This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 121,447 times.

Do you have an old car sitting around in your driveway or backyard that you haven't driven in years? Even one that doesn’t run? Or do you have a new car you don’t need anymore? Instead of letting it rot away in your driveway, do some good by donating your car to the Salvation Army. There is no cost to you for donating.[1] The SA will use the car to help people in your community, and you can receive a tax deduction for the donation.

Steps

Scheduling the Donation

-

1Read the Internal Revenue Service’s (IRS) “Donor’s Guide to Vehicle Donation.”[2] If you plan to claim a tax deduction for donating your car, make sure to read this publication ahead of time. It explains all of the IRS regulations regarding the donation of cars and other vehicles, and how to claim a deduction, if applicable.

- You can find this form by searching its title on the IRS website.

- You may also want to talk to a tax advisor beforehand about your plans to make a vehicle donation.

-

2Visit the Salvation Army donation website.[3] Specific information on how to donate a car will vary depending upon your location and the Salvation Army center you will be working with. By visiting the SA donation website, you can enter your ZIP code and find this information.

- You can also call the Salvation Army at 1-800-SA-TRUCK (1-800-728-7825) to arrange a car donation.

- In the US, the SA is divided into four regions, one each for the central, eastern, southern, and western states. Each region provides distinct information for tax purposes.

- If your car is subject to a loan, it will most likely have to be settled before the vehicle can be donated. Contact the SA for details.

Advertisement -

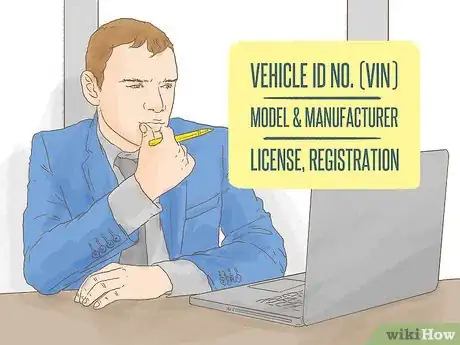

3Enter information related to your car.[4] You can begin the process of donating your car online through the Salvation Army donation website, or over the phone. You will need to enter information about your car, including:

- The car vehicle identification number (VIN). This can usually be found at the bottom of the windshield on the driver’s side, and in a few other locations (check your car’s owner’s manual for details).

- The car’s manufacturer and model name, year of production, and color

- The current license plate number

- The address on the car's registration

-

4Specify when you want the car to be picked up.[5] The Salvation Army is happy to come and pick the car up from you, saving you time and trouble. You can select a preferred time (morning, afternoon, evening, or anytime) for the pickup when entering your information on the SA donation website, or over the phone.

- If you have any special notes about the pickup (for example, “beware of dog,” or “garage is in the backyard”), you will have the opportunity to give these as well.

-

5

-

6Clean out your car. Wash it, vacuum the inside, and make sure to remove any personal items from the car so that it is ready to be picked up. It's not mandatory, but if you're donating it already, why not do some extra good and make it look nice?

-

7Have the Salvation Army pick up your car. The SA will visit your home at the scheduled time to pick up the car. You will turn over the keys and signed the title, and SA workers will answer any questions you may have.

-

8Receive your tax-deductible receipt when the car is picked up.[8] When the Salvation Army comes to pick up your car, they will provide you with a receipt that you can use when filing your taxes in order to receive a deduction. Additional information to be used when filing your taxes will be mailed to you by the SA once your vehicle is sold.

- Make sure to record the car’s odometer reading when the SA comes to pick it up. You will need this later to claim your deduction.

Getting your Tax Deduction

-

1Read and understand IRS regulations regarding vehicle donations.[9] The IRS monitors vehicle donations to make sure that donors get the right tax benefit, and to prevent fraud. Regulations regarding vehicle donations may change from year to year. You can find the most up-to-date information on the IRS website.

- You can reread the regulations concerning vehicle donations in the IRS publication “Donor’s Guide to Vehicle Donation.”[10]

- The Salvation Army has also published a legal memorandum on tax exemptions.[11]

- Currently, you can only itemize deductions (such as for donating a vehicle) on Schedule A of IRS Form 1040.[12]

- If you have questions or would like assistance in getting a deduction for donating your vehicle, contact a tax advisor.

-

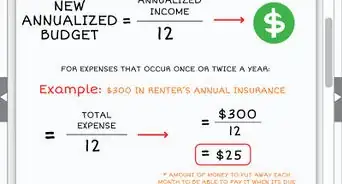

2Determine the sale price of your car. The tax benefit you receive will be based on the amount the Salvation Army sells your car for.[13] Operable vehicles are auctioned each month using the SA’s online car auction, which usually leads to high sale prices. Within 30 days, the SA will mail you information regarding the sale for you to use for tax purposes.

- If your vehicle is not operable, the SA will pick it up and mail you information regarding its salvage price within 30 days.

- Generally, the IRS will only allow a deduction of the price the car is actually sold for by the Salvation Army.[14] In rare cases, you may be able to deduct the fair market value of the car (for example, if the SA makes repairs or other improvements to the vehicle before selling it).

-

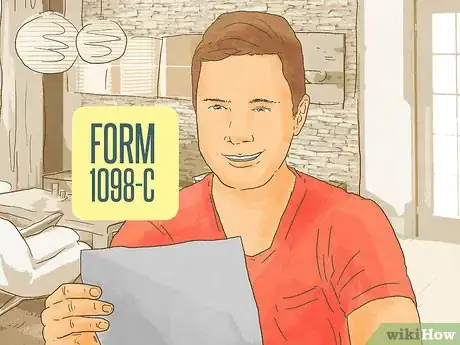

3Obtain IRS form 1098-C.[15] This form is used to claim your deduction. You can obtain form 1098-C from the IRS website, a tax advisor, or an automated tax preparation software program. There will be four copies of form 1098-C: one copy will go to the IRS, one to you, one to your records, and one to the donee (the Salvation Army, in this case).

- Detailed instructions are included with form 1098-C. Read them and make sure you completely understand them. If you have questions, contact a tax advisor or preparer.

-

4Complete form 1098-C and include it with your tax return.[16] If you use automated tax preparation software or a third-party tax preparer, then the form will be submitted for you. If you prepare and send your own tax forms, make sure to include the completed form 1098-C with your return for the year you donate the car. In order to complete form 1098-C, you will need information including:

- Your name, address, and tax ID number

- The make, model, year, VIN, and odometer reading of the car you donated

- The date of the sale (this information will be mailed to you by the Salvation Army)

- The amount the car was sold for (this information will be mailed to you by the Salvation Army)

- A statement on how the car was used for charity (for example, selling it to raise funds for a rehabilitation program). The Salvation Army will provide you information about this, but you can contact them if you have questions.

References

- ↑ http://easternusa.salvationarmy.org/use/car-donations/

- ↑ https://www.irs.gov/pub/irs-pdf/p4303.pdf

- ↑ https://satruck.org/?_ga=1.215727575.1977360724.1445265790&cm_mc_uid=04241325096914452657903&cm_mc_sid_51410000=1445265790

- ↑ https://satruck.org/?_ga=1.215727575.1977360724.1445265790&cm_mc_uid=04241325096914452657903&cm_mc_sid_51410000=1445265790

- ↑ https://satruck.org/?_ga=1.215727575.1977360724.1445265790&cm_mc_uid=04241325096914452657903&cm_mc_sid_51410000=1445265790

- ↑ https://satruck.org/?_ga=1.215727575.1977360724.1445265790&cm_mc_uid=04241325096914452657903&cm_mc_sid_51410000=1445265790

- ↑ http://easternusa.salvationarmy.org/use/car-donations/

- ↑ http://easternusa.salvationarmy.org/use/car-donations/

- ↑ https://www.irs.gov/charities-non-profits/charitable-organizations/irs-guidance-explains-rules-for-vehicle-donations

- ↑ https://www.irs.gov/pub/irs-pdf/p4303.pdf

- ↑ http://national.use-salvationarmy.org/downloads/SalArmyTaxExemption.pdf?cm_mc_uid=27348329425414452657739&cm_mc_sid_51410000=1445265773

- ↑ https://www.irs.gov/pub/irs-pdf/p4303.pdf

- ↑ http://easternusa.salvationarmy.org/use/car-donations/

- ↑ https://www.irs.gov/pub/irs-tege/final_press_release_on_cars_6-3-05.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f1098c.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f1098c.pdf

- ↑ http://easternusa.salvationarmy.org/use/car-donations/

About This Article

To donate your car to the Salvation Army, start by going to the Salvation Army donation website or calling them at 1-800-728-7825. Next, give them information about your car, including the VIN number and license plate number, and schedule a pick up time. Then, make sure to remove any personal items from the car before the Salvation Army workers come to pick it up. When they arrive, turn over the keys and signed title to receive a tax deductible receipt. For more tips from our Finance reviewer, including how to claim a tax deduction for your car, read on!