This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 159,191 times.

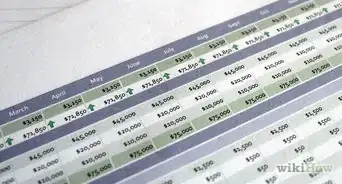

Learning how to read your paycheck stubs can help you to better track your income. Once you understand the layout and terminology of the paycheck stub, you can accurately track how much money you earned, how much money you took home, and how much of your earnings were given to any withholdings. Keeping a careful record of your earnings will help improve your overall personal finances.

Steps

Understanding Your Earnings

-

1Look at the top of your pay stub. You will find basic information at the top of your paycheck stub, such as the name and address of your employer and the date that the paycheck was issued. You may also find information about the company that processes payroll for your company.[1]

- You will likely find the check number at the top of your paycheck stub. This is useful for entering into your financial records to track income sources and amounts.

- If something is wrong with your paycheck, it will likely be the fault of the payroll company. Check with human resources if you spot a problem.

-

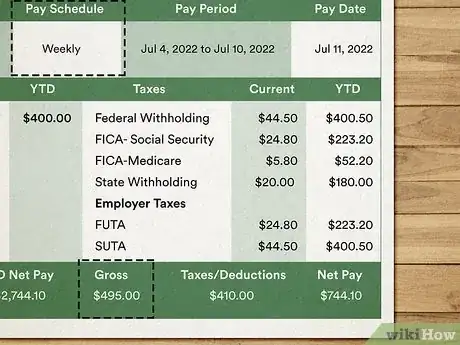

2Find the area labeled “Gross Pay”. Gross pay is the total amount that you earned before any withholdings have been taken. The gross pay will usually be over a certain period of time, known as a pay period.[2]

- Any taxes or other withholdings will not be reflected in your gross pay.

- A pay period will vary in length, depending on your employer. These pay periods may commonly cover weekly, bi-weekly, or monthly periods. Other pay periods are possible, however, not as common.

Advertisement -

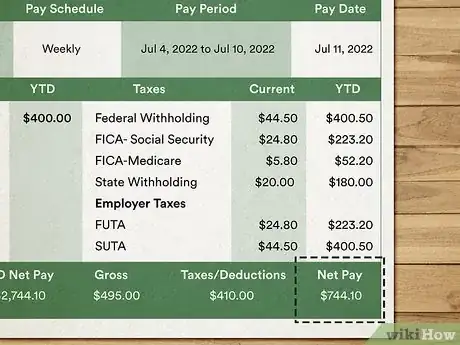

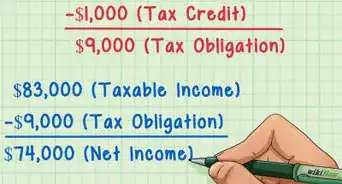

3Locate your “Net Pay”. Find the amount next to the area labelled net pay to learn how much of your earnings are yours to take home. An amount next to net pay has already had any withholdings or taxes removed from it.

- Net Pay is the actual amount of your earnings that you will receive.

Learning What Taxes and Withholdings Were Taken

-

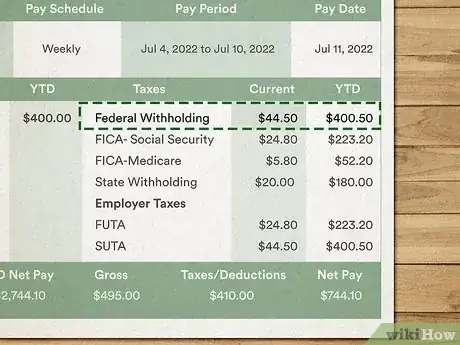

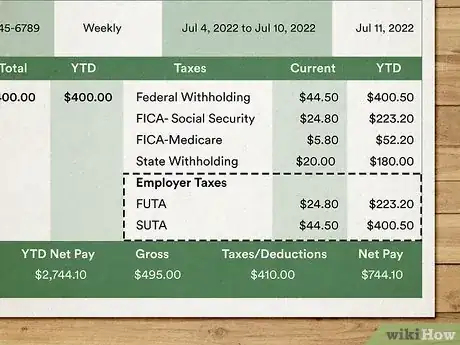

1Look for “Federal Tax Amount”. This area will give you the total amount that the Federal Government has taken from your pay for taxes due. This amount will vary depending on how many exemptions you claimed when your filed your W-4 tax form.[3]

- You can change the amount of exemptions at any time by filling out a new W-4 form.

- Ask your human resources contact to change your W-4 form or how best to make changes to it.

- Exemptions can be made for yourself, others, or you can claim none.

-

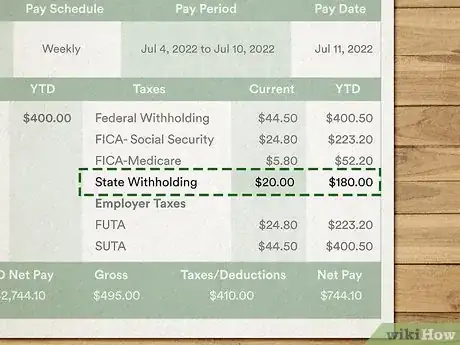

2Find the area labeled “State Tax”. The area marked state tax will usually be found very close to the item for federal tax. This listing for state tax will show your just how much of your earnings went to the state you live in.[4]

- State Tax will vary from state to state.

- Not all states will collect an income tax.

- State taxes are used for public projects such as education and health care.[5]

-

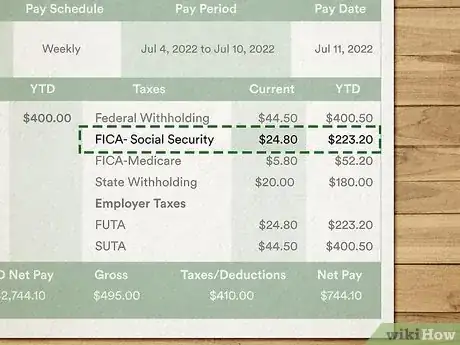

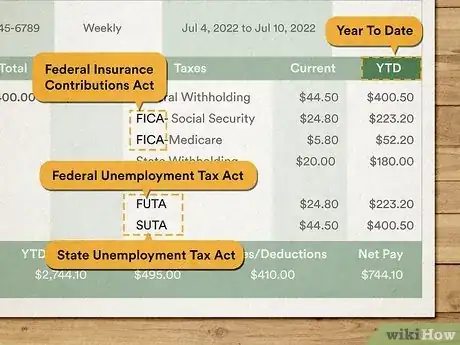

3Locate the item labeled “Social Security”. Social security is a federally mandated payment into the social security system. When you reach an age at which you might retire, you will be able to access the social security system funds, receiving a monthly payment from them.[6]

- Paying into social security will help finance your retirement.

- You will contribute 6.2% of your income to social security payments.

- Your employer will also contribute 6.2% of your income to social security payments.

-

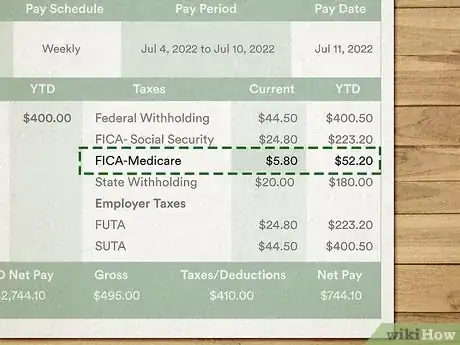

4Find the area listed as “Medicare”. Medicare is program that can help with medical payments and billing, once you are eligible for social security. Payment into Medicare is mandatory for both you and your employer.[7]

- Medicare payments are set at 1.45% of your paycheck.

- Your employer is also required to pay 1.45% of your paycheck.

- You may also find that your Medicare is part of another item labeled FICA. FICA usually includes Medicare and social security together.

Finding Additional Items and Summaries

-

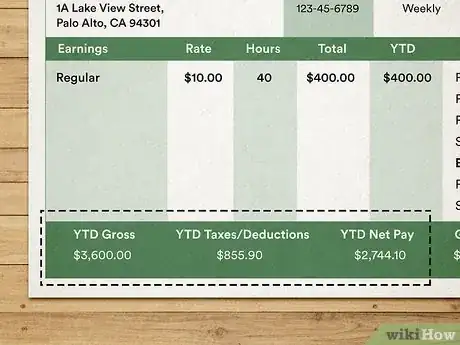

1Look for the item labelled “Year to Date”. Year to date is a useful entry on your paycheck stub that can show you exactly how much you have earned, and how much has gone to taxes or withholdings, up to the current date of that pay stub.[8]

- Use the year to date area of your paycheck stub to keep up-to-date and accurate financial records of your earnings.

-

2Look for additional items that may appear. Each pay-stub will be unique. Beyond the more common items found on your pay-stub, there may appear additional items that you should look for.[9]

- Insurance Deductions. Your company may take money directly from your earnings and place it into your insurance policy payment. If this is so, you can keep an accurate record of how much you have paid for insurance and when the payment was made.

- Retirement Plan. If your employer offers retirement plans, they may take automatic deductions from your pay and apply them to your plan. This can be a great way to save money for retirement and if your paycheck stub has this item, you can easily keep track of your contributions. Your plan may be labeled by the type of plan you are using such as 401(k), 403(b), profit sharing, or IRA.

- Time off. Some employers may enter the amount of time off you have used or have yet to use. This item, while not directly related to earnings, can still be useful in projecting how many hours of pay may be lost if taking time off.

- Additional notices. Employers will sometimes put important information regarding changes to pay policies on the paycheck stub. These will help keep you informed about any upcoming modifications that may affect your net earnings.

-

3Learn what some common abbreviations mean. Often times, your employer, or the payroll company they have hired, will make use of abbreviations on your paycheck stub to save space. Understanding these abbreviations will help you make better sense of the information presented.[10]

- YTD: Year-to-Date

- FT or FWT: Federal Tax or Federal Tax Withheld

- ST or SWT: State Tax or State Tax Withheld

- SS or SSWT: Social Security or Social Security Tax Withheld

- MWT or Med: Medicare Tax Withheld

Expert Q&A

-

QuestionHow do I learn what the abbreviations mean on my pay stub?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor Contact your Human Resources Department or the Company Accounting Department to learn what the abbreviations on your check mean.

Contact your Human Resources Department or the Company Accounting Department to learn what the abbreviations on your check mean. -

QuestionHow do I find out how much I make a month?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor Visit your Human Resources or Payroll Department to see how to understand your income and deductions are calculated.

Visit your Human Resources or Payroll Department to see how to understand your income and deductions are calculated.

References

- ↑ http://www.clearpointcreditcounselingsolutions.org/how-to-read-your-pay-stub/

- ↑ https://www.tiaa-cref.org/public/advice-guidance/education/financial-ed/earning_income/how-to-read-a-pay-stub

- ↑ https://www.tiaa-cref.org/public/advice-guidance/education/financial-ed/earning_income/how-to-read-a-pay-stub

- ↑ https://www.credit.com/personal-finance/how-to-read-your-paycheck-stub/

- ↑ http://www.cbpp.org/research/policy-basics-where-do-our-state-tax-dollars-go

- ↑ https://www.credit.com/personal-finance/how-to-read-your-paycheck-stub/

- ↑ https://www.credit.com/personal-finance/how-to-read-your-paycheck-stub/

- ↑ http://www.clearpointcreditcounselingsolutions.org/how-to-read-your-pay-stub/

- ↑ http://www.clearpointcreditcounselingsolutions.org/how-to-read-your-pay-stub/

About This Article

Your pay check stubs might seem confusing at first, but once you understand the different sections, it’ll make a lot more sense. Under your basic information, you’ll see your gross pay, which is the total amount you earned before deductions. These include state and federal tax, social security, and Medicare if you’re entitled to it. You may also have deductions for your retirement plan, insurance, and any time you took off. Your net pay is the final amount you take home after these deductions. You’ll also find an area labelled “Year to date,” which will tell you how much you’ve earned in the tax year so far and how much you’ve paid towards things like tax and social security. For more tips from our Financial co-author, including how to read common abbreviations on your pay check stubs, read on!