This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 122,125 times.

Taxpayers in the United States pay federal income tax according to how much taxable money they make each year. The tax bracket, listed in a tax table or tax schedule, tells you approximately how much tax you will pay. It is important to note that your tax bracket is not the percentage of your income that you will pay in taxes. The actual amount you will pay in taxes is found through a formula when you complete your annual tax filing. However, by finding your taxable income and tax bracket, you will be able to ballpark your taxes and properly evaluate certain financial decisions.

Steps

Estimating Your Income

-

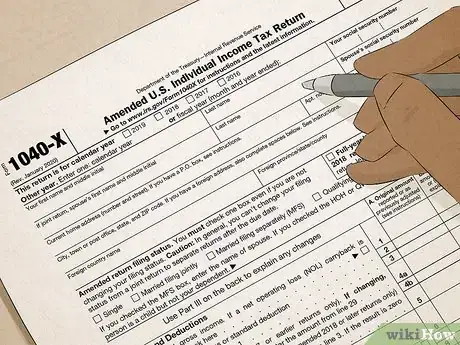

1Use the correct form. In order to determine your taxable income, start by selecting the correct IRS 1040 form to file with. See the IRS website for more information.

- Note that there are certain types of income, like long-term capital gains, qualified dividend income, Section 1250 depreciation recapture, and self-employment income, that will be taxed at a different rate than your marginal federal tax rate

-

2Estimate your adjusted gross income. Your adjusted gross income will be the amount you will make in the current year, minus any pre-tax adjustments to your income, like deductible traditional IRA or 401 K contributions. Check your pay stubs, last year's W-2 or last year's tax return to get a more accurate estimate for the money you're likely to make.Advertisement

-

3Figure out your deductions. If you plan to itemize your deductions, you may want to do a general estimate based on last year's return, if your expenses are similar. If you don't plan to itemize your deductions, determine your standard deduction amount based on official IRS standards.

- Standard deduction amounts change from year to year, and you'll always need to double-check against the official IRS numbers.[1]

-

4Subtract your deductions. Once you've subtracted your deductions from your adjusted gross income, the result is your taxable income. You will use this figure to determine your tax bracket.

Choosing a Bracket

-

1Determine your filing status. The IRS establishes different tax bracket depending on your filing status. Your filing status is where you indicate whether you are filing as a single person, a married couple filing jointly, a married couple filing separately, a qualified widow, or head of household.[2]

- Figure out your filing status, then scroll down until you see the taxable income amount you calculated in the first section, and learn what percentage of that income will be taxed.

-

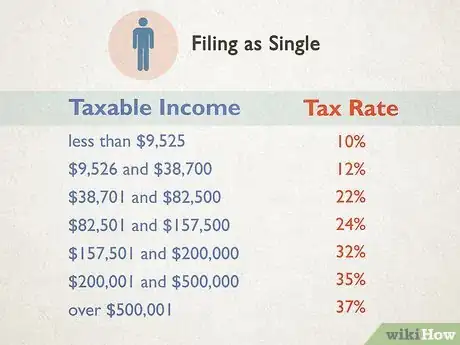

2Determine if you are filing as single. Use the "Single" filing status if you are unmarried, divorced, or legally separated as of the last day of the current tax year. If your taxable income is:[3]

- Less than $9,525, your tax bracket is 10%

- Between $9,526 and $38,700, your tax bracket is 12%

- Between $38,701 and $82,500, your tax bracket is 22%

- Between $82,501 and $157,500, your tax bracket is 24%

- Between $157,501 and $200,000, your tax bracket is 32%

- Between $200,001 and $500,000, your tax bracket is 35%

- Over $500,001, your tax bracket is 37%

-

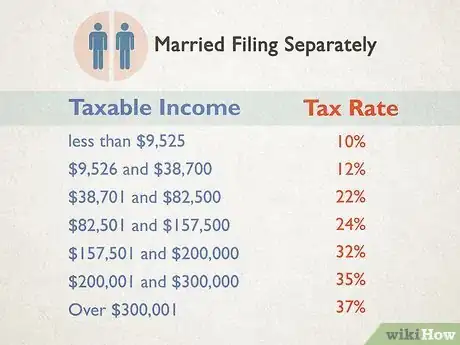

3Figure out if you are filing as married filing separately. If you are married but will not file taxes with your spouse, use this filing status. If your taxable income is:[4]

- Less than $9,525, your tax bracket is 10%

- Between $9,526 and $38,700, your tax bracket is 12%

- Between $38,701 and $82,500, your tax bracket is 22%

- Between $82,501 and $157,500, your tax bracket is 24%

- Between $157,501 and $200,000, your tax bracket is 32%

- Between $200,001 and $300,000, your tax bracket is 35%

- Over $300,001, your tax bracket is 37%

-

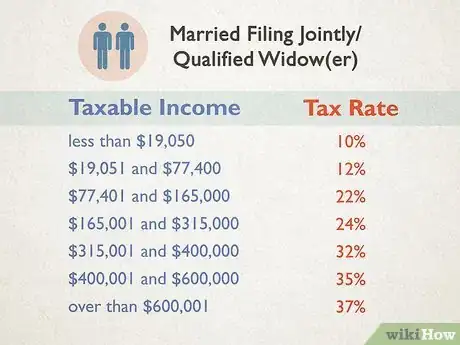

4Figure out if you are filing as married filing jointly or as a qualified widow(er). Use the "Married" filing status if you plan to file your taxes jointly with your spouse. This means you will use your combined income as the determination of your tax bracket. You can also use this bracket if your spouse died during the current tax year. Use the "Qualified Widow(er)" if your spouse died in the previous tax year, you filed jointly the year before, and have at least one dependent. If your taxable income is:[5]

- Less than $19,050, your tax bracket is 10%

- Between $19,051 and $77,400, your tax bracket is 12%

- Between $77,401 and $165,000, your tax bracket is 22%

- Between $165,001 and $315,000, your tax bracket is 24%

- Between $315,001 and $400,000, your tax bracket is 32%

- Between $400,001 and $600,000, your tax bracket is 35%

- Over $600,001, your tax bracket is 37%

-

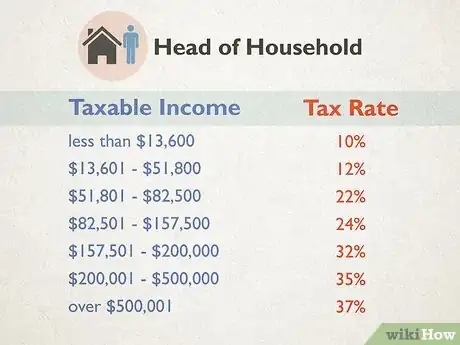

5Determine if you are filing as a head of household. Use the "Head of Household" filing status if you are unmarried, have at least one dependent living with you and if you provide over half of the money required to keep up your household. You can also file for this if you provide over half the income for the household, have at least one dependent and your spouse did not live with you for the last six months of the year. If your taxable income is:[6]

- Less than $13,600, your tax bracket is 10%

- Between $13,601 and $51,800, your tax bracket is 12%

- Between $51,801 and $82,500, your tax bracket is 22%

- Between $82,501 and $157,500, your tax bracket is 24%

- Between $157,501 and $200,000, your tax bracket is 32%

- Between $200,001 to $500,000, your tax bracket is 35%

- Over $500,001, your tax bracket is 37%[7]

Expert Q&A

-

QuestionWhat tax would I pay for a long-term capital gain if I am in the 15% tax bracket?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant The 2017 Tax Cuts and Jobs Act changed the tax brackets. Those who were previously in the 15% tax bracket are likely in the 12% bracket now. For taxpayers in the 10% and 12% tax brackets under the new tax law, they are taxed at a 0% on long term capital gains.

The 2017 Tax Cuts and Jobs Act changed the tax brackets. Those who were previously in the 15% tax bracket are likely in the 12% bracket now. For taxpayers in the 10% and 12% tax brackets under the new tax law, they are taxed at a 0% on long term capital gains. -

QuestionIs this information current for the 2018 federal tax filing year?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant Yes, this information has been updated for the 2018 federal tax filing year.

Yes, this information has been updated for the 2018 federal tax filing year. -

QuestionIs social security income taxable?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant Whether or not your social security is taxable for federal income tax purposes depends on what your total income level for the year is. As much as 85% of your social security benefits may be subject to federal income tax.

Whether or not your social security is taxable for federal income tax purposes depends on what your total income level for the year is. As much as 85% of your social security benefits may be subject to federal income tax.

Warnings

- The US tax brackets change from year to year. You will need to consult your tax preparation expert or IRS.gov for up to date information at the end of each tax year.⧼thumbs_response⧽

- Do not calculate your taxes from your tax bracket percentage. The bracket rates described in this article are marginal rates. As such they are applied only to the income that falls within that “bracket” of taxable income, then all taxes so calculated are added up to get the total.⧼thumbs_response⧽

References

- ↑ http://www.irs.gov/publications/p501/ar02.html

- ↑ http://www.bankrate.com/calculators/tax-planning/1040-form-tax-calculator.aspx

- ↑ https://www.nerdwallet.com/blog/taxes/federal-income-tax-brackets/

- ↑ https://www.nerdwallet.com/blog/taxes/federal-income-tax-brackets/

- ↑ https://www.nerdwallet.com/blog/taxes/federal-income-tax-brackets/

- ↑ https://www.nerdwallet.com/blog/taxes/federal-income-tax-brackets/

- ↑ https://www.fidelity.com/taxes/tax-brackets

- ↑ https://www.fidelity.com/taxes/tax-brackets

- ↑ https://www.fidelity.com/taxes/tax-brackets