X

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 22,658 times.

All states require business owners who sell taxable merchandise or services to the general public to get a seller's permit and file sales tax returns.[1] If you've decided to close your business, you must cancel your seller's permit. You also have a number of other steps to take that can take months to complete.[2]

Steps

Part 1

Part 1 of 3:

Canceling Your Seller's Permit

-

1Determine your closeout date. Your closeout date determines your last day of business and the day your seller's permit will be cancelled, which may be after you file your application.

- If you don't specify a closeout date, your seller's permit typically will be cancelled on the date you file your notice with the office that issued your permit and you won't be able to sell any more products or services.

-

2Liquidate your business assets and sell off inventory. Follow your state's procedures for selling inventory and assets associated with your business prior to canceling your permit.

- Your seller's permit allows you to sale taxable goods and services. Keep in mind that in many states the sale of your fixtures or other business equipment is considered a taxable sale.

- In some states you can continue to sell merchandise or other items after you cancel your seller's permit, but you must collect, report, and pay the state sales and use tax on those items.

- You may want to consider having a "going out of business" sale that's open to the general public to get rid of your inventory. If you simply sell all of your inventory to another business, you may have to comply with additional bulk sales laws.[3]

Advertisement -

3Contact the office that issued your seller's permit. You must cancel your seller's permit with the government agency that originally issued it, typically by filling out a form.

- You can call or check the website of the department or office that issued your seller's permit to find out what the procedure is for canceling your permit.

- Most states have cancellation forms available for download on the website of the department that issues seller's permits.

-

4Fill out your form. Include all necessary information to ensure prompt and efficient cancellation of your permit.

- On the form, provide your contact information as well as the address where your business records are being kept.

- The form also typically requires information such as the date you stopped being actively engaged in business and the reasons why, how you disposed of your inventory and other business assets, any assets or inventory you retained.

-

5Submit your form. When you've completed your form you typically must mail it to the state tax office, although some states allow you to submit the form online.

- The address probably is located either on the form or the instructions accompanying it. If you have to mail your form, consider using certified mail or another trackable service so you know when it is received.

- Once you submit your form it will be reviewed by staff in the office. As long as everything is complete and all required information has been included, your permit will be cancelled.

-

6File your final tax return. Once your seller's permit is cancelled you are responsible for filing a final sales tax return with your state.

- In your final return you must report all sales up to the closeout date you specified. This includes sales of fixtures, equipment, or other business assets.

- You must pay all taxes before your closeout will be finalized. Using a certified check or money order may expedite the process.

-

7Report and pay use tax. In some situations, if you convert equipment or other items you purchased for your business for your own personal use, you must pay a use tax.

- You should consider working with a CPA to dispose of your business assets, particularly if you plan to convert a business asset to personal use for which you previously were claiming a deduction.

Advertisement

Part 2

Part 2 of 3:

Resolving Your Finances

-

1Collect outstanding customer accounts. If you have any customers who owe you money for products or services already delivered, those accounts should be paid in full before you close your business.

- Keep in mind that if you have customers who owe you money, you may want to try to collect as much as you can before you announce that you're going out of business. Once you've closed, it may be significantly more difficult to collect.[4]

-

2Close supplier, vendor, and service accounts. You must notify and cancel any contracts you have with other businesses that supply the goods and services you need to operate your company.

- For example, if you have contracts or subscriptions for utilities, phone service, or internet and web hosting, these companies need to know when to shut off those services and where to send the final bill.[5]

- If you have suppliers, you'll also want to let them know when to cut off deliveries and when final payments will be made.[6]

- If you lease business space, you'll want to check your lease and find out how much notice you must give the landlord to break the lease and pay any required fees. Typically you must provide at least 30 days' notice.[7]

- If you plan to use the space through the end of the lease, make sure your landlord has contact information so he or she can refund your deposit.[8]

-

3

-

4Notify your creditors. If your business has any outstanding debts, you must let the companies holding those debts know that the business is closing and how to contact you.

- After you've notified creditors that you are closing your business, make plans either to pay any debt in full or to settle out and close the account. Whatever arrangements are made, make sure you get confirmation of that agreement in writing.[11]

- If you are unable to pay the debts through the business's receipts and assets, you might consider filing for bankruptcy to protect your personal assets.[12]

-

5Notify and pay your employees. You should check your state law to determine how much notice, if any, you're required to give your employees that you're closing your business.

- Generally, you must give your employees at least two weeks' notice.[13] If you don't want to lose employees during the final months you are in operation, you may want to wait as long as possible to let employees know, or provide a retention bonus for employees who are willing to stay until the last day of business.

- Make sure you've paid all required employment-related taxes as well, since the IRS can hold you and any other business owners personally liable for any outstanding payroll taxes.[14]

-

6Close your business accounts and credit cards. After you've received all payments and settled all debts, you should permanently close all of the business's financial accounts.[15]

- Closing the accounts eliminates potential liability in the event a card or account number is lost or stolen.

- Make sure you've set aside some money to pay any creditors whose accounts you may have overlooked when you were settling your finances.[16]

-

7Close your IRS account. After you've filed your final taxes, you should write to the IRS if you've closed your business and will no longer need your employer identification number (EIN).[17]

- Keep in mind that the IRS can't cancel your EIN. The number is assigned to your business entity and will not be reassigned to another entity. You also cannot reuse it if you later decide to start a different business – you'll have to apply for another EIN.[18]

- When you're ready to close your account, write a letter to the IRS with the complete legal name of your business, the business's legal address, the assigned EIN, and the reason you wish to close your account.[19]

- If you have your EIN assignment notice you should send that along with your letter. Make a copy for your records before you mail it, and send it to Internal Revenue Service, Cincinnati, Ohio, 45999.[20]

Advertisement

Part 3

Part 3 of 3:

Closing Your Business

-

1File dissolution documents. If you've organized your business as a corporation or an LLC, you typically have to file dissolution documents with your state's secretary of state to close the company.

- Keep in mind this requirement typically doesn't apply to sole proprietorships, but it may apply to partnerships even if you haven't incorporated the business.[21]

- Typically you'll have to close your business or partnership according to the guidelines you established in your articles of organization or operating agreement, which you also filed with the state.[22]

- Check your state law to make sure you're following the correct steps to legally dissolve your corporation or LLC. If you fail to meet these requirements, you will continue to be liable for the company's taxes and filings even if you're technically no longer in business.[23]

-

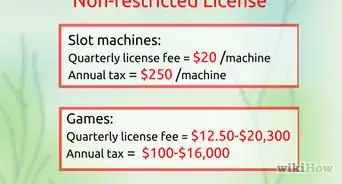

2Cancel all licenses and permits. In addition to your seller's permit, canceling any other permits or licenses that were issued to the business protects you from further liability.[24]

- Unfortunately, you will have to contact each government office individually and go through distinct processes to cancel each license or permit you had for your business.[25]

- If you don't cancel all your licenses or permits, you will continue to be charged annual fees and must fulfill any other maintenance requirements such as quarterly reporting.[26]

- Contact the department or agency that issued each license to find out how you can cancel it or close it out.[27] In some cases you may owe fees, or you may be issued a refund.

- Keep in mind that some agencies charge an additional processing fee if you're canceling an active license before its expiration date.

-

3Abandon your business name. Even if you weren't registered as a corporation or LLC, if your business name was filed with your state's secretary of state and you've closed your business, you should release it.[28]

- In addition to filing a statement with the state government abandoning the name, most agencies also require you to post a notice of abandonment in a local newspaper for several weeks.[29]

Advertisement

References

- ↑ http://www.nolo.com/legal-encyclopedia/checklist-closing-business-20-things-29027.html

- ↑ http://www.nolo.com/legal-encyclopedia/checklist-closing-business-20-things-29027.html

- ↑ http://www.nolo.com/legal-encyclopedia/checklist-closing-business-20-things-29027.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/closing-business-what-you-need-30264-2.html

- ↑ https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Canceling-an-EIN-Closing-Your-Account

- ↑ https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Canceling-an-EIN-Closing-Your-Account

- ↑ https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Canceling-an-EIN-Closing-Your-Account

- ↑ https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Canceling-an-EIN-Closing-Your-Account

- ↑ http://www.nolo.com/legal-encyclopedia/checklist-closing-business-20-things-29027.html

- ↑ https://www.sba.gov/content/steps-closing-business

- ↑ https://www.sba.gov/content/steps-closing-business

- ↑ http://www.nolo.com/legal-encyclopedia/free-books/small-business-book/chapter12-13.html

- ↑ http://www.nolo.com/legal-encyclopedia/free-books/small-business-book/chapter12-13.html

- ↑ http://www.nolo.com/legal-encyclopedia/free-books/small-business-book/chapter12-13.html

- ↑ http://www.nolo.com/legal-encyclopedia/free-books/small-business-book/chapter12-13.html

- ↑ http://www.nolo.com/legal-encyclopedia/free-books/small-business-book/chapter12-13.html

- ↑ http://www.nolo.com/legal-encyclopedia/free-books/small-business-book/chapter12-13.html

- ↑ https://www.sba.gov/content/steps-closing-business

About This Article

Advertisement