This article was co-authored by Jennifer Mueller, JD and by wikiHow staff writer, Eric McClure. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 14 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 25,400 times.

Your will is an essential document that ensures your legacy is maintained and that your loved ones get what they deserve once you pass. As such, writing a will can sound intimidating, but it’s often a very straightforward process. It helps that there are a lot of resources out there to help with this. We’ll walk you through the steps you can take to compose a simple will so that you can help your friends and family when you’re gone. As a note, this article only addresses the process for writing a will in the United States—your will may look quite different depending on where you live.

Steps

Example and Template

Composing the Will

-

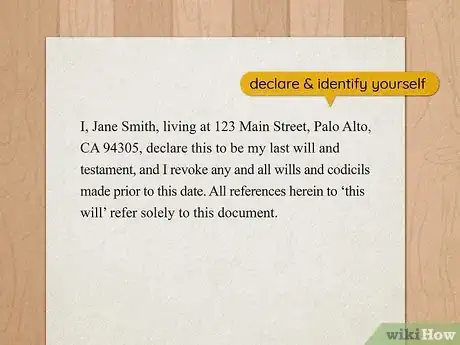

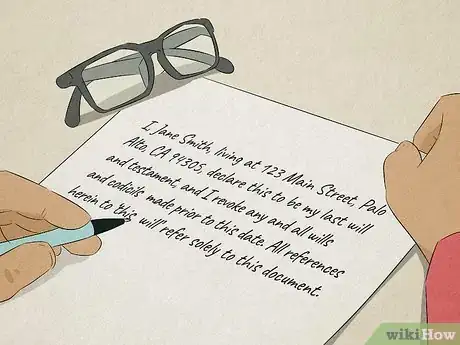

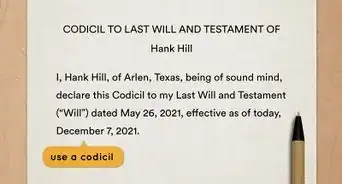

1State that this is your will in the declaration and identify yourself. The declaration is the little paragraph at the beginning that explains what document the reader is looking at. It explains that this is your will, and you’re the person who wrote it. Be sure to include some verifiable information in case there’s another person with your name who leaves a long lost will behind and confuses everyone.[1] Here’s what it may look like:

- “I, [full name], living at [full address], declare this to be my last will and testament, and I revoke any and all wills and codicils made prior to this date. All references herein to ‘this will’ refer solely to this document.”

- A codicil is a fancy legal term for “amendment.”

- Generally speaking, you’ll want to make sure you use the proper legal terminology in a will.

- “I, [full name], living at [full address], declare this to be my last will and testament, and I revoke any and all wills and codicils made prior to this date. All references herein to ‘this will’ refer solely to this document.”

-

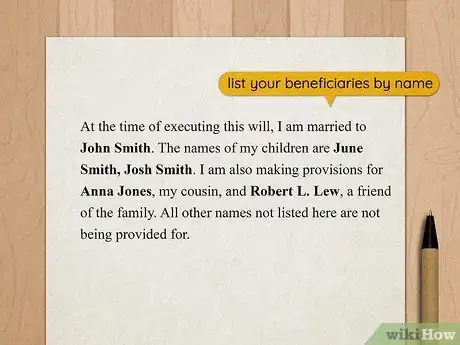

2List your beneficiaries by name and describe who they are. A beneficiary is anyone who you’re leaving something behind to. For most people, this will be their immediate family, although you can list anyone you’d like here.[2] You might write:

- “At the time of executing this will, I am married to [full name]. The names of my children are [list of full names]. I am also making provisions for [full name], my cousin, and [full name], a friend of the family. All other names not listed here are not being provided for.”

- If you plan on leaving anyone out of your will, mention it here. You might say, “I specifically and intentionally am failing to provide for [insert name], my [relation], in this will.”

Advertisement -

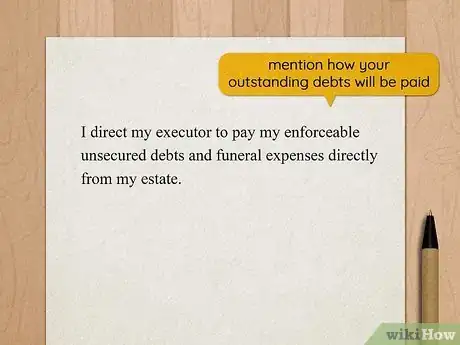

3Describe how you’d like your outstanding debts to be paid. This section explains how, and who, any costs should be covered after your passing. Most people will include instructions for paying outstanding loans, like personal debts or mortgages.[3] You may write:

- “I direct my executor to pay my enforceable unsecured debts and expenses directly from my estate.”

- The executor is the person you designate to carry out the instructions of your will. You can name them here if you’d like, or list them in a separate section near the end of the will.

- While the executor is required to pay your debts once you’re gone, that money will come of out of your estate—not their pockets. However, co-signers, joint account holders, and your spouse may be on the hook depending on the kind of debt you’re carrying and where you live.[4]

- “I direct my executor to pay my enforceable unsecured debts and expenses directly from my estate.”

-

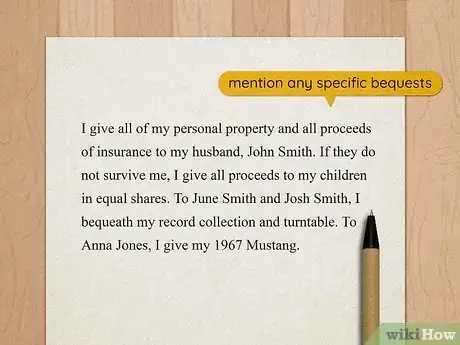

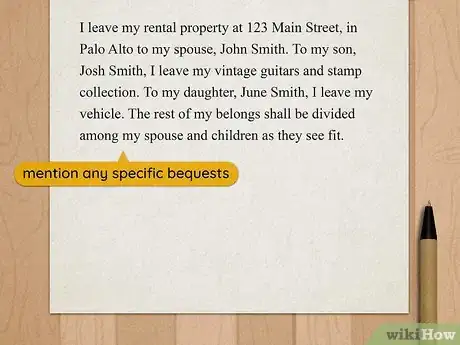

4Include any specific bequests you’d like to make if you have any. There are a few ways to do this. You can either divide the estate based on percentages, list the specific items you want to distribute to specific people, or some combination of the two.[5] You might say:

- “I give all of my personal property and all proceeds of insurance to my spouse, [spouse’s full name]. If they do not survive me, I give all proceeds to my children in equal shares. To [full name], I bequeath my record collection and turntable. To [full name], I give my 1967 Mustang.”

- The “in equal shares” here indicates that you simply want anything not bequeathed individually to be split up fairly among your children.

- “I give all of my personal property and all proceeds of insurance to my spouse, [spouse’s full name]. If they do not survive me, I give all proceeds to my children in equal shares. To [full name], I bequeath my record collection and turntable. To [full name], I give my 1967 Mustang.”

-

5Separate your bequests into different asset classes if you prefer. Most people will divide their assets into different categories and give them to their loved ones this way. For example, you could explain your liquid cash distributions in one paragraph, real estate in another, and stocks and bonds in another.[6]

- “I leave my rental property at [address] in [city] to my spouse, [full name]. To my son, [full name], I leave my vintage guitars and stamp collection. To my daughter, [full name], I leave my vehicle. The rest of my belongs shall be divided among my spouse and children as they see fit.”

-

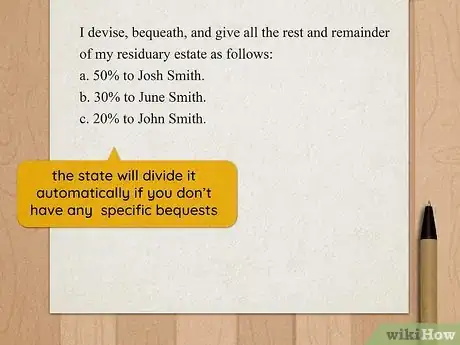

6Add no specific bequests and let the state divide it automatically. If you don’t bequeath any specific items in your will, that’s okay. Your state has intestacy laws that determine how estates are divided if no will exists. Usually, 100% of your belongings go to your spouse if you have no children, 100% to your children if you have no spouse, or a split if they’re all still around.[7]

- You’ll need to look the intestacy laws up where you live, but they’re generally very similar to one another.

-

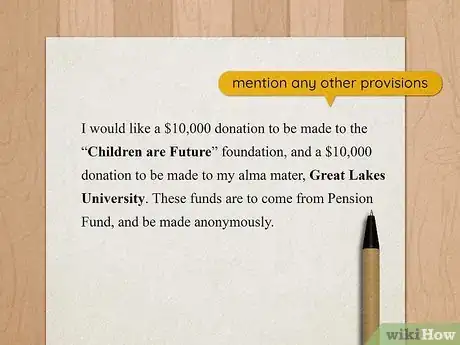

7Mention any miscellaneous provisions and requests. If you want to give money to charity, or you have any specific requests that don’t fit under another category, like what happens to your pet if they survive you, put it in a section for miscellaneous provisions.[8] You might write:

- “I would like a $10,000 donation to be made to the [charity name] foundation, and a $10,000 donation to be made to my alma mater, [school name]. These funds are to come from [account], and be made anonymously.”

- If your spouse isn’t around, include specific provisions for your children’s care if they’re all under 18. You’ll need to chat with a relative or friend to see if they’ll agree to be their guardian, and then include this line item in your will.

-

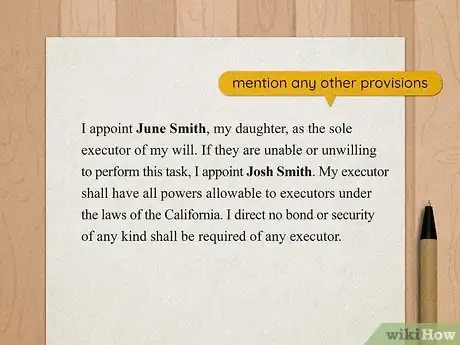

8Select a level-headed and responsible executor to carry out the will. The executor is the person in your life whom you trust enough to carry out your wishes. Try to choose someone you trust who won’t be so emotionally distraught by your passing that they’d struggle with the responsibility.[9] Ideally, choose someone with a background in accounting, law, or tax prep. You can always choose an attorney, law firm, or accountant you know!

- “I appoint [full name], my [relationship], as the sole executor of my will. If they are unable or unwilling to perform this task, I appoint [different full name]. My executor shall have all powers allowable to executors under the laws of the [state where you live]. I direct no bond or security of any kind shall be required of any executor.”

- The “bond or security” language is designed to save money. In some states, an executor bond will legally force the executor to distribute your assets as listed, but this will cost money. If you trust them, this is unnecessary.[10]

- “I appoint [full name], my [relationship], as the sole executor of my will. If they are unable or unwilling to perform this task, I appoint [different full name]. My executor shall have all powers allowable to executors under the laws of the [state where you live]. I direct no bond or security of any kind shall be required of any executor.”

-

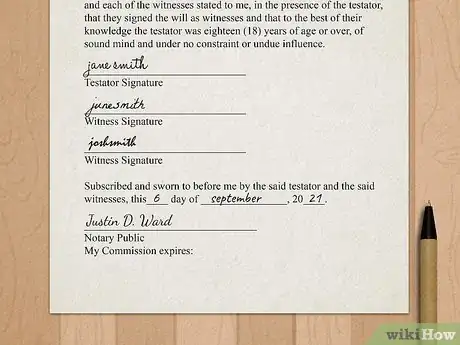

9Sign and date your will in the presence of two witnesses if necessary. Most states require witnesses. If you live in one of these states, have two individuals witness your will and sign it. Some states have specific requirements for who can or cannot be a witness, so consult a lawyer if you need help.[11]

- You can sign your will in the presence of a notary to make it self-proving. This will prove that it’s valid, since the notary will demonstrate that you weren’t under duress or anything when you signed the will.

- The requirements here are actually different from state to state, although many states use this “two witness” requirement. Still, look up your state law to ensure that you follow the rules here.

Choosing a Writing Method

-

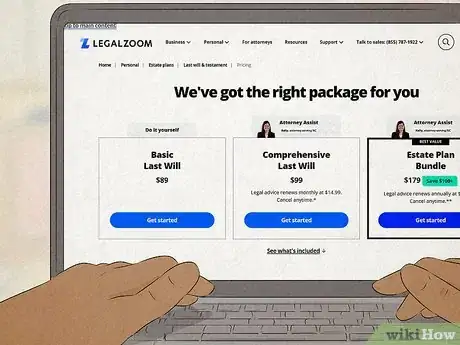

1Choose an online service to write your will to make things easy. With an online writing service, you pay a small fee and the website offering the service will walk you through the entire process. If you want to write your own simple will, this is the simplest way to do it. There’s a lot of legal jargon used in wills that can be difficult to write from scratch.[12]

- These services range from $5-150, depending on how much customization you’d like. Popular online will providers include Legal Zoom, Rocket Lawyer, and Trust & Will.

- Free Will is an online will writing service that is (as the name implies) absolutely free.

-

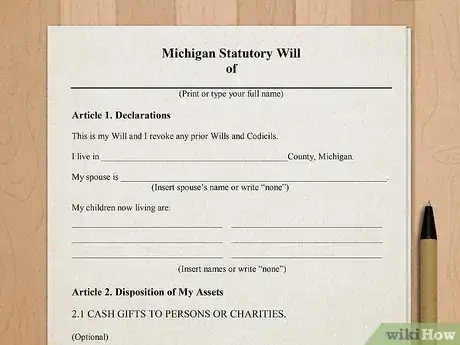

2Use your state’s statutory form if they offer one for a free will. Some states have a statutory will form that walks you through every single thing you’ll need to do to craft a legally valid will. This is a great option if you want a totally free and valid will that’s easy to compose. You can find a statutory will form online if you live in California, Maine, Michigan, New Mexico, or Wisconsin.[13]

- The main downside with these wills is that they’re not customizable. Depending on the options available on the statutory will form, you may not be able to make specific requests or changes.[14]

-

3Write it from scratch if you don’t have any complex instructions. Depending on where you live, you can theoretically write your will on a napkin and have it hold up in court. If you really don’t have a large portfolio of assets and your will is going to be super straightforward, you may prefer to write your will entirely on your own.[15]

- It is generally not recommended to do this if you have a lot to leave behind. If someone challenges your will in court and you didn’t write it 100% correctly, the entire document may be thrown out.[16]

-

4Collaborate with an attorney to draft your will so it is airtight. If you want to make sure that your will holds up in court with certainty, it’s best to work with a lawyer on this one.[17] It may cost $500-700, but it’s worth it if you have specific requirements. You should definitely consult a lawyer if any of the following apply to you:

- You have a complex portfolio of assets that you want distributed in a very specific way.

- You plan on leaving anyone out of your will, you have children with multiple people, or you’re divorced.

- You aren’t on good terms with your extended family.

- You have a sizable amount of money to leave to your partner and/or children.

Warnings

- This process only applies to wills in the United States. You’ll need to refer to your country’s laws if you live outside of the US.⧼thumbs_response⧽

References

- ↑ https://www.findlaw.com/estate/wills/sample-basic-will-annotated.html

- ↑ https://www.legalzoom.com/samples/last_will_and_testament.pdf

- ↑ https://www.legalzoom.com/samples/last_will_and_testament.pdf

- ↑ https://www.consumerfinance.gov/ask-cfpb/if-someone-dies-owing-a-debt-does-the-debt-go-away-when-they-die-en-1463/

- ↑ https://www.findlaw.com/estate/wills/sample-basic-will-annotated.html

- ↑ https://www.findlaw.com/estate/wills/sample-basic-will-annotated.html

- ↑ https://www.nycourts.gov/courthelp/WhenSomeoneDies/intestacy.shtml

- ↑ https://www.legalzoom.com/samples/last_will_and_testament.pdf

- ↑ https://www.kiplinger.com/article/retirement/t021-c032-s014-7-tips-for-choosing-the-right-executor.html

- ↑ https://www.findlaw.com/legalblogs/law-and-life/does-your-will-executor-need-to-be-bonded/

- ↑ https://www.alllaw.com/articles/nolo/wills-trusts/witness-requirement-execute.html

- ↑ https://www.aarp.org/money/estate-planning/info-03-2011/cost-effective-wills.html

- ↑ https://www.nolo.com/legal-encyclopedia/statutory-wills.html

- ↑ https://www.nolo.com/legal-encyclopedia/statutory-wills.html

- ↑ https://texaslawhelp.org/article/do-it-yourself-guide-for-handwritten-wills

- ↑ https://www.theguardian.com/money/2015/feb/09/dangers-diy-wills-mistakes

- ↑ https://www.aarp.org/money/investing/info-2019/15-minute-will.html

- ↑ https://www.kiplinger.com/article/retirement/t021-c000-s002-should-i-hire-a-lawyer-to-write-a-will-or-do-it-my.html

- ↑ https://www.forbes.com/sites/deborahljacobs/2012/08/09/when-should-you-redo-your-will/?sh=412010494a3a

- ↑ https://www.theguardian.com/money/2015/feb/09/dangers-diy-wills-mistakes