wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 17 people, some anonymous, worked to edit and improve it over time.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 89% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 108,946 times.

Learn more...

An IOU is normally written when someone lends money to another person and wants that money back by a specific date. An IOU may also be used when a service or product is provided and an agreement is made that it will be paid for at a later date.

Steps

Writing an IOU

-

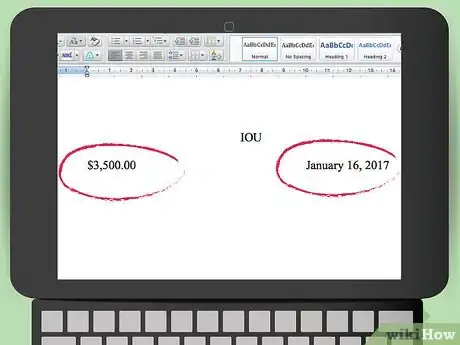

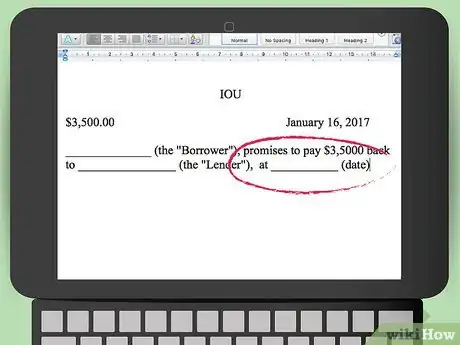

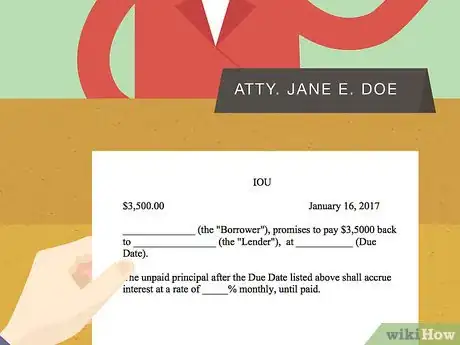

1Include the date and the amount being borrowed, or the amount agreed on for the service or product.[1] How much did you loan out?

-

2Include a due date for return of the funds. When do you expect the borrower to pay you back? If multiple payments will be made, agree on specific dates for the payments.Advertisement

-

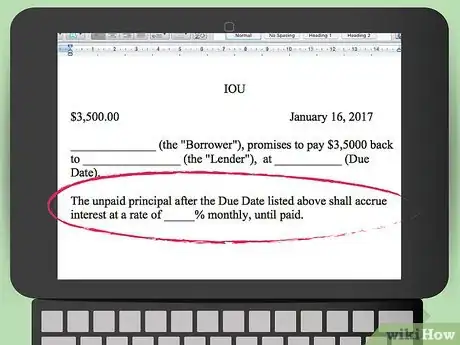

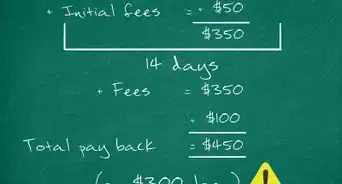

3Include how much interest you will charge. Especially if you're lending money to a friend or family member, it may seem a little extortionate to charge interest. But there are several good reasons why you may want to charge the person you're giving money to a little bit of interest:

- If you're giving away money without interest, you're losing money. You're losing purchasing power (the ability to buy and invest with the money you're lending) and inflation is outstripping your money.

- If you charge someone interest, the borrower may be more likely to pay you back quicker than had you not. Think about it: Interest lasts as long as the life of the loan, so if the borrower holds on to the money longer, they'll end up paying more interest.

- Don't charge more than 15% or 20%. In fact, interest rates above 15% or 20% might not even be allowed under predatory lending laws.[2] So keep the interest rate at something manageable and both parties will be happy.

-

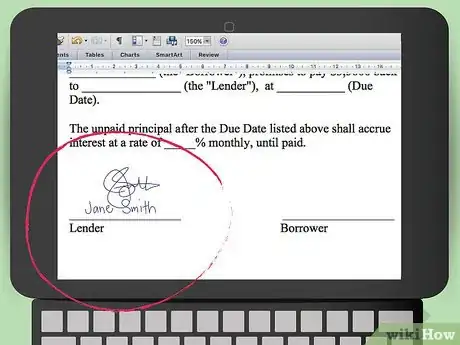

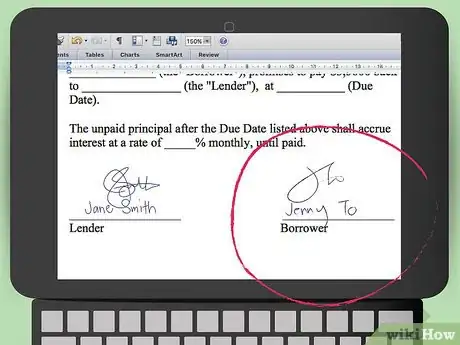

4Sign the document yourself. Include your signature along with your legal name.

-

5Make sure the other party signs the document. Have them put down a signature along with a legal name.

-

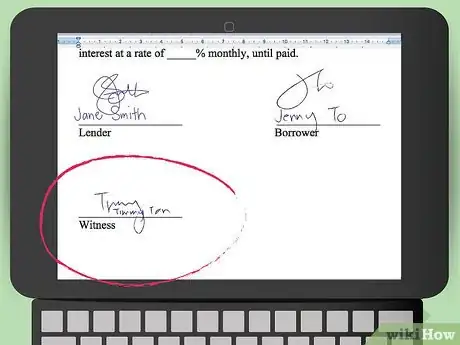

6If possible, have a witness (optional).[3] Although a witness does not make or break the IOU, it's helpful if you ever need to go to court. A witness might be able to prove a binding verbal contract took place.

Knowing the Legal Implications

-

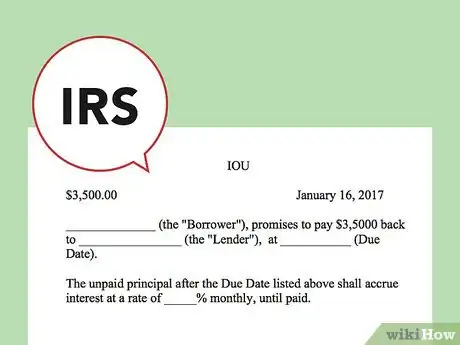

1A legally-binding IOU can help you if you ever get audited by the IRS.[4] It's therefore important that you make sure you have formatted the IOU as specified up top, especially if you're lending a significant amount of money.

-

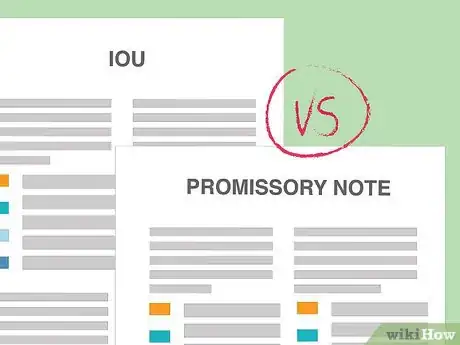

2Know the difference between an IOU and a promissory note. IOUs are often difficult to enforce in court, being informal agreements usually agreed upon without the benefit of a witness. Whereas some IOUs only state an amount agreed upon, promissory notes state an agreed-upon amount in addition to the steps necessary to pay back the debt and the consequences if the borrower fails to do so.[5]

- If you're lending a larger amount than you're comfortable with, take the time to make a promissory note. A promissory note will make it easier than an IOU to recoup any money you lent out in court.

- In order to establish a promissory note, you should have it notarized. (Other than that, it takes basically the same form as an IOU.) Notarizing a document just means signing it in the presence of a state-sponsored witness and stamping it with a seal of approval.

-

3If in doubt about any aspect of an IOU, talk to a lawyer. A lawyer will be able to explain all the small legal details associated with an IOU, and should be able to offer suggestions about possible legal recourse you can take if you become unable to recoup the principal.

References

- ↑ http://consumer.findlaw.com/credit-banking-finance/use-promissory-notes-when-lending-to-family-and-friends.html

- ↑ http://blogs.findlaw.com/law_and_life/2013/04/legal-how-to-writing-an-iou-or-loan-note.html

- ↑ http://www.howtodothings.com/finance-real-estate/what-is-an-iou

- ↑ http://consumer.findlaw.com/credit-banking-finance/use-promissory-notes-when-lending-to-family-and-friends.html

- ↑ http://www.investopedia.com/articles/bonds/07/promissory_note.asp

About This Article

Writing an IOU is a straight-forward way to make sure everyone’s on the same page with a loan. At the top of the page, write “IOU” with the amount borrowed and the date. Then, write out a sentence including the borrower’s name, how much they borrowed, the lender’s full name, and the date the loan should be paid back by. For example, you could write, “John Smith promises to pay $3,500 back to Harry Truman by January 2nd, 2025.” In the next sentence, write out how much interest will accrue until the loan is paid off. Have both the lender and the borrower sign the document, then have a witness sign as well to make it official. To learn the difference between an IOU and a promissory note, read on!