This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 86% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 94,051 times.

A loan agreement is a legally binding agreement that describes the terms on which a loan will be extended and repaid. You may need to draft a loan agreement if you are loaning money to (or borrowing from) family, friends, or a small business. Each year almost $90 billion is loaned between family and friends.[1] A loan agreement helps each party know what the terms of repayment are and what will happen if a payment is late.

Steps

Preparing to Write the Agreement

-

1Understand the purpose of a loan agreement. A loan agreement is formal proof that the two parties have an agreement for how borrowed money will be paid back. It protects both parties in case they later have a disagreement with respect to the borrowed funds.[2] Accordingly, loan agreements should clearly explain the following:

- the amount borrowed

- the terms of repayment, including when payment is due and interest to be applied

- what happens if the borrower is late with payments or doesn’t repay

-

2Confirm that you want to lend to the borrower. Before loaning money, you should assure yourself that the borrower will be able to pay back the loan. First, you can trust your instincts: ask yourself how confident you are that the borrower will pay you back. Second, you can ask the borrower for proof of creditworthiness:

- Credit report. You can ask the borrower to pull his or her credit report and share it with you.[3] The score is good evidence of the person’s ability and willingness to repay the loan. It also can tell you the borrower’s current indebtedness.

- Proof of income. You may want to see a 1040 form for proof of the borrower’s income. You could also ask to see a recent pay stub. If you are loaning to a small business, you may want to ask to see financial accounts.

- Work references. You can also request a phone number for the borrower’s employer, so that you can confirm that the borrower is employed.

Advertisement -

3Decide on an interest rate. A critical part of any loan agreement is the interest rate. States limit the maximum amount you can charge in interest. These laws are called “usury” laws. For example, in Idaho, interest for personal loans cannot exceed 12%.

- You need to be sure not to charge more interest than is allowed in your state. Research your state usury laws.

- Also, the IRS requires that you charge at least the applicable federal rate, otherwise the loan will count as a “gift.” You must charge interest if the loan is for $10,000 or more.[4]

-

4Negotiate with the other party about the terms. The loan agreement memorializes the agreement the parties reach. Accordingly, you should talk ahead of time, and come to an agreement about the amount of the loan and repayment.

- For example, you may go back and forth on interest rates and a payment schedule. Both parties might agree on a loan amount but disagree as to interest rates or the length of repayment. You need to hammer these issues out before you sit down to write the loan agreement.

- Don’t leave anything undecided before drafting the loan agreement. You want the written agreement to contain the entirety of what the two parties agreed to.

Writing the Loan Agreement

-

1Title the document. Open a blank word processing document. At the top, center the words “Loan Agreement” in bold.[5]

-

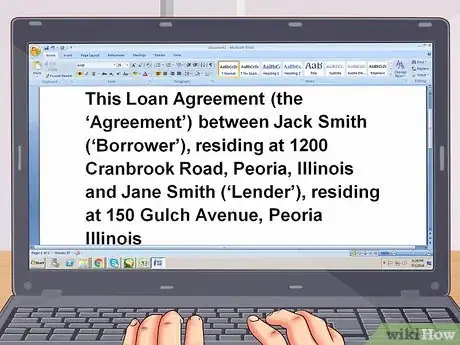

2Identify the parties. A contract is an agreement between two parties. Accordingly, you need to identify both parties to the loan agreement. Be sure to identify each party by whether it is the “Borrower” or the “Lender” and include each party’s address.

- For example, you might want to write: “This Loan Agreement (the ‘Agreement’) between Jack Smith (‘Borrower’), residing at 1200 Cranbrook Road, Peoria, Illinois and Jane Smith (‘Lender’), residing at 150 Gulch Avenue, Peoria Illinois…”[6]

-

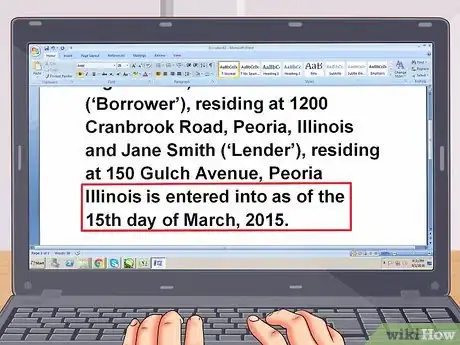

3Add the date. Also include the date the loan agreement is entered into.[7] The date is important in case a legal dispute arises.

- You can state “…is entered into as of the 15th day of March, 2015.”

-

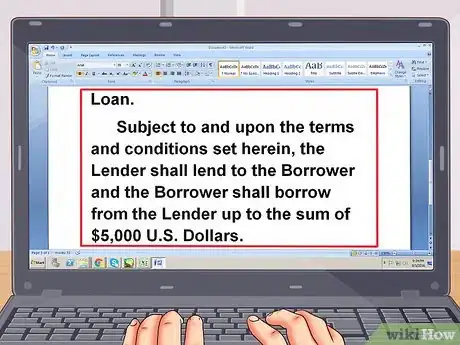

4State the amount of money borrowed. Once you have identified the parties, you will need to identify the amount of the loan.

- Write: “Loan. Subject to and upon the terms and conditions set herein, the Lender shall lend to the Borrower and the Borrower shall borrow from the Lender up to the sum of $5,000 U.S. Dollars.”[8]

-

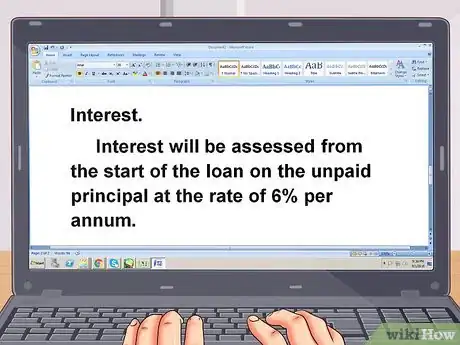

5State the interest rate. You also should state when interest begins to accrue and how the interest rate is calculated, for example, by year.

- Sample text: “Interest. Interest will be assessed from the start of the loan on the unpaid principal at the rate of 6% per annum.”

-

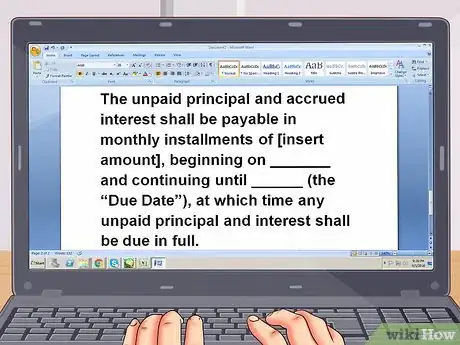

6Provide the repayment schedule. State how often payments are made, as well as when the first payment is due and when the last is due.

- For example, “The unpaid principal and accrued interest shall be payable in monthly installments of [insert amount], beginning on _______ and continuing until ______ (the “Due Date”), at which time any unpaid principal and interest shall be due in full.”

- To figure out the monthly payment, you can visit this calculator. You can enter the loan amount, the length of repayment (“loan term”), and the interest rate. The calculator will then tell you the monthly amount.

- You can also print out an amortization schedule after you have entered the information.

-

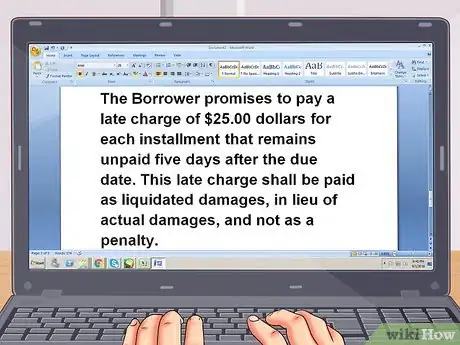

7Insert a clause on late fees. To induce the borrower to pay in a timely manner, you may want to include a late fee. You may be familiar with late fees from your credit card. Include any grace period.

- Sample language could be, “The Borrower promises to pay a late charge of $25.00 dollars for each installment that remains unpaid five days after the due date. This late charge shall be paid as liquidated damages, in lieu of actual damages, and not as a penalty.”[9]

-

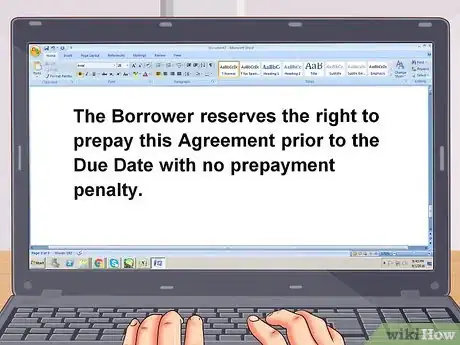

8Include a clause about prepayment. State whether or not prepayment of the entire loan is allowable. If you allow it, then add the following:

- “The Borrower reserves the right to prepay this Agreement prior to the Due Date with no prepayment penalty.”

-

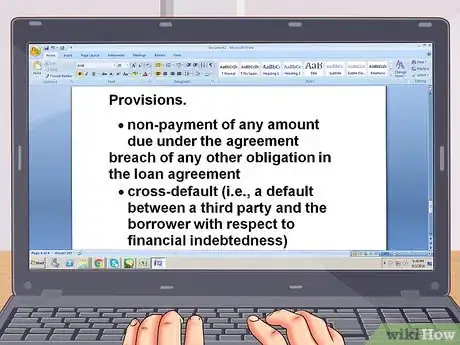

9Include default provisions. You need to identify events that qualify as default and then state the consequences. Often, lenders state that a default will accelerate payment, so that the entire loan amount becomes immediately due.

- Common events that qualify as default include:[10]

- non-payment of any amount due under the agreement

- breach of any other obligation in the loan agreement

- cross-default (i.e., a default between a third party and the borrower with respect to financial indebtedness)

- the borrower’s insolvency

- any materially adverse change in the borrower’s position (i.e., job loss, business closure, etc.)

- You can state “If any one or more of the following events shall occur and be continuing, the Lender may, at its option, declare the outstanding amount immediately due and payable:”[11] and then list the qualifying events as bullet points underneath.

- Common events that qualify as default include:[10]

Finalizing the Loan Agreement

-

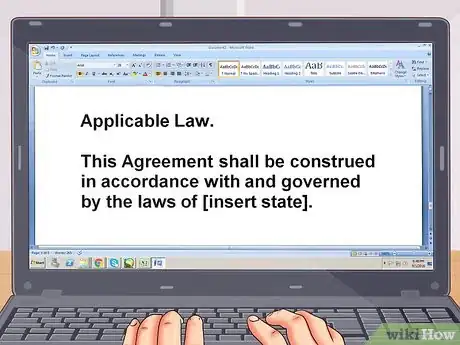

1Add a choice of law provision. You will want to finish the loan agreement with “boilerplate” provisions. These are provisions that clarify how contract disputes are resolved. An important provision is to state what law governs the loan agreement. Generally, people choose the state where the loan is agreed to.

- Sample language: “Applicable Law. This Agreement shall be construed in accordance with and governed by the laws of [insert state].”[12]

-

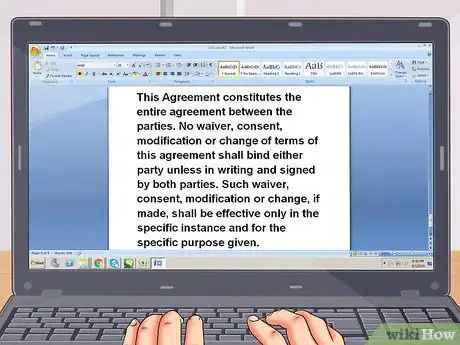

2Include a merger clause. You want to state that the contract contains the entirety of the agreement and that any changes must be in writing. This will protect you in case the other party later claims that you had side agreements not included in the loan agreement.

- You could write, “This Agreement constitutes the entire agreement between the parties. No waiver, consent, modification or change of terms of this agreement shall bind either party unless in writing and signed by both parties. Such waiver, consent, modification or change, if made, shall be effective only in the specific instance and for the specific purpose given.”[13]

-

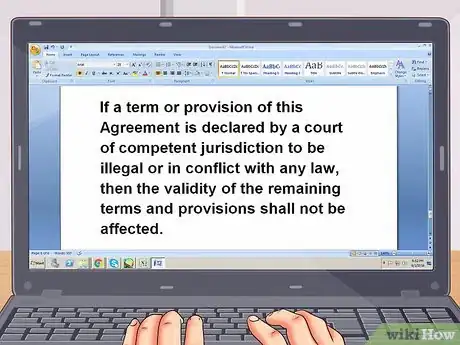

3Add a severability clause. Generally, if one part of the contract were to be found illegal, then the entire contract could be voided. To prevent this, include a severability clause.

- Sample language could be: “If a term or provision of this Agreement is declared by a court of competent jurisdiction to be illegal or in conflict with any law, then the validity of the remaining terms and provisions shall not be affected.”[14]

-

4Create a signature block. At the bottom of the page, include signature blocks. There should be one for the lender and one for the borrower.[15] Leave space so that each party can write in the date on which they signed the agreement.

-

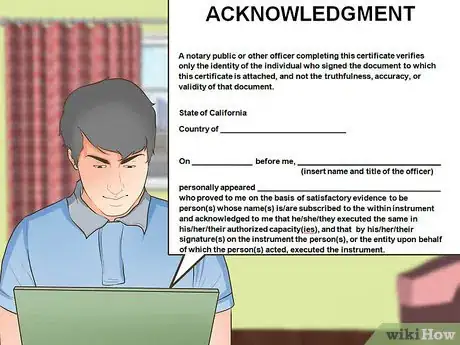

5Insert a notary block. Generally, you do not need loan agreements to be notarized. However, it can provide protection in case a legal dispute arises and there are questions about whether or not one of the parties signed the agreement.

- Find an appropriate notary block for your state. Search “your state” and then “notary block” or “acknowledgement” using your favorite web browser. Sample blocks are often posted online.

- Here is sample language for California.

Warnings

- Although you could make an oral contract, these are harder to enforce because you will not have conclusive proof of the terms of the contract. Always be sure to put your loan agreement in writing.⧼thumbs_response⧽

- If you are charging interest on a loan, you may want to speak to an accountant. You may have to claim interest on your tax forms.⧼thumbs_response⧽

References

- ↑ https://www.debt.org/credit/loans/friends-family/

- ↑ https://www.debt.org/credit/loans/friends-family/

- ↑ http://www.kiplinger.com/article/credit/T035-C000-S002-smart-ways-to-loan-money-to-family.html

- ↑ http://www.kiplinger.com/article/credit/T035-C000-S002-smart-ways-to-loan-money-to-family.html

- ↑ https://www.leaplaw.com/pubSearch/preview/loan.pdf

- ↑ https://www.leaplaw.com/pubSearch/preview/loan.pdf

- ↑ https://www.leaplaw.com/pubSearch/preview/loan.pdf

- ↑ https://www.leaplaw.com/pubSearch/preview/loan.pdf

- ↑ https://www.rocketlawyer.com/form/loan-agreement.rl

- ↑ http://www.lexology.com/library/detail.aspx?g=6f5797ce-ca35-47d0-9fed-458dc4b1c141

- ↑ https://www.leaplaw.com/pubSearch/preview/loan.pdf

- ↑ https://www.leaplaw.com/pubSearch/preview/loan.pdf

- ↑ http://www.nd.gov/ndic/lrc/lrcinfo/pr-sample-contract.pdf

- ↑ http://www.nd.gov/ndic/lrc/lrcinfo/pr-sample-contract.pdf

- ↑ https://www.leaplaw.com/pubSearch/preview/loan.pdf

About This Article

Before you write a loan agreement, decide on the interest rate you want to charge, and don’t exceed your state’s maximum rate. Negotiate ahead of time with the other party to agree on the amount of the loan and the payment schedule. To write the agreement, start by naming the parties involved and state the amount of the loan. State the interest rate, provide the payment schedule, and include clauses for late fees and prepayment penalties, or any other terms of your agreement. At the bottom of the document, include signature blocks where each party can sign. For more tips from our Legal co-author, like how to finalize your loan agreement, keep reading!