the month in question. Since January has 31 days, you would multiply 0.0958 x 31 to get 2.97. Your interest in January would be 2.97 percent of your balance.

-

5Multiply that monthly rate by your outstanding balance. Remember to convert the percentage to a decimal. In our example, 2.97 percent becomes 0.0297.

- If you have a balance of $1,000 at the end of January, you pay $1,000 x 0.0297, or $29.70 in interest.

Calculating Interest for a Tiered APR

-

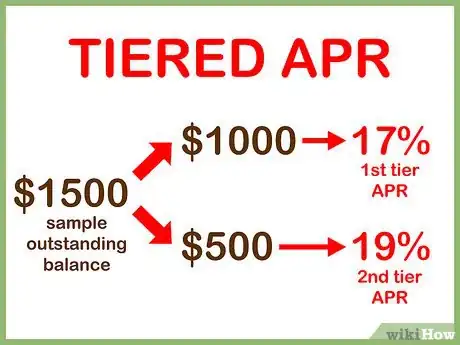

1Understand how tiered APRs work. With a tiered APR, the credit card company applies different rates to different parts of the balance. For example, it may charge 17 percent on balances up to $1,000 and 19 percent on balances above $1,000.00. If you have an outstanding balance of $1,500, you would pay 17 percent interest on the first $1,000 and 19 percent interest on the last $500.

-

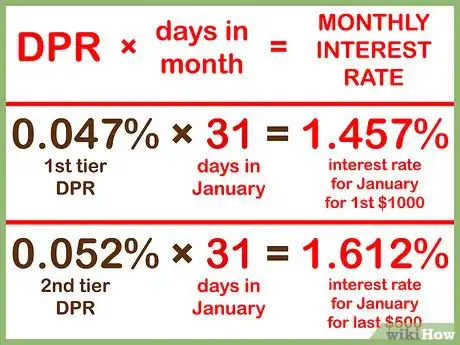

2Calculate the DPR for each tier. Figure out how many tiers apply to the outstanding amount at the end of your billing cycle. You need to figure out the DPR for each of those rates individually. So, for our example:

- 17 ÷ 365 results in a DPR of 0.047 for the first $1,000 of your balance.

- 19 ÷ 365 results in a DPR of 0.052 for the last $500 of your balance.

-

3Multiply each DPR by the number of days in the month. The steps are essentially the same as those for fixed and variable rates, as you can see. But it's important that you remember to apply each step to the different tier rates. Assume that we’re calculating the monthly rate for January, which has 31 days.

- 0.047 x 31 = a monthly rate of 1.457 percent for the first $1,000

- 0.052 x 31 = a monthly rate of 1.612 percent for the last $500

-

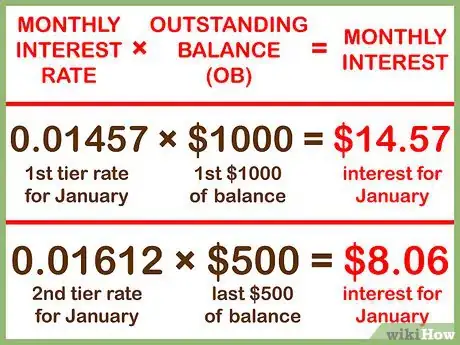

4Calculate the interest paid on your outstanding balance. Again, move decimal points two places to the left to convert percentages to numbers that can be multiplied.

- $1,000 x 0.01457 = $14.57 of interest paid on the first $1,000

- $500 x .01612 = $8.06 of interest paid on the last $500

-

5Add the amounts together to find your total. $14.57 + $8.06 = $22.63 of interest paid on your outstanding balance of $1,500.

Calculating Interest for a Cash Advance APR

-

1Understand what a cash advance APR is. This rate can be higher than your normal APR, but has an important distinction from a purchase rate. Interest on purchase APRs is calculated only at the end of each billing cycle. However, with a cash advance, interest is charged every single day until you pay off the balance of the cash advance. The cash advance rate goes into effect the second you do one of the following:

- Withdraw cash from an ATM or bank branch using your credit card.

- Transfer funds from your credit card to your overdraft account.

- Write a check off your credit card.

- Use your credit card to buy foreign money.

-

2Inspect your statement and contract to determine your cash advance APR. You may have to squint to read the fine print, but you’ll find it in there somewhere.

-

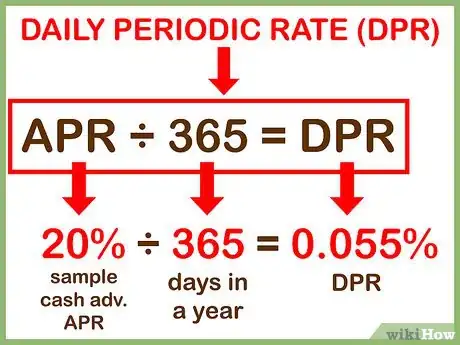

3Calculate your DPR. This is the interest rate you pay per day. To find it, divide your cash advance APR by 365 days. For example, if your cash advance APR is 20 percent, complete the following equation: 20 ÷ 365 = 0.055

-

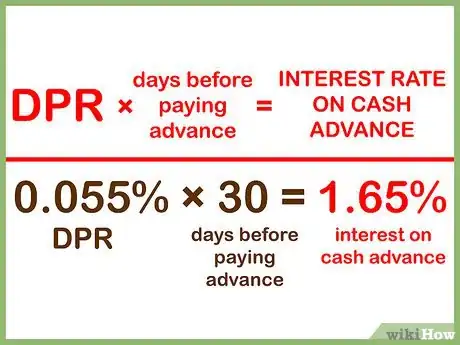

4Count how many days you waited to pay off the advance. Multiply the amount from the previous step by that number of days. So, if you waited 30 days to pay off your cash advance at an APR of 20 percent, complete the following equation: 0.055 x 30 (days) = 1.65. Your interest rate on the cash advance is 1.65 percent.

-

5Calculate the amount of interest you paid. Multiply the interest rate from the previous step by the amount of money you withdrew. If you withdrew $1,000 in our example, you would complete the following equation: 1,000 x 0.0165 = 16.50. You will pay $16.50 in interest on your cash advance.

Protecting Your Finances

-

1Make your payments on time. The more late payments you make, the more likely the credit card company is to increase your APR. If you miss a payment, pay it as soon as possible. The company might report you to credit reporting agencies even before 30 days pass. This damages your credit rating in a way that takes a long time to undo. Keep your FICO score up by proving yourself to be a reliable debtor.[4]

-

2Pay attention to rate increases. The law requires your credit card company to give you 45 days' notice before raising your interest rate. However, the company might not give you an explanation for the rate change. If you don't get an explanation, call your credit card company to find out why your rate was changed. If the company can't give you a good answer, it might be time to transfer your balance to another credit card.

- Good reasons to raise your rate include consistently missed payments or a low credit score.

-

3Try to lower your APR. Credit card companies are in the business of making money. They won’t lower your APR just because you're a good customer. If you want to be rewarded for your years of timely payments, you need to call your credit card company and convince it to change your rate.

- Before calling your credit card company, research what a fair APR for your FICO score would be.[5]

- Then call your credit company and try to renegotiate your APR based on your research.

- If the company is unwilling to do so, it may make sense to transfer your balance to another credit card.

Expert Q&A

-

QuestionHow do I compute the monthly payment for a credit limit of 400 and OB 300?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor You will only pay interest on the $300 outstanding balance, not the credit limit. The minimum monthly payment on a credit card is set by the credit card issuer, usually the greater of a pre-established minimum payment amount or an amount equal to the interest charged for the period plus 1% of the balance

You will only pay interest on the $300 outstanding balance, not the credit limit. The minimum monthly payment on a credit card is set by the credit card issuer, usually the greater of a pre-established minimum payment amount or an amount equal to the interest charged for the period plus 1% of the balance -

QuestionIf my monthly minimum payment is about $30.00 on a debt of $1200.00 what will it be if I increase my debt to $5000.00?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor The monthly payment typically includes 1% of the outstanding principal amount or $12.00 of the $30.00 payment. The interest rate would be $18.00 per month or $216 annually on a principal of $1200 or an interest rate of 18%. Your minimum payment on a $5000 balance would be approximately $50 in principal and $75 in interest at the same rate or a minimum of $125.

The monthly payment typically includes 1% of the outstanding principal amount or $12.00 of the $30.00 payment. The interest rate would be $18.00 per month or $216 annually on a principal of $1200 or an interest rate of 18%. Your minimum payment on a $5000 balance would be approximately $50 in principal and $75 in interest at the same rate or a minimum of $125.

Things You'll Need

- Original credit card agreement.

- Calculator.

- Monthly statements.

References

- ↑ https://www.bankofamerica.com/credit-cards/education/what-is-apr.go

- ↑ http://www.bankrate.com/finance/credit-cards/6-facts-about-credit-card-apr-1.aspx

- ↑ http://www.bankrate.com/rates/interest-rates/prime-rate.aspx

- ↑ http://www.myfico.com/crediteducation/whatsinyourscore.aspx

- ↑ http://ficoforums.myfico.com/

About This Article

To calculate your credit card interest, start by dividing your annual interest rate (APR) by 365, or the number of days in a year, to get your daily periodic rate (DPR). For example, if your APR is 19%, divide 19 by 365 to get 0.052, which is your DPR. Then, multiply 0.052 by the number of days in the current month to get the interest rate percentage. In January, for example, you would multiply 0.052 by 31 to get an interest rate of 1.61%. Finally, multiply 1.61 by your outstanding balance to calculate the amount of interest you would need to pay for that month. For more advice from our Finance reviewer, including how to calculate interest for a default or penalty APR, keep reading.