This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

This article has been viewed 29,670 times.

Learn more...

Commercial real estate is a highly competitive sector where great fortunes can be made or lost. Evaluating a commercial property requires a high level of detail and an ability to pay attention to both tangible and intangible factors. The profitability of the space can be assessed by looking at the potential revenue and costs for the first year. However, you’ll also want to look at the neighborhood, the space’s visibility, and the site’s zoning status.

Steps

Calculating a Property’s Income, Price, and Value

-

1Estimate the gross scheduled income (GSI). Add together the total rent that can be expected from the entire space. Apartment complexes, strip malls, and segmented office buildings can all be evaluated in this way. Remember to tailor the rent expectations for each area of the space to match its particular market value.[1]

- For example, a 2-bedroom apartment will typically rent out for more than a 1-bedroom apartment in the same complex.

-

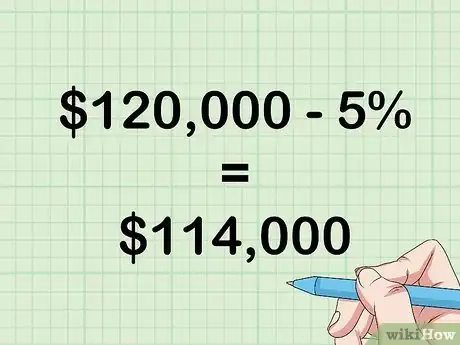

2Subtract a 5% vacancy from the GSI. Not all of your units in a commercial property will remained fully occupied throughout the year. To accurately reflect this in your calculations, go ahead and subtract 5% from the total GSI. The resulting number is your effective gross income (EGI).

- This is the percentage that most lenders will use when considering your potential purchase as well.

Advertisement -

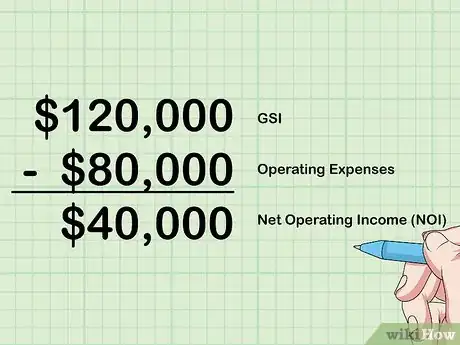

3Calculate the property’s net operating income (NOI). This is a number that can help you decide whether or not you’ll make a profit from a property. Get the property’s first year estimated gross operating income. Then, get your estimated operating expenses for that same time period. Subtract your expenses from your income. If the resulting NOI is positive, then you’ll make an initial profit.[2]

- To be even more accurate for a rental property, replace the GSI in your calculations with the EGI. This is a more conservative estimate of profit.

- For example, your operating expenses for a space might include advertising costs or management fees.

- This is also referred to as “EBITDA” or total earnings before interest, taxes, depreciation, and amortization.

-

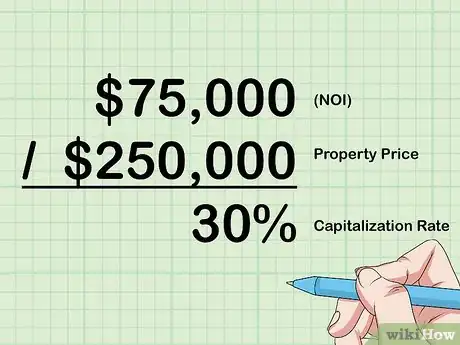

4Calculate the property’s capitalization or “cap” rate. This is determined by dividing the NOI by the price of the property. It will result in a percentage that is the cap rate. This percentage will vary depending on the area and its real estate offerings. The cap rate shows your potential profit margins from a property.[3]

- For example, if a property has an NOI of $75,000 and is priced at $250,000, then the capitalization rate would be 30 percent.

-

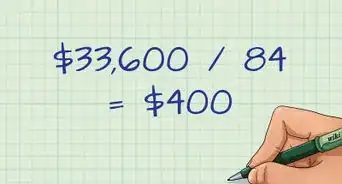

5Divide NOI by the cap rate to determine a property’s ideal price. Whether you are buying a property or trying to sell one, it’s important to come up with a sales price that fits the market. If you divide your current or potential NOI by the cap rate for the area, then you’ll get a sales price that will include both profits and operating expenses.

- For example, if the property has a cap rate of 5% and an NOI of $90,000, then the price should be $1.8 million.

-

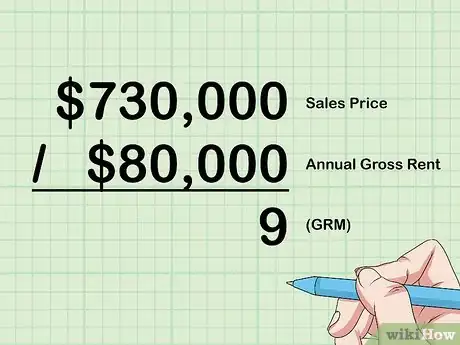

6Calculate the gross rental multiplier (GRM) for the property. Get the listed selling price for a commercial space and then divide it by annual gross rental income. This will give you a GRM number that you can then use to determine profitability.

- You can estimate the GRM for a market area by performing these calculations with multiple properties and averaging the results.

- For example, if a property’s sales price is $730,000 and its annual gross rents equal $80,000, then it has a GRM of 9.

-

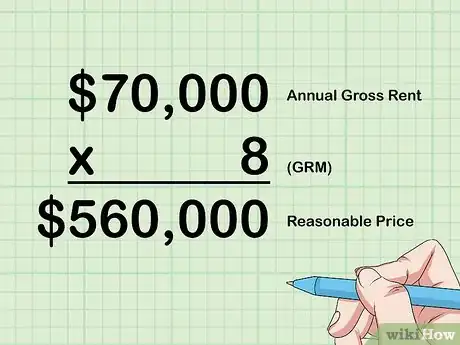

7Use the GRM to create a property value estimate. Multiple the annual gross rents of the property by the GRM for the individual property or for the area. The number that results is an estimate of the property value according to the current market.

- For example, if a property has an annual gross rent of $70,000 and a GRM of 8, then a reasonable price would be $560,000.

- Your commercial real estate agent or appraiser should be able to provide you with an accurate GRM for the area or property.

Weighing Financial Factors

-

1Get an accurate square footage. Look over the appraisals and documentation provided by the seller to verify that they list a complete square footage for the space. If the footage numbers differ, this is something to address early on. Commercial property value is directly tied to the square footage that is available for use in the space.[4]

- This is something that is a bit different from residential real estate where square footage places a lesser role in valuation.

- Calculate the price per square foot (PPSF) by dividing the sales price by the total square footage.

-

2Look for any damaged areas that require repairs. This is where it helps to work with a professional commercial inspector. If the property has anything that will require fixing before occupation, then you’ll need to deduct those costs from any potential revenue. This is another reason why it’s always a good idea to inspect a property in person, if possible.[5]

-

3Calculate the cost of any repairs over time. Ask the owner about the age and condition of all electrical, plumbing, or other mechanical aspects of their commercial property. Then, compare the current ages of these items to their estimated total number of years of usage. This will give you an idea as to what will need repair in the short and long term.[6]

- For example, the air conditioning unit for a commercial building might be functioning just fine. But, if it is over 20 years old, it could need repair or replacement at any moment.

-

4Ask for the current owner’s income and expenses paperwork. After you express a serious interest in a property, it is often okay to approach the owner or their representative and request paperwork from the past year’s occupation. They might give you tax documents, electricity bills, or even revenue documentation.[7]

-

5Read over the annual property operating data (APOD) report. This report contains information regarding the rental income, operating expenses, loan details, and cash movements for a particular property. It is intended to show an overall financial picture of a property over the past year and can be used to determine future potential.[8]

Identifying Possible Uses for the Property

-

1Rely upon the advice of an expert real estate team. Even if you are experienced in purchasing commercial property, it is still helpful to seek out the advice of financial specialists. An accountant can help you purchase within your budget. A lawyer can assist with the negotiation process. A broker can search through properties with you.[9]

- If you are already working with a broker, they may be able to suggest a particular lawyer or accountant to add to your team.

-

2Seek out information on the property’s zoning laws and building codes. The zoning laws will determine what type of businesses can occupy the property and may limit its possible uses. The building codes may list out what changes you can make to the space. This is especially important if the property lies in a historic area.[10]

- For example, if you are considering renting to a manufacturer, the property may need to be zoned for industrial uses.

-

3Determine if the property is suitable for triple net leases. This is when you fill up a property with renters who pay for all of the space’s expenses directly and on their own. The only expense that the property owner covers is the overall mortgage for the property. For that reason, a space that is eligible for triple net leases might be less of a financial risk.[11]

- For example, CVS, Starbucks, and other large companies will often create triple net leases with property owners.

-

4Calculate the number of dwellings for an apartment space. If the commercial property will be used for multi-family housing, then the revenue it generates will be directly tied to the number of residents living at the location. Look at the layout and determine how it can be, or is already, broken down into livable spaces.[12]

- Keep in mind that most multi-family commercial structures have spaces for differing numbers of residents. For example, an apartment complex might have one, two, and three-bedroom rental options.

Considering Intangible Factors

-

1Assess the motivation level of the seller. Evaluating a commercial property is not an exact science and sometimes intangibles, such as the seller’s desires, come into play. If a seller is desperate to off-load a property, then the price may be lowered below market value. If a seller has time to sell, then they may set the price higher initially.[13]

-

2Walk the area and talk to the neighbors. Spend an afternoon canvassing the neighborhood and knocking on doors. Discuss the area’s development, crime problems, and other potential issues with residents. If the area surrounding a commercial property is crime-ridden or full of vacancies, then the space may be less desirable.[14]

-

3Factor in the publicity value of a storefront. If you plan to use the space for your own business or to rent it out to other businesses, then think about how the property appears on the outside. Is it a high-traffic area that will yield significant exposure to the general public? Is it around other similar businesses?[15]

Warnings

- Be prepared to place 30% cash or more down on a commercial property. This is standard procedure for most commercial property loans.[17]⧼thumbs_response⧽

References

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/09/tips-commercial-real-estate.asp

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/09/tips-commercial-real-estate.asp

- ↑ http://thebusinesstimes.com/metrics-available-to-evaluate-commercial-real-estate-purchases/

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/09/tips-commercial-real-estate.asp

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/09/tips-commercial-real-estate.asp

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/09/tips-commercial-real-estate.asp

- ↑ https://www.nolo.com/legal-encyclopedia/pros-cons-investing-commercial-real-estate.html

- ↑ http://thebusinesstimes.com/metrics-available-to-evaluate-commercial-real-estate-purchases/

- ↑ https://www.inc.com/guides/2010/07/how-to-purchase-commercial-real-estate.html

- ↑ https://www.inc.com/guides/2010/07/how-to-purchase-commercial-real-estate.html

- ↑ https://www.nolo.com/legal-encyclopedia/pros-cons-investing-commercial-real-estate.html

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/09/tips-commercial-real-estate.asp

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/09/tips-commercial-real-estate.asp

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/09/tips-commercial-real-estate.asp

- ↑ https://www.nolo.com/legal-encyclopedia/pros-cons-investing-commercial-real-estate.html

- ↑ https://www.inc.com/guides/2010/07/how-to-purchase-commercial-real-estate.html

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/09/tips-commercial-real-estate.asp