This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow's content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 91,058 times.

Learn more...

If you are an Indian citizen living in another country, the income you earn there may still be subject to Indian income tax. However, if India and the country where you live have a Double Taxation Avoidance Agreement (DTAA), you may be able to claim relief under that treaty. To exclude that income from Indian income tax, you must submit a tax residency certificate, as well as a no pe declaration from the entity that pays you. We'll show you how to find out if you're eligible, as well as how to fill out both your 10F and no pe forms.

Steps

Determining Your Eligibility

-

1Confirm there is a DTAA that applies to you. Form 10F only excludes your income from Indian income taxes if India and the country where you live have a treaty in place. You also must be subject to income tax in the country where you live.[1]

- The Indian Income Tax Department has a searchable list of all tax treaties between India and other countries around the world. You can access this list and read the treaties at https://www.incometaxindia.gov.in/Pages/international-taxation/dtaa.aspx.

-

2Determine whether you are eligible for tax residency. Generally, you are considered a tax resident if you are subject to income tax in the country where you live and where you earned the income in question.[2]

- If you were required to file taxes in the country where you live, or if taxes were withheld from your paychecks, you likely are eligible for tax residency.

Advertisement -

3Apply for residency certification with the country where you live. Each country has its own process for obtaining a tax residency certificate. Make sure you start the process several months before you need to file your tax return in India.[3]

- You can typically download an application form from the website of the tax authority in the country where you live.

- Read the instructions carefully and gather any documents you'll need to complete the application before you start filling out the form.

-

4Pay any required application fees. Many countries require you to pay a fee before they will issue you a tax residency certificate. These fees vary among countries and must be paid in local currency.[4]

- For example, if you want to apply for residency certification in the U.S., you must pay an $85 application fee for each application you file.

- Check accepted methods of payment. You may not be able to use a credit card.

-

5Mail your completed application to the appropriate address. You typically are required to attach documents to support the claims you make in your application. Therefore, it must be mailed to the relevant tax authority in the country where you live.[5]

- The method of payment you choose may determine the address where you mail your application package.

- Make a copy of everything you send for your records before you mail it.

-

6Receive your tax residency certificate. After your application is received and processed, you'll get your tax residency certificate in the mail, typically within 30 to 45 days of when your application was sent.[6]

- If the tax department or agency requires additional information from you before your application can be processed, you may receive a separate notice.

Completing Form 10F

-

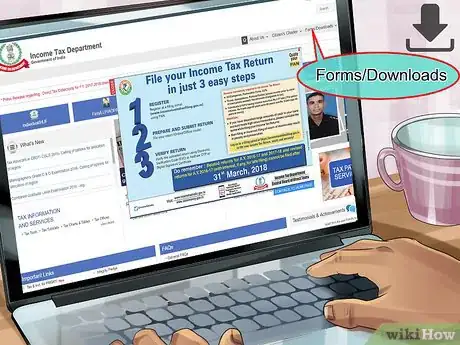

1Download the form from the Income Tax Department. The Indian Income Tax Department has Form 10F available for download on its website. Find the form by going to https://www.incometaxindia.gov.in. Click on "Forms/Downloads" and choose "Income Tax Forms" from the drop-down menu. Then enter "10F" in the search box and click "Search."[7]

- This is a fillable form. Make sure you have the updated version of Adobe Acrobat Reader installed on your computer.

-

2Provide your residency and tax identification information. The purpose of Form 10F is to establish your identity, that you are an Indian citizen, non-resident of India, and pay taxes in the country where you do live.[8]

- The period of residential status you list on Form 10F should be the same as the period of residential status listed on your tax residency certificate.

- Make sure you include your PAN. There are strict penalties if you don't.

-

3Print and sign your form. There are two spaces on Form 10F for you to sign. The first is your plain signature, the second is a self-verification. Here, you attest that all the information in the form is true and accurate to the best of your knowledge.[9]

- You must date the verification portion of the form. It doesn't have to be witnessed by anybody.

-

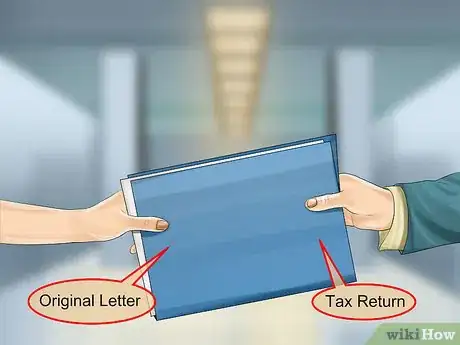

4File your form with your tax return. When you file income tax returns for the year covered by the period on your tax residency certificate, you must submit that certificate along with Form 10F.

- Make copies of your form before you submit it so you have it for your records.

-

5Maintain documentation of the information provided. You are not required to submit documentation as evidence of the claims in your Form 10F. However, you should still have proof and keep it in your personal records in case you are audited or asked by the Income Tax Department to provide it.[10]

Obtaining a No Pe Declaration Letter

-

1Request a no pe letter from the company paying you. This letter is a declaration that the company paying you has no permanent establishment in India. If you work for an Indian company, you may have to pay income taxes in India even if you are not a resident.

- You need one of these letters from every entity that pays you income if you want to exclude that income from Indian income taxes. For example, if you earn interest on a bank account in a bank in your resident country, you also need a no pe letter from them.

- The company may have a form letter already drafted. If not, you can find templates online that are used by other companies.

-

2Make copies of the letter. You must submit the original declaration letter when you file your taxes along with your tax residency certificate and your Form 10F. You still need at least one copy for your own records.

- Any copies should be kept along with your copies of your tax residency certificate, Form 10F, and other documentation to prove the statements you made on those forms.

-

3Submit the original letter with your tax return. When you file your tax return, you must provide a no pe declaration letter for any income that you want to exclude from Indian income tax under a DTAA treaty.

References

- ↑ https://www.incometaxindia.gov.in/Pages/international-taxation/dtaa.aspx

- ↑ https://www.irs.gov/pub/irs-pdf/i8802.pdf

- ↑ https://www.irs.gov/individuals/international-taxpayers/form-6166-certification-of-us-tax-residency

- ↑ https://www.irs.gov/pub/irs-pdf/i8802.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i8802.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i8802.pdf

- ↑ https://www.incometaxindia.gov.in/forms/income-tax%20rules/103120000000007197.pdf

- ↑ https://www.incometaxindia.gov.in/forms/income-tax%20rules/103120000000007197.pdf

- ↑ https://www.incometaxindia.gov.in/forms/income-tax%20rules/103120000000007197.pdf

About This Article

If you're an Indian citizen living and working in a country that has a Double Taxation Avoidance Agreement with India, you'll need to fill out a 10F form to ensure your income is not subject to Indian income tax. To find out if you're exempt, use the Indian Income Tax Department website to search for a tax treaty with the country you're living in. Then, apply for residency certification in your current country to have a tax residency certificate mailed to you. From here, you can download Form 10F from the Indian Income Tax Department website by searching for "10F" under "Income Tax Forms" on the "Forms/Downloads" page. Using your residency and tax identification information, fill out the form, sign it, and mail it with your income tax returns for the year. For more advice, like how to obtain a no pe declaration letter, read on!