This article was co-authored by Derick Vogel. Derick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

There are 16 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 48,307 times.

Any late payments listed on your credit report will lower your credit score, which can make it harder for you to get a loan, mortgage, insurance, and even a job. Luckily, there are steps you can take to remove the late payment from your history and repair your credit. First, check your records to find out if the charge is a mistake or legitimate. If you really did miss a payment, then you can appeal to your creditors to remove the payment. If you discover that you paid the bill, then you can dispute the charge with the credit agencies. In either case, you'll be on your way to fixing your credit report soon.

Steps

Investigation and Evidence

-

1Get a copy of your credit report by contacting the 3 reporting agencies. If your credit score drops or you suspect that a late payment is being recorded on your score, then start by obtaining your full credit report.[1] Request a report from all three credit reporting agencies: TransUnion, Equifax, and Experian. You can do this by calling 1-877-322-8228, or by visiting their website at annualcreditreport.com. You will need to provide your name, Social Security number, address, and date of birth.[2]

- You are allowed a free copy of your credit report every 12 months. You are also allowed a copy if you've been denied a loan or credit, are unemployed and looking for a job, or were the victim of fraud or identity theft.

-

2Identify the late payments on each credit report. Once you get your reports, go through each one very carefully. Check for any errors or potential problems that might be hurting your credit score.[3] If you find any, write down the date, charge amount, and creditor to start your appeal process. Some things to look out for include:[4]

- Payments marked late that you know you paid, bills listed twice, bills more than 7 years old, open credit lines or accounts that you think you closed, and inaccurate credit limits.

- The 3 credit reports might not be exactly the same. It's normal for some agencies to report more than others.

Advertisement -

3Check your bank statements for evidence if you paid the bill. If there is a late payment marked on your credit report, then check your bank records to see if you paid it. Your statement should show a date that you made the payment. If you can find the payment on your statement, then you have a good case to dispute the charge with the credit agency.[5]

- It's easy to check your bank statements with online banking. If you don't have online access, call your bank to get a full account and payment history.

- It's also possible that you'll find out you really did miss a payment. In this case, submitting a goodwill letter to your creditor is a good option to try and get that removed.

-

4Report fraud or identity theft to the bank and FTC to eliminate the charge.[6] It's unfortunately always a possibility that late payments are because of fraud. If you can't verify payments on your report, then you may have been the victim of identity theft.[7] Report the fraud to the credit agency, your bank, and the Federal Trade Commission right away to prevent further damage to your credit. If this was indeed a fraudulent charge, then it'll be removed from your credit record.[8]

- If you know who stole your identity, you can also report the fraud to the police.

- Some fraud red flags to look out for include addresses or names on your credit report that you don't recognize, accounts that you don't own, payments to companies you don't recognize, or payments that you can't verify.

Goodwill Letters for Creditors

-

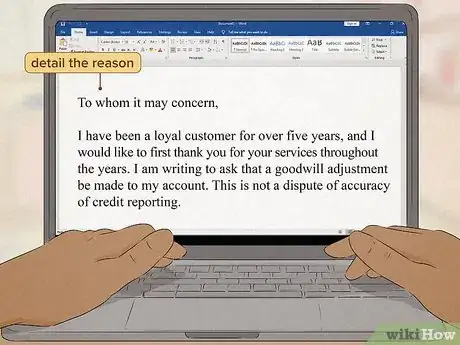

1Thank the creditor and detail the reason for the letter. If you have a good history with your creditor, then they might be willing to work with you and get rid of the charge.[9] Start by thanking your creditor for their service and stating that you've been a good customer for some time.[10] Additionally, make sure to state that your letter is a goodwill letter and not a dispute letter so they understand what's going on.[11]

- For example, “To whom it may concern, I have been a loyal customer for over five years, and I would like to first thank you for your services throughout the years. I am writing to ask that a goodwill adjustment be made to my account. This is not a dispute about the accuracy of credit reporting.”

- You can also write an email instead of a letter if you have the creditor's contact information. Follow the same steps for a goodwill letter.

- If you don't have a good history with the creditor, then a goodwill letter will probably not work. In this case, you'll have to call and negotiate a removal.

-

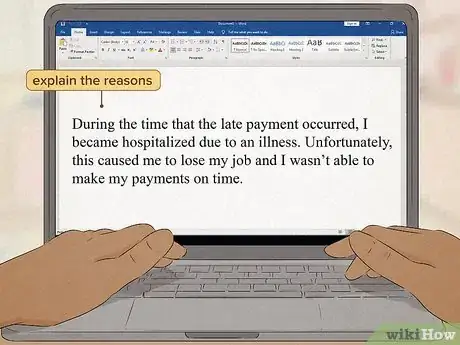

2Explain the reasons for the late payment. Acknowledge that the late payment is your fault, but that certain circumstances prevented you from paying on time.[12] Explain what happened so the company can sympathize with you. Avoid using the excuse, “I forgot.”[13]

- For example, “During the time that the late payment occurred, I became hospitalized due to an illness. Unfortunately, this caused me to lose my job and I wasn’t able to make my payments on time.”

-

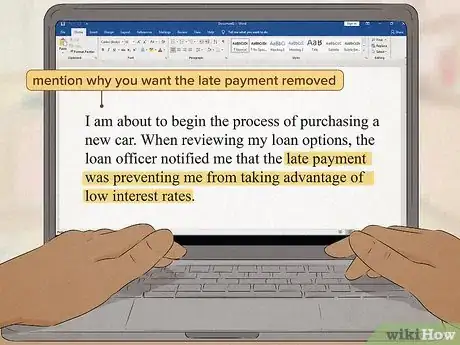

3Include the reason that you want the late payment removed. If you need to improve your credit score to qualify for a car or mortgage loan, include this in the letter. If you have an existing loan with a high interest rate, then wanting to refinance your loan is also a legitimate reason for wanting to improve your credit score.[14]

- For example, “I am about to begin the process of purchasing a new car. When reviewing my loan options, the loan officer notified me that the late payment was preventing me from taking advantage of low interest rates."

-

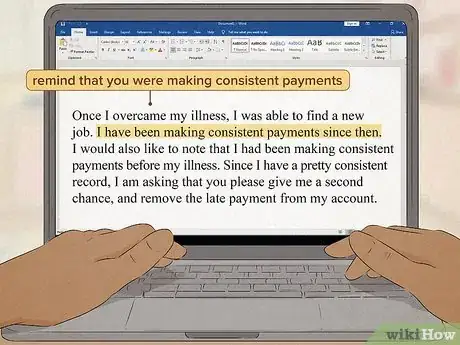

4Remind the creditor that you were making consistent payments. Pointing out that you were making consistent payments before the late payment occurred may help sway the creditor's opinion in your favor.[15] Additionally, if you have been making consistent payments since the late payment occurred, point this out too.[16]

- For example, "Once I overcame my illness, I was able to find a new job. I have been making consistent payments since then. I would also like to note that I had been making consistent payments before my illness. Since I have a pretty consistent record, I am asking that you please give me a second chance, and remove the late payment from my account.”

-

5Conclude the letter by thanking them for their time again. Maintain a friendly tone, even if you think there was some kind of error. Also offer to answer any questions that they might have, or provide any supporting documents that may help them decide.[17]

- For example, “Thank you for your time and consideration. I really appreciate it. Please feel free to contact me for any additional documentation that would assist you in reaching a positive outcome.”

-

6Send the letter to the company’s customer service address. Whether your creditor is a bank or private lender, send the letter to the recommended customer service address. This way, you'll know that your request will end up in the right hands.[18]

- Make sure to request a “return receipt request” service. This way you can keep track of what the creditor received for your records.

- You can also send this as an email to the lender's email address.

-

7Follow-up if you don't hear back within a few weeks. Persistence might help your case. If a few weeks go by and you haven't heard anything from the lender, try calling or emailing to see if they received your letter. This might remind them to have a look at your case.[19]

- Be prepared to plead your case again when you contact the lender. Remind them that you've been a great customer and made an honest mistake during a hard time. This might sway them.

Phone Negotiation

-

1Contact your creditor’s customer service.[20] Visit the website of the creditor you are in debt to. Call the customer service number provided. Explain to the representative that you would like to talk to someone about a late payment on your account. They will either transfer your call, or give you the account manager’s information.[21]

- A customer service number is typically located at the bottom of the webpage.

- The first person you talk to is probably just a customer service rep who won't be able to make any change to your credit history. You'll have to specifically ask for a manager or someone with the authority to make the change.

- It's very important to stay polite and courteous with everyone you speak to. Representatives are much more willing to work with polite people instead of rude people. It's definitely understandable to feel stressed, but don't take it out on the people you're speaking with.

-

2Tell the creditor about any hardships that caused your late payments. Emergencies happen, and some creditors are willing to work with you in these cases. Be sure to mention any problems you encountered, like an illness, natural disaster, job loss, or other financial hardship. The creditor might be more willing to make an exception for you and remove the late payment.[22]

- Some creditors have hardship plans for people who have experienced these problems. You can negotiate a lower rate or lump sum payment to satisfy your debt with these plans.

- In the future, it's always best to contact your creditor right away if you experience a hardship. This way, they can work with you right off the bat instead of waiting until you've fallen behind.

-

3Sign up for automatic payments. Many creditors will agree to remove a late payment if you sign up for automatic payments in exchange for the removal. Let the creditor know that you have the funds, like a stable job, to qualify for automatic payments.[23]

- This method works well if you only have 1 or 2 late payments on your account.

-

4Offer to pay off the balance. Tell the creditor that you are willing to pay off all or part of the debt in exchange for deletion of the late payments. If the creditor agrees, make sure to request the agreement in writing.[24]

- If you have a payment that is more than 120 days late, then this method may not work.

-

5State that you'll close your account if the creditor can't work with you. Ultimately, creditors want your business, so the risk of losing a customer might make them more willing to work with you. As a last resort, you could always threaten to cancel your account with this creditor and find another one. This could give them a push to make some exceptions to keep you as a customer.[25]

- Continue to be friendly and courteous if you take this route. Say something like, "Unfortunately, if you can't do anything to help me, I'll have to find another creditor to work with." Stay calm and don't yell.

- Note that this might only work if you were a good customer. If you have a poor credit history with this creditor, they might not be sad to see you leave.

Online Disputes for Inaccurate Charges

-

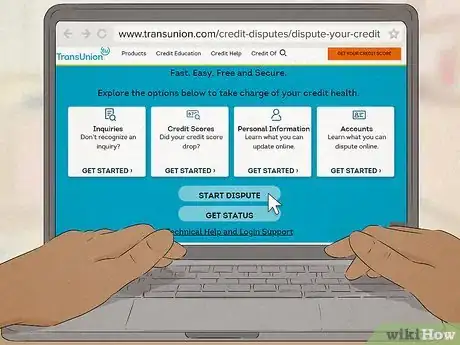

1Go to the dispute page for each of the major credit agencies. The 3 major credit reporting agencies, Equifax, TransUnion, and Experian, all have dispute tabs on their websites. If you have evidence that the late payment is a mistake or fraudulent, then go to these pages and file a dispute with each of the reporting agencies to have it removed.

- Equifax: https://www.equifax.com/personal/credit-report-services/credit-dispute/#

- Transunion: https://www.transunion.com/credit-disputes/dispute-your-credit

- Experian: https://www.transunion.com/credit-disputes/dispute-your-credit

- Note that this option is only appropriate if you believe the late fee is a mistake or fraud. If there actually is a late payment on your record, you have to contact the lender instead of the reporting agencies.

-

2Create an account with the reporting agency if you don’t have one. In order to submit a dispute, you have to make an account with each reporting agency. Click the option to make an account and fill in the required information like your name and contact information. Make a password and then your account is complete.[26]

- If you already have an account, you can just sign in normally.

-

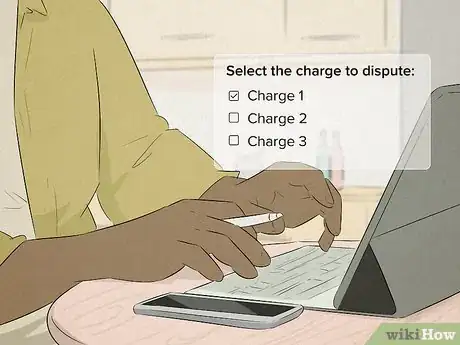

3Select the charge that you want to dispute. Once you’re in your account, select the option to open a dispute. A list of the late payments on your record should pop up. Select the charge that you want to dispute.[27]

- If you want to dispute multiple late payments, then you’ll probably have to select each one separately.

- The particular process for selecting and submitting disputes might be different for each agency. Follow the directions for each one and contact customer service if you have any problems.

-

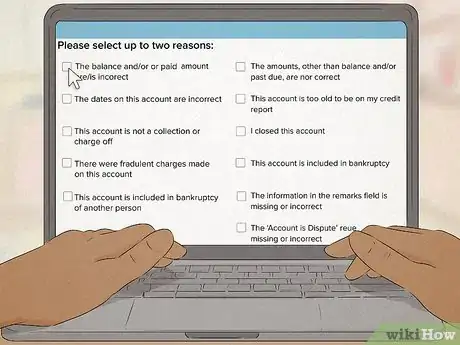

4Explain the reason for the dispute. When you make your selections, you’ll probably be asked to provide details about the dispute. Explain why you think the charge is a mistake and should be removed. Mention relevant evidence you have, like proof that you paid the bill or identity theft.[28]

- There might also be a dropdown menu to further categorize your dispute. Select the option that matches your dispute the closest.

-

5Upload any evidence you have proving the error. Some reporting agencies give you a section to upload supporting documents. This helps you prove your case, so scan in any evidence you have and upload it with your dispute.[29]

- Relevant documents are bank statements showing that you paid the bill, letters from your creditor saying that the bill was paid, or any other documents that prove the payment should be removed.

- Circle parts of the documents that prove your claim. For example, the date of a payment is relevant to your case.

-

6Submit the dispute and let the agency process it. Once you’ve filled everything out, review it all carefully. When you’re satisfied that you’ve provided as much information as you can, hit “Submit.” Now it’s up to the agencies to process your dispute and respond.[30]

-

7Wait about 30 days for the agencies to respond. In most cases, the credit agencies will take about 2-4 weeks to process and review your claim. During that time, they’ll reach out to the lenders and see if the late payment is accurate or not. If they find out the report was a mistake, they will correct it. When they’re done, they’ll respond to you with the verdict.[31]

- By law, the agencies have to send a notice of credit correction to anyone that you ask them to. If you were trying to get a loan or rent an apartment, for example, you can ask them to send a report to the lender and landlord to prove that the charge was a mistake.

- If the agency finds that the charge was legitimate but you still don’t agree, you can request that a dispute notice be added to your report. That way, people who view the report will see that you’re in the process of challenging the charge.

-

8Complain to the CFPB if the agencies aren’t cooperating. If for any reason you feel that the credit agencies aren’t handling your request or siding with you despite your evidence, can you officially complain to the US government’s Consumer Financial Protection Bureau. They can review the dispute and see if you’re being treated unfairly. If they agree with your claim, then they can order the agencies to remove the charge.[32]

- To submit a CFPB complaint, visit https://www.consumerfinance.gov/complaint/ and fill out the necessary information.

- In most cases, the CFPB can get back to you within 15 days.

Mail-In Disputes

-

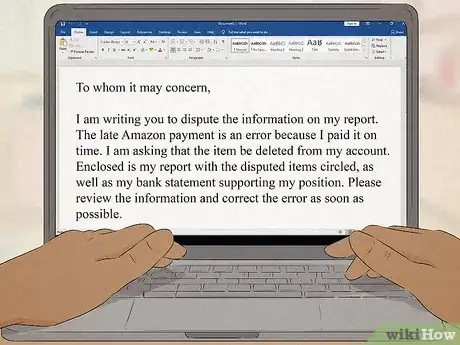

1Write a dispute letter for late payments you think are a mistake. At the top of the letter, write your complete name and current address. Write a letter that is simple and to the point. Identify each disputed item on the report and the reasons for why you are disputing the information. Then request that the disputed item be removed or corrected. Before sending the letter, make a copy of it for your records.[33]

- For example, “To whom it may concern, I am writing you to dispute the information on my report. The late Amazon payment is an error because I paid it on time. I am asking that the item be deleted from my account. Enclosed is my report with the disputed items circled, as well as my bank statement supporting my position. Please review the information and correct the error as soon as possible.”

-

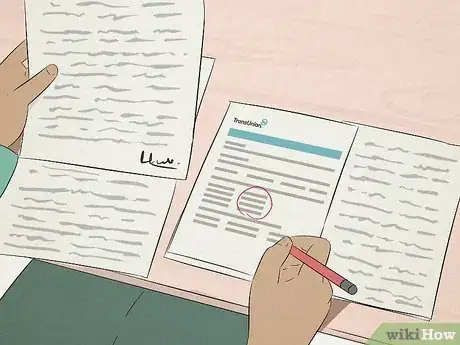

2Include copies of supporting materials to prove your case. Include a copy of your credit report with the disputed item circled in red. Include copies of payment records from your bank, court documents, and any other materials that support your case.

- Make sure to include copies of the original documents instead of the original ones.

-

3Send the letter and documents through certified mail. Send your letter and supporting documents to each reporting agency. Make sure to request a “return receipt requested” service. This way you can keep track of what the credit reporting agency received. The following are the addresses for each agency:[34]

- Experian, P.O. Box 2002, Allen, TX 75013

- TransUnion, Baldwin Place, P.O. Box 2000, Chester, PA 19022

- Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374

-

4Wait about 30 days for a response. Credit reporting agencies must investigate your case within 30 days. If verification shows that the error on your report was valid, then they must remove it and update your information. The agency will send you a letter in writing with the results, and free copy of an updated report if changes were made to it.[35]

- If the agency cannot verify the information’s accuracy on your report, then they will remove it.

References

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ https://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ https://www.thestreet.com/how-to/how-to-remove-late-payments-from-credit-report-15122527

- ↑ https://www.thestreet.com/how-to/how-to-remove-late-payments-from-credit-report-15122527

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ https://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ https://www.usa.gov/identity-theft

- ↑ Alex Kwan. Certified Public Accountant. Expert Interview. 1 June 2021.

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ https://www.transunion.com/article/how-to-remove-late-payment-from-credit-report

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ https://www.transunion.com/article/how-to-remove-late-payment-from-credit-report

- ↑ https://www.sample-resignation-letters.com/how-to-write-a-goodwill-letter-with-sample.html

- ↑ Alex Kwan. Certified Public Accountant. Expert Interview. 1 June 2021.

- ↑ https://www.sample-resignation-letters.com/how-to-write-a-goodwill-letter-with-sample.html

- ↑ https://www.sample-resignation-letters.com/how-to-write-a-goodwill-letter-with-sample.html

- ↑ https://www.nerdwallet.com/article/finance/goodwill-letter

- ↑ https://www.nerdwallet.com/article/finance/goodwill-letter

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ http://www.finweb.com/banking-credit/how-to-remove-a-late-payment-from-your-credit-report.html#axzz4ufWj8k2H

- ↑ https://www.bankrate.com/finance/debt/how-to-negotiate-with-credit-card-companies/

- ↑ https://money.usnews.com/money/blogs/my-money/2014/08/25/how-to-get-a-credit-card-late-payment-fee-waived-in-4-easy-steps

- ↑ http://www.finweb.com/banking-credit/how-to-remove-a-late-payment-from-your-credit-report.html#axzz4ufWj8k2H

- ↑ https://www.finweb.com/banking-credit/how-to-remove-a-late-payment-from-your-credit-report.html#axzz4ufWj8k2H

- ↑ https://www.transunion.com/blog/credit-advice/how-to-dispute-your-credit-report

- ↑ https://www.experian.com/blogs/ask-experian/credit-education/faqs/how-to-dispute-credit-report-information/

- ↑ https://www.experian.com/blogs/ask-experian/credit-education/faqs/how-to-dispute-credit-report-information/

- ↑ https://www.transunion.com/blog/credit-advice/how-to-dispute-your-credit-report

- ↑ https://www.transunion.com/blog/credit-advice/how-to-dispute-your-credit-report

- ↑ https://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ https://www.consumerfinance.gov/complaint/

- ↑ https://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ https://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ https://www.transunion.com/article/how-to-remove-late-payment-from-credit-report

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ https://www.consumer.ftc.gov/articles/0145-settling-credit-card-debt