This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 765,298 times.

Receipts serve as a document for customer payments and as a record of sale. If you want to provide a customer with a receipt, you can handwrite one on a piece of paper or create one digitally using a template or software system. If you plan on doing business, it’s important that you know how to properly write a receipt for proper documentation, tax purposes, and to protect yourself and your customers.

Steps

Sample Receipts

Handwriting a Receipt

-

1Buy a receipt book to make writing receipts easier. You can purchase a 2 part carbonless receipt book online or at an office supply store or one that has several sheets of reusable carbon paper. These booklets are usually prenumbered and already have the receipt headings in place. Make sure to get booklets with 2 part forms so that you get a copy that you can keep for your records. If you don’t have a booklet on hand, you can simply handwrite receipts on a piece of paper and photocopy them.[1]

- Make sure that the carbon paper is between the original and the copy before starting to write a receipt.

- Use a pen when handwriting receipts, making sure to press down firmly so that the information transfers to the copy.

-

2Write the receipt number and date on the top right. Write out the full date that you made the sale and a chronologically ordered receipt number under it. Each receipt should have a number so that you can keep track of each sale throughout the day. For the receipt number, start with 001 and go up one number for every receipt. You can do this ahead of time so you don't need to write it every time you make a sale.[2]

- For example, the top right of the receipt would look something like:

January 20, 2019

004 - You can reset the receipt numbers every day as long as you also write the date on every receipt.

- Most receipt booklets will already have a different receipt number for each receipt.

Advertisement - For example, the top right of the receipt would look something like:

-

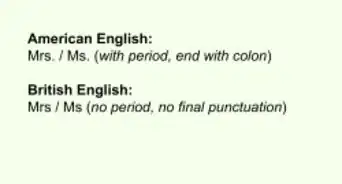

3Write your company name and contact information in the top left. Write your company phone number and address under the company name. You can also include other details like the website, social media accounts, and/or operating hours. This information will serve as proof that your company made the sale and will help the customer contact you if they need to.[3]

- If you don’t have a company, write your full name instead of a company name.

-

4Skip a line and write down the items purchased and their cost. Write the name of the item on the left side of the receipt and write the cost of each item on the right side of the receipt. If you sold more than one item, list the items and their prices in a row.[4]

- For example, an itemized list on a receipt should look something like:

Toilet paper………..$4

Comb………………$3

Moisturizer………...$20

- For example, an itemized list on a receipt should look something like:

-

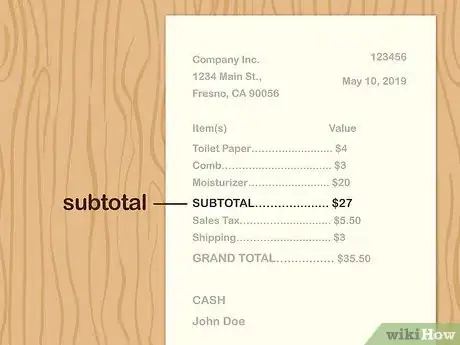

5Write the subtotal below all of the items. The subtotal is the cost of all the items before taxes and additional fees. Add up the cost of each of the items that you sold and write the total number under the list of item prices. [5]

- To be accurate, use a calculator to add up the items.

- The subtotal should look something like:

Toilet paper………..$4

Comb………………$3

Moisturizer………...$20

SUBTOTAL………..$27

-

6Add taxes and other charges to the subtotal for the grand total. List the name of the tax or additional charges on the left side of the receipt and transcribe their cost on the right side of the receipt. Then, add any applicable fees and taxes to the subtotal to get the grand total, or the amount that the customer has to pay.[6]

- The grand total should look something like:

SUBTOTAL………..$27

Sales Tax………….$5.50

Shipping…………..$3

GRAND TOTAL…..$35.50

- The grand total should look something like:

-

7Write down the payment method and the customer's name. The payment method could be cash, check, or credit card. On the last line of the receipt write the customer’s full name. If they paid by credit card, have them sign the bottom of the receipt. Then, make a copy of the receipt and keep it for your records and hand the customer the original receipt.[7]

Making a Digital Receipt

-

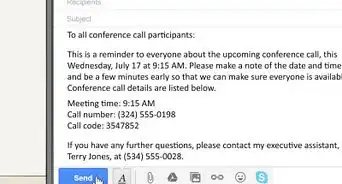

1Download a receipt template for an easy digital solution. If you are providing someone a receipt online, it may be easier to write the receipt on the computer. In this case, search for receipt templates online and download one that suits your needs. Then, fill in all the applicable fields using a word processor and send the customer a copy of the receipt.[8]

- Remember to include the date of sale for any receipt that you write.

- Only download templates from sites that look reputable.

-

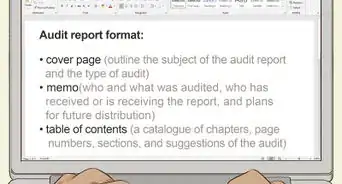

2Use software to create receipts with a professional look. Compare paid and free receipt generating software programs and download the one that best suits your needs. Set up the program and fill in your company name and information on the settings tab. Then, it’s just a matter of properly filling in the applicable fields. Once you’re done, the program will generate a professional-looking receipt for you to give to the customer, and will log the receipt in its database so you can refer to it later.[9]

- Popular receipt programs include NeatReceipts, Certify, and Shoeboxed.

- You can also upload your company logo so that it shows up on the customer copy of the receipt.

-

3Use a POS system for highly accurate receipt management. A POS, or Point of Sale system, is a system that helps you track business expenses, sales, receipts, and can process payments like checks and credit cards. This system will automatically generate a receipt for the customer at the point of sale and log the sale in your database. Compare different POS systems online and choose one that fits your needs. Then, download the system onto your computer and work with customer support to get automatic receipts generated every time you make a sale.[10]

- Popular POS systems include Vend, Shopify, and Square Up.

- Many POS systems can now be downloaded on your phone, tablet, or computer.

Community Q&A

-

QuestionDoes a receipt have to match the date of my money order?

Community AnswerYes, the date should match the money order for accurate record keeping.

Community AnswerYes, the date should match the money order for accurate record keeping. -

QuestionHow do I fill out receipts when two or more people write individual checks for payment and they request individual receipts?

GEttingerCommunity AnswerFill out the receipt as you normally would, then label exactly what the payment is for. For example, if it's for rent you could write something like, "50% of Jan. rent" and then write the cost on the right side of the receipt. Give each person an individual receipt for their payment and keep a copy of each transaction for your records.

GEttingerCommunity AnswerFill out the receipt as you normally would, then label exactly what the payment is for. For example, if it's for rent you could write something like, "50% of Jan. rent" and then write the cost on the right side of the receipt. Give each person an individual receipt for their payment and keep a copy of each transaction for your records. -

QuestionWho gets the original receipt and who gets the duplicate or copy?

Community AnswerTypically, the purchaser gets the receipt and the merchant gets the copy.

Community AnswerTypically, the purchaser gets the receipt and the merchant gets the copy.

References

- ↑ https://pocketsense.com/audit-dont-receipts-10010002.html

- ↑ https://bizfluent.com/how-5063258-write-receipt-payment.html

- ↑ https://www.adobe.com/sign/hub/document-types/can-invoice-be-handwritten

- ↑ https://www.adobe.com/sign/hub/document-types/can-invoice-be-handwritten

- ↑ https://bizfluent.com/how-5063258-write-receipt-payment.html

- ↑ https://www.business.gov.au/finance/payments-and-invoicing/receipts-and-proof-of-purchase

- ↑ https://bizfluent.com/how-5063258-write-receipt-payment.html

- ↑ https://www.examples.com/business/payment-receipt.html

- ↑ https://www.techrepublic.com/blog/five-apps/five-apps-for-managing-your-receipts/

About This Article

For hand-written sales receipts, buy a 2 part carbonless receipt book. Use a black or blue pen and bear down. Include the date, items bought, taxes, total transaction amount, and the method of payment. Review the information, then stamp it with your company's official stamp. Give the copy to the customer and retain the original. To learn how to create a rent receipt or to see a sample receipt, keep reading!