This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 106,872 times.

Learn more...

The U.S. federal government provides farm subsidies (also called agricultural subsidies) to help farmers manage the production and maintenance costs of running their businesses. Subsidies can aid when the market price of a crop is low or when a disaster strikes. Farm subsidies also promote conservation by paying farmers to fight erosion by converting some agricultural land to vegetative cover.

Steps

Finding Available Assistance

-

1Locate your nearest Farm Service Agency (FSA) office. Farm subsidies are administered through the Farm Service Agency. You will want to work closely with your local FSA office, which can help you identify programs and apply. You can find your state office by visiting a USDA website here: https://www.fsa.usda.gov/state-offices/index. Click on your state.

- At your state’s website, you should look for a link to county offices. Contact information should be provided.

-

2Identify popular subsidy programs. The FSA runs many different subsidy programs that help farmers. Some of these programs help you in the event of a disaster, whereas others are meant to cushion changes in the price of commodities. FSA also tries to encourage conservation by paying you not to plant land. The following are only some of the programs FSA runs:

- Price loss coverage. Eligible producers can receive compensation when the market price for their commodities falls below a reference price set by Congress.[1]

- Agricultural risk coverage. Producers can receive compensation when their revenue falls below a predetermined average.

- Dairy margin protection program. This insurance program provides payments when the national dairy production margin falls below a certain point.[2]

- Disaster assistance. The FSA provides relief for losses as a result of fire, flood, drought, pest infestation, tornadoes, and other natural disasters.[3]

- Conservation reserve program. You can receive a yearly rental payment from the federal government. In exchange, you agree to stop using environmentally sensitive land for agricultural purposes and instead convert it to vegetative cover. Contracts last 10-15 years.[4]

Advertisement -

3Discuss eligibility with your local FSA. Each program has its own eligibility criteria, which you can obtain from your local FSA. You should stop in and meet the staff. You will probably find that you will work closely with them in the future.

- Your local FSA can also discuss other programs not mentioned in this article.

Choosing Price Loss Coverage or Agriculture Risk Coverage

-

1Compare the programs. Farmers can receive subsidies if the price of their crops falls below a certain benchmark set by Congress. However, they must choose to enroll either for Price Loss Coverage or Agricultural Risk Coverage (ARC). Also, ARC comes in two forms.

- Price Loss Coverage. You receive a payment if your covered commodity is below the reference price. Payments are made on a crop-by-crop basis using your farm’s base acreage and program yield. You can enter covered commodities individually.

- ARC-County option. FSA will estimate crop revenue using the average county yield. You will receive payment if the crop revenue falls below the ARC-County guaranteed revenue. You can enter covered commodities individually.

- ARC-Individual option. If the actual revenue from all of your covered commodities is less than the ARC-Individual guarantee, then you will receive payment. If you choose this option, then you must enter all covered commodities.

-

2Check if you grow a qualifying commodity. Not every commodity is eligible for price loss payments or ARC coverage. Instead, only the following will qualify:[5]

- barley

- corn

- rice (medium grain, long grain, and California medium grain)

- oats

- grain sorghum

- wheat

- chickpeas (large and small)

- peanuts

- soybeans

- dry peas

- lentils

- other oilseeds

-

3Contact your FSA office. In order to qualify, you will also need to meet certain Adjusted Gross Income limits and be actively engaged in farming.[6] Talk to FSA staff about whether Price Loss Coverage or Agricultural Risk Coverage is better for you. Once you make a choice, you can’t change easily.

Participating in the Dairy Margin Protection Program

-

1Check if you are eligible. The protection program is only open to certain dairy producers in the United States. To be eligible, you must meet the following criteria:[7]

- You produce and market milk from cows that are in the U.S.

- You can provide proof of milk production when you register.

- You aren’t enrolled in the Risk Management Agency’s Livestock Gross Margin for Dairy Program.

-

2Choose your level of coverage. FSA provides catastrophic coverage, which doesn’t cost you anything apart from a basic $100 annual administrative fee. However, you can also choose different levels of buy-up coverage.[8]

-

3Find out the registration period. Enrollment is limited to certain times of the year. For example, to get coverage for 2017, you must enroll between July 1, 2016 and December 16, 2016.[9] If you miss this deadline, then contact your local FSA to ask when the next enrollment period will be.

-

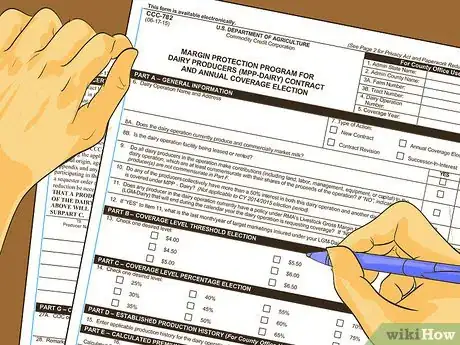

4Apply for the program. You can apply by getting the appropriate forms from your local FSA. You will need to complete and submit the following:[10]

- CCC-781, “Production History Establishment”

- CCC-782, “Contract and Annual Coverage Election”

Applying for Disaster Payments

-

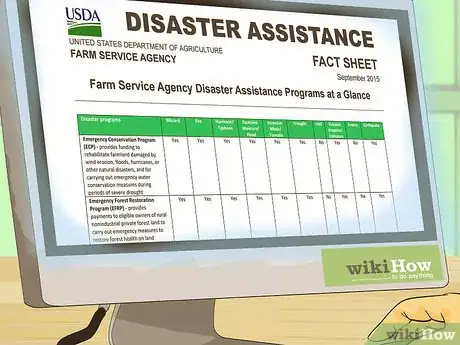

1Identify the different disaster programs. The FSA administers many different programs that provide disaster relief. You can find summaries on this convenient fact sheet: http://www.fsa.usda.gov/Internet/FSA_File/disaster_assistance_program.pdf. Generally, the following programs are available:

- Funding to rehabilitate damaged farmland.

- Funding to restore rural private forests destroyed by natural disasters.

- Emergency assistance for producers of livestock, honeybees, and farm-raised fish.

- Emergency loans to help producers recover from losses caused by natural disasters.

- Assistance to orchardists and nursery tree growers to replant or rehabilitate.

- Compensation for grazing losses suffered due to drought or fire on Federally managed land.

-

2Check eligibility requirements. Each disaster program has different eligibility requirements which cannot be summarized here. You should stop into your FSA office to check whether you qualify. To qualify, you generally must be in areas designated by FSA as eligible for disaster relief. There are also requirements for eligible livestock. For example, the following livestock are covered for grazing losses due to drought or fire under the livestock forage disaster program:

- alpacas

- beef cattle

- buffalo

- beefalo

- dairy cattle

- deer

- elk

- emus

- equine

- goats

- llama

- poultry

- reindeer

- sheep

- swine

-

3Apply with your local FSA office. You must submit a completed application and required supporting documentation to your local FSA office. There will be different deadlines depending on which disaster program you are applying for.

- For example, you must submit your application within 30 days after the end of the calendar year in which you suffered a loss if you are seeking assistance under the livestock forage disaster program.

- If you are applying for tree assistance, then you must apply within 90 days of the disaster or when it became apparent that you suffered a loss.

Participating in the Conservation Reserve Program

-

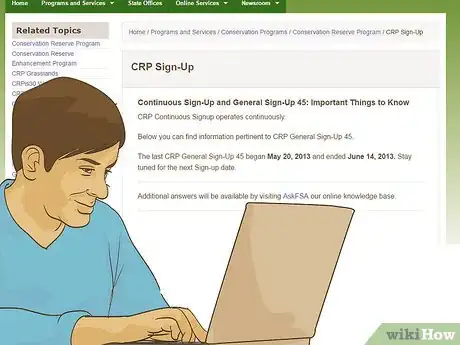

1Check when you can apply. If you have owned or operated the land for at least 12 months, then you can apply. You can enroll in the Conservation Reserve Program (CRP) in two ways. You should pick the method which works best for you:

- General sign-up. General sign-ups are announced periodically by the Secretary of Agriculture. They do not occur at set intervals. Instead, you should ask your local FSA office to notify you of when a general sign-up has been announced.

- Continuous sign-up. You can also apply any time that you want using continuous sign-up. Unlike general sign-up, offers are not subject to competitive bidding.[11] Instead, FSA will identify the most environmentally-sensitive lands and enroll them in the program.

-

2Confirm you qualify. To qualify for general sign-up, your land must meet certain conditions. You should check to see that your land qualifies:

- You must have planted cropland four of the past six years between 2008 and 2013, and the land must be capable of being planted.

- Alternately, certain pastures that can act as riparian buffers also qualify.

- The land must be sufficiently vulnerable to erosion.

-

3Apply for the program. You can get more details about either general sign-up or continuous sign-up by contacting your local FSA.[12] You should also discuss what factors FSA will use to rank to analyze the land’s potential environmental benefits.

Community Q&A

-

QuestionCan I get a subsidy with one acre?

Community AnswerYou should talk to your local FSA office.

Community AnswerYou should talk to your local FSA office.

References

- ↑ http://www.ers.usda.gov/topics/farm-economy/farm-commodity-policy/crop-commodity-program-provisions-title-i.aspx

- ↑ https://www.fsa.usda.gov/programs-and-services/Dairy-MPP/index

- ↑ https://www.fsa.usda.gov/programs-and-services/disaster-assistance-program/index

- ↑ https://www.fsa.usda.gov/programs-and-services/conservation-programs/conservation-reserve-program/index

- ↑ http://www.ers.usda.gov/topics/farm-economy/farm-commodity-policy/crop-commodity-program-provisions-title-i.aspx

- ↑ http://www.ers.usda.gov/topics/farm-economy/farm-commodity-policy/crop-commodity-program-provisions-title-i.aspx

- ↑ https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/Price-Support/pdf/2016/mpp-dairy_fact_sheet_august_2016.pdf

- ↑ https://www.fsa.usda.gov/programs-and-services/Dairy-MPP/index

- ↑ https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/Price-Support/pdf/2016/mpp-dairy_fact_sheet_august_2016.pdf

- ↑ https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/Price-Support/pdf/2016/mpp-dairy_fact_sheet_august_2016.pdf

- ↑ https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/FactSheets/2014/crp_consv_contin.pdf

- ↑ https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/FactSheets/2014/crp_consv_contin.pdf