This article was co-authored by Justin Barnes. Justin Barnes is a Senior Home Care Specialist and the Co-Owner of Presidio Home Care, a family-owned and operated Home Care Organization based in the Los Angeles, California metro area. Presidio Home Care, which provides non-medical supportive services, was the first agency in the state of California to become a licensed Home Care Organization. Justin has over 10 years of experience in the Home Care field. He has a BS in Technology and Operations Management from the California State Polytechnic University - Pomona.

There are 9 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 11 testimonials and 83% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 109,139 times.

When you retire, you may be wondering what to do next. You want to have an enjoyable life after working all those years. The first step is making sure you are healthy enough to enjoy your free time. You'll also need to ensure you have the funds to pay for what you want to do. Finally, you need to find activities you enjoy and people you enjoy doing them with so you have an active life.

Steps

Staying Healthy

-

1Exercise regularly. Take walks. Go swimming. Work in the garden. Every little bit helps you stay active and healthy.

- Grab a buddy when you want to exercise. Having someone exercise with you will make you more likely to keep to an exercise routine.

- Aim for half an hour of activity every day.

- Check your local community for classes. Many cities offer exercise programs specifically for seniors at free or reduced costs.

-

2Trade inactive time for active time. That is, instead of being on the computer, go bowling with friends. Instead of watching television, try playing a game that makes you get up and move.Advertisement

-

3Eat more fiber. Fiber is essential for keeping your digestive system happy. However, it also may keep your cholesterol down, an important consideration the older you get. In addition, it can decrease your risk of developing certain types of illnesses, such as cancer and diabetes.[1]

- If you're over 50, you need 21 grams (0.74 oz) of fiber daily as a woman and 30 as a man.[2]

- Whole grains, vegetables, and fruits are all a great source of fiber.

-

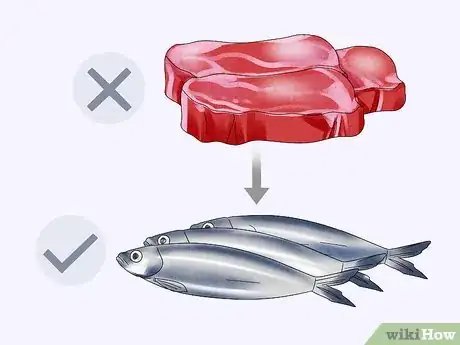

4Eat a balanced diet. Incorporate plenty of fruits and vegetables into your diet. Trade red meats for fish. Skip sugary sodas and desserts. The better the fuel you put in your body, the happier it will be.[3]

-

5Quit smoking. This recommendation is important for people of any age, but it's especially important for seniors. Smoking increases your chances of heart disease and cancer, so consider taking the plunge into non-smoking as you enter retirement.[4]

-

6Visit your doctor. When you're older, you need to visit your doctor more often to check up on your health. You should be going at least once a year but preferably more often.[5]

-

7Stay on top of personal hygiene. Make sure you are brushing and flossing twice day. Moisturize your dry skin. Make sure you're wearing sunscreen when you go out. These little preventative measures will help keep you happy and healthy as you age.[6]

Having Enough Money to Do What You Love

-

1Look for senior perks. Many restaurants and businesses offer discounts for people over 65. Some even offer this benefit for people as young as 55. Don't be afraid to ask about discounts because not every place advertises it.

- Also, consider joining AARP, which provides even more discounts for seniors at various businesses.[7]

-

2Downsize your living. After you retire, you may realize you don't have enough income to meet the demands of what you want to do. If so, you might consider downsizing to a smaller house. Even if your house is already paid off, you can use the profit to invest, allowing you to have more income in your later years.[8]

- You may also consider moving to an apartment. That way, you can invest all the profits from your house, and you have a place to live where you don't have to provide upkeep.[9]

-

3Live in a No-Tax State. While it may seem odd to move to a new state at this point in your life, you'll find that certain states do not tax pensions and social security. For instance, Florida, Pennsylvania, and Nevada are just a few states with this benefit.[10]

- This is just one of many factors to consider when choosing where to retire.

-

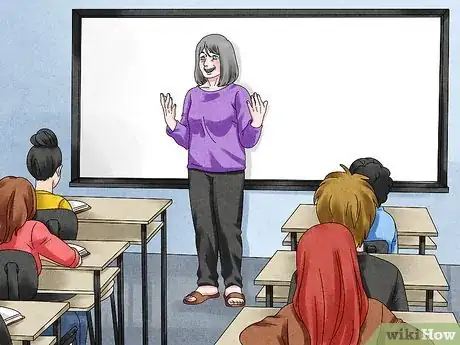

4Take small side jobs. Maybe you just want a little extra cash for the occasional dinner out. If that's true, think about taking small side jobs. For instance, you could offer tutoring services to local high school students. You could also put your expertise to work by still consulting in your professional field. Another option is pet sitting or house sitting. All of these side jobs will give you the extra cash you need to help you enjoy retirement.

-

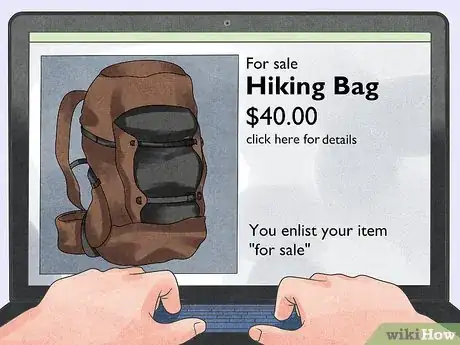

5Sell what you don't want. While it's a nice gesture to donate items to local charities, you can also sell items you don't want in your local classifieds or online. You can make some extra cash and de-clutter your home at the same time.

-

6Cash in rewards. That is, many grocery stores have reward programs, such as offering a discount on gas or personalized coupons if you join their reward programs. Your credit card may have a reward program, as well. Make sure you take advantage of all the rewards you come across because they do add up to extra cash.

-

7Apply for Medicare. Medicare will cover many of your medical expenses in retirement, though not all. To cover more, you may need to get a supplemental plan, which can be cheaper overall.[11]

- Most people get at least Medicare Part A and B. These two plans cover hospital visits and doctors' visits with a copay. Some people also get Part C, which is a supplemental plan that covers parts of what A and B don't. A Part D plan, also supplemental, can help cover your medication expenses.

- Part A is free in most cases (if you paid into to Medicare for at least 40 years), while the premium for Part B is based on your income. Parts C and D usually cost money as supplemental plans.

-

8Consider your bills. Take a hard look at your monthly bills, and cut anything that you do not use often or that is not essential. For instance, you may decide that getting a newspaper everyday isn't important because you can get most of your news online. Alternatively, maybe you'll decide you can do without cable and get your entertainment cheaper through online streaming services.

Finding Interests and Social Groups

-

1Take some time to travel. If you've always loved adventure, retirement is a great time to travel. You now have all the time you need to visit the places you always wanted to see. Plus, seeing the world will keep you engaged and interested in the world[12]

- Unfortunately, as a retiree, money may be a problem for you. If it is, try traveling on a budget. For instance, some websites allow you to do travel exchanges; you allow someone to stay in your home for the opportunity to stay in someone else's home in another location.[13]

- Similarly, think about other cheaper places to stay, such as hostels and even dorm rooms. Some hostels limit their guests to young people, but others accept people of all ages and even offer semi-private rooms. Also, some universities offer dorm rooms up for people to stay in for cheaper than a hotel.

- Another option is to explore places close to home. Most people don't take the time to see the attractions within an hour or two of their homes, so take day jaunts to nearby places.

-

2Volunteer your time. You are a skilled individual who has extensive experience--put that experience to use. If you have accounting skills, small nonprofits would love your help. If you are a writer, maybe you can assist with newsletters for the library. Your skills would be much appreciated, and it keeps you involved in the community and seeing people.[14]

-

3Visit your local library. Your library is a well of information. It offers free resources to help you pursue your interests, from books on guitar playing to computers. Most libraries also have free programs that you can attend and enjoy.

-

4Pick three to four hobbies. While that number seems arbitrary, it's not. With just one or two hobbies, your schedule won't be very busy. However, having more hobbies will create a busier schedule and make you happier overall.[15]

- Think about what you've always wanted to do. Maybe learn the violin, or take a dance class. You could also learn how to play chess or take up gardening.

-

5Find a local group with similar hobbies. For instance, if you love to knit, find a local knitting club to join. If you enjoy soccer, find a local group in your age range. Check with your local library or the parks and recreation department to find groups. You can also use websites such as Meetup.[16]

-

6Keep up with old friends. Whether it's work friends or just neighbors or church friends, make it a point to have social engagements with your friends. Try to schedule an evening or afternoon out at least once a week.[17]

References

- ↑ http://familydoctor.org/familydoctor/en/seniors/staying-healthy/good-health-habits-at-age-60-and-beyond.html

- ↑ http://familydoctor.org/familydoctor/en/seniors/staying-healthy/good-health-habits-at-age-60-and-beyond.html

- ↑ http://www.webmd.com/healthy-aging/features/power-play

- ↑ http://smokefree.gov/reasons-to-quit

- ↑ http://www.medicinenet.com/senior_health/page3.htm

- ↑ http://www.medicinenet.com/senior_health/page3.htm

- ↑ http://www.csmonitor.com/Business/Saving-Money/2015/0510/How-to-enjoy-retirement-even-if-you-haven-t-saved-enough

- ↑ http://www.csmonitor.com/Business/Saving-Money/2015/0510/How-to-enjoy-retirement-even-if-you-haven-t-saved-enough

- ↑ https://money.com/happy-retirement-tips-advice/

- ↑ http://www.csmonitor.com/Business/Saving-Money/2015/0510/How-to-enjoy-retirement-even-if-you-haven-t-saved-enough

- ↑ http://www.csmonitor.com/Business/Saving-Money/2015/0510/How-to-enjoy-retirement-even-if-you-haven-t-saved-enough

- ↑ http://money.usnews.com/money/blogs/on-retirement/2014/09/30/5-ways-to-just-enjoy-retirement

- ↑ https://www.homeexchange.com/en/

- ↑ http://money.usnews.com/money/blogs/on-retirement/2014/09/30/5-ways-to-just-enjoy-retirement

- ↑ https://money.com/happy-retirement-tips-advice/

- ↑ http://www.forbes.com/sites/deborahljacobs/2013/05/10/how-to-beat-the-retirement-blues/

- ↑ http://money.usnews.com/money/blogs/on-retirement/2014/09/30/5-ways-to-just-enjoy-retirement