This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

There are 19 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 115,207 times.

The Internal Revenue Service (IRS) requires that employers file a W-2 for each of their employees. On this form, you report the wage or salary the employee was paid during the year. You also specify the amount of federal, state, and other taxes withheld from an employee's paycheck. If you’re setting up your payroll department and you’re looking for information on how to file your W-2 forms correctly so that the IRS isn’t bugging you come tax season, we’ve got you covered with everything you’ll need to know.

Steps

Preparing a W-2

-

1Determine whether an individual is an employee or an independent contractor. You only file a W-2 for employees, not independent contractors. There isn’t a bright-line test, but the IRS will look at a variety of factors regarding independence and control of wages and work hours, such as the following:[1]

- An employee is usually subject to the business' instructions about when, where, and how to work. Independent contractors typically choose their own methods.

- Employees generally are reimbursed for out-of-pocket expenses, such as office supplies. Independent contractors typically are not.

- Employees are usually engaged with the expectation that they will be working indefinitely with the business. Independent contractors, however, are free to seek out different business opportunities and advertise their services openly.

- Employees are guaranteed a regular wage (hourly, weekly, etc.). By contrast, independent contractors are usually paid a flat fee.

- An employee may be provided with benefits such as health insurance, a pension plan, sick pay, or vacation pay. Independent contractors aren’t.

- You should make the determination between employee and independent contractor when you first hire the individual.

-

2Obtain W-2 and W-3 forms. W-3 forms are for the employer's records and must be transmitted to the Social Security Administration (SSA) along with the W-2 forms. You can order both from the IRS website.

- Visit here to order: https://www.irs.gov/businesses/online-ordering-for-information-returns-and-employer-returns.

- Alternately, you can file electronically. Register at the Social Security Administration (SSA) website.[2]

- Avoid printing off forms from the internet. Copy A of the form must be printed with red ink so that SSA can scan it.[3] If you don’t want to order forms from the IRS, then you can get forms from an office supply store or a local accounting firm.

Advertisement -

3Gather payroll information. To fill out a W-2, you must know how much an employee was paid during the year and how much you withheld for tax or other reasons. Collect this information ahead of time.

-

4Collect other relevant employer/employee information. Relevant info includes employer/employee names, addresses, Social Security or tax ID numbers, and employee wages and tips.

- Employees will supply their contact info and Social Security Numbers upon hiring, via form W-4, the Employee's Withholding Allowance Certificate, but wage and tip information will come from your payroll register's figures.

- You will also need your business' state tax ID number. Check with your state's Department of Revenue if you still have trouble identifying this number. They will provide a listing of the types of taxes paid at the state level.

Filling Out a W-2

-

1Input the employee's Social Security Number into Box A. You should have already acquired the employee's necessary personal information via the W-4.

- Box A is located at the very top of the form and should read "Employee social security number."

- Use black ink and a font size that is legible. The IRS recommends 12 point Courier font.[4]

- Fill in the 9-digit Social Security Number with its respective dashes, as follows:

123-45-6789

-

2Fill in your Employer Identification Number into Box B. Your Employer ID number (EIN) is assigned by the IRS to identify your business for taxation purposes. Businesses generally apply for an EIN by submitting an SS-4 form to the IRS via fax or mail. However, a business can also apply for an EIN via phone, email, or online.[5]

- The EIN is a 9-digit number with a dash separating the first two numbers from the remaining seven. For example:

12-3456789

- The EIN is a 9-digit number with a dash separating the first two numbers from the remaining seven. For example:

-

3Enter the employer's name, address, and zip code in Box C. This refers to your business' name and location. Be sure you fill out the W-2 in a legible black font.

- For example:

Johnson Technical Corps

850 Tech Drive

Suite 400

Antioch, CA 94531

- For example:

-

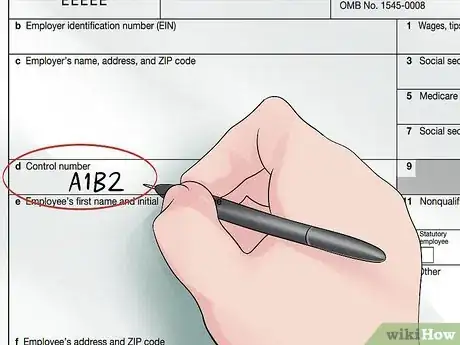

4Generate a control number for Box D. The control number is unique for each employee and will help you keep track of each individual as you fill out multiple forms. You need a control number if you are filing multiple W-2s.

- You can either generate the number manually, or your payroll preparation software can generate this number electronically.

- Your control number may contain both letters and numbers, such as A1B2.

-

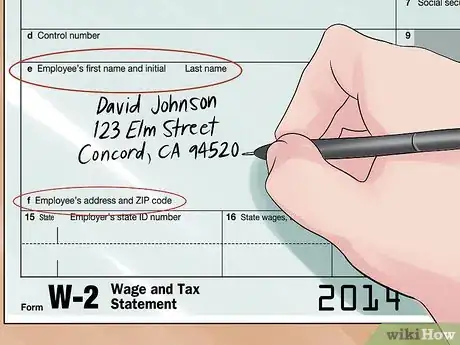

5Complete Boxes E and F. Insert the employee’s name in Box E and their address in Box F.

- For example:

David Johnson

123 Elm Street

Concord, CA 94520

- For example:

-

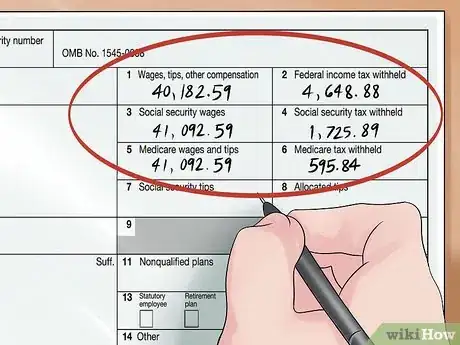

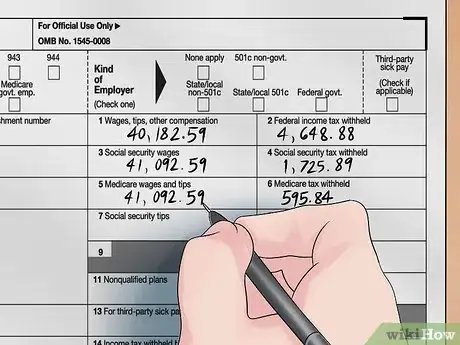

6Complete Boxes 1-8 with payroll information. These boxes cover all the areas of employee taxation as well as wages, tips, and withholding.[6] Remember to report decimal and cents on amounts.[7]

- For Box 1, you will need to specify the total wages, tips, and other compensation given to your employee that are subject to federal income tax during the previous year.

- In Box 2, identify the total amount withheld in federal income tax.

- In Box 3, insert the employee's total wages subject to the Social Security tax.

- For Box 4, indicate the total employee Social Security tax withheld. Don’t include your share as an employer.

- In Box 5, insert the employee's total Medicare wages and tips.

- In Box 6, enter the total Medicare tax withheld from the employee. Don’t include your share as an employer.

- For Boxes 7 and 8, you must specify the employee's Social Security tips and allocated tips, respectively.

-

7Complete Box 10. In this box, you specify the amount of dependent care benefits you paid to an employee.[8] Dependent care benefits are part of the overall employee benefits plan.

- For example, your company could provide a daycare center for employees. Alternately, you could have reimbursed expenses for dependent care through a flexible spending account.[9]

- Any amounts over $5,000 should also be included in Box 1.

-

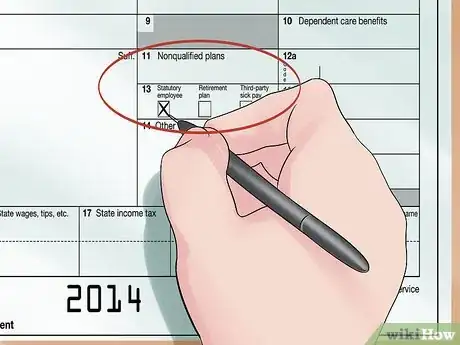

8Complete Box 11, if necessary. Report any distributions to your employee from a nonqualified deferred compensation plan or a nongovernmental section 457(b) plan in this box (as well as in Box 1).[10] The Social Security Administration needs this information to determine if any amount you reported in box 1 or boxes 3 or 5 was earned in a previous year.[11]

-

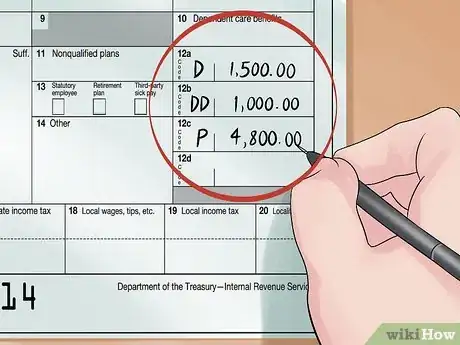

9Fill in Box 12, if necessary. You need to complete Box 12 if you paid fringe benefits to an employee. Box 12 is subdivided into smaller categories and requires a code and monetary amount to be input into each subcategory. The codes you will use are located on the W-2 form. If you have more than 4 items in Box 12, you will need to put the additional items on a second W-2. Some of the codes include the following: [12]

- Codes "A" and "B" refer to uncollected Social Security or Medicare tax on tips, respectively.

- Codes "D-H" refer to contributions to retirement plans, such as 401(k) or 408(b).

- Code "L" indicates reimbursements you paid to employees for business expenses that came out of their own pockets.

- Codes "M" and "N" refer to uncollected Social Security and Medicare tax on group-term life insurance.

- Code "W" specifies contributions made to the employee’s Health Savings Account.

- "AA" are designated Roth contributions under a 401(k) plan.

- "BB" are designated Roth contributions under a 403(b) plan.

- Code "DD" refers to the amount of non-taxable employer-sponsored health coverage.

-

10Complete Box 13. Check any box that applies to your employee. Options are "Statutory Employee," "Retirement Plan," or "Third-party Sick Pay."[13]

- Check "Statutory Employee" for independent contractors you are treating as employees for certain tax purposes. These independent contractors must fall within certain categories created by statute and meet certain conditions in order to be classified as statutory employees.[14]

- Check the box titled “Retirement Plan” if your employee participates in certain plans. See Publication 590-A.

- Select "Third-party Sick Pay" if you are a third-party sick pay payer who is filing Form W-2 for an insured’s employee or if you are an employer reporting sick pay payments made by a third party.

-

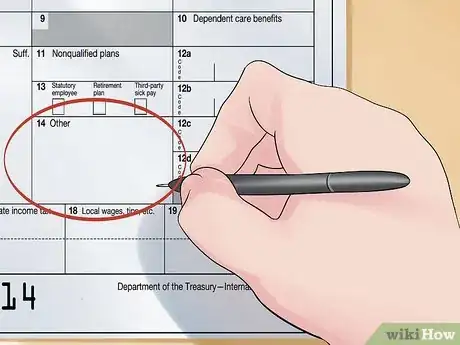

11Include other deductions or compensation in Box 14. This is an "other" box and is provided for any additional monies that must be reported to the IRS that fit no other category. Compensation you can report in this box includes:[15]

- 100% of a vehicle’s annual lease value

- state disability insurance taxes withheld

- union dues

- nontaxable income

- educational assistance payments

-

12Complete state and local tax information in Boxes 15 - 20. The ID numbers are assigned by the individual state.[16]

- In Box 15, specify your two-letter state code and your business' tax ID number. You can retrieve this information from your state's Department of Revenue.

- Input the state wages in Box 16, state income tax withheld in Box 17, any local wages in Box 18, local income tax withheld in Box 19, and locality name in Box 20.

- Notice that there is space for two states and two localities on the form. If an employee has wages in more than two states or localities in one year, you must complete an additional W-2.

Filling Out a W-3

-

1Confirm your name and ID number are accurate. They must match the information on your annual or quarterly tax return. A W-3 is a transmittal form which must be sent to the Social Security Administration.

- Your employer name and employer identification number must be supplied in order for your W-2 to be tracked by the SSA.

- Have your W-2 ready because you will be reporting the same totals on your W-3 as well.

-

2Identify what type of payer and employer you are. Check the appropriate boxes based on the following:

- Payer. Most businesses will check box 941, since the 941 form is what most employers use to report quarterly wage and tax information.[17]

- Employer. Most will check “none apply.” The other boxes apply to non-profits and the federal government.

- Establishment number. This box applies to businesses with separate establishments under one entity.

-

3Complete total wage and tax information. You will need to enter this information from your W-2 form. In box C, also state the total number of W-2 forms to be sent.[18]

- To prepare for a W-3 form, you must add up wages in each category of the W-2 and use them to complete the W-3. The totals for each item on the W-3 must equal the totals for all of the corresponding items on the W-2 form.

- Be sure you use Form W-3 for the correct year.[19] Use the form for the year the income was taxable, not the year you are filing the form. This goes for the W-2 form as well.

Distributing Your Forms

-

1Print out the W-2 and W-3 forms from the IRS website. You can access IRS.gov 24 hours a day, 7 days a week. If you are ordering forms from the IRS website instead of printing them, know that it may take 7-15 business days for the forms to arrive.

- Be sure your printed forms align with the pre-printed format, which can be verified on multiple websites.[20]

- Do not download "Copy A" of the W-2 or W-3 forms separately. The Social Security Administration only accepts red-ink versions or approved substitute versions of these forms. You can be penalized if you don’t provide a form that can be scanned.[21]

- Remember to use the form for the year the income was taxable, not the year you are filing the form.

-

2

-

3Send copies to the Social Security Administration. By January 31, send Copy A of the W-2, along with your W-3 form, to the SSA. You must furnish these copies to SSA by January 31.[25]

- To file paper forms, use the following address:

Social Security Administration

Data Operations Center

Wilkes-Barre, PA 18769-0001 - If using "Certified Mail" to file, mark the ZIP code as 18769-0002.

- If using an IRS-approved delivery service, add "Attn: W-2 Process, 1150 E. Mountain Dr." to the address and mark the ZIP code as 18702-7997.

- Do not send checks, cash, money orders, or other forms of payment. Employment tax forms, remittances, and Forms 1099 must be sent to the IRS.

- You can also file the forms online.

- To file paper forms, use the following address:

-

4Keep "Copy D" and a copy of your W-3 with your business records. As specified earlier, these forms will need to be filed in your employer records for 4 years.[26]

Expert Q&A

-

QuestionWhich W2 forms should I send to my employees?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant You need to send copies B, C, and 2 to your employees near the end of the year.

You need to send copies B, C, and 2 to your employees near the end of the year. -

QuestionIs code D the employee's health insurance premium contribution and code DD the employer's amount?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant Box 12 Code D refers to amounts that were withheld from the employee's pay to be contributed to a 401(k) plan. Box 12 Code DD refers to all pre-tax amounts paid for employee's health insurance; this includes both amounts that were withheld from the employee's pay to purchase health insurance as well as amounts that the employer paid for the employee's health insurance as a fringe benefit.

Box 12 Code D refers to amounts that were withheld from the employee's pay to be contributed to a 401(k) plan. Box 12 Code DD refers to all pre-tax amounts paid for employee's health insurance; this includes both amounts that were withheld from the employee's pay to purchase health insurance as well as amounts that the employer paid for the employee's health insurance as a fringe benefit.

References

- ↑ http://www.irs.gov/publications/p15a/ar02.html#en_US_2014_publink1000169489

- ↑ https://www.ssa.gov/employer/

- ↑ https://www.irs.gov/pub/irs-pdf/fw2.pdf

- ↑ https://www.thebalance.com/common-errors-in-completing-form-w-2-397992

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/how-to-apply-for-an-ein

- ↑ https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

- ↑ https://www.thebalance.com/common-errors-in-completing-form-w-2-397992

- ↑ https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

- ↑ https://www.thebalance.com/understanding-form-w-2-wage-and-tax-statement-3193059

- ↑ https://www.thebalance.com/understanding-form-w-2-wage-and-tax-statement-3193059

- ↑ https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

- ↑ https://ttlc.intuit.com/questions/1899457-meaning-of-the-codes-and-amounts-in-box-12-of-your-w-2

- ↑ https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

- ↑ http://www.taxslayer.com/support/336/w-2--what-is-a-statutory-employee?language=1

- ↑ https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

- ↑ https://www.thebalance.com/what-is-a-w-3-form-398523

- ↑ https://www.irs.gov/pub/irs-pdf/fw3.pdf

- ↑ http://www.irs.gov/instructions/iw2w3/ch01.html

- ↑ https://www.costcochecks.com/product.aspx?lineid=19061&productid=88426#.U467s3JdVuI

- ↑ https://www.irs.gov/pub/irs-pdf/fw3.pdf

- ↑ https://www.irs.gov/taxtopics/tc752.html

- ↑ https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

- ↑ https://www.irs.gov/instructions/iw2w3/ch01.html

- ↑ https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

- ↑ https://www.irs.gov/taxtopics/tc752.html

-Step-9.webp)