This article was co-authored by Andrew Lokenauth. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

There are 13 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 14 testimonials and 89% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 615,362 times.

Investing in the stock market can be a great way to have your money make money, particularly in today’s economic climate where savings accounts and long-term bank notes do not offer significant returns. Stock trading is not a risk-free activity, and some losses are inevitable. However, with substantial research and investments in the right companies, stock trading can potentially be very profitable.

Steps

Getting Started

-

1Research current trends. There are many reputable sources that report on market trends. You may want to subscribe to a stock-trading magazine such as Kiplinger, Investor's Business Daily, Traders World, The Economist, or Bloomberg BusinessWeek. .[1]

- You could also follow blogs written by successful market analysts such as Abnormal Returns, Deal Book, Footnoted, Calculated Risk, or Zero Hedge.[2]

-

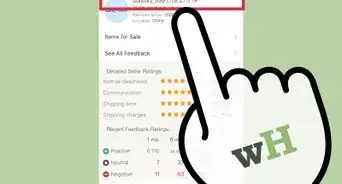

2Select a trading website. Some of the top-rated sites include Scottrade, OptionsHouse, TD Ameritrade, Motif Investing and TradeKing. Be sure that you are aware of any transaction fees or percentages that will be charged before you decide on a site to use.

- Be sure the service you use is reputable. You might want to read reviews of the business online.

- Select a service that has amenities such as a mobile phone app, investor education and research tools, low transaction fees, easy to read data and 24/7 customer service.

Advertisement -

3Create an account with one or more trading websites. You’re unlikely to need more than one, but you may want to start with two or more so that you can later narrow your choice to the site you like the best.

- Be sure to check out the minimum balance requirements for each site. Your budget may only allow you to create accounts on one or two sites.

- Starting with a particularly small amount, like $1,000, may limit you to certain trading platforms, as others have higher minimum balances.[3]

-

4Practice trading before you put real money in. Some websites such as ScottradeELITE, SureTrader, and OptionsHouse offer a virtual trading platform, where you can experiment for a while to assess your instincts without putting actual money in. Of course, you can’t make money this way, but you also can’t lose money![4]

- Trading in this manner will get you used to the methods and types of decisions you will be faced with when trading but overall is a poor representation of actual trading. In real trading, there will be a delay when buying and selling stocks, which may result in different prices than you were aiming for. Additionally, trading with virtual money will not prepare you for the stress of trading with your real money.

-

5Choose reliable stocks. You have a lot of choices, but ultimately you want to buy stock from companies that dominate their niche, offer something that people consistently want, have a recognizable brand, and have a good business model and a long history of success.[5]

- Look into a company's public financial reports to evaluate how profitable they are. A more profitable company usually means a more profitable stock. You can find complete financial information about any publicly traded company by visiting their website and locating their most recent annual report. If it is not on the site you can call the company and request a hard copy.[6]

- Look at the company's worst quarter on record and decide if the risk of repeating that quarter is worth the potential for profit.[7]

- Research the company's leadership, operating costs, and debt. Analyze their balance sheet and income statement and determine if they are profitable or have a good chance to be in the future.[8]

- Compare the stock history of a specific company to the performance of its peer companies. If all technology stocks were down at one point, evaluating them relative to each other rather than to the entire market can tell you which company has been on top of its industry consistently.[9]

- Listen to a company's earnings conference calls. First, analyze the company's quarterly earnings release that is posted online as a press release about an hour before the call.

-

6Buy your first stocks. When you are ready, take the plunge and buy a small number of reliable stocks. The exact number will depend on your budget, but shoot for at least two.[10] Companies that are well-known and have established trading histories and good reputations are generally the most stable stocks and a good place to start. Begin trading small and use an amount of cash you are prepared to lose.[11]

- It is reasonable for an investor to begin trading with as little as $1,000. You just have to be careful to avoid large transaction fees, as these can easily eat up your gains when you have a small account balance.[12]

-

7Invest mostly in mid-cap and large-cap companies. Mid-cap companies are those that have a market capitalization between two and $10 billion. Large-cap companies have market caps larger than $10 billion, while those with market caps smaller than $2 billion are small-caps.[13]

- Market capitalization is calculated by multiplying a company’s stock price by the number of shares outstanding.[14]

-

8Monitor the markets daily. Remember the cardinal rule in stock trading is to buy low and sell high. If your stock value has increased significantly, you may want to evaluate whether you should sell the stock and reinvest the profits in other (lower priced) stocks.

-

9Consider investing in mutual funds. Mutual funds are actively managed by a professional fund manager and include a combination of stocks. These will be diversified with investments in such sectors as technology, retail, financial, energy or foreign companies.

Understanding the Basics of Trading

-

1Buy low. This means that when stocks are at a relatively low price based on past history, you buy them. Of course, no one knows for sure when the prices are going to go up or down—that’s the challenge in stock investing.

- To determine if a stock is undervalued, look at the company's earnings per share as well as purchasing activity by company employees. Look for companies in particular industries and markets where there's lots of volatility, as that's where you can make a lot of money.

-

2Sell high. You want to sell your stocks at their peak based on past history. If you sell the stocks for more money than you bought them for, you make money. The bigger the increase from when you bought them to when you sold them, the more money you make.

-

3Do not sell in a panic. When a stock you have drops lower than the price you bought it for, your instinct may be to get rid of it. While there is a possibility that it can keep falling and never come back up, you should consider the possibility that it may rebound. Selling for a loss isn’t always the best idea, because you lock in your loss.

-

4Study the fundamental and technical market analysis methods. These are the two basic models of understanding the stock market and anticipating price changes. The model you use will determine how you make decisions about what stocks to buy and when to buy and sell them.[15]

- A fundamental analysis makes decisions about a company based on what they do, their character and reputation, and who leads the company. This analysis seeks to give an actual value to the company and, by extension, the stock.

- A technical analysis looks at the entire market and what motivates investors to buy and sell stocks. This involves looking at trends and analyzing investor reactions to events.[16]

- Many investors use a combination of these two methods to make informed investment decisions.

-

5Consider investing in companies that pay dividends. Some investors, known as income investors, prefer to invest almost entirely in dividend-paying stocks. This is a way that your stock holdings can make money even if they don't appreciate the price. Dividends are company profits paid directly to stockholders quarterly.[17] Whether or not you decide to invest in these stocks will depend entirely on your personal goals as an investor.

Developing Your Stock Portfolio

-

1Diversify your holdings. Once you have established some stock holdings, and you have a handle on how the buying and selling works, you should diversify your stock portfolio. This means that you should put your money in a variety of different stocks.

- To diversify your stock portfolio, consider investing in index funds like the S&P 500, these funds have a list of 500 companies and is safer than investing in individual stocks.

- Start-up companies might be a good choice after you have a base of older-company stock established. If a startup is bought by a bigger company, you could potentially make a lot of money very quickly. However, be aware that 90% of startup companies last fewer than 5 years, which makes them risky investments.[18]

- Consider looking into different industries as well. If your original holdings are mostly in technology companies, try looking into manufacturing or retail. This will diversify your portfolio against negative industry trends.

-

2Reinvest your money. When you sell your stock (hopefully for a lot more than you bought it for), you should roll your money and profits into buying new stocks. If you can make a little money every day or every week, you’re on your way to stock market success.

- Consider putting a portion of your profits into a savings or retirement account.

-

3Invest in an IPO (initial public offering). An IPO is the first time a company issues stock. This can be a great time to buy stock in a company you believe will be successful, as the IPO offering price often (but not always) turns out to be the lowest price ever for a company’s stock.

-

4Take calculated risks when selecting stocks. The only way to make a lot of money in the stock market is to take risks and get a little bit lucky. This does not mean you should stake everything on risky investments and hope for the best, though. Investing should not be played the same way as gambling. You should research every investment thoroughly and be sure that you can recover financially if your trade goes poorly.

- On one hand, playing it safe with only established stocks will not normally allow you to "beat the market" and gain very high returns. However, those stocks tend to be stable, which means you have a lower chance of losing money. And with steady dividend payments and accounting for risk, these companies can end up being a much better investment than riskier companies.

- You can also reduce your risk by hedging against losses on your investments. See how to hedge in investments for more information.

-

5Beware of the downside of day trading. Brokerage firms will usually charge fees for every transaction that can really add up. If you make more than a certain amount of trades per week, the Security Exchange Commission (SEC) forces you to set up at institutional account with a high minimum balance. Day trading is known for losing people lots of money as well as being stressful, so it is usually better to invest over a long period of time.

-

6Talk to a Certified Public Accountant (CPA). Once you start making serious money in the stock market, you may want to talk to an accountant about how your profits will be taxed. That said, while it's always best to talk to a tax professional, in many cases you will be able to adequately research this information for yourself and avoid paying a professional.

-

7Know when to get out. Trading in the stock market is like legal gambling and not an honest investment in the long term period. This is where it is different than investing, which is longer-term and safer. Some people can develop an unhealthy obsession with trading, which can lead you to lose a lot (even all) of your money. If you feel like you're losing control of your ability to make rational choices about investing your money, try to find help before you lose everything. If you know a professional who is smart, rational, objective, and unemotional, ask that person for help if you feel out of control.

Expert Interview

Thanks for reading our article! If you'd like to learn more about stock trading, check out our in-depth interview with Andrew Lokenauth.

References

- ↑ http://www.wisestockbuyer.com/2012/09/7-of-the-best-investing-magazines/

- ↑ http://traderhq.com/best-trading-blogs/

- ↑ http://www.nasdaq.com/investing/start-investing-1000.stm

- ↑ http://investorjunkie.com/14217/virtual-trading-account/

- ↑ http://www.forbes.com/sites/benzingainsights/2012/06/15/six-rules-to-follow-when-picking-stocks/

- ↑ http://www.marketwatch.com/story/how-to-choose-a-stock-1305567953708

- ↑ http://money.cnn.com/magazines/moneymag/money101/lesson6/index5.htm

- ↑ http://www.finra.org/Investors/SmartInvesting/ChoosingInvestments/Stocks/

- ↑ http://money.cnn.com/magazines/moneymag/money101/lesson6/index5.htm

- ↑ http://www.nasdaq.com/investing/start-investing-1000.stm

- ↑ http://www.investopedia.com/articles/basics/11/dangerous-moves-first-time-investors.asp

- ↑ http://www.nasdaq.com/investing/start-investing-1000.stm

- ↑ http://www.investopedia.com/video/play/midcap/

- ↑ http://www.investopedia.com/video/play/midcap/

- ↑ http://wanderingtrader.com/day-trading-blog/how-professional-day-traders-make-money-in-the-stock-market/

- ↑ http://www.investopedia.com/university/technical/

- ↑ http://www.forbes.com/sites/benzingainsights/2012/06/15/six-rules-to-follow-when-picking-stocks/

- ↑ http://www.forbes.com/sites/martinzwilling/2012/09/21/how-to-invest-in-startups-to-balance-your-portfolio/

About This Article

While stock trading can be risky, you might be able to make a lot of money if you do your research and invest in the right companies. Start by researching current market trends from trustworthy publications, like Kiplinger, Bloomberg BusinessWeek, and the Economist. Then, decide which trading sites you'd like to use, and make an account on 1 or more of the sites. If you can, practice trading before you put any real money in the market by using market simulators. When you're ready to trade, choose a mixture of reliable mid-cap and large-cap stocks, and monitor the markets daily. For tips from our financial reviewer on buying and selling stocks for profit, read on!