This article was co-authored by Michael R. Lewis and by wikiHow staff writer, Christopher M. Osborne, PhD. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 9 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 94% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 119,375 times.

While it tends to play “second fiddle” to gold, silver can make a great addition to anyone’s investment portfolio. People who invest in precious metals tend to appreciate the sense of permanence, stability, and tangibility that comes with owning an item like silver, whether it is sitting in your home safe or a huge vault somewhere. There are many options when it comes to investing in silver, and, like all investments, varying levels of risk and reward. Consider the benefits of owning silver and your own overall investment strategy as you compare these options.

Steps

Deciding to Invest in Silver

-

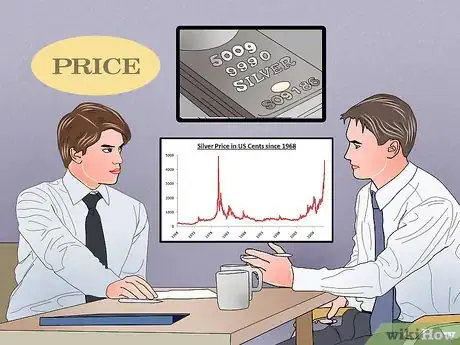

1Decide when to buy silver. Every investor wants to know the magic formula that will let him or her know when to buy or sell. Unfortunately, buying silver, like any other type of investing, is primarily educated guessing. Over the past 100 years, the price of silver per troy ounce has ranged in (inflation-adjusted) price from about $4 to $106, with the current price sitting at about $15. This price happens to be quite close to the inflation adjusted price 100 years ago, in 1916.[1]

- Silver is a good investment from a risk perspective. For one, precious metals, including both silver and gold, typically are counter-cyclical. This means that they generally maintain value or increase in value during a recession. Additionally, silver has many practical, industrial uses, which guarantees that silver will remain in demand (read: at a reasonable market price) as long as other currencies remain strong.[2]

- The current gold-silver price ratio, which reflect the price of gold against the price of silver, stands at about 82:1 ($1230/oz for gold, $15/oz for silver), well above the historical ratio, which is generally about 15:1. This may mean it is a good time to “buy low” on silver, but the historical price volatility of silver makes for difficult predicting.[3]

- Do your homework, consult your investment advisor, and make your best educated guess.

-

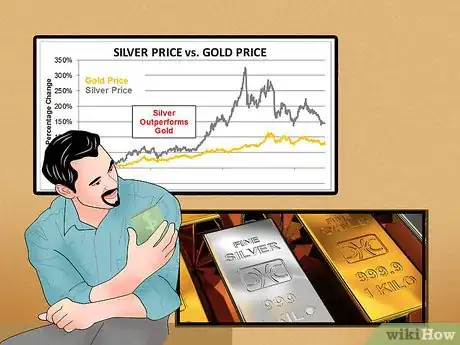

2Compare silver and gold. Gold holds an exalted position among precious metals because of its longstanding association with wealth and objects of beauty like jewelry and its significantly higher per-ounce value than silver. Silver, however, has many benefits as an precious metals investment, and may actually be preferable to gold in some respects.

- The current price difference per troy ounce of gold and silver stands at roughly a 82:1 ratio; in historical terms stretching back two-plus centuries, the ratio has typically been closer to 15:1. This may mean silver would appear to be severely undervalued compared to gold and a good buy vis-a-vis gold right now, but of course there is no guarantee of that.[4]

- Silver's lower value may make it less efficient to invest in when compared to gold. $5000 of silver takes up substantially more space than the same value of gold, which is something to consider in regards to the costs of transportation, storage, and protection.[5]

- Silver has more industrial applications than gold, as it is a common component in consumer electronics, for instance. This tends to give it a greater price volatility than gold.[6] Silver’s price does, however, tend to rise faster than gold’s during a “bull market” for precious metals (for instance, during the 1970s).[7]

Advertisement -

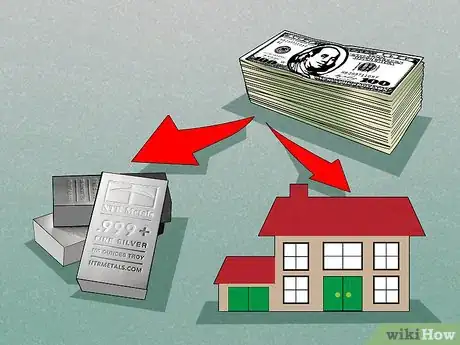

3Diversify your portfolio. This is sage advice for any investor, of course, and is just as true when talking specifically about investing in silver. Spreading your money around in different aspects of silver investing can offer you a greater chance of higher gains while offering the relative security of buying into a precious metal.

- Whatever its form, precious metals investing should not normally be the dominant focus of your portfolio. Use it as a way to further diversify your investments and to act as a hedge against some of the more volatile aspects of your portfolio.

- Every expert will offer his or her own particular advice, but one rule of thumb is to keep precious metals investments at roughly 10%-15% of your overall portfolio.[8]

- Some experts will tell you that if you are going to invest in silver, it is best to go straight to the source and buy tangible amounts of the real thing. In the end, however, the choice on how to diversify (or not) your silver portfolio is yours.

Purchasing and Possessing Silver Metal

-

1Weigh the benefits of precious metal possession. Precious metals like gold and silver are distinctive in that they are a commodity with commercial and industrial applications, as well as a form of money in and of themselves. People have been using silver as a form of currency for millennia, and its inherent value seems unlikely to change anytime soon.[9]

- People who are wary of buying stock in technologies that seem to become obsolete overnight or in commodities that only seem to exist on paper (or in the digital realm) can be particularly drawn to the lasting value of a tangible item like silver. However, silver’s longstanding status does not shield it from the ups and downs of the market, and it should not normally be the primary focus of an investment portfolio. As always, diversification is preferable.

- Owning the actual silver bullion (as bars or coins) and keeping it in your home or safe deposit box can offer a sense of security that stock certificates or online brokerage accounts can’t match. But remember, possessing the actual item means you have to store it and protect it.[10]

-

2Buy silver bars. Purchasing bars of silver at the standard .999 quality (that is, 99.9% pure silver) is generally the most cost-effective way to acquire the metal. These bars of silver are available in a variety of different shapes and weights. All sources of silver will have some sort of markup in addition to the current market (or “spot”) price, but that markup tends to be less for bars than coins. [11] [12]

- Of course, your local shopping plaza isn’t likely to have a shop selling silver bars. Silver bars can, however, be purchased from many banks as well as from bullion dealers. Do your homework to make sure you are buying from a reputable dealer, however, to ensure that you are getting the amount of pure silver that you’re paying for.

- Make sure you have a plan for securely storing and protecting your silver bars. A bank safe deposit box can be a good choice, or a high-quality home safe if you prefer to keep your bullion on your own property. Look into insurance for this substantial investment as well.

-

3Buy silver coins. When it comes to silver, you have far more coin purchasing options than you do with bars. All coin options are more portable and convenient than silver bars, but they also generally sell with a higher markup. This is extra markup is due to the cost of designing and minting the coins.

- For instance, the U.S. Mint sells silver bullion coins at a $2 markup per coin.[13]

- Bullion coins are essentially much smaller, disc-shaped silver bars; they are priced and sold in a similar fashion, with their price determined largely by the prevailing market rate and how much silver is actually contained in the coin.

- To help you in purchasing silver bullion coins from reputable dealers, the U.S. Mint’s website offers a searchable list of dealers in your area at http://catalog.usmint.gov/bullion-dealer-locator?_ga=1.74213714.1728674329.1421249845.

-

4Consider collectible coins. Collectible coins were made with varying amounts of silver content and often minted decades or more ago. They have many other elements factor into their prices, such as historical significance, rarity, and even design. This causes greater price volatility, making collectible coins a greater risk/reward venture.

- Typically, the numismatic values of collectible coins are far greater than the value of their silver or gold content.[14]

Investing in Silver Sans the Metal

-

1Weigh the possible benefits of investing without possessing. While it can be comforting to be able to see and hold your actual investment, remember that silver bars or coins just sit there and have their value determined by factors like scarcity and industrial usefulness. Alternatively, when you buy stock in a good company, it can enhance its value through its own actions — earning profits, diversifying, expanding, etc. Even companies tied closely to silver can create value for your investment beyond just the fluctuating price for the metal.[15]

- Stock certificates or an online portfolio are indeed less tangible than a stash of silver in your safe, but that makes them much easier (and cheaper) to buy, sell, transfer, and possess.

- Some people think physical possession of precious metals makes good sense during times of economic distress, or even some apocalyptic scenario when our digital world comes crashing down. However, if the worst-case scenario does happen and society as we know it is in tatters, how practical will it be for you to trade a silver bar for food or shelter anyway?

-

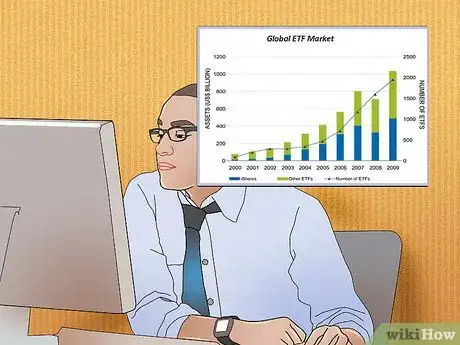

2Invest in a silver ETF. Exchange Traded Funds are “baskets” of assorted assets that are bought, sold, and traded like traditional stocks on exchanges. In recent years, precious metals ETFs have become a very popular means of owning silver without actually having the metal in your safe.

- Shares in silver ETFs are backed by actual silver bullion stored in vaults; owning shares, however, does not give you the right to access or “trade in” for this actual silver.[16]

- There are many silver ETFs available for purchase, with the iShares Silver Trust (SLV) as one of the most popular. As with any investment, do your research before buying.

- Owning a silver ETF will save you the costs and worries of holding, protecting, and transporting your silver, but you lose the benefits of tangible possession and have to pay management and other fees, which cut into the value of your investment.[17]

-

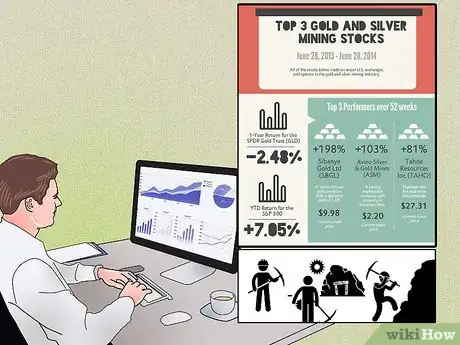

3Look into mining stocks. Instead of investing in the silver itself, you can choose to invest in the companies that acquire it from underground. Despite some myths you may come across, however, this sort of investment is more volatile, and silver mining stocks have increased in value at one-third the rate of silver bullion since 2000.[18]

- If you want to invest in companies that mine specifically for silver, your options are actually rather limited. Only about 30% of the world’s supply is mined by silver-focused companies.[19]

- You are more likely to invest in companies that inadvertently dig up silver while extracting other metals, which is known as “silver streaming.” Surprisingly enough, seventy percent of the world’s silver supply is mined as a by-product of mining another element.

- Whichever options you choose, remember that investments in silver mining stocks are susceptible not only to fluctuations in the price of silver bullion, but also factors like labor unrest, supply chain problems, environmental concerns, and so forth.

- It is probably best to compare mining company investing to buying stock in other industrial sectors, rather than to buying actual silver.

References

- ↑ http://www.macrotrends.net/1470/historical-silver-prices-100-year-chart

- ↑ http://commodityhq.com/commodity/precious-metals/silver/

- ↑ http://www.goldcore.com/us/knowledge/faq/invest-silver/

- ↑ http://www.goldcore.com/us/knowledge/faq/invest-silver/

- ↑ http://blogs.wsj.com/totalreturn/2014/11/11/how-to-invest-in-silver/

- ↑ http://www.kiplinger.com/article/investing/T015-C009-S001-how-to-invest-in-silver.html

- ↑ http://www.goldcore.com/us/knowledge/faq/invest-silver/

- ↑ http://www.goldcore.com/us/knowledge/faq/invest-silver/

- ↑ http://www.kiplinger.com/article/investing/T015-C009-S001-how-to-invest-in-silver.html

- ↑ http://blogs.wsj.com/totalreturn/2014/11/11/how-to-invest-in-silver/

- ↑ http://www.wealthdaily.com/articles/wealth-in-silver-investments/2523

- ↑ http://blogs.wsj.com/totalreturn/2014/11/11/how-to-invest-in-silver/

- ↑ http://blogs.wsj.com/totalreturn/2014/11/11/how-to-invest-in-silver/

- ↑ http://www.providentmetals.com/knowledge-center/precious-metals-resources/bullion-vs-numismatic-coins.html

- ↑ https://trendshare.org/how-to-invest/should-you-invest-in-gold-or-silver

- ↑ http://blogs.wsj.com/totalreturn/2014/11/11/how-to-invest-in-silver/

- ↑ http://www.wealthdaily.com/articles/wealth-in-silver-investments/2523

- ↑ http://www.thestreet.com/story/13099489/2/the-5-biggest-myths-about-investing-in-gold-and-silver.html

- ↑ http://blogs.wsj.com/totalreturn/2014/11/11/how-to-invest-in-silver/