wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 20 people, some anonymous, worked to edit and improve it over time.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 80,691 times.

Learn more...

Silver is a precious metal that has long been used for currency and a wide range of industrial applications. Like gold, it is purchased in large quantities by investors who wish to trade the commodity or use it as a hedge against economic uncertainty. If you want to get into the silver-trading game and need to know where to start, here's a quick primer on all the essential things you'll want to know.

Steps

Preliminary Steps

-

1Consider the kind of silver you’d like to buy. You can buy physical silver (scrap silver and bullion), paper silver (which buys you the rights to physical silver that you won’t have to store yourself) and silver futures, which is a way to bet on what you think silver will be worth in the future.

- If you want to own tangible silver, beware of bait-and-switch techniques where a seller offers papers that claim to grant you ownership of physical silver held elsewhere.

-

2Find a reputable dealer. To avoid scams and other unfavorable buying situations, find a reputable dealer. In the United States probably the best way to connect with a reputable dealer is viewing the list of recommended dealers on the US Mint's website. Type "coin dealer database US Mint" into your favorite search engine, and that will connect you to a page on the US Mint's website where you can search for national and local dealers that have been vetted by the Mint.[1]Advertisement

-

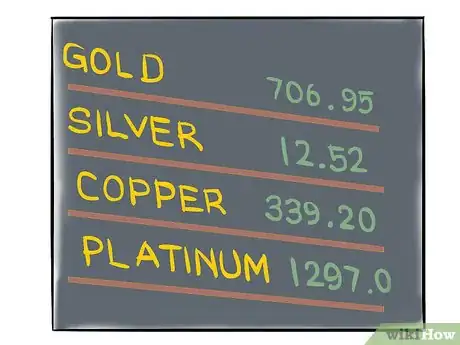

3Determine silver's market value. In financial markets there's something called a troy ounce that shows the price of a precious metal per raw ounce. Look up the current value to make sure a seller is not charging you considerably more than market price for silver. (A price slightly higher than market value would not be unusual, but you should be able to find silver at market price if you look hard enough.)

-

4Negotiate terms. In any sale of silver, there are often specific terms that need to be negotiated between seller and buyer. Without considering these issues, you may be selling yourself short when purchasing physical silver.

- If you are buying "paper" silver (documents granting silver ownership), determine how the seller holds the physical silver represented by the paper. For example, buyers have reported that commercial banks may offer paper representing physical silver, only to encounter frustrating delays and obstacles when the customers demand to receive actual silver.

- Discuss numismatic and raw values for silver. Some sellers offer silver coins as physical silver. In this kind of transaction it's important for the buyer to understand how numismatic (coin) value may affect a purchase. Without going over this critical detail, you could end up paying too much for your silver. (In other words, don't pay a numismatic price unless you specifically want coins, which typically fetch a higher price than bullion does.)

- Ask about premium fees. Some sellers (such as banks) charge extra fees for the sale of silver. This can cause a buyer to lose ground the moment they make a purchase. Demand that your seller honor a fair transaction value for silver so that you can see an immediate gain if the price of silver increases.

- Ask about buybacks. Some sellers will buy back physical silver that they sell to you, and others won't. Keep in mind that without a buyback agreement, you may suffer losses when you try to sell your silver if you cannot find a buyer who will honor fair market values based on the original sale price as well as current market realities.

-

5Get cost-basis information for tax filing. Another important step in buying silver or any other precious metal is to get documentation of your sale and the cost of the silver. This is so that you can declare your cost basis when you sell the silver in the future. Without this information, the federal IRS could cause problems with your sale when you pass the metal on to another buyer.

Buying Scrap Silver

-

1Know how to identify real silver. Genuine silver jewelry or silverware will be stamped with the number 800 or 925 or a promise that the silver is sterling (e.g., "Ster," "Sterling" or "Stg"). If you cannot find an identifying mark on your silver, here are three tests you can perform if you're trying to tell real silver from fake silver.

- Real silver rings. Either flick a silver coin into the air or tap it with another coin to produce a sound. The sound you should hear with silver is a ringing sound, high-pitched and bell-like. If you flip a 1932-1964 quarter (90% silver) and a post-1964 quarter (90% copper), you should hear the difference immediately.

- Real silver melts ice. Place an ice cube on a block of silver or a silver coin and watch the ice cube melt faster than it would if it were merely left out at room temperature. Silver melts ice quickly because it has very high thermal conductivity. In other words, ice "sucks" the heat out of silver.

- Real silver isn't magnetic. Get a rare-earth neodymium magnet. Tilt a silver bar at a 45° downward slope, and let the neodymium magnet slide down the bar. On real silver the magnet will make a slow descent down the bar. On non-silver materials, it will either stick to the top of the bar or slide down very quickly.

-

2Ask friends and family if they have any scrap silver they'd like to sell. Many people have broken or damaged silver jewelry that they’d be happy to sell at a reasonable price. Some may even give you things for free.

-

3Place ads. Use Craigslist, your local newspaper, or even your local radio station to make it known that you’re interesting in buying scrap silver.

-

4Watch for a fair deal. Ask around in the community before taking the first deal you see. (Online testimonials should be viewed with skepticism.) If a deal seems too good to be true, it probably is. Using the US Mint's list of recommended dealers is a good starting point.

-

5Find your own sources. Look at online auctions, garage sales, flea markets, thrift shops, and consignment stores. Online auctions will generally have higher prices, but the trustworthy ones will also have ways for you to verify that what you’re purchasing is actually silver. You can sometimes find hidden treasures in the bulk and miscellaneous baskets at second-hand shops – and for a fraction of what they’re worth.

- In particular, look for thick rings, broken jewelry, and silverware.

-

6Get to know local pawnshop owners. While pawn shops aren’t necessarily the first place you’ll want to go to find silver, getting to know the owners can provide you with a lot of valuable insights and possibly set you up with contacts. If you’re lucky, you’ll find a pawn shop that doesn’t have the resources or inclination to deal with scrap silver and will work out a deal to put you in touch with potential sellers.

-

7Look for silver in unexpected places. In addition to jewelry, silver can be found in circuit boards, old electronics, mobile phones, photographic plates and old cameras. Look for dead electronics in thrift shops and scrap yards or whenever a school or office building is upgrading its equipment.

-

8Break your silver down. Take out any non-silver components and collect all the silver pieces in sealable containers.

- Note that some jewelry will be worth more in an unaltered form than when broken down for scrap.

Buying Silver Coins, Bars or Rounds

-

1Think about investing in silver coins. Silver coins derive their value both from their silver content and the numismatic value of the coin. In most cases, numismatic value is the main component. What this means is that the characteristics of the coin — primarily its condition and the history attached to it — mean more to collectors than the actual value of the silver when determining price. For this reason many investors caution against investing in silver coins if you're not interested in numismatics at all.

- Because of the collectible nature of silver coins, their prices can be very volatile. In fact, their prices can shift dramatically due to market demands, often for reasons that have nothing to do with the price of silver. If you're going to invest in silver coins, be aware of this before embarking on your journey.

-

2Try your hand at investing in silver bars. Silver bars consist of almost pure silver. Because of this unique feature, they often trade at above-market price. You can find silver bars at major banks or bullion dealers.

- Silver bullion is effectively the same thing as silver bars. Bullion coins are made of precious metals, designed to store value instead of being used in commerce. As such, you can buy silver bullion coins if you're not committed to the notion of having silver bars.

- Silver bars come in different shapes and weights. 1 oz., 5 oz., 10 oz., 100 oz. and 1000 oz. bars are the standard, although there are certain manufacturers who design even lighter bars. What you need to know when thinking about weight is this: the smaller the bar, the higher the premium you'll pay per ounce. [2] So the best value is to buy larger bars.

-

3Consider investing in silver "rounds." A silver round is a cross between a bar and a coin. Like bars and bullion, rounds have no numismatic value. They look like coins, however, and usually contain a troy ounce of silver (1/12 of a pound). When purchased from a private manufacturer, they are often minted with a custom design.

Buying Silver without Physically Owning It

-

1Consider investing in an ETF. An exchange-traded fund is a mutual fund that tracks an index or commodity (like silver) but is traded like a stock. [3] While ETFs are similar to index funds, there is often no commission fee associated with the buying or selling of the ETF, unlike some index funds. [4]

- When you choose to invest in an ETF, you're not actually buying physical silver or even the right to redeem silver. Normally, you're just making a bet that the price of silver is going to rise. [5]

- If, on the other hand, you're convinced the price of silver is going to go down, or you simply want insurance in case the price of silver drops, you can also short sell ETFs.

- ETFs provide a very high level of liquidity, meaning that they can be cashed in quickly without substantially affecting their value.

-

2Consider investing in a mining company. It's a riskier proposition, but a potentially lucrative one. Consider these caveats, however:

- The price of a mining company's stock may go down even though the value of the commodity goes up. Even if the price of silver is appreciating, you could lose money on your investment if the mining company you invest in suffers from bad management or has a poor financial quarter. Investing in mining companies is risky.

- With greater risk comes potentially greater reward. If you can stomach the increased risk, or if you have an appetite for it, investing in mining operations can yield hefty rewards. [6]

Making the Most of Your Silver

-

1Know that owning physical silver is probably more useful than owning a non-physical security certificate. Physical silver -- coins, bars, bullion or rounds -- is widely used both as currency and in industrial manufacturing. This makes physical sliver more versatile than "paper" silver, though not necessarily as liquid. If you're planning on investing in silver, consider starting with the physical metal before venturing into other more-complex forms of ownership.

-

2Use silver as a hedge. In a time of economic uncertainty and slow growth, silver is an excellent hedge. A hedge is a strategy that reduces your risk of losses when the market fluctuates, usually by investing in an offsetting position. Silver is a good hedge against currency inflation. That's because if the value of currency drops, precious metals like silver and gold remain relatively stable or even increase in value.

-

3Don't buy on hope or sell on fear. Many buyers of silver and gold approach such an investment from the wrong angle: they buy when they notice the price going up (since the "value" is increasing), and they sell when they notice the price going down (when the "value" is diminishing). This is a classic violation of the first principle of investing — buy low and sell high.

- Think of things the other way around. Instead of buying when everyone else is confident, and the price of silver is high, buy when everyone else is worried, and the price of silver has dropped. Instead of buying when prices are high, that's the time to be selling. Instead of selling when prices are low, that's the time to be buying. Although this is an emotionally difficult path to tread, it's the best way to make money over time.

- Take a look at a historical graph of silver prices. Over the last few decades the price of silver has periodically fallen to about $5 an ounce. [7] If you can afford to wait until silver falls to that level again, invest in it at that time. When economic times are uncertain and the price of silver goes up, unload your silver for a hefty profit, or keep it as a hedge against currency depreciation.

-

4Remember that the silver market is very volatile. [8] If you're not ready for a rollercoaster ride when you buy silver, perhaps it isn't the right investment for you. Of course, if you happen to buy silver when it's bottomed out, most of the future volatility will be to the upside . Even then, however, expect tortuous price fluctuations as consumer sentiment and monetary policy change periodically.

Community Q&A

-

QuestionIs it a good time to invest in silver?

DonaganTop AnswererWe don't know what the spot price will be a day or a year from now, so it's hard to say. However, precious metals are often considered a good inflation hedge, so in that sense, it's always a good time to buy silver.

DonaganTop AnswererWe don't know what the spot price will be a day or a year from now, so it's hard to say. However, precious metals are often considered a good inflation hedge, so in that sense, it's always a good time to buy silver. -

QuestionAre there tax consequences when selling silver bars vs. rounds vs. coins?

DonaganTop AnswererYou will pay ordinary income tax on any profit you make in selling silver no matter which form it takes.

DonaganTop AnswererYou will pay ordinary income tax on any profit you make in selling silver no matter which form it takes. -

QuestionHow do I sell silver bullion?

DonaganTop AnswererGo to a local coin dealer, or search for an online broker who deals in precious metals. There are many. Just search for "silver brokers."

DonaganTop AnswererGo to a local coin dealer, or search for an online broker who deals in precious metals. There are many. Just search for "silver brokers."

References

- ↑ https://catalog.usmint.gov/bullion-dealer-locator

- ↑ http://goldsilver.com/article/how-to-buy-silver-bars-(3)/

- ↑ http://www.investopedia.com/terms/e/etf.asp

- ↑ http://www.forbes.com/sites/mitchelltuchman/2013/06/28/what-is-an-etf-three-simple-answers/

- ↑ http://www.bankrate.com/finance/investing/buying-and-selling-silver-1.aspx

- ↑ http://www.bankrate.com/finance/investing/buying-and-selling-silver-2.aspx

- ↑ http://silverprice.org/silver-price-history.html

- ↑ http://theeconomiccollapseblog.com/archives/silver-at-less-than-19-dollars-an-ounce-are-you-kidding-me

About This Article

To buy silver, your best bet is to go through a reputable dealer so you don't have to worry about being scammed or charged an unfair price. If you live in the United States, you can find a list of reputable dealers by visiting the U.S. Mint's website. However, if you're just looking to buy scrap silver, you can try looking for ads online, asking friends or family, or putting an ad in your local newspaper. You can even find scrap silver in items at garage sales and thrift stores. For more tips, like how to invest in silver without actually owning it, scroll down!