This article was co-authored by Alan Mehdiani, CPA and by wikiHow staff writer, Jennifer Mueller, JD. Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 47,841 times.

If you own rental property in the U.S., creating an LLC to manage that property can be a good way to protect your personal assets. An LLC also makes it easier for you to keep your business expenses separate from your personal expenses, which can make things easier for you at tax time. Transferring rental property to an LLC can be difficult, particularly if you have a mortgage on the property. You may want to consult an attorney to help guide you through the process.[1]

Steps

Forming Your LLC

-

1Contact your lender. If your rental property is mortgaged, call your lender before you start setting up your LLC. Let them know that you want to create an LLC to manage your rental property.[2]

- Even though the LLC is still technically you, it is a separate entity. Lenders may be reluctant to transfer the mortgage to your newly formed LLC. You may have to pay fees to transfer the mortgage, and they may charge you a higher interest rate.

- Check your mortgage agreement for a "due on sale" clause. Even though no money is changing hands and you'll still own the property, your mortgage company may look at the transfer of ownership as a sale and demand you pay the balance of the mortgage in full.

-

2Consult a CPA or attorney. Before you create an LLC, make sure the costs won't exceed the benefits. A CPA or attorney can look over your rental business and give you advice on whether creating an LLC would be a good idea for you.[3]

- Depending on your familiarity with business and legal documents, you may also want an attorney to draw up your LLC paperwork for you and help you register your business. Most attorneys charge between $1000 and $2000 for this service.

Advertisement -

3Choose your business name. When you create an LLC, you'll need a unique name for your business that isn't already being used by another business in your state. You can find a business name directory on the website of your state's Secretary of State to verify that the name you've chosen is unique.[4]

- Your name should be creative and stand out, but you also want something that will sufficiently identify the type of business you're engaged in. For example, if your last name is Sunshine, you might try "Sunshine Property Management, LLC."

- If your business name is sufficiently unique, you may also be able to get the name trademarked. A trademark from the U.S. Patent and Trademark Office (USPTO) provides additional protection so your business name can't be used by another business anywhere in the country.

-

4Draft your articles of organization and operating agreement. These documents are the legal backbone of your LLC. Most states don't require you to file these documents with the Secretary of State when you register your LLC. However, they are still essential because they outline the structure of your LLC and how decisions are made.

- You can also include provisions in your operating agreement describing the procedure for adding new members or transferring new property into the LLC in the future.

- While you don't necessarily need an attorney to draft these documents, you might consider hiring someone if you have multiple members in your LLC, or if your LLC will be managing multiple properties.

- Include your rental property in your operating agreement as a capital asset. You'll need to record the fair market value of the property as well as any liabilities, such as mortgages. [5]

-

5Register your LLC with your state's Secretary of State. Your state's Secretary of State will have forms for you to complete to register your LLC so you can conduct business in the state. Some states allow you to complete this process online.[6]

- You'll have to pay an initial filing fee when you register your LLC. These fees vary greatly among states, but typically are several hundred dollars. Some states require you to pay annual fees as well to maintain your registration.

- Check the website of your state's Secretary of State to learn more about your state's process, or stop by a local office and speak to someone on staff.

-

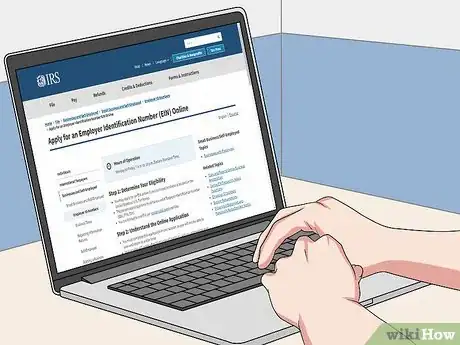

6Get an employer identification number (EIN). Because your LLC is a separate entity, you'll need to get an EIN from the IRS so you can open bank accounts and pay state and federal taxes on your rental income.[7]

- You can apply for an EIN with the IRS easily by visiting https://sa.www4.irs.gov/modiein/individual/index.jsp. The process is free and only takes a few minutes. Your EIN will be generated immediately, although it may take a little longer for it to show up in IRS records.

-

7Open a bank account. Once you have an EIN, you can set up a separate bank account for your rental property. You may want to set up several accounts so you can keep your operating funds separate from your rent payments.

- Some banks may have special packages available for landlords and small businesses that are managing rental properties. Check with your local bank to learn more about your options.

Transferring Your Rental Property

-

1Review your leases. If you use a standard lease form, it typically includes a clause that allows for the lease to continue after a transfer in ownership or reorganization of your business. Check your leases to make sure they will remain valid under new ownership.[8]

- Be sure to update your lease forms so that they include the name of your LLC rather than your name.

-

2Notify your tenants. Once your rental property is transferred to your LLC, your tenants will be paying rent to the LLC rather than to you personally. Provide them with the correct business name and other payment information.[9]

- If you use an online service to take rent, update the information in that service so that the rent payments are being deposited into your LLC account rather than your previous account.

-

3Update your security deposit account. Contact the bank where you kept security deposits and find out what you need to do to change the name on your security deposit account to the name of your LLC.[10]

- Different banks will have different procedures. Some banks may require you to close the old account and open a new one.

-

4Sign a new mortgage agreement. If you have a mortgage on your rental property, you must enter a new mortgage agreement in the name of your LLC. The process for this varies greatly among lenders.[11]

- Typically you'll sign an entirely new mortgage agreement, although the process may not be as extensive as it was for your initial mortgage.

- Because your LLC is a new entity and doesn't have any credit history, your lender may require you to cosign on the mortgage individually along with your LLC. This doesn't affect the limitations on liability that creating an LLC provided, but it does mean that you have personal responsibility for paying the mortgage.

-

5Update your insurance. If you have landlord insurance or other liability insurance on your rental property, you will need to transfer that policy to your LLC. Some insurance companies may require you to close the old policy and open a new one.[12]

- When you transfer your insurance to your LLC, your rates may go up because your LLC is a newly established entity. You won't be able to rely on your personal financial and credit history.

- In addition to liability insurance, you also want to check your title insurance to make sure that the LLC will still be covered.

-

6Draft a Quit Claim deed. A quit claim deed transfers your rental property from you personally to the name of your LLC. Because a property transfer like this is considered a sale, you may have to pay a transfer fee. There also may be property tax consequences since the transfer may trigger a tax assessment.[13]

- The quit claim deed is the simplest type of deed, and simply transfers any interest you have in the property from you as an individual to your LLC. You can find quit claim deed forms online. Your county clerk's office also may have blank forms you can use.

-

7File your deed with the county clerk's office. Once you've filled out and signed your quit claim deed, you must file it with the deed clerk to complete the process of transferring ownership of the property from you individually to your LLC.[14]

- Make a copy of the deed before you record it and keep it with your business records.

- You'll be charged a fee to record the new deed, typically under $50.

Getting Permits and Licenses

-

1Publish a "Notice of Intent" if required. When you change ownership of property, some states require you to publish notice in a newspaper of record to alert the public of the ownership change. Some states also require similar notices if you are changing the organization structure of a business.[15]

- Your state's Secretary of State office will be able to tell you if the state requires publication of any notice when you file your forms to create your LLC.

-

2Contact your local housing regulatory agency. Each city or county has a regulator that enforces the local housing code and zoning regulations. Any permits or licenses that you got for your rental property must be updated for your LLC.[16]

- Typically the easiest way to make sure you're in compliance with state and local law is to call the housing regulatory agency and explain what you're doing. Let them know that you are creating an LLC to manage your rental property, and find out what you have to do to get your licenses in order.

- You may also be able to find out how to transfer your licenses to your LLC on the agency's website.

-

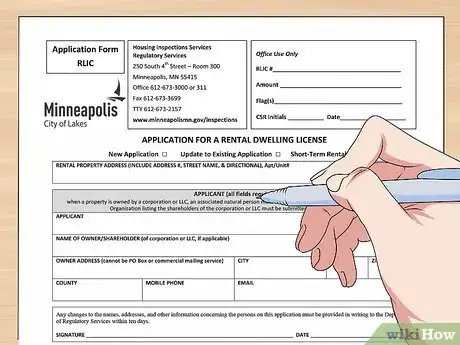

3Get a rental license for your LLC. Most cities require landlords to have a rental license. If you had one as an individual landlord, you will have to apply for a new one in the name of the LLC. Get this process started as soon as possible after you form your LLC so you remain in compliance with local ordinances.[17]

-

4Complete any required inspections. When you transfer your rental property from your name to the name of your LLC, it may trigger an inspection. Local housing regulators inspect rental properties for compliance whenever there is a change in ownership.

- If you have a single-member LLC, you may be exempted from an additional inspection.

-

5Apply for state and local business licenses. Your state or city may require licenses for your LLC to engage in commercial activity. You can typically find out what licenses you need by visiting the business services agency for your city or state.[18]

- If you were previously operating as a sole proprietor, you may not have needed a business license. However, business licenses typically are required for all LLCs.

Expert Q&A

-

QuestionWhat is the best way to pay myself from my LLC?

Alan Mehdiani, CPAAlan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

Alan Mehdiani, CPAAlan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

Certified Public Accountant Figure out what the tax structure of your LLC is. For instance, with an LLC that's taxed as a sole proprietorship, it's very easy to pay yourself—you just take the money out of the account the same way you would if you had no entity and you were just operating by yourself. It gets more complicated when you're taxed as a C corporation, since you would pay yourself either a salary or dividends (and each has its own tax implications). If you're taxed as an S corporation, you can pay yourself either through wages (like a salary) or what's called a distribution.

Figure out what the tax structure of your LLC is. For instance, with an LLC that's taxed as a sole proprietorship, it's very easy to pay yourself—you just take the money out of the account the same way you would if you had no entity and you were just operating by yourself. It gets more complicated when you're taxed as a C corporation, since you would pay yourself either a salary or dividends (and each has its own tax implications). If you're taxed as an S corporation, you can pay yourself either through wages (like a salary) or what's called a distribution.

Expert Interview

Thanks for reading our article! If you'd like to learn more about dealing with real estate businesses, check out our in-depth interview with Alan Mehdiani, CPA.

References

- ↑ https://www.rentalutions.com/education/articles/should-you-create-an-llc-for-your-rental-property

- ↑ https://www.apartments.com/rental-manager/resources/article/do-i-need-an-llc-for-my-rental-property

- ↑ https://www.apartments.com/rental-manager/resources/article/do-i-need-an-llc-for-my-rental-property

- ↑ https://www.sba.gov/business-guide/launch-your-business/choose-your-business-name

- ↑ https://www.score.org/blog/how-transfer-assets-your-llc

- ↑ https://www.sba.gov/business-guide/launch-your-business/register-your-business

- ↑ https://www.sba.gov/business-guide/launch-your-business/get-federal-and-state-tax-id-numbers

- ↑ https://www.rocketlawyer.com/blog/how-to-create-an-llc-for-your-rental-property-924146

- ↑ https://datcp.wi.gov/Documents/LT-LandlordTenantGuide497.pdf

- ↑ https://www.landlordology.com/how-to-properly-handle-security-deposits/

- ↑ https://frascona.com/transfer-of-rental-propertyto-a-legal-entity/

- ↑ https://frascona.com/transfer-of-rental-propertyto-a-legal-entity/

- ↑ https://www.rentalutions.com/education/articles/should-you-create-an-llc-for-your-rental-property

- ↑ https://www.rentalutions.com/education/articles/should-you-create-an-llc-for-your-rental-property

- ↑ https://www.rocketlawyer.com/blog/how-to-create-an-llc-for-your-rental-property-924146

- ↑ http://www.minneapolismn.gov/inspections/rental/index.htm

- ↑ http://www.phila.gov/li/pages/tenantlandlord.aspx

- ↑ https://business.phila.gov/housing-inspection-license/