This article was co-authored by Alan Mehdiani, CPA and by wikiHow staff writer, Jennifer Mueller, JD. Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 18,939 times.

If you own a business in Texas that sells products or provides taxable services, you must collect state and local income tax from your customers and pay that money to the Texas Comptroller's Office on either a monthly, quarterly, or yearly basis. The state sales and use tax is 6.25 percent, but cities and counties can add up to 2.00 percent on top of that, for a maximum total rate of 8.25 percent. Those additional local taxes vary greatly throughout the state.[1]

Steps

Applying for a Permit

-

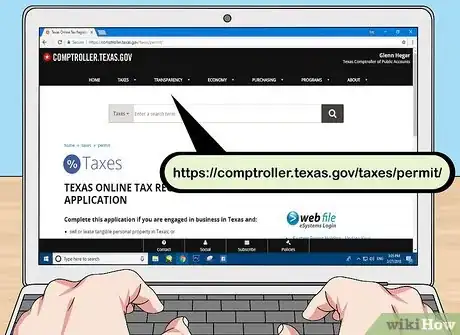

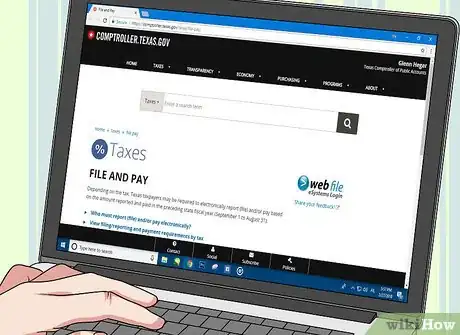

1Visit the eSystems website to apply. Before you can file a Texas sales and use tax return, you must file an application for a sales tax permit. The easiest way to do this is through the electronic filing website of the Texas Comptroller's Office.[2]

- Go to https://comptroller.texas.gov/taxes/permit/ and follow the link that says "Apply for Permit via eSystems" to get started.

- If you don't want to apply and pay online, you can download PDFs of the paper application form at https://comptroller.texas.gov/taxes/sales/forms/.

-

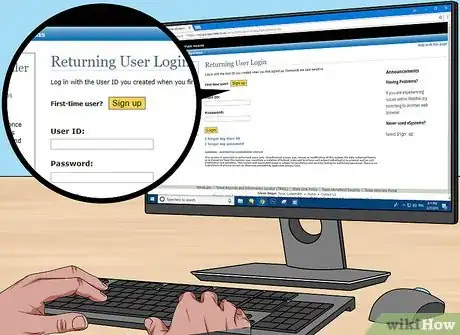

2Create an account on eSystems. Once you're on the eSystems website, click the "Sign up" button to start creating your account. To start, you'll simply create a username and password. Enter your own name and email address.[3]

- Be sure to use an email address that is associated with your business, not a personal email address.

Advertisement -

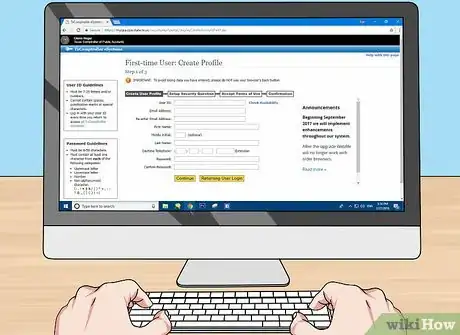

3Complete a permit application. After creating your account, you'll have access to the permit application. Here, you will provide information about your business, including the type of goods or services you sell and your business's location.[4]

- To identify the type of business you own, provide the appropriate North American Industrial Classification System (NAICS) code. If you're not sure which one to use, search at https://www.census.gov/eos/www/naics/.

- Make sure you provide the correct tax ID number. If you are a sole proprietor, this will be your personal Social Security number.

- For a Texas corporation, you need your corporation's file number from the Secretary of State. If you have a corporation, you will also need Social Security numbers for all officers or directors.

-

4Receive your permit in the mail. When you complete your application, you'll get a notice from the Comptroller's Office when your application has been approved. This may take 2 to 3 weeks.[5]

- If you don't get anything from the Comptroller's Office after 30 days, call the customer service liaison at 888-334-4112.

-

5Record your due dates. Your acceptance notice will let you know whether you must pay your sales and use taxes yearly, quarterly, or monthly. Your due dates will vary depending on how often you have to pay. Write them down and set reminders so you don't miss one.[6]

- If you file your report after the due date, you'll be assessed a $50 fee, plus a 5 percent penalty if your payment is less than 30 days past due. A 10 percent penalty is assessed for payments more than 30 days past due.

Calculating Taxes Owed

-

1Identify the city and county taxes for your location. The comptroller's office has a number of tax tables on its website that will let you know what local taxes you must pay based on where your business is located.[7]

- If you have more than one location, you may have more than one tax rate. Make sure you look up the rates for all locations.

- The Comptroller's Office has an online rate locator that you can use to easily find the combined sales and use tax rate for your business. Enter your business's address at https://mycpa.cpa.state.tx.us/atj/ and click "Search."

-

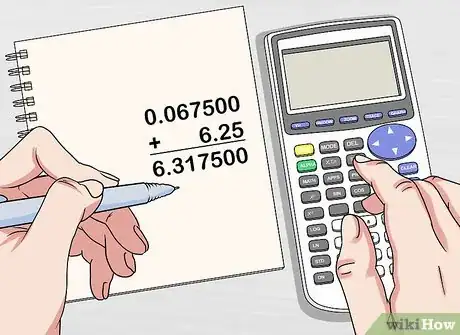

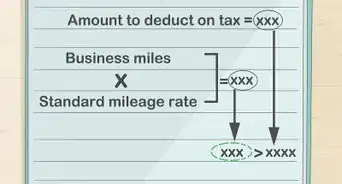

2Add the city and county rate to the 6.25 percent state rate. The total rate is the amount you must charge your customers. You may still have to separate out state and local taxes on receipts. However, it will make your accounting easier if you know the total rate.[8]

- When you compute sales taxes, calculate to the third decimal place and round from there.[9] Many point-of-sale systems will do this for you automatically.

-

3Open a bank account to deposit taxes. You will collect sales tax from your customers. Depositing that money in a separate bank account will make it easier for you to pay the appropriate amounts on your due date.[10]

- Deposit taxes on at least a weekly basis. If you have a higher sales volume, you may want to do it daily.

-

4Evaluate sales tax software. There are a number of computer applications and web-based services that will automatically compute and transfer your sales taxes for you. Many of these services will also file your returns for you.[11]

- If you're already using accounting software for your business, see if it has sales tax options available. If not, make sure you're choosing a service that is compatible with the accounting software you already have.

Submitting Your Return

-

1Choose your reporting and payment method. The Comptroller's Office offers several different ways to file and report your sales and use taxes. You can use sales tax software to file automatically, file through your eSystems account, or download and print forms to mail.[12]

- If you're filing online, your return must be submitted by 11:59 p.m. on the due date. Mailed returns that are post-marked by the due date won't be considered late even if the Comptroller's Office doesn't receive them until later.

-

2Complete your return. On your return, you must list your taxable sales for the reporting period along with the applicable tax rate. The amount you pay must equal the total sales and use tax for both state and local taxes.[13]

- If you want to file a paper form, the Comptroller's Office will mail you a blank return before your due date. You can also download a PDF at https://comptroller.texas.gov/taxes/sales/forms/.

-

3Make your payment. If you are paying using electronic debit, your payment must be scheduled before 6:00 p.m. the day before the due date. If you're filing your report on the due date, you may have to make your payment before you file your report.[14]

- You can pay online with a credit card or electronic check. If you want to mail in a paper return, you can also mail in your payment using a paper check. Make sure your account is properly noted on the memo line.

-

4File your report. If you're filing your report online, you'll receive a confirmation that your report has been received. Make sure you file it before noon on the due date to avoid late fees and penalties.[15]

- If you have any issues with electronic filing or payment, or you don't receive a confirmation, call Electronic Reporting at 800-442-3453.

References

- ↑ https://comptroller.texas.gov/taxes/sales/

- ↑ https://comptroller.texas.gov/taxes/permit/

- ↑ https://mycpa.cpa.state.tx.us/securitymp1portal/displayCreateAccountPart1.do

- ↑ https://comptroller.texas.gov/taxes/permit/

- ↑ https://comptroller.texas.gov/taxes/permit/

- ↑ https://comptroller.texas.gov/taxes/sales/

- ↑ https://comptroller.texas.gov/taxes/sales/

- ↑ https://comptroller.texas.gov/taxes/sales/

- ↑ https://comptroller.texas.gov/taxes/sales/faq/collection.php

- ↑ https://www.tax.ny.gov/bus/st/bank.htm

- ↑ https://www.capterra.com/sales-tax-software/

- ↑ https://comptroller.texas.gov/taxes/sales/filing-requirements.php

- ↑ https://comptroller.texas.gov/taxes/sales/forms/

- ↑ https://comptroller.texas.gov/taxes/file-pay/

- ↑ https://comptroller.texas.gov/taxes/file-pay/

About This Article

To file a Texas sales and use tax return, first, file an application for a sales tax permit at the Texas Comptroller’s Office website. Once you receive your permit in the mail 2 to 3 weeks later, record the due dates when you need to pay a sales and use taxes, which should be noted in your acceptance notice. From there, you can calculate the city and county taxes owed for your location using the tax tables on the comptroller’s office website. When you do, make sure to add the city and county rate to the 6.25 percent state rate. Once you’re ready to file, you can pay what you owe with sales tax software, an eSystems account, or by printing and mailing the proper forms. For more help, like how to set up an eSystems account, read on.

-Step-9.webp)