This article was co-authored by Ryan Baril. Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

This article has been viewed 101,243 times.

Western Union is a popular money transfer service in the United States. Though it does not offer loans directly, it partners with Check Into Cash, a loan service. After receiving a loan through Check Into Cash, you can get the money wired through Western Union to your bank account. These loans can be useful in times of urgent need, but be aware that these loans also have high interest rates.

Steps

Receiving a Title Loan

-

1Consider alternative solutions first. Before you rush into getting a title loan, consider alternative options like asking a friend or family member for a loan. Getting a loan from a trustworthy friend can make you feel less stressed about borrowing the money. They may also give you a better deal on interest than what you would get through a loan service.

- If you do decide to pursue a title loan, always be aware of the terms of the loan and your payment plan. Be prepared to pay back the loan on time.

-

2Use your car title as collateral for the loan. A title loan is a loan in which your car title is used as collateral. You do not need good credit for a title loan, but if you fail to repay the loan you will lose your car. Depending upon your state of residence and the condition of your vehicle, the maximum amount of the loan may vary.

- The car will need to be in your name and you will need the title of the car for the loan application. The title of your car will need to be free of outstanding loans in order for you to get a loan.

- You do not need to give up your car to get a title loan.

- Be aware that this service may not be available in all states.

Advertisement -

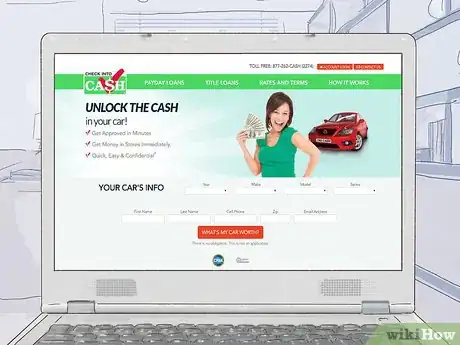

3Get an online estimate. You can go to the Check Into Cash website and get a quote for how much you get on the title loan based on the value of your car. Fill out the title loan quote form to get an estimate online.

-

4Bring the necessary documents to a Check Into Cash store. Search online to find a Check in Cash location near you. Bring the following documents in person to the store to complete the loan:

- Government-issued photo ID, such as your Driver’s License or your passport

- Proof of residence, such as a bill with your address on it or rent agreement

- Proof of income, such as your most recent pay check

- The title of your car

-

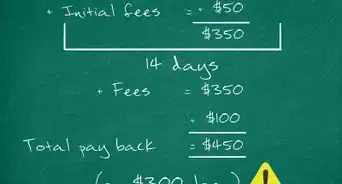

5Review the interest rate for the loan. The interest rate for the loan will depend on which state you live in, but they will likely be very high. Make sure you are aware of the interest rate for the loan before you agree to it.[1]

- You will likely need to be able to pay the flat interest rate, in addition to the loan, back based on the term date of the title loan. Failure to do so can result in your losing your car and damage your credit rating.

-

6Wait for the loan to process. Title loans usually process right away when done in person at a Check In Cash location. You can then arrange to receive the loan into your bank account via Western Union.

- Once you receive the title loan, you should make a plan to pay back the loan in installments over a set period of time. This will ensure you are not charged high interest rates and that you can keep the title to your car.

Getting a Payday Loan

-

1Be aware of the high interest rates of payday loans. Payday loans are a way to get quick money without good credit. You can use payday loans to cover unexpected expenses until your next paycheck. However, the interest rates are high on these types of loans. The interest rate will depend on what state you are getting the loan in.[2]

-

2Apply online for a payday loan. To apply for a payday loan, fill out the application on the Check Into Cash website. To apply you will need to have the following:

- Proof of a checking account open for at least 90 days. You will need to provide your bank account number so Check Into Cash can automatically deposit and deduct cash from your account.

- Proof of 21 years of age, such as a Driver’s License

- Proof of US Citizenship, such as a passport or a permanent residency card

- Proof of a current phone number and address, such as your rent agreement or mail with your address and phone number on it

- Proof of employment, such as a recent paycheck from your employer

- Check Into Cash might also contact your employer to verify employment.

-

3Apply in person for the loan. If you’d prefer to apply for the payday loan in person, find a Check In Cash location near you. Bring all the required supporting documents and fill out the loan application. There is no application fee for this loan.

- Maximum loan amounts are determined by state rules.

- Going in person to apply can also allow you to ask the Check In Cash associate about the interest rate for the payday loan in more detail.

-

4Receive the money. Payday loan applications submitted online should be processed within a business day and the money will be deposited in your account immediately. In person applications will be processed instantly. You can use Western Union to process the loan money and deposit it into your account.

- You can receive an online payday loan in Alabama, Alaska, California, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Kansas, Louisiana, Michigan, Mississippi, Missouri, Nevada, Ohio, Oklahoma, Oregon, South Dakota, Tennessee, Texas, Utah, Washington, Wisconsin, and Wyoming.

-

5Prepare for the loan amount to be deducted from your bank account. When you receive the payday loan, you will need to agree to a set date when the loan amount plus interest rate fee will be automatically deducted from your bank account. Make sure you have enough money in your bank account during this time so the loan can be repaid.

- If you do not have enough funds, you may be charged additional fees. Failure to repay the loan on time can also hurt your credit.