This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow's content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 14,645 times.

Learn more...

If you own a business in Australia, you must report and pay your business taxes to the Australian Taxation Office (ATO) using a Business Activity Statement (BAS). How you complete your BAS depends generally on your business registrations and whether you lodge your statement monthly or quarterly. The ATO will send you a BAS to complete a few weeks before the deadline for you to lodge it.[1]

Steps

Organizing Your Financial Records

-

1Maintain accurate business records. If you don't have an accountant, record all your business sales and purchases on a daily basis. This will make it easier to complete your BAS. It will also help ensure that you don't miss anything that requires you to make a correction or adjustment.[2]

- If you're keeping your books on your own, you can use accounting software to make it easier to record transactions.

-

2Open a separate account for your Goods and Services Taxes (GST). Many banks offer GST accounts with limited or no fees. You can deposit taxes paid by customers in that account as you get them. It will be easier to pay your taxes when they're due if you already have the money set aside.[3]

- Contact the bank where you already have business accounts and ask about GST products and services they offer.

- Make a habit of transferring GST from your regular account to your GST account on a regular basis. For example, if you own a retail shop or restaurant, you may want to make those transfers on a daily basis.

Advertisement -

3Choose the calculation worksheet method or the accounts method. With the worksheet method, you calculate the GST you owe step by step. With the accounts method, the information is compiled directly from your accounting records.

- To use the accounts method, your records must be set up so that you can easily identify GST amounts, and separately record GST-free items.

- If you are a smaller business and use Simpler BAS reporting or pay installments, you don't need to choose a reporting method. You will automatically use the accounts method.

-

4Identify your accounting basis. For your first tax period, choose between a cash basis or accrual basis. With cash basis, sales are accounted for when money is received. With accrual basis, you account for sales when you issue the invoice.

- If you are a small business with less than $10 million in turnover per year, you can choose either basis. Larger businesses must ask the ATO for permission to use cash basis accounting.

- If you later want to change your accounting basis, you must contact the ATO. The change won't take effect until the first day of the next full tax period.

Completing Your Statement

-

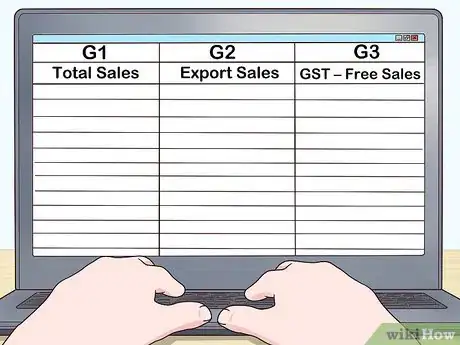

1Provide information about your sales. Report your total sales at G1, your export sales (if any) at G2, and your GST-free sales at G3. If you're using the accounts method, exclude the amount of GST from your sales at G1.

- The sales you report at G1 include basically everything, with the exception of dividends or distributions, donations or gifts, and refunds or proceeds from loans. If you're unsure whether something should be included, consult a tax professional.

- The export sales you include at G2 are GST-free sales. Show the value provided to Customs and Border Protection, as well as any amount you received for shipping and insurance.

- GST-free sales reported at G3 include all sales of basic food and beverages. If you are a food retailer, you may be eligible to use a simplified accounting method to estimate GST-free sales.

-

2Use the worksheet to calculate sales for the full reporting method. Unless you're using Simpler BAS reporting or the accounts method, you must complete additional lines on your BAS using the worksheets provided.

- The worksheet allows you to report income received from the sale or short-term lease of residential property. Subtract this amount from your total sales, along with your export and GST-free sales, to get your taxable income.

-

3Report your capital and non-capital purchases. You can deduct the amount of purchases you make for your business from your taxable income. Report capital purchases, such as fixtures and equipment, along with usual office supplies and other daily expenses of operating your business.

- Capital purchases and non-capital purchases should be reported separately at G10 and G11.

- Business purchases, such as inventory bought for resale, should not be included here. You also can't include insurance premiums related to your business, or salary and wages you pay to your employees.

-

4Calculate purchases on the worksheet for the full reporting method. This worksheet is not required if you're using the accounts method or Simpler BAS method of reporting. The worksheet covers purchases for making input-taxed sales.

- Include purchases made that relate to making sales of input-taxed sales, such as the sale or short-term lease of real estate.

-

5Fill in the summary section. You will find the summary section on the back of your BAS. In this section, you'll report the total amount of GST you are liable to pay for the period covered by the BAS.

- If you pay using the quarterly installments method, you'll enter the amount of your installment that was pre-printed at G21 on your BAS. If you've had to adjust this figure, you'll use the amount at G23 instead.

- If you use the accounts method, use the number shown at 1A in your account records.

- If you use the calculation worksheet method, this amount is the amount shown at G9.

-

6Finalize your statement. Before you lodge your BAS, read over the information you've reported carefully to make sure your calculations are accurate and you've filled in everything that applies to your business.

- When you're satisfied with your BAS, sign and date it so that you can lodge it. Make a copy of it for your records before you lodge it with the ATO.

Lodging Your Statement

-

1Submit your BAS and payment through ATO online services. If you are registered through the ATO's business portal, or have Standard Business Reporting (SBR) enabled accounting software, you can lodge your statement using either of those methods.

- Individuals and sole traders can also lodge their BAS and pay online through a myGov account that is linked to the ATO.

- If you submit your BAS online, your next BAS will be delivered to you electronically through the same service.

-

2Hire a registered tax or BAS agent. If you hired a registered tax practitioner or BAS agent to complete your BAS for you, they can lodge your statement for you. Even if you have a tax practitioner or agent lodge your statement on your behalf, you can still access it yourself through ATO online services if you are registered.

-

3Mail your BAS using the pre-addressed envelope. If you receive a paper BAS in the mail from the ATO, you can return it using the envelope provided in the packet with your forms. Mail the original, not a copy.

- If you've misplaced your envelope, mail your paper forms to Australian Taxation Office, Locked Bag 1936, Albury NSW 2460.

-

4Use the automated phone system if you have nothing to report. Even if you have nothing to report for the period, you are still required to lodge a BAS. The ATO has an automated phone line you can use for this purpose.

- Call 13 72 26 to lodge a "nil BAS." This line operates 24 hours a day, 7 days a week.

Correcting or Adjusting Activity Statements

-

1Make an adjustment if changes occur during the current reporting period. Events may occur after you've lodged your business activity statement that increase or decrease the amount of GST you have to pay. The ATO provides worksheets you can use to record your adjustments.

- There are separate worksheets for sales, purchases, bad debts, and creditable purposes. There is also a worksheet to provide a summary of all the adjustments you made.

- You can download the worksheets at https://www.ato.gov.au/uploadedFiles/Content/ITX/downloads/QC17537_Worksheets_js32842_w.pdf.

- Use the overall adjustment amount you calculated on your worksheet, then multiply it by 11.

-

2Work out adjustments within your accounts if you pay installments. Some businesses make quarterly installment payments rather than calculating the exact amount of GST each tax period. This method works best if your business income is generally consistent.

- The installments are based on the previous year's tax liability. If your actual tax liability differs from the estimate, you'll make the adjustments directly on your Business Activity Statement.

-

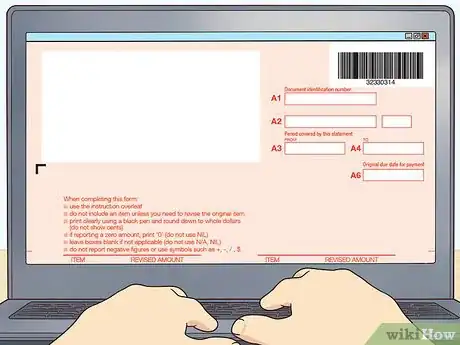

3Lodge an activity statement revision form if you find an error. Correcting an error in a previous statement is not the same as making an adjustment, even though it may have the same effect. The revision form is available online if you've registered for online services with the ATO.

- If you've not yet registered your business for online services, you can call the ATO at 13 28 66. Operators are available between 8:00 a.m. and 6:00 p.m. Monday through Friday.