wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 14 people, some anonymous, worked to edit and improve it over time.

The wikiHow Tech Team also followed the article's instructions and verified that they work.

This article has been viewed 118,254 times.

Learn more...

If your business involves any type of inventory, whether a huge amount or just a few items, the inventory needs to be tracked. You or your bookkeeper can use QuickBooks for storing inventory information and also for adjusting inventory counts and values based on the current market. You most likely count your inventory on a regular basis and any changes should be recorded in your financial records. You don't want to have to pay taxes on inventory that you don't have; therefore, you should always take a regular count and adjust your records as necessary. With QuickBooks, it is a very simple process to make these adjustments.

Steps

-

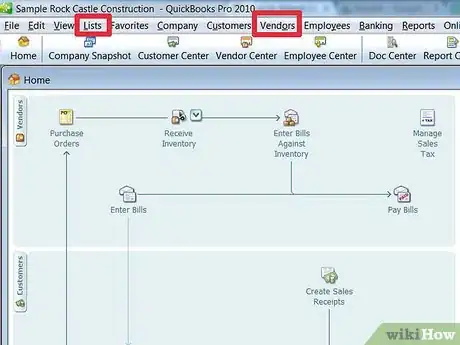

1Select "Lists" or "Vendors."

-

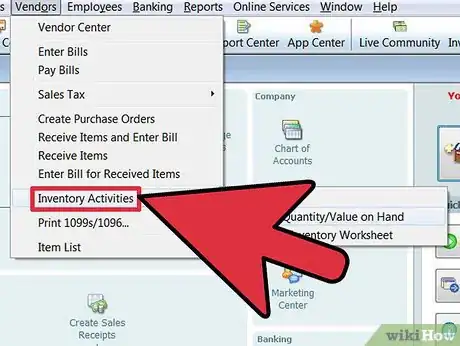

2Select "Items" under Lists or "Inventory Activities" under Vendors.Advertisement

-

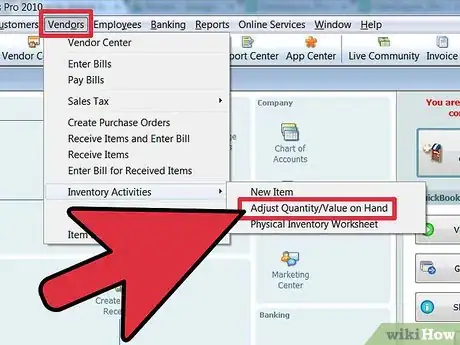

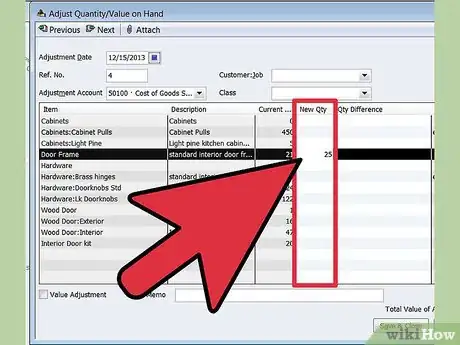

3Select "Adjust Quantity/Value on Hand" in the drop-down list under either Lists or Vendors.

-

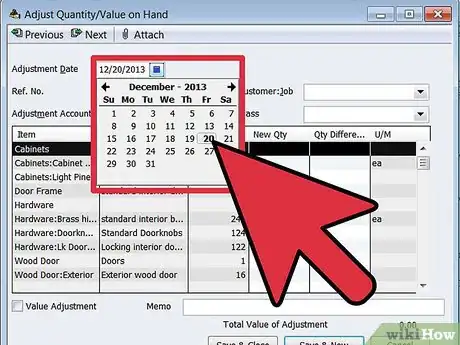

4Enter the date that you made your physical count of your inventory.

-

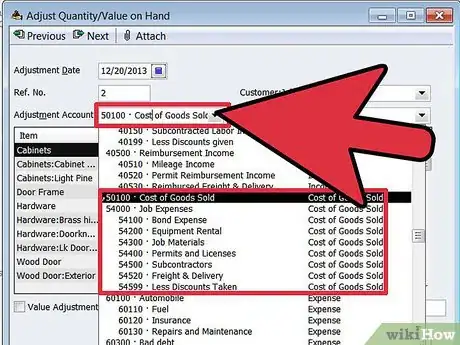

5Select an expense account (an inventory item) from the adjustment list you opened up. This is the account you selected to track your inventory decline.

-

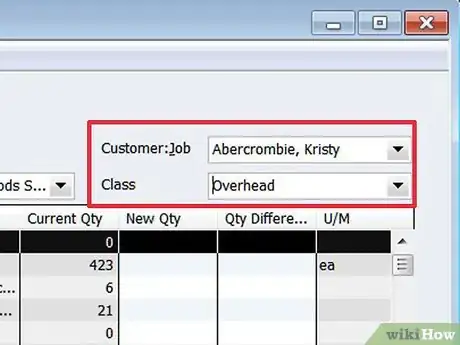

6Identify the customer job and class, if applicable, from the drop-down list.

-

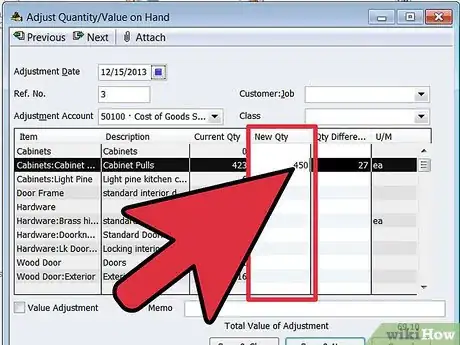

7Type in the new physical count in the column named "New Qty" or enter a new value in the "Qty Difference" column and QuickBooks will calculate the adjusted quantity for you.

-

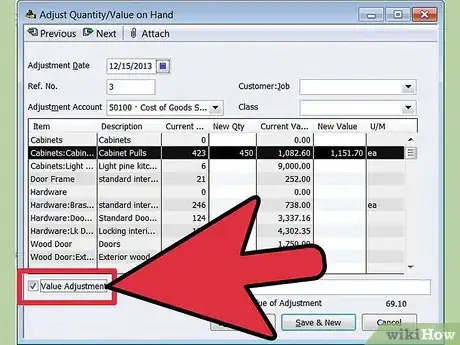

8Check the box named "Value Adjustment" if you want to see an expanded version of the open window; however, this is not necessary to change or adjust your inventory.

-

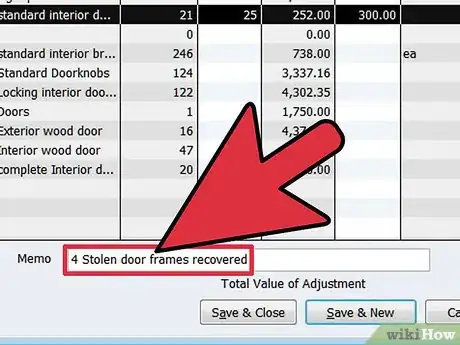

9Enter the new count in the "New Qty" column if using the expanded method for value adjustments. This allows you to mark down the items as the market value decreases.

-

10Use the "Memo" text box to write a short description or note to describe what you've done, who was involved in counting inventory or other notes, if necessary.

-

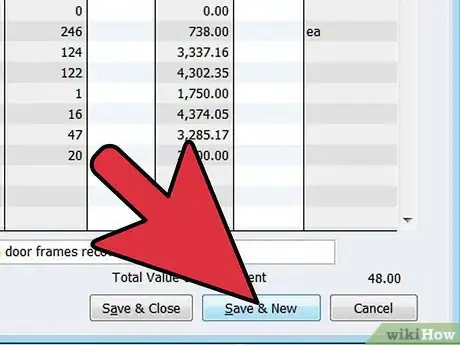

11Click the button marked "Save & Close" or "Save & New" to record your revisions.

Community Q&A

-

QuestionHow do I delete an inventory adjustment?

Community AnswerThis process below will delete the dollar amount, but will leave the Quantity on Hand to the Adjusted number. Choose Transactions > Registers. Select account, Inventory Asset. Identify the inventory adjustment to be deleted in the register. Select the row and click, Delete.

Community AnswerThis process below will delete the dollar amount, but will leave the Quantity on Hand to the Adjusted number. Choose Transactions > Registers. Select account, Inventory Asset. Identify the inventory adjustment to be deleted in the register. Select the row and click, Delete.

Things You'll Need

- Home or office computer

- QuickBooks software or online QuickBooks service

- Inventory records including personnel who performed the count, date and counts

- Calculator (optional)