This article was co-authored by Scott Maderer, MBA. Scott Maderer is a Certified Financial Coach and Stewardship Coach in San Antonio, Texas. He received a Master of Business Administration from Texas A&M University-Commerce in 2013 and is a Licensed Human Behavior Consultant (DISC) by Personality Insights, Inc.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 42,641 times.

When an individual or a group of investors (as opposed to a bank or finance company) holds the note for a mortgage (they are entitled to receive the payments made by the home buyer), they will often sell the mortgage to another individual or group of investors. That's because they prefer to have a lump sum rather than payments over 20 or 30 years. As a result, they'll sell the mortgages for less than the amount shown on the note. A little research and due diligence can show any potential investor how to buy a mortgage, as well as where to find mortgages to purchase.

Steps

Understanding the Mortgage Note Market

-

1Understand the concept of a mortgage note. When a home buyer takes out a mortgage to buy a home, either from a financial institution or another individual, the home buyer agrees to make payments at a set interest rate over a period of time. The right to receive those payments, the mortgage note, is held by the institution or individual that put up the original capital to buy the home. The note holder can then sell the note for a lump sum if they choose. This gives them an instant payout on the loan, instead of waiting for all of the payments on the mortgage to come in (which may take 15 to 30 years).[1]

- The advantage to buying a mortgage note is that it provides the note holder with a steady, passive income stream over the life of the loan. This can be important for investors looking to plan for retirement, for example.[2]

-

2Understand the risks of investing in mortgage notes. In any mortgage note investment, the note holder assumes the risk of default. Default occurs when the borrower becomes incapable of paying the mortgage payments on the property. This means that the property is now delinquent and the note holder is no longer receiving mortgage payments (meaning no return on their investment). If sufficient time passes, the note holder can foreclose on the property and repossess it from the borrower.[3]

- If a repossession occurs, the note holder must hope that the sale price of the home covers the amount that they spent to purchase the mortgage note. Otherwise, they stand to lose money on the investment.

- Default risk is higher among certain commercial properties and homes owned by borrowers with poor credit. However, any property is theoretically susceptible to default.

Advertisement -

3Know where mortgage notes can be purchased. Mortgage notes are traded between note holders (banks or individuals) and buyers on the secondary markets. To get started, search for real estate investment services or investment brokerages that offer access to mortgage notes. In addition, there are also specialized websites for trading mortgage notes.[4] Search online for these opportunities and consider your options carefully.

- Before investing any money, thoroughly research the legitimacy of your chosen broker or website. Look for official licenses and reviews from previous participants. Always be very cautious when committing your money to an investment.

-

4Know the types of properties the mortgages can be held on. Investors can purchase mortgages held on land, single-family homes, condominiums, commercial property, or rental property. Which type of mortgage note property type is right for you will depend on your budget and risk tolerance. For example, the most affordable mortgage notes will typically be on single-family homes. Commercial and land mortgages will likely be prohibitively expensive for the average investor. Risk will depend on the specific property, but in general commercial property will be a riskier investment than home mortgages (assuming the borrower has good credit). Evaluate each property for individual risk before investing.

-

5Learn about different types of mortgage financing. In addition to mortgages financed by banks and other financial institutions, there are also mortgages financed by private individuals. These are called private mortgages and include seller-financed properties, where the seller loans the purchase price to the buyer, and private lender mortgages. Home buyers generally choose these options if they are unable to quality for institutional mortgages because of their default risk (the risk that they won't pay the loans back).

- These mortgages often carry above-market interest rates, guaranteeing a higher return for the note holder; however, this is balanced by the risk of owning this type of note. If the buyer is incapable of making payments, the note holder must repossess the property and hope that the sale value covers their investment.[5]

- Some seller-financed properties also rely on a type of financing that includes a balloon payment (a large lump sum payment made at the end of the loan term). These payments can be large and difficult for the borrower to repay, so they typically refinance the loan sometime before the balloon payment is due. If they default on this payment though, the note holder is left with a defaulted property and a small, or possibly negative, return.[6]

Finding the Right Mortgage

-

1Determine your risk level. Figure out how much risk you are willing to accept in order to make high returns. This can be instrumental in choosing what type of mortgage investment you want to make. You can make a significant return on mortgages, but that means you'll assume some level of risk.

- For example, mortgages that are sold at a high loan-to-value ratio might advertise an attractive return, but if the borrower defaults, you might not get all of your money back even if you foreclose on the property.[7]

-

2Decide which type of mortgage to purchase. Investing in mortgages is just like investing in anything else. There are numerous options and you want to find the type of investment that you think will offer you a healthy return. Consider the different options presented above and decide which makes the most sense for you.

-

3Find mortgages. Once you've settled on a type of investment, it's time to find an opportunity. Search investment brokerages and mortgage note trading websites to locate several investment properties to investigate further.

- Prospective investors can also advertise in local papers or on Craigslist that they will purchase mortgages for cash.

- Investors can also perform a public records search to find mortgage holders. Make friends with someone in the appropriate department of the county. The appropriate department will vary from county to county; start at the property appraiser’s office and ask which department records mortgages. That’s where investors should start their public records search.

- There are several specific online options for finding mortgages on the secondary market.

- As with almost all other types of searching, it's usually best to start online.

-

4Consider notes that are in first position only. Be sure that you're buying notes that are in first position and not second (or third) position. As the name implies, first position mortgage holders are first entitled to the property in the event that the borrower defaults.[8]

- If you buy a mortgage in second position, and the lender defaults, it's likely that the property will be sold at a steep discount and the leftover equity will all go to the mortgage holder in first position.

Finalizing the Purchase

-

1Determine the value of the property. If you're buying a note for $200,000 and you're told that the property is worth $300,000, then you're going to want to verify that the property is actually worth $300,000.

- You can either search for the property yourself, using an online service like Zillow.com, to determine value or have the home professionally appraised. This will ensure that your investment is actually as valuable as the seller claims.

- For peace of mind, you can view and assess the property yourself to the extent that you can and determine if you think it's worth the advertised value.

- Keep in mind that property values can change, at times very quickly. Any appraised value may change as conditions of and around the property change.

-

2Ensure that the mortgage is in line with your risk profile. Whether you're interested in buying a note that's in default so that you can get a higher return or you want something less risky (like a mortgage that's being paid reliably) that provides a modest return, make sure that the note you're evaluating is in line with your financial goals. A note in default can make it difficult for you to collect on mortgage payments, as this means that the borrower is no longer capable of making the agreed upon payments. Default can also lead to further complications like deferred maintenance costs and foreclosure.[9]

-

3Run a credit check on the borrower. If the borrower is facing a bankruptcy, it could be difficult for you to collect on the note. The borrower will have to give you permission to run a credit check, but it's better to be safe than sorry.

-

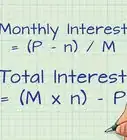

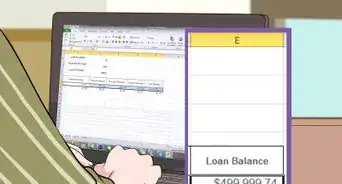

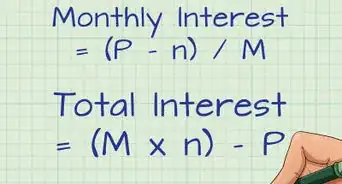

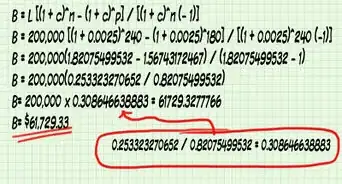

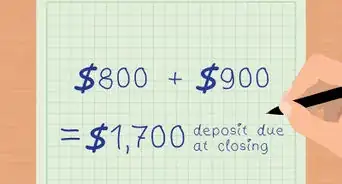

4Obtain all of the original legal documents associated with the loan. This is where you need to make sure that all legal and financial claims are in order. You might have to run your own amortization schedule on your favorite spreadsheet to determine that the amount left on the note is consistent with what the seller is saying.[10] Also, the original legal documents should contain information about the appraisal, the original loan value, and the interest rate.

-

5Close the deal. Once you're satisfied that everything is as advertised and the mortgage is in line with your financial goals, make an offer.

- As with other markets, there's typically room for negotiation in the mortgage market. Offer less than what the seller is asking to maximize your return.

- It might be best to get an attorney involved, at least for your first mortgage purchase. You don't want to get in financial trouble because a legal technicality was overlooked.

Warnings

- Don’t let the investor rush the sale. Before buying a mortgage, investors should feel completely at ease with the terms of the sale and condition of the property. Investors should also understand everything in the contract and feel as though the seller has answered all questions honestly and completely.⧼thumbs_response⧽

- Some investors may offer to sell a partial mortgage, where the new mortgage holder “shares” the mortgage payments with the old investor. This can work out well for many investors, but before entering into such a contract, investors should contact an attorney and have him or her review the paperwork.⧼thumbs_response⧽

- Exercise caution when purchasing a new mortgage as opposed to a “seasoned” mortgage. A seasoned mortgage is one where the borrower has made several on-time payments.⧼thumbs_response⧽

References

- ↑ http://finance.zacks.com/buy-sell-mortgage-notes-10384.html

- ↑ http://noteinvestor.com/how-to-buy-mortgage-notes/

- ↑ http://www.investopedia.com/terms/d/delinquent_mortgage.asp

- ↑ http://finance.zacks.com/buy-sell-mortgage-notes-10384.html

- ↑ https://www.washingtonpost.com/realestate/what-to-know-before-buying-mortgage-notes/2013/04/18/0481cabe-a37d-11e2-be47-b44febada3a8_story.html

- ↑ https://www.washingtonpost.com/realestate/what-to-know-before-buying-mortgage-notes/2013/04/18/0481cabe-a37d-11e2-be47-b44febada3a8_story.html

- ↑ http://www.investopedia.com/terms/l/loantovalue.asp

- ↑ http://www.investopedia.com/terms/f/first_mortgage.asp

- ↑ http://www.bloomberg.com/bw/articles/2014-02-27/delinquent-mortgages-draw-investors-seeking-cheap-properties

-Step-18.webp)