This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 106,847 times.

As a vendor, you may or may not want to provide an early payment discount to your customer. It depends mainly on your cash flow and if you can afford to do so. As a customer, it is usually advantageous for you to consider paying an invoice early if you receive a discount and if your budget and cash flow allow it. Either way, the calculation for finding the early payment discount is simple and requires only basic math.

Steps

Evaluating the Pros and Cons as a Vendor

-

1Analyze cash flow and cash collection cycle. You should also analyze your collection problems first to identify whether late payments are systemic or limited to a few customers. If 80% of customers pay within 10 days before offering a discount, providing a discount would be unwise and just result in lower revenues. However, if late payments are prevalent among customers, a discount might be advantageous.

-

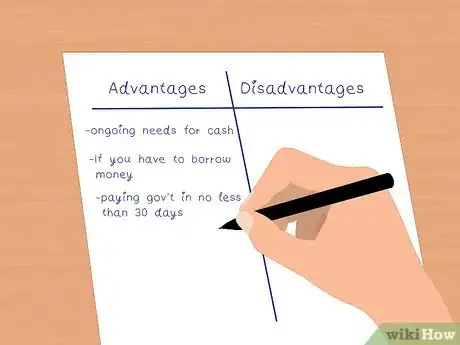

2Consider the advantages of offering early payment discounts. If you have ongoing needs for cash in order to make payroll and purchase raw materials, getting paid in 10 days rather than waiting 30 days will be worth offering the discount. If you have to borrow money in order to meet day-to-day expenses before you are paid, then it is definitely to your advantage to offer the discount.[1]

- Some clients such as the government have rules that require paying in no less than 30 days.[2]

- Set fixed policies and provide to all customers based upon the volume of business.

Advertisement -

3Consider the disadvantages of offering early payment discounts. The customer might take the discount and still pay you at 30 days. Then you will have to make a collections call. The customer could also pay you within 10 days some months but 30 days in other months, which makes it difficult to plan your cash flow. Also if you are offering the discount every month to a number of different customers, the amount of revenue you are losing can really add up.[3]

- Consider the relative strength between the vendor and the buyer. Large, national customers regularly take discounts, especially where the product or service is readily available elsewhere, and still pay late, knowing the vendor doesn't want to chase off a big client.

-

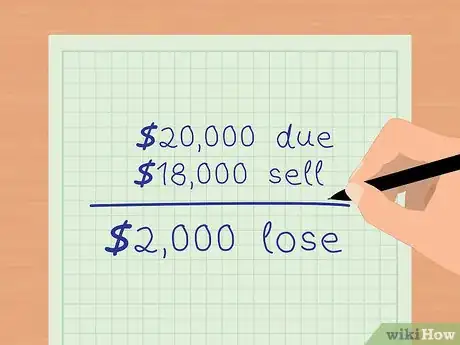

4Consider factoring instead of customer discounts. Factoring means selling your accounts receivable to a company in order to get immediate payment at a discounted amount. Then your customer would pay the factoring company.[4]

- For example, you might have $20,000 due from one of your customers. You could sell this receivable to a factoring company for $18,000.

- Most factors have recourse, so the risk of non-collection remains with vendor.

Calculating the Early Discount Amount as a Vendor

-

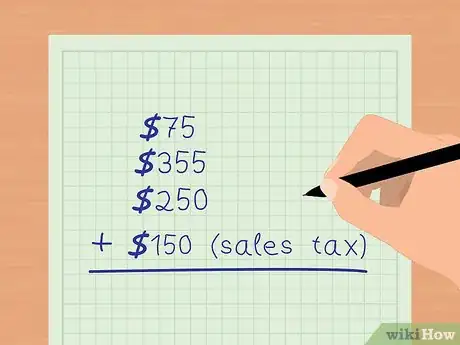

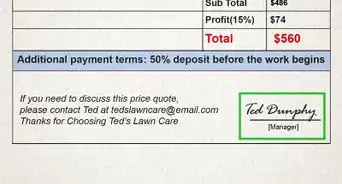

1Calculate the total amount due on the invoice to your customers. Be sure to include the sales tax in the total. Invoices should be generated as soon as you ship the ordered product or finish providing a service.

-

2Decide what percent discount you will give your customer for early payment. Find out what the usual percentage is in your industry by asking others in a professional association. For example, you could offer 2 percent off if paid in 10 days instead of 30 days.

- The discount should be noted on the invoice as 2/10 net 30.

-

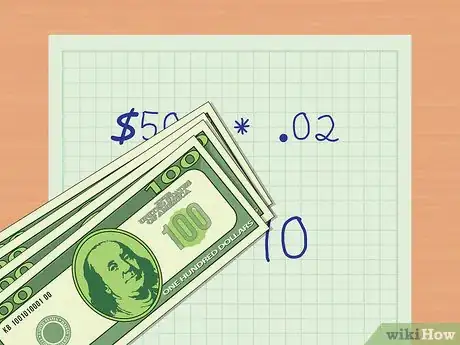

3Multiply the percent discount by the total owed on the invoice. The discount should never apply to the sales tax. Whether or not shipping and handling are included with the product price is also to be considered when determining the total invoice amount. For example, if the total invoice is $500, multiply $500 by 2 percent or .02 to get $10. This is the amount of revenue you will be losing by offering the discount.

-

4Subtract the discount amount from the total amount owed. For example, $500 - $10 = $490. This is the net amount owed with the discount.

Deciding to Take Advantage of an Early Payment Discounts as a Customer

-

1Understand your own cash flow before making a decision. If you don't have a cash flow problem or can borrow from the bank easily, taking advantage of the discount is almost always warranted. However, if you find yourself struggling to come up with money to pay vendors, the ability to pay the full amount late may be more advantageous.

-

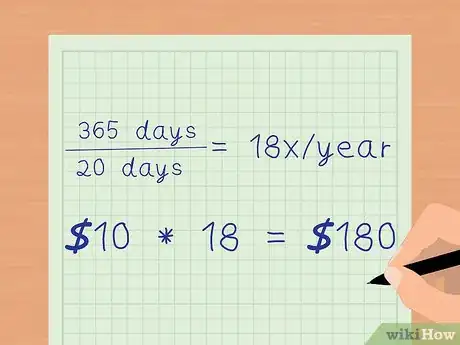

2Compare the total amount owed vs. the discounted amount. Using the above example, with a 2 percent discount on a $500 dollar invoice, the savings would be $10 if you pay within 10 days. Decide if the savings are worth using your cash earlier than necessary in the month by calculating the annual savings you would earn for the extra 20 days.

- For example, if you have the opportunity to do this every 20 days, it would happen 18 times a year (365 days divided by 20 days = 18). That means you could save up to $180 ($10 X 18 times per year) each year by using a $490 amount each month.[5]

-

3Consider taking advantage of an early payment discount. First calculate what the annual interest rate would be, based on the two percent discount, for example, provided by the vendor if you pay in 10 days. This is because you will be earning interest on the discounted amount if you had it in the bank.[6]

-

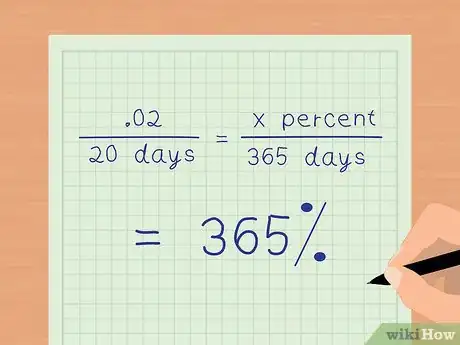

4Calculate the annual interest rate you would earn on the 2 percent you saved. For example, let's say you are offered a 2 percent discount for paying a bill within 10 days. You can calculate what that 2 percent would be worth on an annual basis. That is because you have the use of the money for an additional 20 days (assuming 30 days in a month). To find the comparable annual interest rate set up a ratio:

- 2 percent or .02 / 20 days = x percent / 365 days. Then solve for x. .02 x 365 = 20x. Therefore the comparable annual interest rate is .365 or 36.5 percent.[7]

- Since 36.5 percent in this example is a very high interest rate, this demonstrates it is usually advantageous for a customer to take advantage of an early payment discount if you have enough money in your checking account or you have a line of credit.

Things You'll Need

- Invoice with total due

- Paper, pen or pencil

- Calculator

References

- ↑ http://www.comcapfactoring.com/blog/should-you-offer-early-payment-discounts-to-clients/

- ↑ http://www.comcapfactoring.com/blog/should-you-offer-early-payment-discounts-to-clients/

- ↑ http://www.comcapfactoring.com/blog/should-you-offer-early-payment-discounts-to-clients/

- ↑ http://www.investopedia.com/terms/a/accountsreceivablefinancing.asp

- ↑ http://www.accountingcoach.com/accounts-payable/explanation/5

- ↑ http://www.accountingcoach.com/accounts-payable/explanation/5

- ↑ http://www.accountingcoach.com/accounts-payable/explanation/5