This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

This article has been viewed 64,995 times.

Learn more...

If you own and operate a business in the state of Nevada and wish to obtain a gaming license for the operation of gaming devices within your business, you will need to apply with the Nevada Gaming Commission and State Gaming Control Board. This board is responsible for issuing and regulating gaming licenses within the state. In order to get a gaming license in Nevada, you will be required to fill out an application, as well as provide detailed information about your business.

Steps

Obtaining a Restricted License

-

1Determine the needs of your business. If you run a business and would like to supplement your income with slot machines, a restricted license may work for you. With a restricted license, you can have up to 15 slot machines. The slot machines cannot be your primary business. Factors that the Gaming Control Board and Gaming Commission may consider include:

- The amount of floor space for your slot machines compared to the amount of floor space for your primary business

- The investment in the slot machines compared to the investment in your primary business

- The time you spend managing the slot machines compared to the time spent managing your primary business.

-

2Decide if your business is suitable. If your primary business is a bar, tavern, saloon, restaurant with a separate bar area, liquor store, grocery store, convenience store or drug store, it will be pretty easy to get a restricted license. If you have some other type of business like a laundromat or gas station, it will be more difficult to get your application approved. The commission can reject your application if they find your location unsuitable.

- If your business sells alcohol by the drink, you will have to meet other requirements related to the size of your business and your kitchen operation.

- If your business is located near a school, church, playground, or has a lot of minors as patrons, it may be unsuitable.

Advertisement -

3Complete your application. The application for a restricted license includes your personal history, financial information, and a criminal background check. The application is very extensive and requires multiple forms. Many people have a gaming attorney help them navigate the application process. Visit the Nevada Gaming Control Board and Gaming Commission website to access all of the necessary forms

- Form 1: A two page document that details your identify and the type of license you need. You will enter your name, mailing address, and the gaming devices you plan to offer.

- Form 2: All the names of your partners, directors, shareholders, and bonus and profit sharing information.

- 12 page personal history questionnaire: This form requires 3 character references, your name, age, citizenship, previous residences, family information, arrests, litigations, detentions, military record, and a 25 year employment history.

- Form 20: Your financial status including the revenue you will invest, the source of revenue, and if you will play an active role in managing the gaming activities.

- Form 15: Information about the location of your primary business, the maximum number of patrons you can have, your business hours, if any of your customers will be minors, the original floor plan, 3 pictures of your business, and a copy of the lease or deed.

- Form 27: Determines if the slot machines are secondary to your primary business

- Forms 10, 17, 18, 28, and 28A give the Board permission to conduct a criminal background check and access your financial information.

-

4Pay your application fee. You must pay a $150 application fee and a $550 investigation fee. These fees are non-refundable. You may also have to pay other investigative fees or make a deposit before the investigation begins.

- You may receive a refund at the end of the process.

-

5Attend your public hearing. Once the Board has reviewed your application and completed their investigation, you will be notified about your public hearing. The Board may or may not request that you attend the hearing. Do not worry if you are asked to appear, the Board may simply need additional information.

- Show up to your hearing on time, but be prepared to wait for a few hours.

- It typically takes 6 to 8 months to go from filing your application to having your hearing. This time frame may vary depending on the complexity of your application and the workload of the Board and Commission.

- After your hearing, your application may be accepted, denied, approved with conditions, or referred back to the Board.

Obtaining a Non-Restricted License

-

1Determine if you need a license. If you own a casino or manufacture and/or distribute gaming devices, you will need to obtain a non-restricted license. If you are an owner in a publicly traded company, you will not need a license unless you own more than 10% of the company. However, if you are a shareholder in a private company, you will need to obtain a license.[1]

- Some officers and directors of public companies (e.g. president, secretary, chief financial officer, chief executive officer) will need a license.

-

2Work with a gaming attorney. It will be very difficult to go through the application process alone. A gaming attorney will serve as the point person for the application process, prepare and review your documents, present your case before the Board and Commission, and guide you through the investigation.[2]

- A gaming attorney will also make the process quicker. A quicker process will save you money on investigative fees.

-

3Complete your application. The application is very long and extensive. The first 45 pages will detail your personal information history, employment history, residential information, criminal background, civil litigation, and your licensing background. The next 20 pages details your financial information such as your tax information, bankruptcy disclosures, salary, assets, liabilities, and the source of your investment in your business. Other documents you must file include:[3]

- Third party request for banks and employers to release information

- Fingerprint cards

- A form that releases the regulators from any liability from the investigation

- A personal history disclosure form

- A $500 check

-

4Pay your fees. The Gaming Control Board charges $70 per hour to review your application and investigate your background. A simple investigation costs around $30,000, and a complex investigation can cost over a million dollars. You will receive an estimate of the fees you will be required to pay. The investigation will not begin until you have paid all of your fees.

-

5Attend your opening interview. Early in the investigation process, the agents assigned to your application will request an opening interview with you. During this meeting, the agents will explain the investigation process to you and ask you any additional information about your application.

- This interview is an opportunity to discuss any matters that you failed to disclose in your application. Be honest and do not provide false information. This can come back and hurt you if the investigation uncovers different information.

- This interview takes about 2 or 3 hours.

-

6Give your agent any requested documentation. Your agent will make a written request for some documentation. This typically happens around the time of your opening interview. The documentation may include:

- Your birth certificate

- Your passport

- Your last will and testament

- Any federal, state, county, or city licenses that you hold

- Your current employment and/or stock option agreements

- Copies of any litigation or arbitration that you are involved in and an explanation of the events leading up to this

- 5 years’ worth of income tax returns

- 5 year record of bank account

- Escrow and appraisal documents

- Retirement fund statements

- Lines of credit for the last 5 years

- License and registration for your vehicles

-

7Attend your Board hearing. Both you and your gaming attorney should attend the hearing. The attorney will give an opening and closing statement and present your case. This is also the time for you to address any concerns that the investigative agents have identified. The Board will then approve with or without conditions, deny, or recommend a continuation.[4]

- If your application is approved by the board, the Commission hearing will take place in 2 weeks later. You will attend the Commission hearing as well.

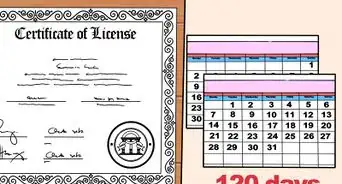

- The Commission must make a decision about your application within 120 days.

Paying Your Fees and Taxes

-

1Request all license tax forms at the time of application. All businesses with gaming licenses will be subject to taxation within the state of Nevada. All businesses will be required to file a monthly gross revenue report, a live entertainment tax report, slot machine voucher reports, a fiscal year report of slot machine taxes, a report of quarterly state gaming license fees, and an annual state license report based on the number of games to be operated. All filing deadlines can be found on the Nevada Gaming Commission and State Gaming Control Board website.

-

2Know the fees for a restricted license. You are required to pay an annual tax and a quarterly license fee. The annual tax is $250 per machine. If you do not have the machine for the entire year, the tax will be prorated based on the month the machine went into operation. The quarterly license fee will vary depending on the number of machines you have.[5]

- Quarterly license fees range from $81 to $1,815.00.

-

3Know the fees for a non-restricted license. You are required to pay a separate annual tax and quarterly licensing fee for slot machines and games. You can prorate some of the fees if you have a non-restricted license. For slot machines, the annual tax is $250 per machine, and this fee can be prorated. The quarterly license fee for a slot machine is $20 per machine and cannot be prorated. The annual license fee for games depends on the number of games you have. Prices range from $100.00 to over $16,000. Quarterly license fees for games range from $12.50 to over $20,300 depending on the number of games you have.

- You will also be required to pay a monthly percentage fee and a live entertainment tax if applicable.

Community Q&A

-

QuestionHow can I get a gaming license?

Community AnswerStart by consulting with a gaming attorney and visiting the website of your state gaming commission.

Community AnswerStart by consulting with a gaming attorney and visiting the website of your state gaming commission. -

QuestionHow long is the registration good for in Las Vegas?

Community AnswerYour license must be renewed the first day of January, and all quarterly state gaming licenses must be renewed on the first day of each calendar quarter thereafter.

Community AnswerYour license must be renewed the first day of January, and all quarterly state gaming licenses must be renewed on the first day of each calendar quarter thereafter. -

QuestionCan I get a gaming license if I am a green card holder?

Community AnswerYes, you can. You will need to disclose all of your information on your application.

Community AnswerYes, you can. You will need to disclose all of your information on your application.

References

- ↑ http://www.lrrlaw.com/files/Uploads/Documents/Obtaining%20Nonrestricted%20Gaming%20License.pdf

- ↑ http://www.lrrlaw.com/files/Uploads/Documents/Obtaining%20Nonrestricted%20Gaming%20License.pdf

- ↑ http://www.lrrlaw.com/files/Uploads/Documents/Obtaining%20Nonrestricted%20Gaming%20License.pdf

- ↑ http://www.lrrlaw.com/files/Uploads/Documents/Obtaining%20Nonrestricted%20Gaming%20License.pdf

- ↑ http://gaming.nv.gov/index.aspx?page=94