This article was co-authored by Scott Nelson, JD and by wikiHow staff writer, Megaera Lorenz, PhD. Scott Nelson is a Police Sergeant with the Mountain View Police Department in California. He is also a practicing attorney for Goyette & Associates, Inc. where he represents public employees with a myriad of labor issues throughout the state. He has over 15 years of experience in law enforcement and specializes in digital forensics. Scott has received extensive training through the National Computer Forensics Institute and holds forensic certifications from Cellbrite, Blackbag, Axiom Forensics, and others. He earned a Master of Business Administration from the California State University Stanislaus and a Juris Doctorate from the Laurence Drivon School of Law.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 48,308 times.

The COVID-19 pandemic has created serious financial hardship for millions of Americans. Fortunately, if your income falls below a certain limit, there’s a good chance that you qualify for a stimulus payment from the government to help you through these difficult times. Most likely, you’ll get a direct deposit straight to your bank account, and you won’t have to take any action to collect your payment. To find out about the status of your payment, you’ll need to first check that you meet the eligibility requirements. Then, simply log onto the IRS’s “Get My Payment” website to find out whether your payment has been processed.

Steps

Checking Your Eligibility

-

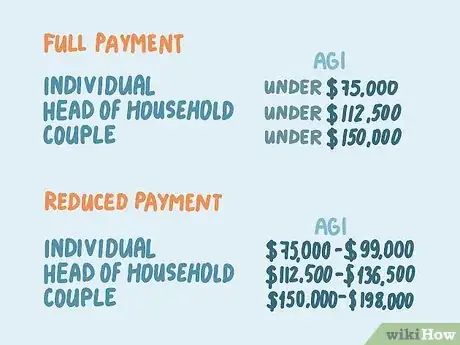

1Calculate your adjusted gross income to determine if you’re eligible. The coronavirus stimulus payments are based on the amount of income you make and how many people are in your household. Use your W-2, 1099, and any other relevant tax forms to calculate your household’s adjusted gross income, or simply look it up on your completed federal income tax return. From there, you can determine if you are under the required limits for getting a full stimulus payment. For example:[1]

- You are eligible for a full payment if you’re filing as an individual and have an AGI under $75,000, if you’re filing as a head of household and your AGI is under $112,500, or if you’re a couple filing jointly and your AGI is under $150,000.

- You’ll receive a reduced payment if you're an individual with an AGI of $75,000-$99,000, a head of household with an AGI of $112,500-$136,500, or a couple filing jointly with an AGI of $150,000-$198,000.

- If your income is above the upper limits for a reduced payment, you won’t be eligible for a stimulus payment.

Did You Know? You don’t have to be making an income from wages to qualify for a stimulus check. You may also be eligible if you’re unemployed, a retiree, a Social Security recipient, on disability or veteran’s benefits, or don’t make enough money to file income taxes.

-

2Count the number of filers and dependents to calculate your check amount. Most people who meet the income requirements will get $1,200 per household member or $2,400 for a couple filing jointly. If you have children or other dependents, you’ll get an additional $500 for each dependent you claim on your taxes.[2]

- For example, if you’re a married couple with 3 kids making under $150,000, you should receive a total payment of $3,900.

- If you qualify for a reduced payment, $5 will be subtracted from your stimulus check for every $100 you make over the applicable income limit. For example, if you’re an individual filer with an adjusted gross income of $80,000, you’ll get a payment of $950.

- Unfortunately, babies born after the end of 2019 or not listed on your most recent tax return won’t be counted for the purposes of the stimulus check.

Advertisement -

3Make sure that you’ve filed a tax return for 2019 or 2020. If you’ve already filed your federal income tax for 2019, your stimulus payment will be based on your 2019 tax return. If you’ve filed for 2020, the payment will be calculated based on the more up-to-date information. If you haven’t filed for either of those years, you may need to do so before you can get your stimulus payment.[3]

- Not everyone is required to file income taxes. You can find out about your filing requirements here: https://www.irs.gov/help/ita/do-i-need-to-file-a-tax-return

- For example, you may not need to file taxes if your income falls below a certain level.

-

4Check if you’re disqualified because you’re a dependent. If someone else can claim you as a dependent on their taxes, you won’t receive a stimulus payment directly. Instead, an additional payment of $500 will go to the person who claims you as their dependent.[4] For example, you may be claimed as a dependent if:[5]

- You’re a child or teen under 19 who has lived at home for more than half of the previous year

- You’re a student under age 24

- Someone else provided more than half of your financial support, or you made an income of less than $4,200 for the tax year

-

5Ensure that you have a valid Social Security number. You must have a valid Social Security number to receive a stimulus payment.[6] Check your Social Security card or a W-2 form to find your 9-digit Social Security number.

- If you can’t find your SS number or if you don’t have one, you can apply for one or get a replacement Social Security card on the Social Security Administration website: https://www.ssa.gov/ssnumber/.

- To apply for a Social Security number, you’ll need to provide documents that prove your age and citizenship, such as your birth certificate, a U.S. driver's license or state ID, or a U.S. passport.[7]

-

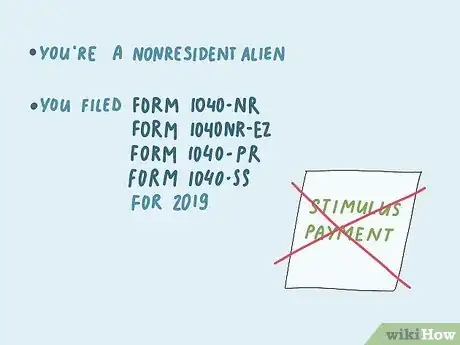

6Expect not to receive a payment if you don’t have an SSN. If you live in the U.S. but you aren’t a citizen and don’t qualify for a green card, you won’t qualify for a stimulus payment.[8] However, if you’re a nonresident alien married to a U.S. citizen or resident alien, you may qualify if you file taxes jointly with your spouse.[9]

- You will also be disqualified for a stimulus payment if you filed certain types of tax forms based on your citizenship or employment status, such as the 1040-NR, 1040NR-EZ, 1040-PR, or 1040-SS for 2020.

- If you have an Individual Taxpayer Identification Number, you are eligible for the stimulus check.[10]

Tracking Your Payment

-

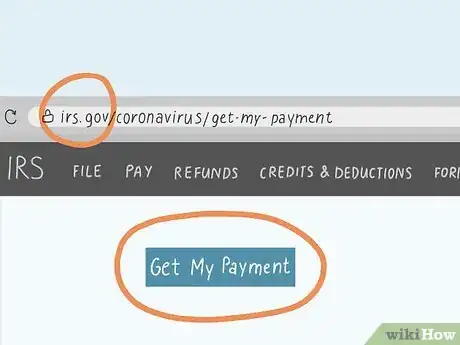

1Visit the IRS “Get My Payment” website to check your status. When you’re ready to check the status of your payment, go to https://www.irs.gov/coronavirus/get-my-payment. Click the blue “Get My Payment” button and follow the prompts.

- At minimum, you’ll be asked to provide your name, date of birth, Social Security number, and street address.

-

2Review the status of your payment on the “Payment Status” page. There are a variety of possible status messages you could receive once you fill out the form. If your payment has already been processed or is pending, a “Payment Status” page will pop up with information about the payment date and how you will receive the payment (e.g., by direct deposit or mail). Otherwise, you’ll be informed that you’re eligible, but the payment hasn’t been processed yet. Alternatively, you might get one of the following messages:[11]

- “Need additional information.” This typically means that you have to provide information about your bank account so that the IRS can send a direct deposit to your account. You may also need to provide additional information to verify your identity.

- “Payment Status Not Available.” You may get this message if the IRS hasn’t determined your eligibility status yet. For example, this message might come up if you haven’t filed your 2018 or 2019 tax return yet, or if you filed it so recently that it hasn’t been processed yet.

Keep in mind: If you don’t normally pay taxes or you receive certain types of benefits, such as SSA, RRB Form 1099, SSI, or VA benefits, your information may not be in the system yet. Keep checking back until your payment status becomes available.[12]

-

3Provide further information if it’s requested. If you get a “Need More Information” message, follow the prompts to provide the necessary info. This will help ensure that you get your payment as quickly as possible! You may need to fill out information such as:[13]

- Your bank account number

- Your bank’s routing number

- The type of account you’re providing information for (e.g., checking or savings)

- Additional security questions to verify your identity

-

4Check back once a day if your payment status isn’t available yet. The payment status page is only updated once every 24 hours, so there’s no need to check more than once a day. If you’ve just provided updated information on your bank account or your tax filing status, wait at least 24 hours for the information to process through the system.[14]

- If you attempt to log in multiple times in one day and the information you provide doesn’t match the records in the system, you may get locked out of your account for 24 hours. If this happens, you’ll see a message that says, “Please Try Again Later” when you try to check your payment status.

-

5Use the “Non-Filers: Enter Payment Info Here” tool if you haven’t filed taxes. If you don’t normally file taxes, the IRS may not have up-to-date information on your address or bank account. In this situation, you may need to provide information through the “Non-Filers: Enter Payment Info Here” tool on the IRS website. Click the blue “Enter your information” button on this page and follow the prompts: https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here.

- Not everyone who doesn’t file taxes is required to use this tool. For example, you probably don’t need to take any action if you receive VA benefits, Railroad Retirement benefits, or Social Security benefits.

- Use this chart to determine if you need to use the “Non-Filers: Enter Payment Info Here” tool: https://www.irs.gov/newsroom/how-to-use-the-tools-on-irsgov-to-get-your-economic-impact-payment.

Receiving Your Money

-

1Check your bank account for a direct deposit on the expected date. Most people will get their stimulus payment as a direct deposit to the bank account associated with their most recent tax refund. If you didn’t get your tax refund as a direct deposit, you’ll have the opportunity to provide account information through the “Get My Payment” website. Once the IRS has your bank account info, you don’t have to take any further actions. Your payment will automatically appear in your account.[15]

- Unfortunately, there’s no way to change your bank account info in the system if it’s already on file with the IRS. If there’s a problem with the account on file, your payment might be sent in the mail instead.

-

2Look for a check in the mail if your bank information isn’t valid. If the IRS isn’t able to make a direct deposit to your bank account for some reason, they’ll send a check in the mail. This might happen if:[16]

- The bank account information on file with the IRS is inaccurate

- The bank account you used to receive your tax refund has since closed

- You haven’t provided any information about your bank account

-

3Don’t take any action unless the IRS requests further information. In most cases, you won’t have to do anything to receive your stimulus payment. The IRS won’t be able to handle most inquiries related to the stimulus payment over the phone or by email, so don’t attempt to contact them that way. You’ll probably only need to provide additional information if it’s requested on the “Get My Payment” website or the IRS contacts you by mail.[17]

Warning: Be cautious about possible scams related to the coronavirus stimulus payment. The IRS won’t contact you over text, email, or phone to ask for your banking information, or ask you to pay a fee to receive your stimulus money. If you get any suspicious emails, forward them to phishing@irs.gov, then delete the email.[18]

-

4Watch for a letter about your payment in the mail. You should receive a letter in the mail within 15 days of when the payment is processed. This letter will include information about how your payment was made and what to do if you didn’t receive your payment as expected.[19]

- This letter will be mailed to the last address on file with the IRS, so you may not receive it if you moved since you last filed taxes and haven’t set up mail forwarding.

Expert Q&A

-

QuestionHow do I avoid scams related to Economic Impact Payments for COVID-19?

Scott Nelson, JDScott Nelson is a Police Sergeant with the Mountain View Police Department in California. He is also a practicing attorney for Goyette & Associates, Inc. where he represents public employees with a myriad of labor issues throughout the state. He has over 15 years of experience in law enforcement and specializes in digital forensics. Scott has received extensive training through the National Computer Forensics Institute and holds forensic certifications from Cellbrite, Blackbag, Axiom Forensics, and others. He earned a Master of Business Administration from the California State University Stanislaus and a Juris Doctorate from the Laurence Drivon School of Law.

Scott Nelson, JDScott Nelson is a Police Sergeant with the Mountain View Police Department in California. He is also a practicing attorney for Goyette & Associates, Inc. where he represents public employees with a myriad of labor issues throughout the state. He has over 15 years of experience in law enforcement and specializes in digital forensics. Scott has received extensive training through the National Computer Forensics Institute and holds forensic certifications from Cellbrite, Blackbag, Axiom Forensics, and others. He earned a Master of Business Administration from the California State University Stanislaus and a Juris Doctorate from the Laurence Drivon School of Law.

Police Sergeant, Mountain View Police Department It's really important that you investigate the email address carefully. Since it's a government initiative, the email address should be from a ".gov" email. If it isn't, it's probably a scan. Then, read the headline carefully to make sure there aren't any spelling errors. An official email should be free of typos. It won't have any emojis either, which scammers love to use to get your attention.

It's really important that you investigate the email address carefully. Since it's a government initiative, the email address should be from a ".gov" email. If it isn't, it's probably a scan. Then, read the headline carefully to make sure there aren't any spelling errors. An official email should be free of typos. It won't have any emojis either, which scammers love to use to get your attention.

References

- ↑ https://www.irs.gov/newsroom/questions-and-answers-about-the-first-economic-impact-payment-topic-c-calculating-my-first-economic-impact-payment

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/publications/p501#en_US_2019_publink1000220868

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.ssa.gov/ssnumber/ss5doc.htm

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/individuals/international-taxpayers/nonresident-alien-spouse

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/coronavirus/get-my-payment

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- ↑ https://www.irs.gov/newsroom/taxpayers-should-be-aware-of-coronavirus-related-scams

- ↑ https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions