This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 56,252 times.

Learn more...

Whether you want to take advantage of a strong silver market or have recently inherited a coin collection, it pays not to rush the selling process. The easiest way to sell coins is to track down a reputable dealer. They’ll offer a wholesale price instead of retail, but a lower rate might be worth the convenience. Other options include auctions, online marketplaces, and searching an online forum for collectors. If your collection includes rare, valuable coins, it’s wise to have a third-party organization appraise and grade them.

Steps

Selling to a Dealer

-

1Find reputable local dealers online or by referral. Look for dealers who belong to reputable organizations.[1]

- Most of the larger, reputable dealers belong to professional organizations, the foremost of which are the American Numismatic Association (https://www.money.org/find-a-dealer) and Professional Numismatists Guild (https://png.memberclicks.net/find-a-png-dealer).

- You can also check with the Better Business Bureau to find out how long the dealer has been in business and if complaints have been filed against the dealer. Remember, though, that a lack of complaints does not necessarily correlate to strong dealer ethics and business practices.

-

2Negotiate with dealers in person. Track down dealers who own shops within driving distance. Bring coins that you think are rare or valuable and photographs of your collection (especially if it’s substantial). Don’t trust a dealer who’s willing to make an appraisal or offer over the phone.[2]

- Value depends on condition, so a dealer or appraiser needs to make a physical inspection in order to accurately value a coin.

- Most dealers will appraise your coins for free if you’re negotiating a sale.

Advertisement -

3Don’t expect a dealer to pay retail for your coins. Dealers operate businesses and have to turn a profit. You can research you coins’ potential value, but keep in mind valuation guides list coins’ retail values. A dealer will offer a wholesale price, which could be 5 to 20 percent less than the retail value.

- You can find price guides and other valuation resources online. For example, check CoinStudy’s resources: http://www.coinstudy.com/.

-

4Get offers from multiple shops. The best way to figure out a good wholesale price for your coins is to negotiate with as many dealers as possible. You might find that a few dealers make offers around 10 percent below retail value. If one dealer makes an offer 25 percent below retail, you’ll know you should steer clear.[3]

-

5Make the transaction. After finding reputable dealers and getting multiple offers, choose the one willing to give you the best price. The dealer will most likely issue a record of the transaction. If they don't, ask for one or create your own bill of sale before making the deal.[4]

- The biggest pro to going with a dealer is convenience: the transaction is quick, easy, and usually paid in cash.

Using Other Sellers

-

1Go for a live auction if you have rare, collectible coins. Find local auction houses online, research their sales histories, and attend live auctions to get a feel for how they operate. If you find one that’s well-advertised, well-attended, and has a history of good bids for coins, contact them and discuss putting your collection up for bid. Keep in mind you’ll have to pay fees, and your item isn’t guaranteed to sell at a fair market price.[5]

-

2Sell directly to a collector to get the highest retail price. If you have rare or collectible coins, you might be able to sell them directly to collectors. Check the community forums on reputable numismatic organizations, such as the Professional Numismatists Guild and American Numismatic Association.[8]

- You’ll have to pay a membership fee to join an organization and post in the forum. If you can get in touch with a collector, you might be able to fetch a higher price than selling to a dealer or at an auction.

- A collector isn't likely to buy a coin that isn’t professional graded, so you’ll need to have your coins professional certified.

-

3Use an online marketplace if you don't want to hunt for other options. It’s convenient to make a sale from the comfort of your own home, and you won't have to spend time researching dealers or auction houses. However, keep in mind any online transaction includes pros and cons. You’ll need to spend money to have your coins graded, pay seller’s fees, and deal with shipping.[9]

- From standard seller’s fees to shipping, selling on eBay will eat away at your time and profit margins. Selling on eBay can also be tough if you don't have a substantial history of positive reviews.

- Great Collections (https://www.greatcollections.com/) and Heritage Auctions (https://coins.ha.com/) are reputable large-scale markets with lower fees.

- If you’re selling your coins in an online auction, there’s no guarantee it’ll fetch a fair market price.

-

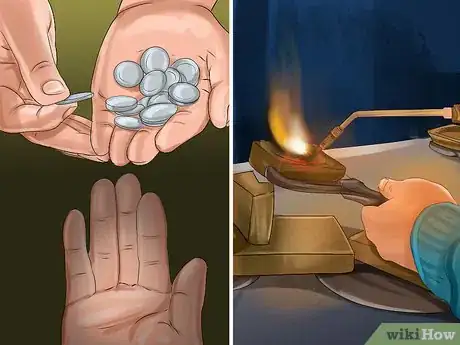

4Sell coins that are only worth their melt value to a local smelter. While some silver coins are numismatic, or collectible, some won’t be worth more than their melt value. You’ll probably have a hard time finding a market for non-collectible coins, so selling them to a local smelter or scrap dealer might be your best option.[10]

- Keep track of silver’s market price, which fluctuates. If the market price is currently in a downward trend, wait until it ticks back up before you sell.[11]

Getting the Best Price

-

1Give yourself at least 2 months to sell your coins. If you rush the selling process, you can be sure you won’t fetch the best possible price. Researching dealers and getting multiple offers takes time. If you’re going with another option, you’ll also need plenty of time to research auction houses or track down collectors.[12]

-

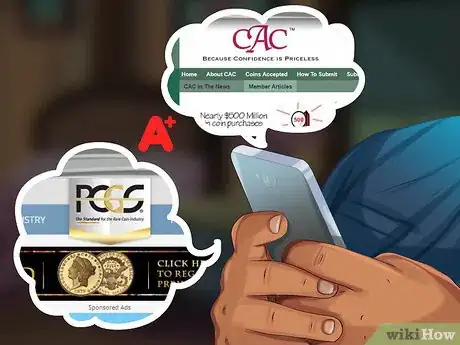

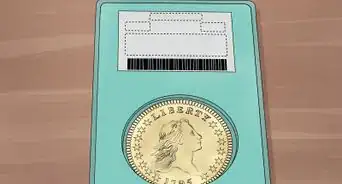

2Have your rare coins appraised and graded. Start your valuation process by checking online price guides. If you think you have a coin that could be worth $100 (USD) or more, have it professionally appraised, graded, and certified. If its rarity and condition have been certified by a third party organization, you’ll have an easier time selling it.[13]

- A reputable dealer who’s a member of a collector’s guild will probably offer a free appraisal if you’re negotiating a sale. While you should genuinely be open to making a deal, you won't be obligated to sell your coins after the dealer offers an appraisal.

- When buying rare coins, knowledgeable coin collectors look for the CAC (Certified Acceptance Corporation) seal: http://www.caccoin.com.

- Getting certified by the Professional Coin Grading Service (PGCS) is another industry standard: https://www.pcgs.com.

- You’ll have to send your coin to the organization and pay for the appraisal and grading. This takes time and money, but it’s worth it if you have an extremely rare coin that’s worth a small fortune.[14]

-

3Don’t clean your coins. You might be tempted to get your coins nice and shiny before trying to sell them. However, oxidized coins (coins with a brownish tinge) are usually more valuable than bright, shiny coins, especially if they’re old or rare.[15]

- For example, you’d never want to clean ancient Roman coins. Removing the patina that shows an ancient coin’s age dramatically affects its value.

-

4Pay taxes on your profit. Remember that you might have a tax liability after selling your coins. Depending on your location, you might be liable for 20 to 30 percent of the difference between the selling price and how much you originally paid for the item.[16]

-

5Keep records of the sale and of your original purchase. If you sold a coin that you paid a lot of money for, it’s vital to have a record of your original purchase. Otherwise, your taxes might be based on the difference between the coin’s face value and your selling price.

- For example, suppose you paid $5,000 (USD) for a rare silver dollar and sold it for $7,500. Its face value is $1, so you’d want to keep a record that you originally paid $5,000 or your tax liability might be based on $7,499 instead of $2,500.

Community Q&A

-

QuestionIf I inherited coins and wanted to sell them, do I still have to pay taxes on them? What if I'm paid in cash?

DonaganTop AnswererYou owe income tax on any profit you make in selling coins. If the taxing agency (e.g., the IRS) has no record of the sale, you can let your conscience guide you in meeting your obligation.

DonaganTop AnswererYou owe income tax on any profit you make in selling coins. If the taxing agency (e.g., the IRS) has no record of the sale, you can let your conscience guide you in meeting your obligation.

References

- ↑ https://coincollector.org/archives/006633.html

- ↑ https://coincollector.org/archives/006633.html

- ↑ http://cointrackers.com/sell-your-coins/

- ↑ http://www.silvercoins.com/sell-for-cash/

- ↑ https://coincollector.org/archives/006633.html

- ↑ https://www.consumerreports.org/cro/magazine/2014/09/the-best-ways-to-sell-your-stuff/index.htm

- ↑ https://coinweek.com/coins/coin-collecting-strategies-2/ten-tips-for-selling-your-coins

- ↑ https://coincollector.org/archives/006633.html

- ↑ http://cointrackers.com/sell-your-coins/

- ↑ https://coincollector.org/archives/006633.html

- ↑ http://www.bankrate.com/investing/when-should-you-sell-your-silver-coins/

- ↑ https://coinweek.com/coins/coin-collecting-strategies-2/ten-tips-for-selling-your-coins/

- ↑ https://coincollector.org/archives/006633.html

- ↑ https://coinweek.com/coins/coin-collecting-strategies-2/ten-tips-for-selling-your-coins/

- ↑ http://cointrackers.com/sell-your-coins/

- ↑ https://www.consumerreports.org/cro/magazine/2014/09/the-best-ways-to-sell-your-stuff/index.htm