wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 12 people, some anonymous, worked to edit and improve it over time.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 11 testimonials and 100% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 248,771 times.

Learn more...

People have many reasons to get jewelry appraised. You may choose to get jewelry appraised for liquidation, or you might want to determine the value of your jewelry for homeowner’s insurance or estate tax valuation. You might also need to value your jewelry if you are getting a divorce or valuing your jewelry as collateral.

Steps

Know What Information Should be Included in an Appraisal

-

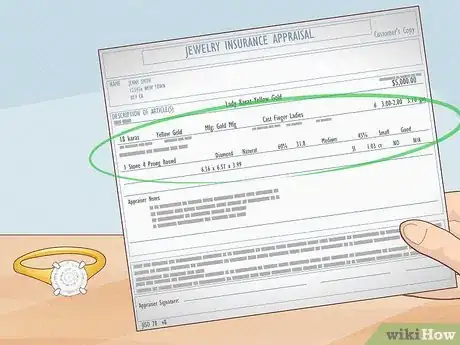

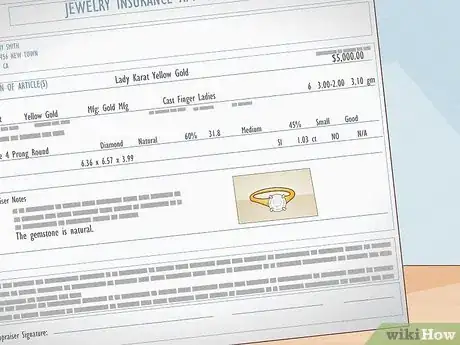

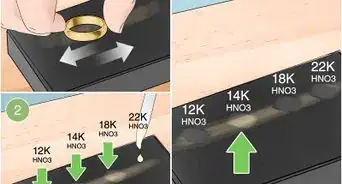

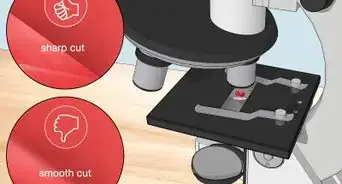

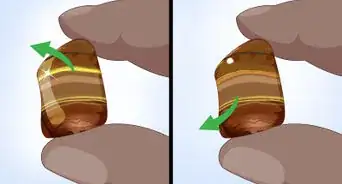

1Look for a description of all characteristics of the piece. Characteristics should include weights, grades and measurements of components. The color grade of the gemstone should be determined by using comparison gemstones.[1]

-

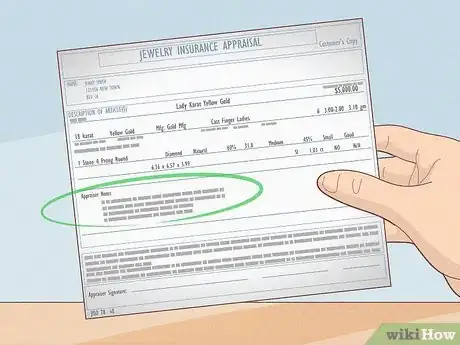

2Expect notes on gemstone treatment. If any atypical treatments were conducted on your gemstone or if your gemstone is untreated, this should be noted on the appraisal.Advertisement

-

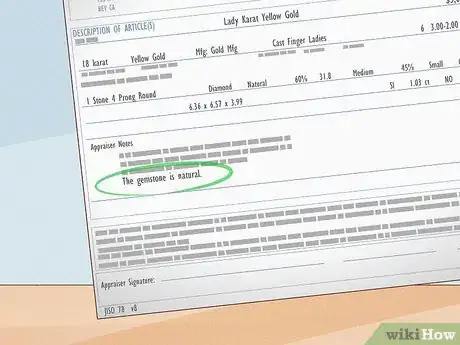

3Watch for a statement of whether the gemstone is natural or synthetic.[2]

-

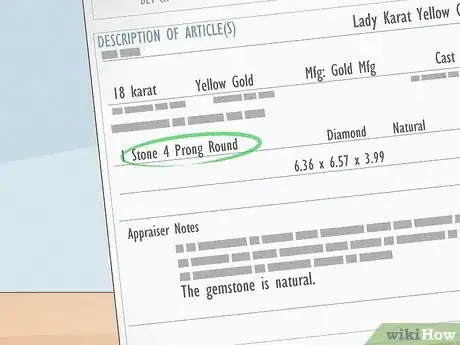

4Expect notes on the type of setting.[3]

-

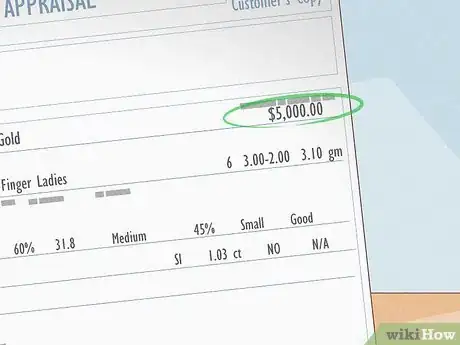

5Look for an appraisal of the jewelry’s value. The value depends on whether you want to insure your jewelry for its actual cash value, its replacement value or its agreed value.

- Cash value is the value of your jewelry at today’s market rate, not at the purchase price.

- Replacement value means the insurer will pay you a specific amount according to its current market value at the time of the loss.

- Agreed value means that you and your insurer settle on a specific value that you will receive in the event of a loss.

-

6Expect the appraisal to include a photograph of the gem.

-

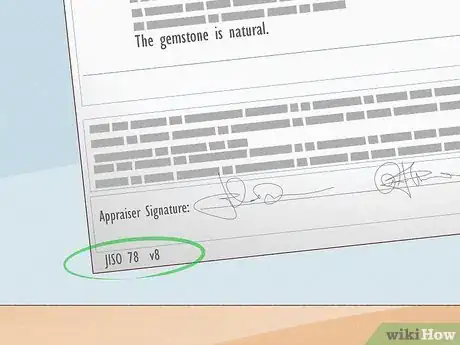

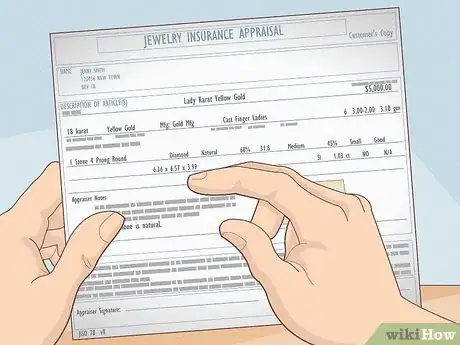

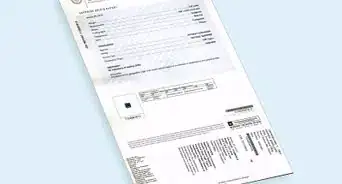

7Make sure that your jeweler uses the proper forms. If your appraisal is for an insurer, then your appraiser should use one of the following forms from the Jewelry Insurance Standards Organization:[4]

- JISO 805—Jewelry Sales Receipt for Insurance Purposes. This form is used when you are purchasing jewelry and can be completed by the retailer who sold the jewelry to you.

- JISO 806—Jewelry Document for Insurance Purposes. This form is used when you’re obtaining a second appraisal.

- JISO 78—Jewelry Insurance Appraisal—Single Item. This form must be completed by a Certified Insurance Appraiser and is a highly detailed description of the item.

- JISO 79—Jewelry Insurance Appraisal—Multiple Items. This form is also completed by a Certified Insurance Appraiser and is used for the valuation of multiple items of jewelry.

Verify a Jewelry Appraiser’s Credentials

-

1Look for both gemological and appraisal education. In addition to understanding gem identification, appraisers need to know valuation theory so that they can appraise the jewelry according to the intended use of appraisal documents.

-

2Review your appraiser’s resume or curriculum vitae. Look for professional certification and continuing education to show that the appraiser is keeping his or her skills current.

-

3Verify any certification or membership credentials. If the appraiser claims to be certified by the American Society of Appraisers, then double-check the certification by calling the organization or by checking the organization’s website.[5]

-

4Check for errors and omissions insurance. Also called liability insurance, errors and omissions protects the appraiser in case an error is made on your appraisal so that you can be compensated appropriately.

Find a Jewelry Appraiser through a Professional Organization

-

1Contact the American Gem Society to find an appraiser in your area. The AGS is a nonprofit dedicated to the education and protection of consumers. Appraisers who are AGS members take an annual Recertification Exam.

-

2Find a jewelry appraiser who is a member of the National Association of Jewelry Appraisers. NAJA labels members according to their level of experience in the industry, and Certified members have reached the apex of education in appraisal studies.[6]

-

3Look for certification from the American Society of Appraisers. ASA-accredited jewelers have thorough training in areas including Appraisal Review and Management, Business Valuation, Gems and Jewelry, Machinery and Technical Specialties, and Personal and Real Property. They also complete examinations and submit evidence that they can handle complex appraisal assignments.[7]

Community Q&A

-

QuestionCan I get jewelry appraised that I acquired from a garage sale or estate sale?

Community AnswerYes. Where you acquired the pieces has no impact on their empiric value.

Community AnswerYes. Where you acquired the pieces has no impact on their empiric value. -

QuestionWhat can I expect the charge to be for multiple pieces I want appraised?

Community AnswerAnywhere from $50 to $150 apiece, depending where you go. A local shop will be more likely to charge less, but a franchise store will charge you way more.

Community AnswerAnywhere from $50 to $150 apiece, depending where you go. A local shop will be more likely to charge less, but a franchise store will charge you way more. -

QuestionWhat does it mean when a piece of jewelry is IGL Certified, and T.W. Certified?

Community AnswerThe former certification means it has been appraised by the International Gemological Laboratory, and the latter indicates that the total karat weight of the stone has been verified.

Community AnswerThe former certification means it has been appraised by the International Gemological Laboratory, and the latter indicates that the total karat weight of the stone has been verified.

Warnings

- Avoid appraisers who ask to keep your jewelry for an extended period of time.⧼thumbs_response⧽

- Avoid appraisers who charge according to the size of your gemstone. A larger stone does not justify a higher fee.⧼thumbs_response⧽

Things You'll Need

- Jewelry

- Proper appraisal forms

References

- ↑ https://beyond4cs.com/faq/getting-your-purchase-appraised/

- ↑ https://jcrs.com/JCRS_for_consumers/appraising_jewelry/jewelry_appraisal.htm

- ↑ http://certgeminfo.com/anatomy-of-a-jewelry-appraisal/

- ↑ https://www.jiso.org/

- ↑ http://www.appraisers.org/

- ↑ https://www.americangemsociety.org/

- ↑ https://www.americangemsociety.org/

About This Article

Getting your jewelry appraised will allow you to find out exactly how much it's worth. To find a reliable appraiser who can give you an accurate appraisal, contact the American Gem Society. Alternatively, you may find an appraiser who is a member of the national Association of jewelry Appraisers. Once you find an appraiser, review their CV to see if they have accreditations in the field. You may also want to check if they have liability insurance, which will mean you’ll be compensated if they make any errors in appraising your item. After they’ve completed the appraisal, expect them to provide a full description of the item, including the size and quality of any gems, the types of precious metals used, and the type of mount used. For tips on how to find the correct forms to complete an appraisal for an insurance company, keep reading!