This article was co-authored by Jonathan DeYoe, CPWA®, AIF®. Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 219,288 times.

The Department of Health and Human Services reported that by 2010 nearly 10 million Americans required long-term care. It is expected that 70% of people turning 65 will need long-term care at some point in their lives and that many of these people will require care from a long-term care facility or nursing home. It is never too early to begin planning for how you will pay for care, protect your assets and qualify for Medicaid.

Steps

Paying for Long-Term Care

-

1Use private wealth. If you have significant financial resources, you may be able to afford to pay for nursing home services or private in-home services out of pocket. It is unlikely that you would be able or desire to reduce your wealth to such a degree as to qualify for Medicaid. The average cost for long-term nursing home care is between $6,000 and $9,000 a month. It may be more cost effective for you to pay for in-home care which may cost approximately $21 an hour.

- If you know in advance you plan to use your own assets to pay for long-term care, it's a good idea to earmark those funds and set them aside before you'll need them.[1]

-

2Rely on family. In 2015, 65 million people provided informal and family caregiving to people who were ill, disabled or elderly.[2] These services not only reduced the cost of caregiving expenses but it also kept people in their homes longer and out of nursing homes. If you only need assistance with certain things, consider asking a family member to help you out during the week or pay someone to come into your home to help you. This will minimize the amount of money you need to spend on long-term care.Advertisement

-

3Pay with private insurance or Medicare. You will need to look closely at your private insurance policy as most insurers do not cover long-term nursing home care. Most insurance policies, including Medicare, limit nursing home care to 100 days as part of rehabilitation after a hospital stay.

- Policies typically only cover short term nursing home stays where you are required to receive skilled care.

- Your insurance plan may help to offset the costs of copays or treatment for short term skilled care but it is unlikely that it will cover long-term care where you only need assistance with activities of daily living (ADL) such as bathing, dressing or eating.

-

4Acquire long-term care insurance. Individuals can purchase long-term care insurance, which reimburses up to a certain amount the cost for long-term health care including assistance with ADLs. You should note that your age and your health are factors in determining the cost of this insurance, so it's a good idea to apply for it by the time you're in your mid-40s.[3] Many elderly people may not qualify for this insurance or, if they do qualify, may not be able to afford this insurance if they wait too long to acquire it. In determining the cost of long-term health insurance policies, insurers examine:

- Your age at the time you purchase the policy.

- The maximum amount the policy will pay out on a daily basis.

- The maximum number of days or years that the policy will pay out.

- Whether you choose any add-ons to the policy such as increases for inflation.

-

5Qualify for Medicaid. Medicaid is a federal program that is administered by each state for its residents. In order to qualify for Medicaid, you have to meet certain income and assets requirements as the program was meant to protect low-income individuals.[4] Medicaid offers most Americans the best potential support for long-term care costs.

- In order to qualify for Medicaid, most states limit a person's assets to $2,000 for an individual and $3,000 for a couple. If one spouse goes into a nursing care, for the purposes of Medicaid, the individual going into care can only have $2000 in non-exempt assets and the spouse remaining at home can keep half of the overall assets. Anything over half the assets plus $2000 must be reduced in order to qualify for Medicaid. This is called the spousal impoverishment rule.

- Medicaid also has monthly income limits that are set on a state-by-state basis. In New York, this amount is $825 a month for an individual living alone and $1,209 a month for a couple.

Paying Down Assets to Qualify for Medicaid

-

1Hire an attorney. The rules governing Medicaid are complex and by violating the rules, you can disqualify yourself from the program. It is very important that you hire an experienced elder law attorney. These attorneys understand all of the Medicaid rules, can help you protect your assets legally, and provide you important financial planning advice.

- When looking for an attorney it is always best to start with a referral from a friend or family member that retained the attorney's services. A trusted recommendation will put you at ease when meeting the attorney for the first time.

- You can locate elder law attorneys through the National Association of Elder Law Attorneys. You can find information about attorneys in your area on their website at: https://www.naela.org or through the American Bar Association at https://www.americanbar.org/groups/legal_services/flh-home/.

- When meeting your attorney for the first time, make sure that you explain all of your concerns, potential sources of income and the outcome that you would like to see. The attorney can then work with you to come up with a financial plan that best meets your needs and protects your assets should you or your spouse require nursing home care.

-

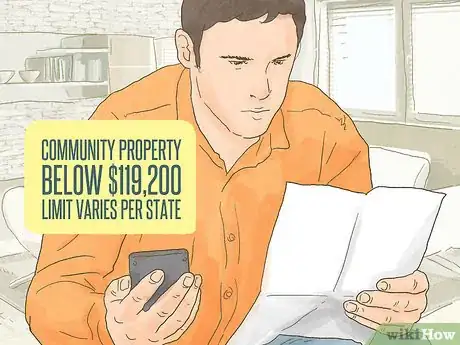

2Make sure your community property is below the limit. When you apply for Medicaid, the assets of both you and your spouse (the community spouse) are added together to determine your total amount of assets (community property). There is a limit to the amount of these assets that, if you are over it, prevents you from receiving Medicaid. This limit depends on your state, but can be as high as $119,200.[5]

-

3Reduce your assets by paying off debts. If your assets are greater than the maximum set by Medicaid, you should try to pay down your assets in order to qualify for the program. While certain assets are not counted towards your Medicaid thresholds, such as your family home or car, you may reduce the number of assets so that one spouse can qualify for the program. You can reduce your assets and become eligible for Medicaid in the following ways:

- Pay for medical care or in-home care.

- Pay for household items or expenses, including prepaying real estate taxes.

- Pre-pay for burial or funeral services.

- Pay off debt, including the mortgage, credit cards or student loans.

-

4Reduce your assets by purchasing assets exempt under Medicaid. There are a number of items that Medicaid does not count towards your overall asset calculation and therefore, by purchasing these items you can reduce your assets to qualify for Medicaid. Some of the assets exempt under Medicaid include

- Necessary household items such as furniture or appliances.

- At least one motor vehicle.

- The family home if at least one of the following people live there: the spouse of the person applying for Medicaid; a child under the age of 21; a disabled child of any age; a child who lived in the home for two years and provided the Medicaid applicant with in-home care; or a brother or sister who are partial owners of the house.

- Term life insurance policies.[6]

Transferring Assets to Qualify for Medicaid

-

1Transfer money into a Medicaid Asset Protection Trust. With a Medicaid Asset Protection Trust (MAPT), you transfer all of your assets to the trust and thereby give up the ability to control those funds. You can remain in your home and your income is outside of the trust but the principal of the trust is protected and does not count towards your Medicaid asset total. Also note, that trusts are subject to seizure in Missouri Case Law-find Mo V. Violet J. Knight and Tommy Jones, Appellants. They believed this "Trust" would keep their property safe. This is not the case.

- It is very important that you use an attorney to set up this trust.

- Assets placed in the trust are subject to the five-year “look back” period discussed below.

- You would have to assign someone other than you or your spouse to act as trustee for the trust.[7]

-

2Beware of the five-year rule. Medicaid closely examines all transfers of assets in the five years prior to a person applying for Medicaid. This is referred to as Medicaid's “lookback” provisions. If Medicaid determines that you conducted a non-exempt transfer, you can be penalized and not allowed to qualify for Medicaid for a certain number of years. It is very important that you speak with an elder law attorney before attempting to transfer funds to qualify for Medicaid. [8]

- Medicaid evaluates all transfers made in the five years before you apply for Medicaid to determine whether any of your transfers were made for “less than fair market value.” Medicaid is checking to see whether you gave your money away so as to avoid paying for your own care. States have differing rules on when to start the “lookback” time and some states even require children to pay for the care of their indigent parents.

- Medicaid calculates the penalty period by dividing the number of assets transferred by the average cost of a private nursing home in your area. You are then restricted by the number of days for which your asset transfer would have paid.[9]

-

3Transfer exempt assets to avoid penalties. There are a number of exceptions to Medicaid's lookback provision that would allow you to transfer certain assets and not be penalized when it comes to qualifying for Medicaid and having Medicaid pay for your nursing home care. These exceptions include:

- Transferring funds to your spouse for your spouse's benefit.

- Transferring assets to your blind or disabled child.

- Establishing a trust for your blind or disabled child.

- Establishing a trust for a disabled individual 65 years or younger, even if the trust is established for the Medicaid applicant.[10]

- As discussed above, you can also transfer your home to certain people and not be penalized. These people include: your spouse; children under the age of 21 or blind or disabled children; Medicaid applicant's siblings who own a partial share in the home; a child who has lived in the home for two years to care for the parent.

-

4Create a life estate. A life estate sometimes referred to as a “Lady Bird deed,” is a type of real estate transfer whereby a person gives or sells their home but retains the right to live in the home until they die or their spouse dies. People use this to protect the home as an asset from nursing homes and Medicaid, as well as a way to have the home skip the probate process.

- While some states do not consider homes part of a person's assets unless the home is worth a certain amount, other states would subject the home to a Medicaid “look back.” This means that if you transferred your home under a life estate within 5 years and you do not meet any of the exceptions discussed above, you will be subject to a Medicaid penalty.[11]

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow can I prepare for the expense of a nursing home?

Jonathan DeYoe, CPWA®, AIF®Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

Jonathan DeYoe, CPWA®, AIF®Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

Financial Advisor This is a very personal issue that depends on your individual plans for the future, your income, and your asset level. It's best to consult an elder law attorney as you make your plan. However, the two main ways to prepare are to either set aside the assets you might need, or to purchase long-term care insurance, preferably around the time you're in your mid-40s.

This is a very personal issue that depends on your individual plans for the future, your income, and your asset level. It's best to consult an elder law attorney as you make your plan. However, the two main ways to prepare are to either set aside the assets you might need, or to purchase long-term care insurance, preferably around the time you're in your mid-40s.

References

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ https://www.caregiver.org/selected-long-term-care-statistics

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ http://healthcare.findlaw.com/medicare-medicaid/the-difference-between-medicare-and-medicaid.html

- ↑ http://www.elderlawanswers.com/does-a-wifes-separate-property-count-toward-a-medicaid-applicants-assets-15127

- ↑ http://www.bizfilings.com/toolkit/sbg/run-a-business/assets/know-law-regarding-medicaid-transfers.aspx

- ↑ http://www.trustlaw.com/medicaid-asset-protection-trusts_2.html

- ↑ http://www.bizfilings.com/toolkit/sbg/run-a-business/assets/know-law-regarding-medicaid-transfers.aspx

- ↑ http://www.elderlawanswers.com/medicaids-asset-transfer-rules-12015

About This Article

Before attempting to protect your assets from nursing home expenses, it’s important to speak with an experienced elder law attorney who can help you navigate your way through Medicaid laws. Once you have legal guidance, they may suggest that you make sure your community property is below the limit, or else you will be disqualified for Medicaid assistance. To reduce your assets, an attorney might suggest paying off debts, like your mortgage, credit cards, or student loans. Additionally, they may help you transfer your money to a Medicaid Asset Protection Trust, which will take your assets out of your control so they don’t count towards your Medicaid asset total. For more help from our Legal co-author, like how to create a life estate, scroll down.